simonkr

Arena Minerals (OTCQX:AMRZF) (TSXV:AN:CA) continues to be one of my favorite companies in the junior lithium space. I first became interested in the company after Lithium Americas (LAC) announced a strategic investment into Arena Minerals, at which point I did a deeper dive into the company. You can find that original article here. This article will focus on the company’s development of its Sal de la Puna (“SDLP”) lithium project.

Strong Resource Development

Since I last provided an update on Arena Minerals, back in April, the company has made significant progress at the Argentinian SDLP project. After announcing that it had begun pond construction in May, Arena announced that its pilot ponds were completed last month. The ponds will be filled with brine from the company’s SDLP project, specifically the Almafuerte claim block, and be used to produce >35% lithium chloride.

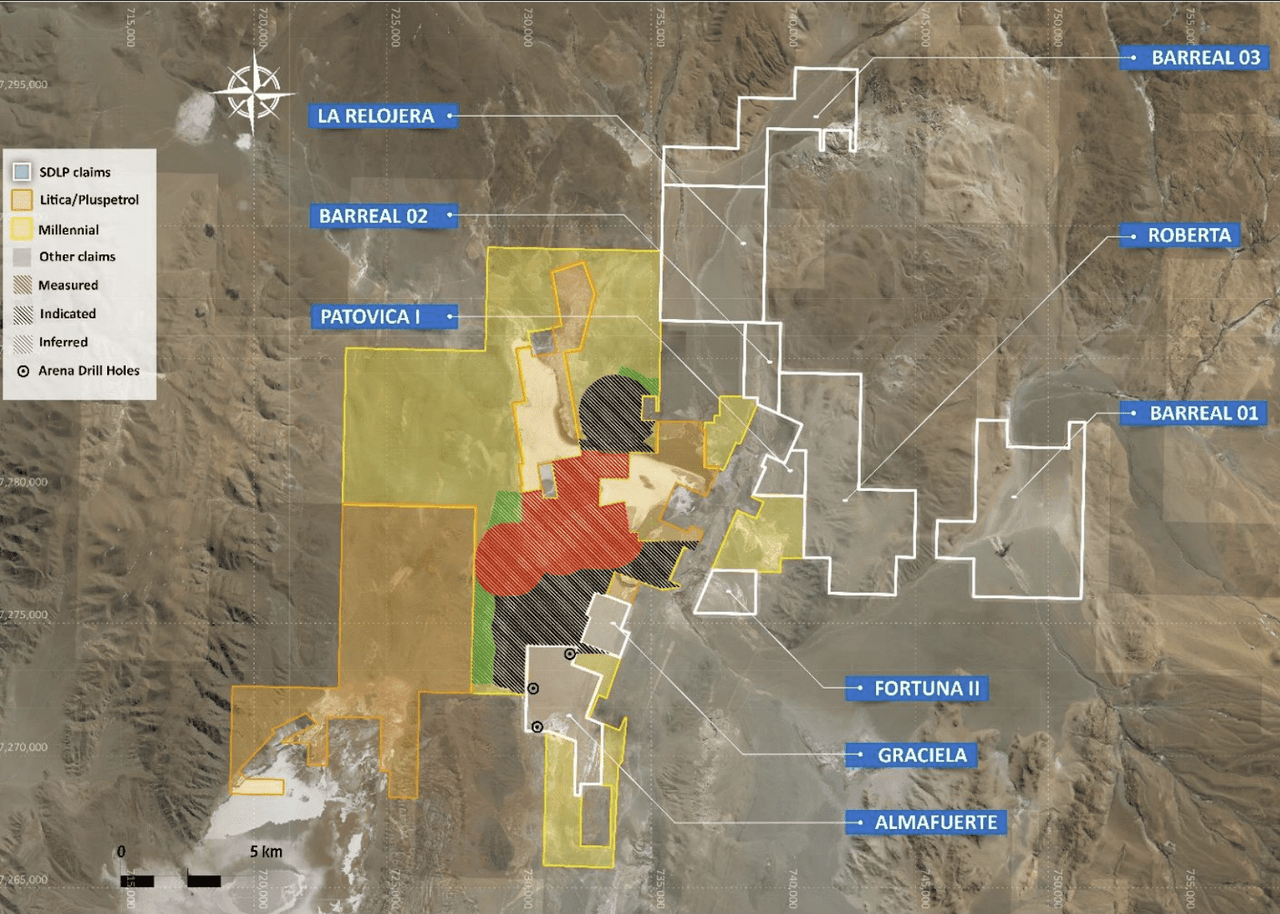

Arena Minerals (Map Accurate as of October 5, 2022)

