Talaj

Some analysts are asking the question:

“Are investor concerns about a Federal Reserve ‘pivot’ in its monetary policy impacting the value of the U.S. dollar?“

Let’s look at the data.

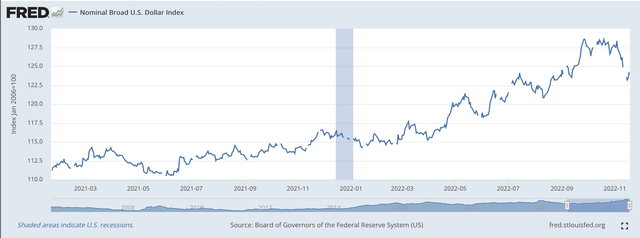

Nominal Broad U.S. Dollar Index (Federal Reserve)

This chart begins on the day that Joe Biden became the president of the United States.

The value of the U.S. dollar has risen from that date.

Note, however, that the series seems to “top out” around September 26, 2022, and then falls off up to the current time.

The talk surrounding this drop is whether or not the Federal Reserve is going to “back off” from its “tight” monetary stance and loosen up on the monetary reigns.

The Fed Reserve still seems to be “sticking to its guns,” but investors still seem to be questioning whether or not the Fed will “keep on, keeping on.” The lessons learned over the past decade or so seem to have taught investors that “buying the dip” will, over time, produce the best results.

This has resulted in greater swings in the value of the U.S. dollar this year than in 2021.

This seems to mimic the volatility in the stock market. The correlation is significant.

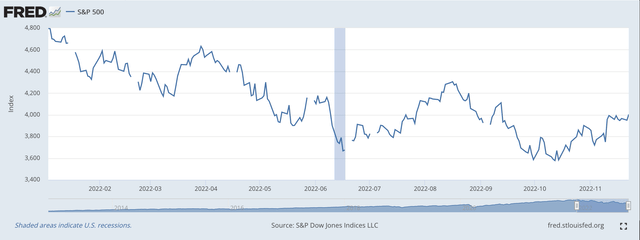

S&P 500 Stock Index (Federal Reserve)

One implication that can be drawn from this is that international money is following the “buy the dip” strategy along with investors from the U.S.

In other words, the Federal Reserve “trained” domestic investors and foreign investors well in the decade following the Great Recession.

In essence, the Federal Reserve became the prime driver of the U.S. stock market in the 2010s, as is shown in some of my recent writing. Now, however, it seems as if other investors have moved toward the same pattern.

Federal Reserve Leadership

But, what does this mean for markets?

The Federal Reserve basically “drove” the U.S. stock market in the 2010s.

Here is the chart for the stock market for the decade of the “teens.”

S&P 500 Stock Market (Federal Reserve)

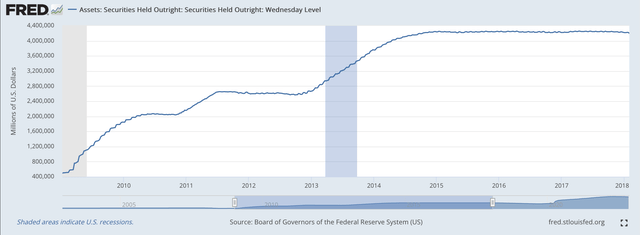

Here is how the Fed added securities to its securities portfolio up to February 2018, when Jerome Powell took over as the Fed chair from Janet Yellen.

Federal Reserve; Securities Held Outright (Federal Reserve)

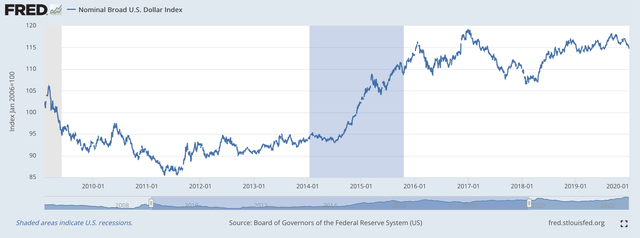

Here is what happened to the U.S. dollar during this decade.

Nominal Broad U.S. Dollar Index (Federal Reserve)

From early January 2011, the basic trend for the U.S. dollar was up.

It seems as if the strategy of Ben Bernanke, chairman of the Fed from February 1, 2006, to January 31, 2014, was to generate economic expansion through three rounds of quantitative easing.

The purpose of this quantitative easing was to stimulate rising stock prices that would produce a “wealth effect” in the private sector that would generate consumer spending.

The plan worked.

But, the economic growth for the expansion of the 2010s, was only about 2.3 percent. Historically, this was a rather modest rate of expansion.

However, prices only rose at a rate that was modestly over 2.0 percent.

This rate of inflation was much less than in other parts of the economically developed world.

The surprise outcome?

The value of the dollar rose throughout the decade since it was much lower than that experienced in other countries.

The 2020s

In the 2020s, the Federal Reserve began to talk about tightening up on monetary policy.

Other central banks around the world put off discussions about how they might tighten up their monetary policies.

In January 2021 when the Biden administration came to office, it was pretty clear that the United States was going to lead the developed world in combating inflation.

The major question was when that battle would begin.

However, investors around the world took the Fed’s statements and constantly began looking for the time when the Fed would get started. We see constantly through 2021 that the market was expecting Fed action.

And, so the statistics began to change.

As you can see from the first chart above that the value of the U.S. dollar began increasing, modestly, at the beginning of 2021.

The rise accelerated as the year moved along.

The value of the U.S. dollar increases through 2021, and then we get to the beginning of 2022 when it becomes almost unanimous that the Fed is going to tighten up its monetary policy.

As mentioned above, the rise in the value of the dollar becomes more variable as investors, more and more, look to “buy the dip.”

And, that is where we are today.

Takeaway

The takeaway from all this to me is that we cannot exclude the value of the U.S. dollar and its movements when we discuss investor attitudes about the future of the Fed’s actions and about how the markets are going to move in this time of Federal Reserve tightening.

The Federal Reserve did its work so well during the 2010s that now even foreign investors are “tied into the Fed” and act as if the Fed is the only act in town.

In my mind, I would like to think that Federal Reserve officials…as well as federal government officials…took a little more interest in the value of the U.S. dollar than they do.

I believe that it is very important to have a strong dollar and to have the central bank consider this as an important objective for it to achieve.

To me, this would lead to a stronger, more competitive U.S. economy, and would also contribute to the leadership role the U.S. plays in the world economy and in global finance.

I like the strong dollar very much. I hope that the value of the U.S. dollar remains strong.

Be the first to comment