Nikada/iStock Unreleased via Getty Images

While Apple (NASDAQ:NASDAQ:AAPL) is our favorite consumer electronics company, we believe Apple is not immune to growth challenges. We recommend investors wait out the holiday season to see how the demand materializes before buying Apple stock. We believe that in the rising interest rate and the inflationary environment we currently are in, the consumer is not immune to slowing down. With Apple raising prices outside the US, Europe, and Japan to offset currency, we expect demand to slow down in these geographies. According to news reports, there is an apparent slowdown in China, making it hard to beat estimates handily. At its recent product launch event, Apple has not introduced any category killer or revolutionary products for the holiday season, making the stock less compelling than usual. Apple stock is not cheap and is trading at 24x C2023 EPS of $6.57, versus the large-cap peer group average of 23x. We expect the estimates to reset lower, making the stock less appealing. Therefore, we recommend investors wait for the dust to settle and for a better entry point before buying the stock.

Widening the product lineup at the top and bottom to widen the user base

On the recent product day, Apple launched the newer versions of its iPhones, Watches, and Air Pods. The products were largely evolutionary rather than revolutionary, and many Apple users will have to think hard if it is worth upgrading their existing products. The company also launched iPhone 14 Plus, a newer model at $899, to make it appealing to more customers at a lower price point. Surprisingly Apple maintained the pricing in the US but raised the prices in Europe and Japan to possibly account for weakening local currencies. We believe Apple is working on a strategy to widen the price points for all its devices from the low-end to high-end. Apple has expanded the Apple Watch category by lowering the Watch SE 2nd gen price while also announcing the Watch Ultra, which supports new GPS frequencies and up to 60 hours battery life. The product introductions confirms our belief that Apple intends to sell as many devices as possible at various price points and lock-in users through its subscription services.

Services are the new jackpot

AAPL is creating i-services for all aspects of life: entertainment, finance, storage, education, health, and automotive, among others. AAPL is playing its cards right by expanding its high-margins service business. The more services customers use, the less incentive they will have to shift to Android. We believe AAPL’s new services are a step forward in AAPL’s mission to sell hardware as more than a work tool. Apple’s install base of 1.8 billion devices will continue to drive growth and profits for the company. The company is working on getting more devices into the hands of its customers so that it can sell them more services over time.

The Services business is one of the fastest growing businesses within AAPL’s product portfolio. AAPL services are slowly slipping into all aspects of life with iCloud for storage, Apple Pay for finances, Apple TV & Music for entertainment, Apple Fitness and Apple watch services to monitor health, Apple News for global affairs, and Apple CarPlay for automotive services. AAPL has essentially built a mini world in which all its customer need is AAPL products to remain connected.

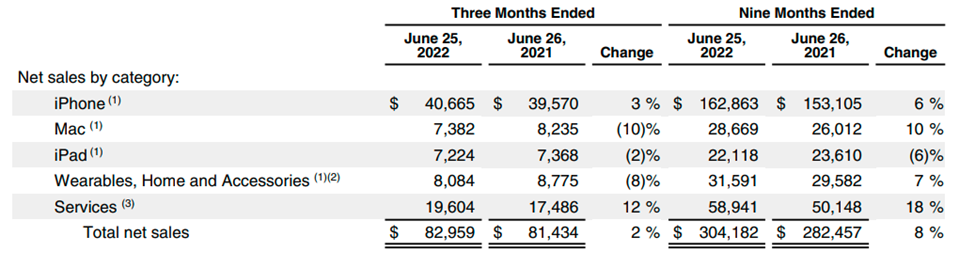

AAPL services have already been growing significantly since 2020. Services revenue reached $68 billion in 2021 compared to $54 billion in 2020. Services remain the fastest growing segment of its revenue and are highly sticky. We expect AAPL’s services to expand its customer base significantly in the coming months. The following chart illustrates Apple’s revenue breakdown.

Apple

Advertising business gaining in strength

AAPL gained market share in digital ads after the company released its iOS privacy update in 2021. The update made it harder for Facebook (META) to track users’ activity. The company advertiser adoption rate for 2Q increased by four percentage points to 94.8%. In comparison, META fell by three percentage points to 82.8%, and Google (GOOG) (GOOGL) dropped two percentage points to 94.8%, according to an analysis conducted by Appsumer. AAPL comes in third place after META and GOOGL in online advertisements. The company still does not beat META or GOOGL’s digital ad market share, but we believe APPL is headed in the right direction to gain a larger market share in the future.