As I noted in my last article, all exploration by Arena up until that point had been carried out in the Almafuerte block, though the company was planning to expand exploration to the Graciela block as well. However, in its most recent update on its ongoing drilling program, Arena Minerals highlighted a discovery made in the Fortuna II block. The hole gave way to a 275-meter brine column with an average lithium grade of 441 mg/l.

The discovery implies that the basin extends further toward the east than originally expected, dramatically broadening the original scope of Arena’s exploration plan. The discovery also prompted the company to acquire another 2,200 hectares, adjacent to the new discovery, bringing the total project area to 13,200 hectares. The new land package stretches down toward the Almafuerte and Graciela blocks, the areas that were previously thought to be of the greatest potential.

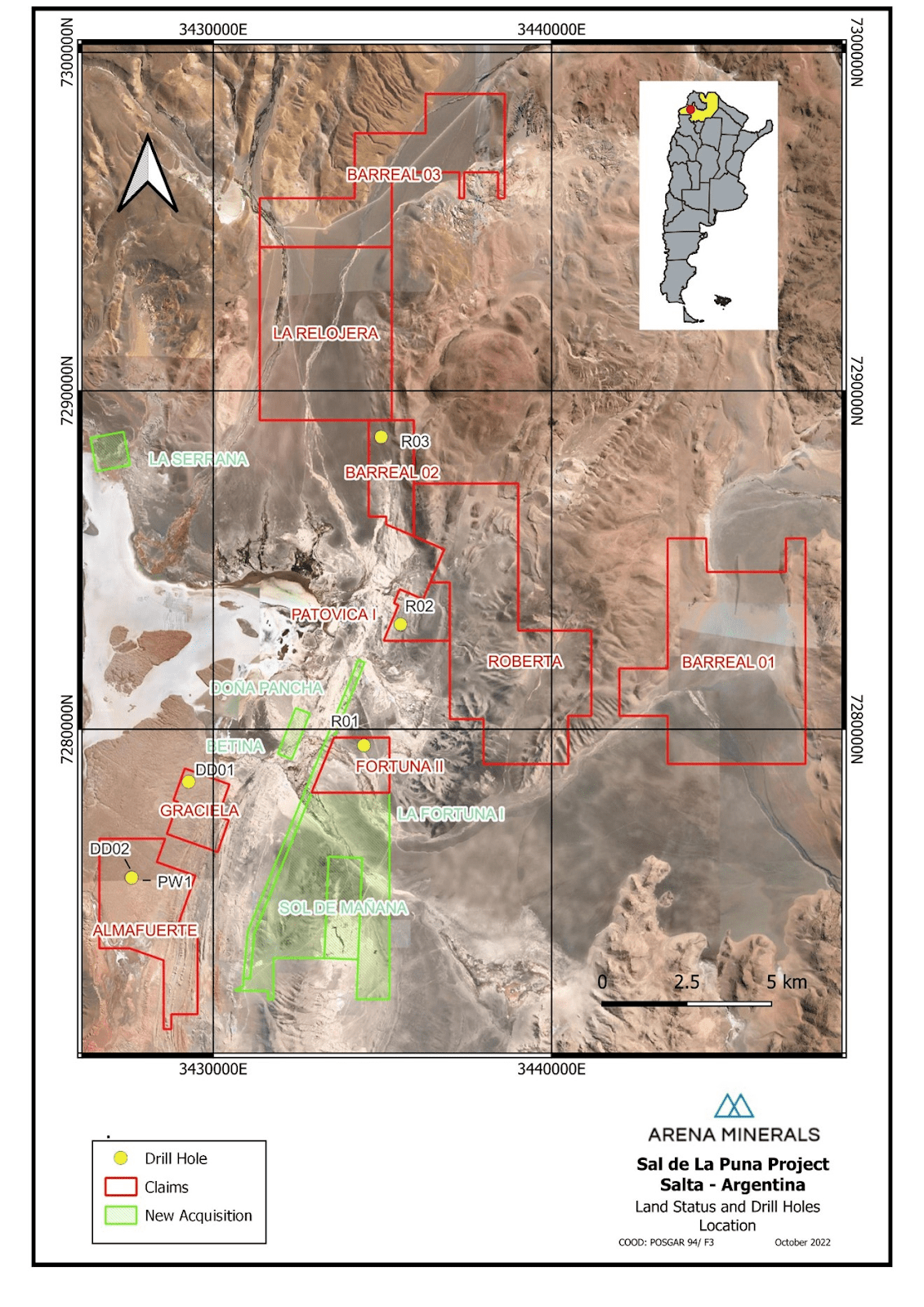

Arena Minerals

You may also notice in the figure above that Arena has still only completed five drill holes on the property itself; the vast majority of exploration has been carried out by the project’s previous owners. The hole dug in the Graciela returned quite positively, with lithiation beginning at a depth of 120 meters and extending down past the 700-meter depth of the hole. While historical drilling focused primarily on the Almafuerte and Graciela blocks, the new discovery has expedited Arena’s process of defining the resource in other parts of the basin. For the time being, exploration progress remains incredibly strong.

Process Innovation

At present, there are a few ways in which lithium is extracted, and then refined, from brines but, no matter the exact chemistry being deployed, the first step is to increase lithium concentration by way of evaporation ponds. These evaporation ponds have become a cornerstone of South American lithium production, immediately recognizable for their brilliant blue hue. And while most producers seeking to innovate on the lithium brine extraction process hope to eliminate the use of these ponds, Arena seeks to add to their capabilities.

In June, the company announced that it had successfully produced 34.7% lithium chloride directly from evaporation ponds at its pilot facility in Catamarca, Argentina. Arena used brine from the SDLP project for this test, treating it with a calcium chloride reagent. The base reaction here isn’t too complex, with calcium chloride reacting with lithium to form lithium chloride. The reaction is aided by the strong reactivity of lithium and chlorine.

