wellesenterprises

Investment Thesis

Archer-Daniels-Midland (NYSE:ADM) has diversified businesses that create the potential for strong shareholder returns. I think this is a good investment to gain exposure to the agricultural bull market. This can also hedge economic headwinds, especially over the long term.

The company’s cyclical nature adds some risk. But the business generates strong returns on its invested capital and consistently gives this cash back to investors. I think this is a good opportunity to start a small position and buy any potential pullback.

Resilient Earnings And Long Term Growth

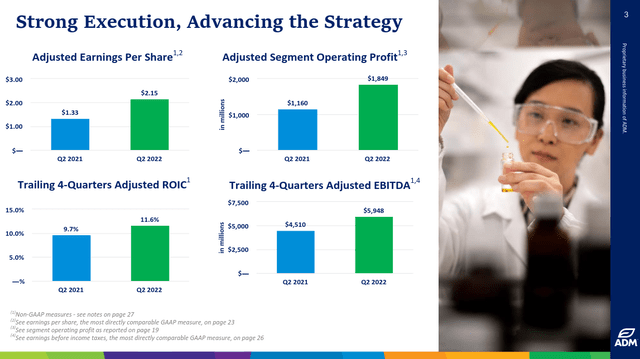

The current agricultural bull market is in full swing. Over the past 12 months, food costs have risen by 11.4%, outpacing the 8.3% inflation in the broader market. Prices for a variety of agricultural commodities have increased heavily. Corn futures (C_1:COM) are up by over 30% year over year, and soybean futures (S_1:COM) are up by 15% year over year. Archer-Daniels-Midland has capitalized on these trends. During the last quarter, the company grew its top line by 19% and its GAAP operating income by almost 100% year over year.

Archer-Daniels-Midland Q2 2022 Earnings Presentation

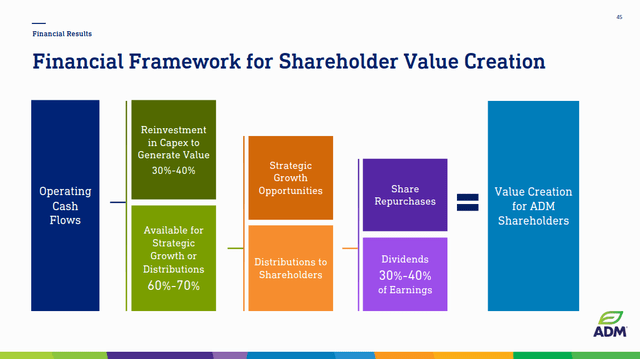

The company has effectively offset inflation with productivity gains. I believe the company is well positioned to further increase its profitability as fuel costs drop and supply chains normalize. Management released a solid plan for reinvestment in capital expenditures and acquisitions. 30% to 40% of cash flows are allocated to capital expenditures and 30% to 40% are reserved for dividends. The remainder will be spent on growth and share repurchases.

Archer-Daniels-Midland 2021 Investor Handout

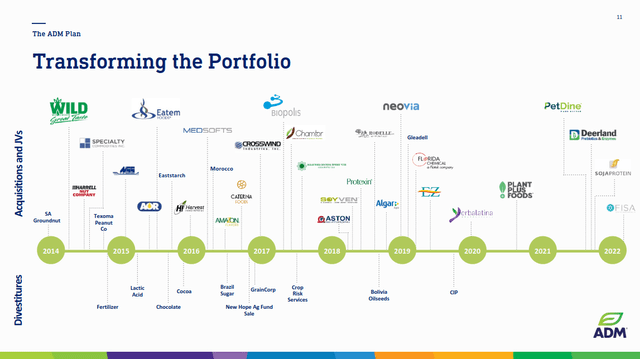

But the agricultural commodities market is cyclical when compared to other consumer staples. Keep in mind that Archer-Daniels-Midland’s revenue was flat for most of the past decade. A lot of the bullish case is based on the company’s continued ability to invest and build capacity.

I think that the company has shown the ability to deliver on these goals. Management reports that their investments are generating better than expected returns. However, the company has a history of explosive earnings growth followed by years of muted returns.

Archer-Daniels-Midland 2021 Investor Handout

In the short term, I think the largest risk of consumer staples investments is demand destruction. Current economic headwinds are changing consumer spending trends. A decline in demand for certain products could hurt the revenue and earnings of companies that are otherwise stable.

I believe that Archer-Daniels-Midland is well positioned to navigate these headwinds. Across the food industry, consumers are already trading down. Lower priced products are becoming more competitive in the marketplace. These trends are being felt across segments. McDonald’s (MCD) and Chipotle (CMG) reported that customers are purchasing cheaper menu items. Grocery businesses have reported similar trends. Archer-Daniels-Midland’s management discussed this dynamic on their last earnings call.

