NiseriN/iStock via Getty Images

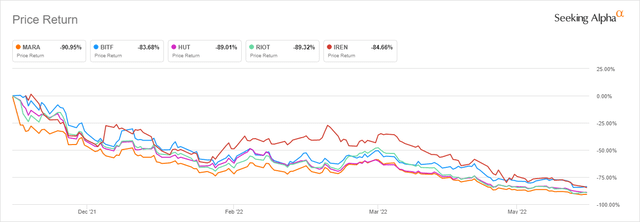

As Bitcoin (BTC-USD) has declined from $69k down to $20k over the last 7 months, the Bitcoin miners have been hit considerably hard. Many of them are down between 80 and 90 percent since their November 2021 peaks.

Performance Since 11/12/21 (Seeking Alpha)

What has hurt the business models for the entire crypto mining sector has been the increase in energy costs coupled with the decline in Bitcoin’s price. For a little more insight on that, check out my article covering Iris Energy Limited (IREN) from about a month ago. Despite the putrid investment climate for crypto mining-related businesses, Applied Blockchain (NASDAQ:APLD) recently completed a Nasdaq up-listing. The organization has gone through a name change and a business change over the last year or so.

Previously it was called Applied Science Products and it ran an internal Ethereum (ETH-USD) mining operation. Assuming Ethereum pulls off the transition to a PoS (proof of stake) consensus mechanism, this pivot from mining is probably a good idea. The company has sold off those mining assets and changed course. Unlike other mining companies, Applied Blockchain now has a very different revenue generation model.

Business model

Rather than owning a large amount of ASICs and mining as many coins as possible, the company is opting for location leasing to customers who use the company’s mining facilities for a service fee. Applied Blockchain describes the business model in this way:

The Company has a colocation business model where customers place hardware they own into the Company’s facilities and the Company provides full operational and maintenance services for a fixed fee. The Company typically enters into long term fixed rate contracts with our customers.

In my view, this makes Applied Blockchain more similar to a company like Compass Mining than it does most of the other publicly traded mining organizations. There’s an argument to be made for this kind of approach to mining. The true mining business has quite a bit of upfront cap-ex and the rigs need to be maintained from their purchase to their eventual obsolescence. With Applied’s colocation model, revenue is fixed and more stable than it would be from owning the actual mining operations. While this means revenue upside is capped at location capacity, it also means the revenue should have a reasonable floor as long as Applied’s prices stay competitive and the company’s customers maintain solvency even when the crypto market struggles.

Next-Gen Data Centers

As a hosting site, Applied Blockchain is essentially a data center provider. The company pointed out both in its May investor deck and during its quarterly earnings call that there is a sizeable advantage in the “Next-Gen” data centers that the company is building compared with traditional data centers. On the last call, CEO Wes Cummins said this:

The next-generation datacenters we’re developing are optimized for large computing power and require more power than traditional datacenters that are optimized for data retention and retrieval. Next-gen datacenters have very different layouts, internet connection requirements, and cooling designs to accommodate different power demands and customer requirements. So we believe we’ve developed a core competency with our team that will be difficult to replicate, especially for traditional datacenter operators.

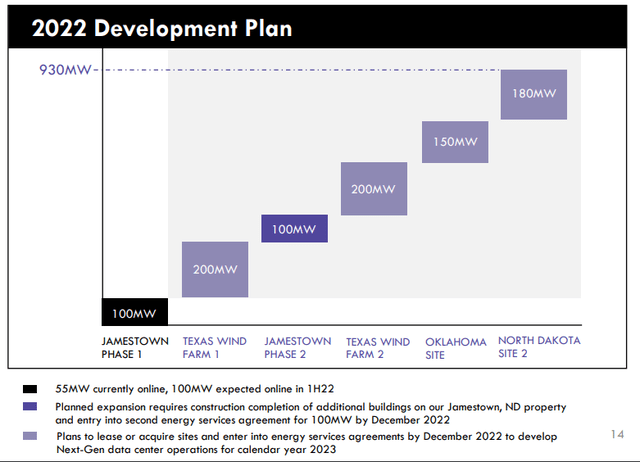

The vast differences in layout and in energy costs mean that traditional data centers are going to have a very difficult time adjusting to accommodate the mining business if they wish to do so. It also means that jurisdiction is important because mining operations rely on very competitive electricity costs. The company currently has operations live in North Dakota (Jamestown) and has plans to build out hosting in Texas and Oklahoma.