But while every other producer produces lithium chloride as an intermediary step for the production of lithium carbonate, this is where the buck stops for Arena Minerals. This decision was made to reduce capital requirements and operational complexity and because 35% lithium chloride is still a darn good product.

Whereas most spodumene producers manufacture 6% spodumene concentrate, Arena Minerals will be producing 35% lithium chloride. Compared to 6% spodumene concentrate, 35% lithium chloride has 2.05x more lithium content. This substantial difference in lithium concentration brings with it a number of benefits.

First of all, by offering a more lithium-dense package, shipping and transportation costs are halved, along with the carbon footprint. While most producers may not care too much about the footprint reduction, they certainly will care about shipping costs. The higher concentration of lithium also contributes to greater ease of refining, though the refining process of lithium chloride is already far less intensive than spodumene.

In the lithium chloride refining process, the concentrate is filtered to remove boron and magnesium contaminates and then mixed with sodium carbonate. The sodium carbonate reacts with lithium chloride to produce lithium carbonate. This lithium carbonate product can be further refined as needed, which is where things get more challenging, but the basic production of lithium carbonate from lithium chloride is fairly straightforward.

However, Arena Minerals also claims that its high concentration of lithium chloride, over 5x higher than what is normally produced for a carbonate precursor (<6% lithium chloride equivalent), consistently yields battery-grade lithium carbonate without any additional refining needed. This too should help secure a premium for Arena’s lithium chloride product and further simplifies the refining process.

Producing lithium carbonate from spodumene concentrate, on the other hand, is a far more arduous process. First, the concentrate is heated to at least 1050°C so that it can undergo a phase change. Prior to this phase change, spodumene is highly resistant to hot acids. Once this phase change is complete, the spodumene is cooled and sulfuric acid is added, at which point the mixture is heated again, though this time to about 200°C.

At this point, the lithium content of the spodumene has been converted into lithium sulfate. The conversion from lithium sulfate to lithium carbonate is practically the same as the conversion process of lithium chloride to lithium carbonate. The significantly more energy-intensive refining process of spodumene versus lithium chloride should also contribute to the premium that producers are willing to pay.