Listen, we’re watching the demand, of course. We go — we work very closely with our customers and our farmers on this. I would say we have seen demand substitution, demand shifting here or there. And you see it in retail, maybe to private label. We’ve seen a little bit to people looking into smaller packaging to make things more affordable. So I would say, if I think of the big categories for ADM, food tends to be, despite all these comments, much more reliable, much more stable in that — just the essential nature of that.

This is where the benefits of diversification are the clearest. Other companies may be exposed to specific agricultural or food products. Those businesses may be left out if demand declines in one or two particular markets. But Archer-Daniels-Midland has broad exposure to a variety of agricultural products. A decline in one business is likely to be offset by an increase somewhere else. A good example of this is the sales balance in the company’s animal feed segment.

I think we have seen less of an impact on an OP perspective because as people like to trade down, if you will, or if they were to trade down from beef, chicken is a cheaper protein. It’s a more affordable protein. And chicken is where we get all the soybean meal mostly sourced. If you think about what’s happening with soybean meal, it is — it has a cost advantage to corn. So it continues to have a high proportion in the rations on things that are, if you will, more demanded right now like poultry.

Weakness in some portions of the animal feed market have reduced volume. But this has been offset by some strength in chicken feed, creating a nice tailwind to boost overall profit.

I think Archer-Daniels-Midland has a favorable risk to reward in the current market. The company has shown the ability to grow its productivity and offset inflation effectively. It also isn’t as vulnerable to many of the current economic headwinds. But the company’s cyclical earnings growth is still a potential risk. Because of this, I’m exercising some caution. I still feel confident in the long term growth of the underlying businesses.

Dividend Growth And Valuation

Archer-Daniels-Midland is trading at a relatively cheap valuation considering its defensive nature. The company has a forward P/E of 12.5 times and a forward EV/EBITDA of just 9.75 times. This is within the range of what I’d be willing to pay for a company with this favorable of a risk profile. The stock has driven strong long term returns while not being very correlated to the overall market.

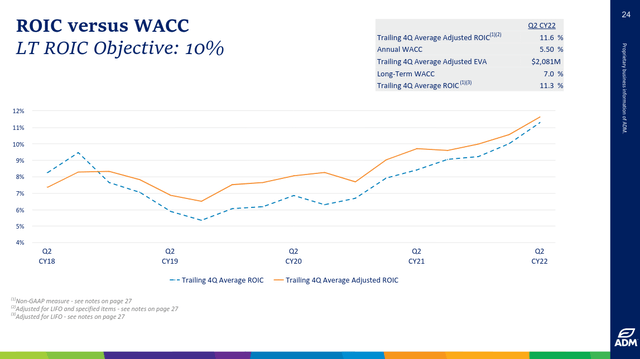

Archer-Daniels-Midland also has a promising return on invested capital. The business’s TTM ROIC hit a high of 11.6% in the last quarter. This marks the third straight quarter at or above the company’s long term goal of 10%. Management is planning to continue growing ROIC above current levels. As rates increase, they’ve committed to maintaining the spread against their weighted average cost of capital.

Archer-Daniels-Midland Q2 2022 Earnings Presentation

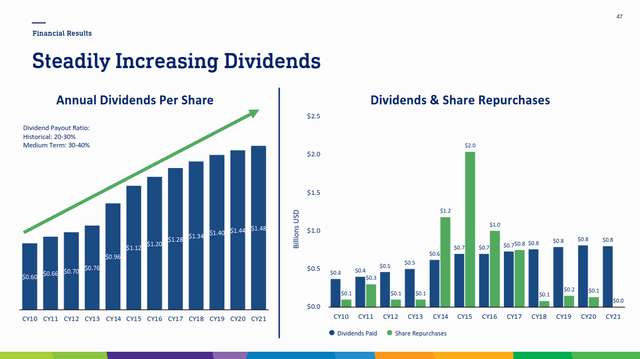

When analyzing direct shareholder returns, the company also appears to be performing well. The business announced plans for $1 billion in share repurchases in the last half of the year. This would be the highest shareholder returns since 2015. Management reiterated their long term goal of $5 billion in buybacks.

Archer-Daniels-Midland 2021 Investor Handout

The business also pays a healthy dividend, which management is committed to growing over time. The business has increased its dividends for 28 years, hiking at a CAGR of almost 9% over the past decade. These consistent increases have continued through multiple recessions and market crashes. At its current levels, the payout is well covered by the company’s earnings. I think that Archer-Daniels-Midland is a solid pick for dividend growth investors. Its payout is sustainable and has room to grow. At the current valuation and ROIC, I don’t think you’re sacrificing total returns for yield, either.

Final Verdict

I believe that Archer-Daniels-Midland is a good dividend growth pick for the long term. The business is effective at investing its capital and increasing its productivity. There is the potential for high returns in the form of both dividends and share buybacks.

In the short term, the business might be more cyclical. The company’s dynamics make it more resilient to consumers trading down. However, it’s unlikely that the current rate of growth is sustainable. While I’m bullish on the stock, I think that slowly adding to a position makes the most sense right now.

Be the first to comment