Valuation

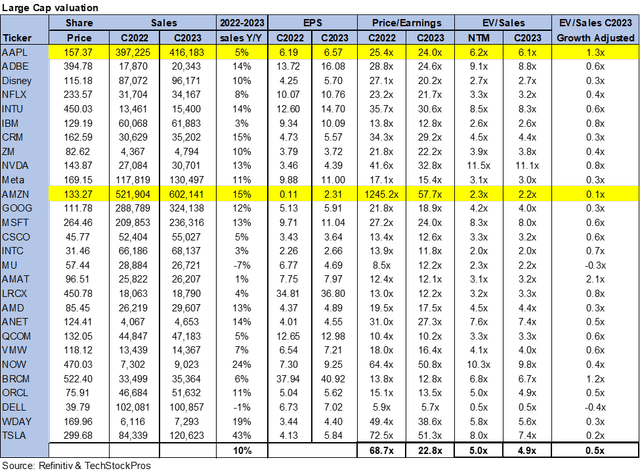

AAPL is not cheap. AAPL is currently trading at 24x C2023 EPS of $6.57 compared to the peer group that is trading at 22.8x C2023. On an EV/Sales, AAPL is trading 6.1x C2023 sales versus the peer group average of 4.9x.

On a growth-adjusted basis, AAPL trades at 1.3x versus the peer group at 0.5x. While we expect the company to outperform market expectations and peer group stocks over the longer term, we expect the stock to be under pressure in the near term. The following chart illustrates AAPL’s valuation relative to its peer group.