Evolving Salar Dynamics

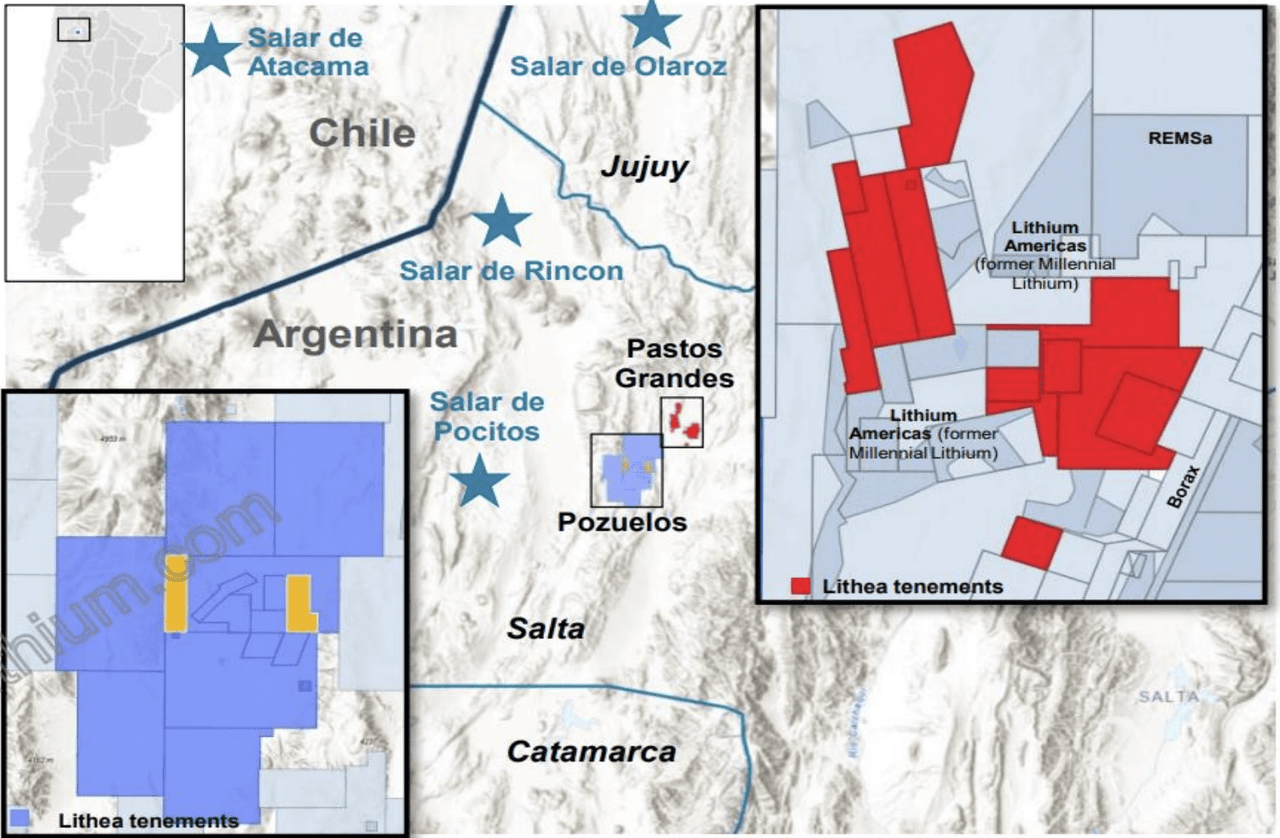

Since I last covered Arena Minerals, Ganfeng has increased its interest in the Pastos Grandes salar. Not by increasing its stake in Arena Minerals, or its SDLP project, but by purchasing Lithea’s 13,470-hectare PPG Project for $962 million. This acquisition is noteworthy for a number of reasons, but chief among them is how it transforms inter-basin relationships.