Development Plan (Applied Blockchain)

From a growth perspective, the company envisions 1.8 GW capacity over the next 2 years and 5 GW capacity over the next five years. That capacity growth comes with a focus on geographic diversity that takes political jurisdiction risk into consideration and that allows for an emphasis on renewable energy usage. At 5 GW capacity, the company projects EBITDA margin of 40%. On the call, Cummins stated that Applied Blockchain estimates demand for their services is growing faster than what they will be able to supply the market:

Our internal estimate is between 5,000 and 6,000 megawatts of hosting capacity needs to come online over the next 12 months to meet the publicly stated goal of the publicly traded mining companies in North America

If those estimates come to fruition, Applied Blockchain should be able to sell mining capacity and generate more stable revenue for the company without much issue.

Valuation

On both the last call and in the May investor deck, Applied Blockchain makes mention of transitioning the company to more of a REIT structure. In the deck, the company cites REITs Digital Realty Trust (DLR), Equinix (EQIX), and Innovative Industrial Properties (IIPR) as having similar models to what they hope they can become. Based off those peers, Applied is very expensive base on sales multiples:

| APLD | DLR | EQIX | IIPR | |

| Price/Sales TTM | 37.69 | 8.03 | 9.03 | 12.55 |

| EV/Sales FWD | 18.87 | 11.06 | 9.53 | 12.30 |

| EV/Sales TTM | 135.86 | 11.53 | 10.89 | 15.65 |

Source: Seeking Alpha

If we view Applied Blockchain more through the lens of a mining business, it’s even more expensive:

| APLD | HUT | MARA | RIOT | |

| Price/Sales TTM | 37.69 | 2.05 | 3.61 | 1.84 |

| EV/Sales FWD | 18.87 | 1.55 | 3.26 | 1.46 |

| EV/Sales TTM | 135.86 | 1.72 | 5.82 | 2.08 |

Source: Seeking Alpha

Based on enterprise value to sales from both a trailing and forward multiple, Applied Blockchain’s valuation is a bit rich compared to both REIT and mining model peers.

Risk

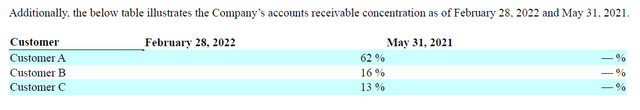

In the last quarterly filing, Applied Blockchain listed its hosting contract customers. Those entities are JointHash Holding Limited, Bitmain Technologies Limited, F2Pool Mining, Inc. and Hashing LLC. Additionally, the company broke out the receivables for 3 of the customers while keeping the names confidential.

Customer Concentration (Applied Blockchain)

In my view, the customer concentration is high with the top receivable at 62% of the total. Beyond that, the mining business is facing serious problems with margins getting squeezed. As I mentioned in my Iris Energy article from last month, higher hash rate and lower crypto prices are the exact opposite of what mining operators want. If that continues, some miners may face solvency concerns.

Summary

In my opinion, Applied Blockchain is an interesting spin on the typical publicly traded crypto mining companies. I think in a diversified equity portfolio with an emphasis on crypto and blockchain tech, Applied Blockchain is probably one to ultimately consider. For me personally, I don’t like it at this valuation. I think there is a pretty big customer concentration risk currently and I’d like to see Applied Blockchain’s receivables become a bit less reliant on the success of one entity. I can’t recommend it here. But I think it’s one to keep an eye on.

Be the first to comment