Apple multiples still remain elevated

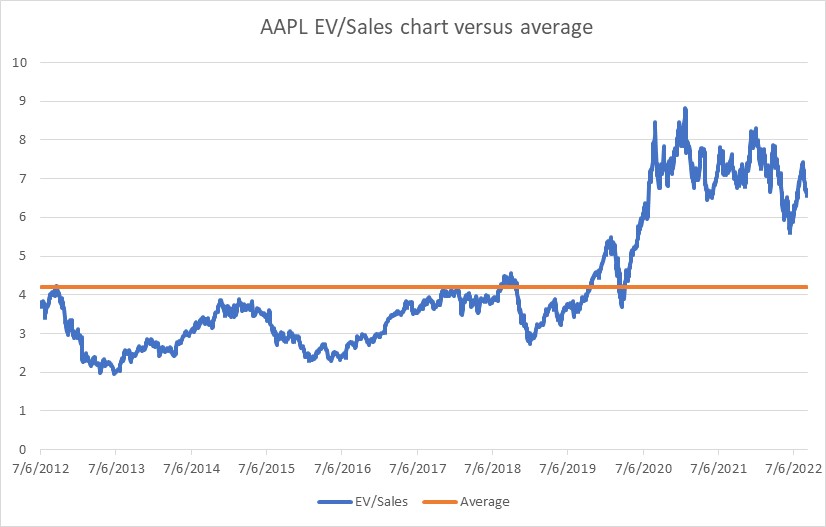

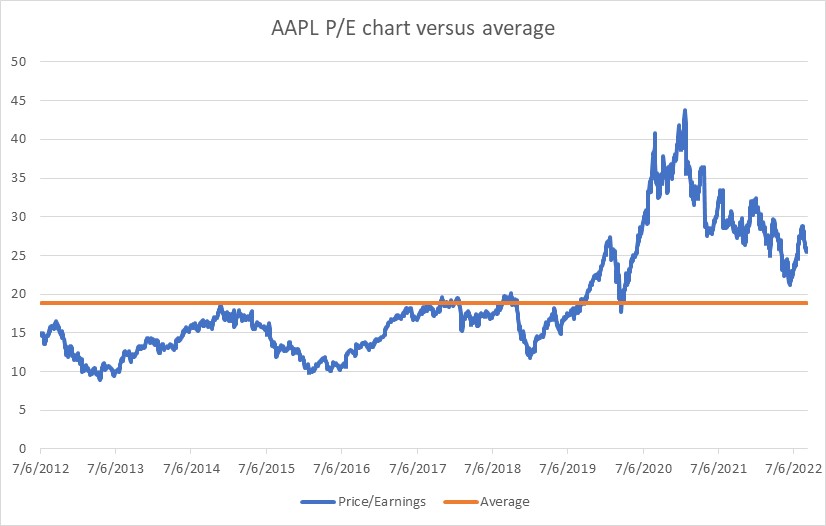

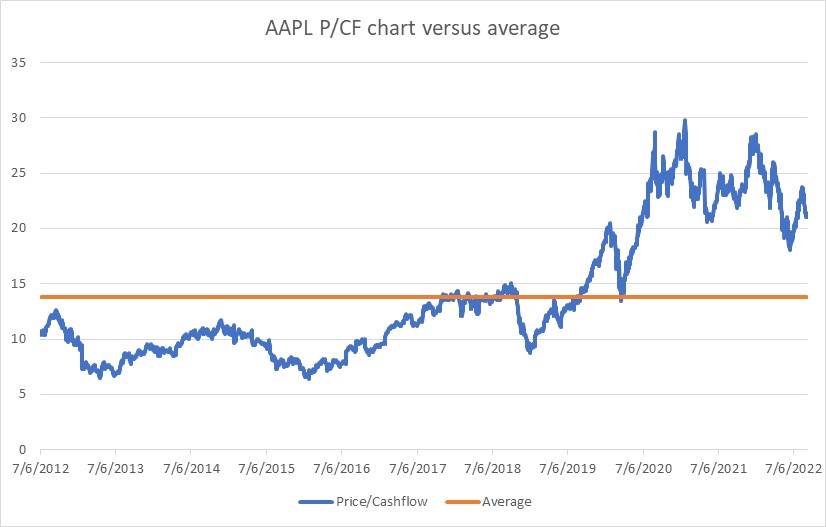

Apple’s P/CF, EV/Sales, and P/E saw rapid expansion over the last ten years. On a P/CF basis, Apple trades at 21x versus the historical mean of 13.8x. On an EV/Sales basis, Apple is trading at 6.6x versus a historical mean of 4.2x. Finally, on a P/E basis, Apple is trading at 24x while the last ten-year average is about 18.9x. While P/E is now at the historical average, P/CF and EV/Sales are above the mean. We believe Apple’s multiples will likely revert to mean over the next few months, and we recommend that investors remain patient for a better entry point. The following charts show that Apple is trading well above the historical averages.

TechStockPros & Refinitiv TechStockPros & Refinitiv TechStockPros & Refinitiv

Word on Wall Street

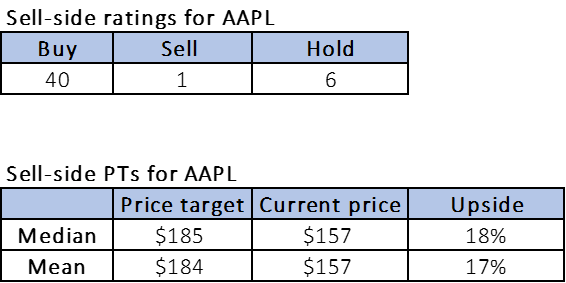

Out of the forty-seven analysts covering the stock, forty are buy-rated, one is sell-rated, and the remaining are hold-rated. The ratings show the Wall Street consensus is overwhelmingly bullish on the stock. AAPL is currently trading at around $157. The median price target is $185, and the mean price target is $184, for a potential upside of about 19%. The following chart indicates the sell-side ratings and price targets.

TechStockPros & Refinitiv

What to do with the stock

While we remain bullish on Apple’s products and its ability to execute its roadmaps, we urge investors to remain patient and wait for a better entry point. We expect the demand for Apple’s products to remain under pressure, and the iPhone upgrade cycle may be challenged and less stellar. Given the world’s challenging environment, we expect many consumers to delay upgrading their iPhone devices. With Apple trading well above its 10-year averages, we believe there is more risk to the stock in the near term than the market is currently pricing. Parts of Europe and Asia are expected to fall into recession over the coming months. Already China is reeling from Covid-induced lockdowns. In the US, inflation is impacting consumer buying habits. Therefore, we expect estimates to come down over the next few months, and the multiple is likely to compress from the current levels. We would be waiting for a better entry point before we buy more shares at the current levels.

Be the first to comment