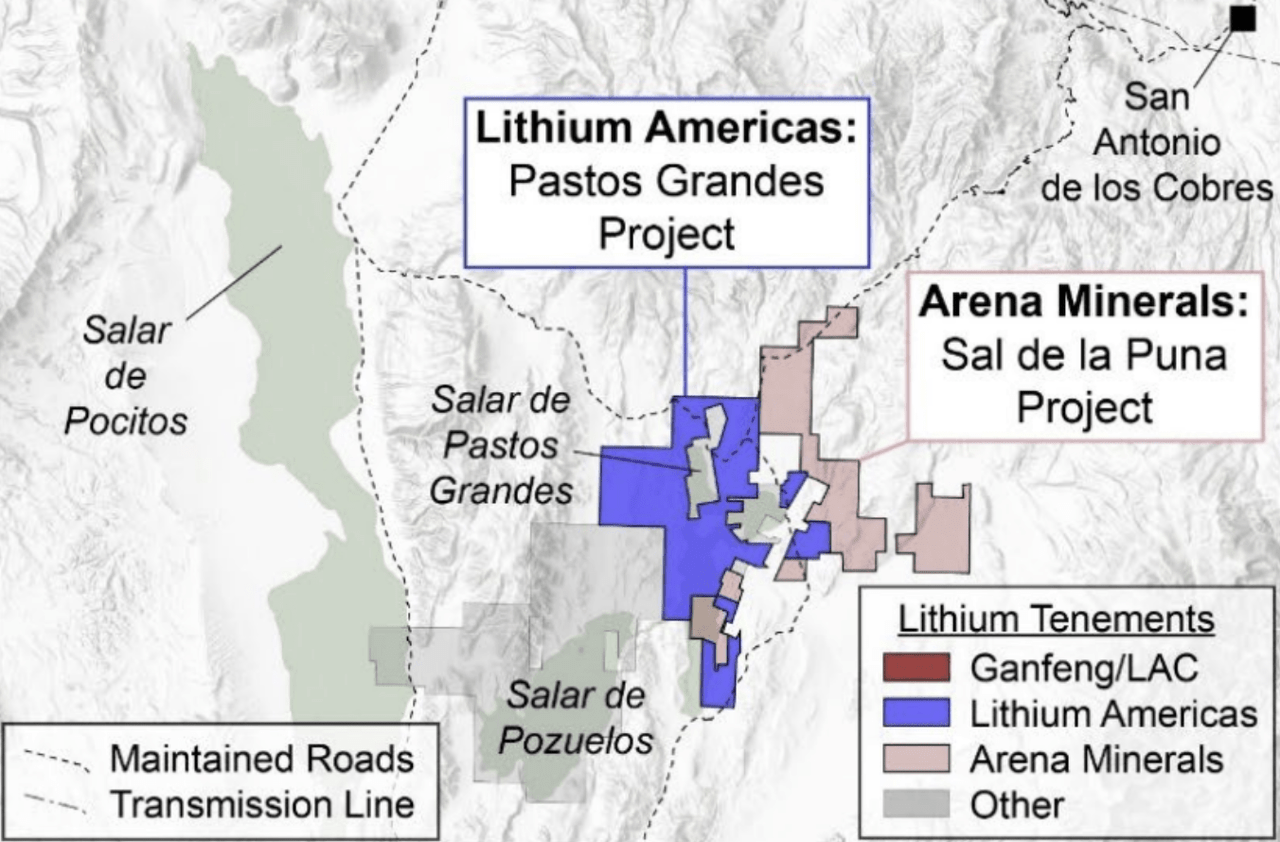

The image below highlights Lithium Americas’ and Arena’s holdings within the Pastos Grandes salar and also notes “other” holdings within the Pozuelos and Pastos Grandes salars.

Lithium Americas

However, as we can see from the below figure, courtesy of Ganfeng, the vast majority of these “other” tenements were formally under the ownership of Lithea. You may notice that the majority of the PPG (“P”ozuelos, “P”astos “G”randes) project area, 10,787 hectares of the total 13,470-hectare package, falls in the Pozuelos salar.

Ganfeng Lithium

For simplicity’s sake, I’ve been referring to Ganfeng’s (OTCPK:GNENY, OTCPK:GNENF) Lithea acquisition as being in the same salar as Arena’s SDLP project and Lithium Americas’ Pastos Grandes project. And while this is technically not true, it might as well be. The Pozuelos and Pastos Grandes salars share much of the same vulcany that is responsible for their lithiation, making their composition incredibly similar. Their proximity and brine similarity are extraordinarily reminiscent of Cauchari and Olaroz, which Ganfeng and Lithium Americas treat as one large salar.

With Ganfeng’s acquisition of Lithea, Arena Minerals, Lithium Americas, and Ganfeng now exhibit almost complete control over the basins. One could argue that, due to Ganfeng’s 19.9% stake in the company and Lithium Americas’ 17.5% stake in the company, the basin is really controlled by Lithium Americas and Ganfeng. This is especially true when Ganfeng’s 35% direct interest in the SDLP project is brought into the picture.

