JHVEPhoto

Thesis

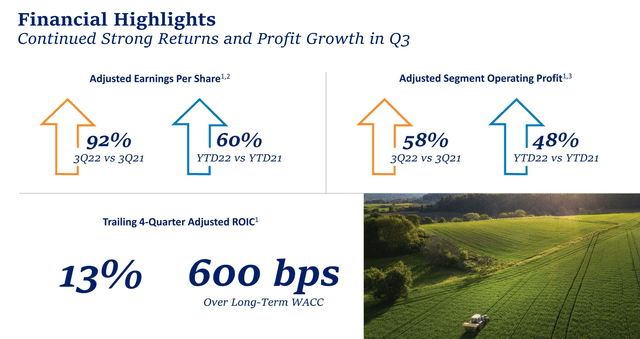

Archer-Daniels-Midland Company (NYSE:ADM) delivered strong Q3 results, comfortably beating analyst consensus estimates with regards to both revenue and EPS. Amidst strong global demand for grains, ADM achieved a 96% year-over-year jump in profits, generating $1.03 billion income attributable to shareholders.

Following the 13th consecutive quarterly earnings beat, I am confident to recommend Archer-Daniels-Midland stock as a ‘Buy’ idea. Personally, I believe that ADM should be fairly valued at $103.56/share.

For reference, ADM stock is up about 32% YTD, versus a loss of almost 20% for the S&P 500 (SPY).

ADM’s Strong Q3

During the September period, ADM managed to increase the top-line results at a 21.3% year-over-year growth rate, generating $24.68 billion of sales. Notably, sales came in about 10% above consensus ($2.47 billion beat), which estimated consolidated sales for the period at $22.21 billion.

Earnings attributable to ADM was $1.03 billion, or $1.83 per share, which is almost double the $526 million in Q3 2021. Again, earnings easily topped analyst consensus estimates of $1.39 per share. Notably, Q3 2022 results marked ADM’s 13th consecutive quarterly earnings beat.

ADM Third Quarter 2022 Earnings

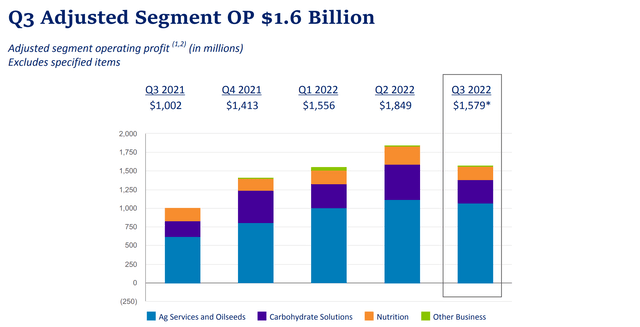

ADM highlighted that the operating income for both the “Ag Services” and “Carbohydrate Solutions” unit was “significantly higher” than in Q3 2021, while “Nutrition” performed in line with 2021.

- Ag Services and Oilseeds delivered an adjusted operating profit of $1.08 billion, versus $618 million for the same period one year earlier

- For Carbohydrate Solutions , adjusted operating profit in Q3 2022 was $309 million versus $219 million for Q3 2021 respectively.

- Adjusted operating profit for Nutrition was $177 million in Q3 2022, versus $176 million for the same period one year prior.

ADM Third Quarter 2022 Earnings

CEO Juan Luciano commented: (emphasis added)

Global demand remains robust, and our adjusted EPS of $1.86 is a reflection of our team’s expertise in managing dynamic market conditions, as well as the unique benefits of our integrated global value chain and our product portfolio.

…Today’s ADM is a resilient company, with a broad global footprint and an array of innovative capabilities that are driving performance for customers, consumers and shareholders.

…And with strong cash flows, we’re advancing productivity initiatives to enhance cost efficiencies and returns; driving innovation efforts to build new capabilities and growth engines across all of our businesses; and continuing to return capital to our shareholders.

Well Positioned For Strong 2023

Although ADM management did not give a formal guidance for Q4 2022 and/or early 2023, management hinted on continued strength. CEO Juan Luciano said that:

We’re well positioned to end 2022 strong, and carry that momentum into 2023.

And Mr. Luciano’s confidence makes sense, in my opinion, as ADM’s business strength is a reflection of strong demand for oilseeds and food procession, as well as tightening grain stocks. Investors should consider that food price inflation – and accordingly expanding margins for ADM – is likely to persist, even though central banks are fighting rising prices.

Food inflation is not only a function of the Russia-Ukraine war, but also a function of a structural supply shortage. According to “Action Against Hunger,” in 2022 about 829 million people do not have enough to eat. Moreover, as the planet is expecting an additional two billion people by 2050, the World Resources Institute highlights a 56% food gap between the crop calories produced in 2010 and the crop calories needed in 2050. The resulting potential tailwind for ADM is obvious.

Valuation Is Attractive

ADM is trading at a one year forward P/E of about x13, a P/B of x0.5 and a P/S of about x2 – with all valuation metrics clearly below the industry median (discount between 30 – 50 percent).

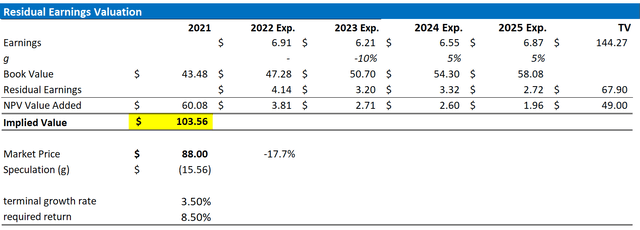

That said, to derive a more precise estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

Residual Earnings Model

With regard to my ADM stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on ADM’s cost of equity at 8.25%.

- For the terminal growth rate after 2025, I apply 3.5%, which (about one percentage point higher than estimated nominal global GDP growth).

Given these assumptions, I calculate a base-case target price for ADM of about $103.56/share.

Analyst Consensus Estimates; Author’s Calculation

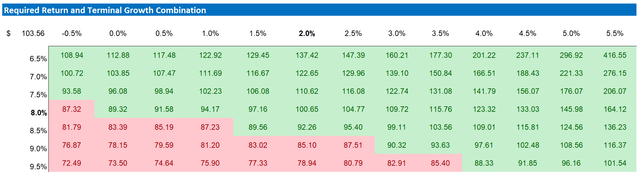

Notably, my base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of ADM’s cost of equity and terminal growth rate, I have constructed a sensitivity table. Note, the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus Estimates; Author’s Calculation

Risks

There are two key risk factors that I would like to highlight: First, as a manufacturing company, ADM remains vulnerable to cost inflation (raw materials and labor), which could pressure the company’s profit margins. Second, there is also the risk that, if other quality companies selloff significantly, the relative equity valuation for ADM could become stretched versus the relative market – which could force a repricing at lower multiples.

Conclusion

ADM stock is a “Buy,” I argue. The company has consistently beaten analyst consensus estimates for the past 13 consecutive quarters, and structural tailwinds – most notably food price inflation and population growth – are likely to support the continuation of this success streak. Moreover, ADM has remained relatively resilient against the macro-economic slowdown and the stock is valued attractively.

Personally, I believe that Archer-Daniels-Midland should be valued at about $103.56/share, which would imply upside of about 18%.

Be the first to comment