Lithium Americas and Ganfeng already have quite a strong relationship, on account of their Cauchari-Olaroz partnership and Ganfeng’s 11% stake in Lithium Americas. Furthermore, Ganfeng first invested in Arena Minerals in March and Lithium Americas invested in the company in July, two months after Arena entered a definitive agreement to purchase the SDLP project. Ganfeng also made its bid for Millennial Lithium in July, four days after Lithium Americas invested in Arena Minerals.

I don’t believe it’s a coincidence that both companies selected the Pozuelos and Pastos Grandes salars as the location of their next lithium projects, especially so soon after taking stakes in Arena Minerals. The fact that Ganfeng went after another company in the area after losing out on Millennial Lithium to Lithium Americas further supports this narrative. I think this, again, speaks toward the strength of Arena Minerals, its management, its project, and its proprietary treatment process.

Arena estimates that the elimination of the purification circuit could save producers anywhere from 40% to 70% on operating costs, which would place them straight at the bottom of the cost curve. Given this potential benefit, it isn’t too hard to believe that other lithium companies would want a piece.

Investment Risks

As with any lithium junior, the need to secure the finances necessary to develop the company’s projects presents risk. In the case of Arena, it is clear that the SDLP project is the company’s primary focus and, as such, it will be the focus of this financing discussion. As of June 30, Arena Minerals had $4.23 million (5.71 million CAD) in cash.

At this point, I would classify Arena’s current cash position as weak, with fundraising inevitable to make significant exploration progression. However, with Ganfeng already on board as a 35% partner for the SDLP project, Arena’s access to capital is far better than most other juniors. As such, I do believe investors should expect dilution down the road, and I wouldn’t be surprised to see Ganfeng increase its project equity prior to construction, but I don’t expect funding to stand in the way of Arena’s commercial development.

On the subject of funding, I would also like to note that Arena’s decision to avoid any purification infrastructure outside of the evaporation ponds will significantly reduce construction costs. At Lithium Americas’ Cauchari-Olaroz project, for example, the refining and purification infrastructure is directly responsible for 31% of initial capital costs. So, by utilizing their process innovation to produce high-quality lithium chloride directly from evaporation ponds, Arena also significantly reduces future financing requirements.

Furthermore, with a looming lithium supply deficit and the nearby projects of Ganfeng and Lithium Americas, Arena may be able to secure financing by promising lithium refiners a portion of its annual lithium chloride production. While such an arrangement would limit Arena’s flexibility, and potentially its ability to fully capitalize on volatile spot pricing, it would help limit shareholder dilution.

After financing risk comes execution, the capability of a company to actually meet the goals it has set for itself. In the lithium industry, especially among juniors, this risk is quite high. Even assuming a project is able to fund exploration, development, and final construction, only about 50% – 60% of lithium production meets the battery grade standard.

Thus, Arena’s decision to focus on 35% lithium chloride, rather than the 99.5% lithium carbonate used in EVs, eliminates one of the riskiest aspects of a junior lithium company. Producing anything at a concentration of 35% is exponentially less difficult than producing it at a concentration of 99.5%. The tolerances are far looser, hence the ability to produce it in an outdoor pond rather than a controlled production environment.

The primary parameters needed for Arena’s pond production method are also incredibly easy to meet. The pond must have a pH that is neutral or basic, the temperature must be between 20°C and 105°C, and pressure must fall between 0 bar and 1.01325 bar. All of these parameters are either naturally occurring at Arena’s project site or, in the case of pH, can be easily altered.

But Arena’s proprietary brine treatment process also invites a unique risk, uncertainty. It’s unclear what exactly this lithium chloride will sell for, as it’s a rather unique lithium product. Given its lithium content, I do feel that it should sell for at least 2x the price of 6% spodumene. However, if Arena’s claims that its product will consistently yield battery-grade lithium carbonate without the use of a purification circuit are true, it could command an even greater premium.

Finally, with a share price below $1, Arena Minerals qualifies as a microcap stock. This brings inherent risk and subjects the company to significant volatility. Furthermore, on the OTC market, the average daily trading volume of just 90,000 could contribute to wide bid/ask spreads. The trading volume of 225,000 on the company’s native Canadian exchange is only marginally better, further contributing to this risk.

Valuation Discussion

Valuing Arena Minerals at this stage is not an exact science. Its maiden resource estimate of 560,000 tonnes LCE is nowhere near representative of the potential its project holds and it’s still unclear what operating profitability may be. The only indication of what promise the facility may have is from the company’s most recent press release, where it indicates that it is beginning the design and permitting process of a 40,000 tpa 35% lithium chloride facility.

While it is unlikely that this will be the final scale of the company’s project, given the youth of exploration, we can examine this preliminary estimate as a conservative basis for valuation. The spot price for spodumene currently resides at ~$5,400/tonne, up dramatically from about $450/tonne in January, 2021. More conservative outlooks estimate a longer term price of $1,800/tonne.

Using this price, and multiplying it by 2.25x to account for Arena’s greater lithium content and ease of processing, we can forecast annual revenue of $162 million. To get an idea of scale, 40,000 tpa of 35% lithium chloride is equivalent to 12,194 tpa of lithium carbonate. For reference, the nearby Pastos Grandes and PPG projects are expected to support annual production of 24,000 tpa of lithium carbonate and 30,000 – 50,000 tpa of lithium carbonate respectively.

I would expect operating costs to be no greater than $600 per tonne, which would yield gross profit of $138 million following the above parameters. This figure isn’t meant to be interpreted as a viable profit target, as it relies upon too many uncertainties to be reliable, but it does help begin to quantify the potential of Arena’s SDLP project. More importantly, it provides insight into the upside potential for Arena Minerals itself.

The company currently trades at a valuation of $138 million. If Arena is to successfully commercialize its deposit, I expect that it will do so inside of six years. While this certainly requires patience, these baseline estimates imply that investors will be well-rewarded should Arena Minerals prove successful.

And for most juniors, that’s really what pricing comes down to. The big if. But that’s not really the full picture for Arena. I don’t mean to imply that risk doesn’t make up a portion of its discount relative to potential future cash flows but, if we were truly looking only at risk, I believe the discount would be far smaller.

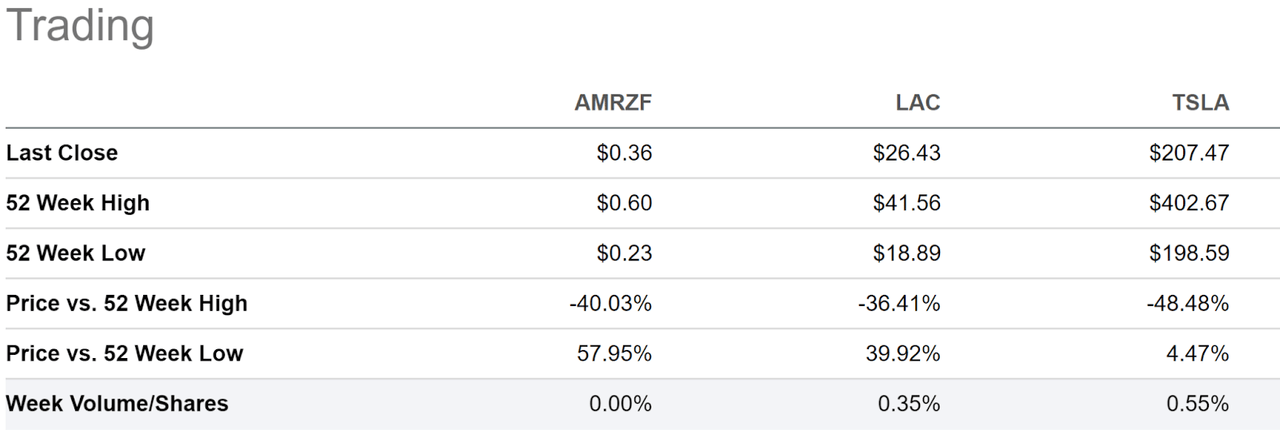

Rather, I believe much of this oversized discount is due to a lack of attention around Arena. The company itself is largely unknown, even among many lithium investors, thus contributing to less interest. The image below highlights the weekly trading volume of AMRZF relative to Lithium Americas and Tesla (TSLA), which was included to demonstrate what a highly popular company might trade at. Even when adding the company’s Canadian trading volume to its OTC trading volume, Arena’s weekly volume/outstanding shares is .081%.

Seeking Alpha

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition.

Be the first to comment