Nikada/iStock Unreleased via Getty Images

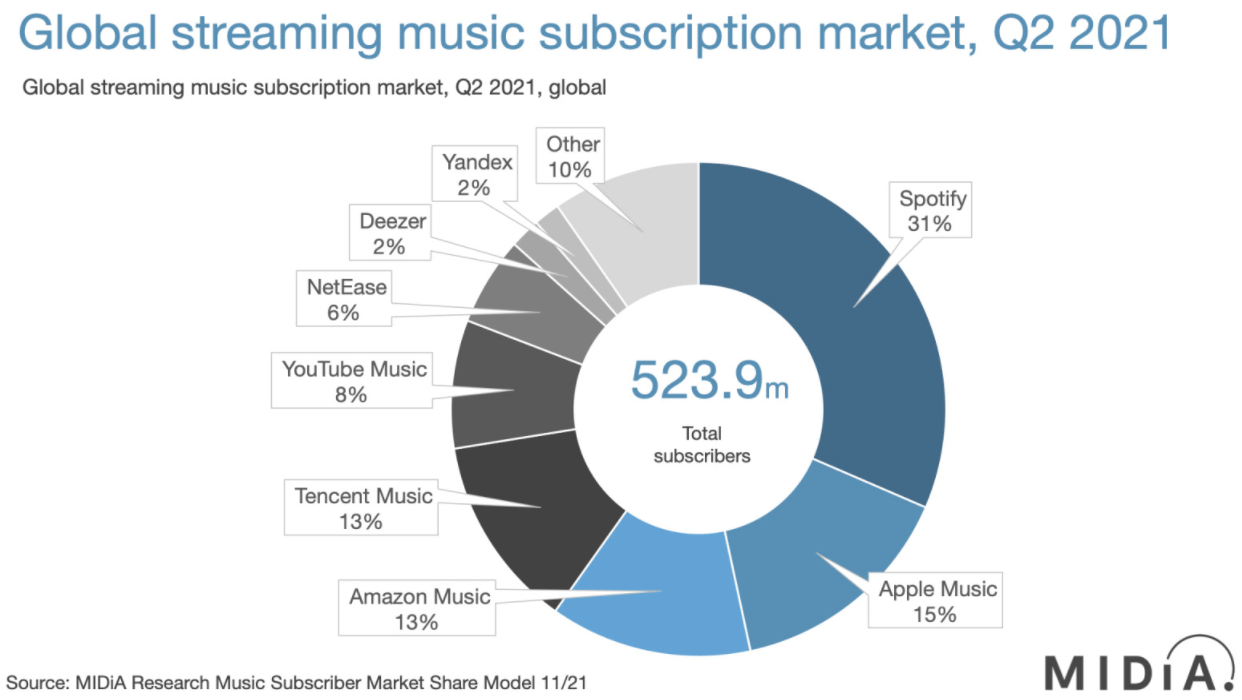

Apple (NASDAQ:AAPL) is facing challenges from Amazon (AMZN) and Google (GOOG) within the music streaming industry. The company has not reported subscriber numbers within this service for over 2 years. One of the reasons could be that there has been a growth slowdown in net subscriber additions. Third-party estimates by MIDiA Research have shown that Apple Music has a 15% market share which is followed by Amazon Music at 13% and YouTube Music at 8%. Both Amazon and Google have a very strong presence in the smart speaker and smart display market which are providing good tailwinds to their music streaming business.

The contribution of music streaming business to Apple’s top line and bottom line is very less which reduces the impact on key financial metrics in the quarterly reports. However, it can have a big impact on the service segment growth in the long run. Hence, any dip in market share for the music streaming business can be a big challenge for the management. It may lead to lower growth estimates for the Services segment which can be a major headwind for Apple stock.

Short-term impact on Services segment and stock sentiment

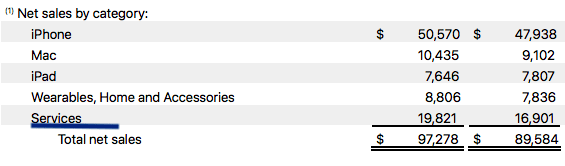

Apple reported Services revenue of $19.8 billion in the latest quarter. The total net sales for the quarter was $97.2 billion. The revenue share of Services segment was only 20% but it plays a much bigger role in the valuation thesis of Apple stock. Apple’s valuation multiple has expanded in the last few years based on the growth potential of Services segment, while the growth in Products like iPhone, Mac and others has been modest.

Apple Filings

Figure 1: Services segment contributes close to 20% of the total revenue base. Source: Apple Filings

Third-party reports estimate that Apple Music’s paid membership is close to 75 million. If we take the average selling price of $100 for this service, it contributes $7.5 billion to Services revenue base on an annualized basis or close to $2 billion on a quarterly basis. Hence, Apple Music contributes close to 10% of Services segment revenue base.

Apple reported 9% YoY revenue growth in the latest quarter while the Services segment grew by 17%. Wall Street expects the Services segment to continue to deliver a better growth rate than the overall revenue growth. A slowdown in the growth rate of Apple Music will impact the growth trajectory of Services segment.

Apple does not have a strong anchor service within its subscription services similar to Amazon’s Prime membership which has over 200 million members. The management is trying to build TV+ service and hopes to have a loyal base for its streaming video and music content. A slowdown or a decline in paid membership within Apple Music can have a big impact on the entire subscription ecosystem of the company. This can cause slower growth in Services revenue growth which can pull down the valuation multiple for Apple stock in the near term.

Slowdown in growth

Music streaming industry has been growing rapidly in the past few quarters. However, Apple’s market share in the streaming music subscription market has declined due to slower growth compared to other peers. In the latest estimates by MIDiA research, the market share was 15%. In the previous report, MIDiA Research estimated that Apple Music’s market share was 16%.

MIDiA Research

Figure 1: Apple is closely followed by Amazon Music and YouTube Music. Source: MIDiA Research

YouTube Music has particularly shown very high growth rates as Google launched attractive subscription options. The last announcement by the company mentioned that it had over 50 million paid subscribers for YouTube Premium and Music business. Google could increase the demand of its Premium and Music subscription by adding further restrictions for non-subscribers on YouTube. Amazon also has a discounted rate for its music streaming platform and gains a lot from its Prime membership which acts as an anchor service for the subscription business.

Apple’s disadvantages

Apple does not have another anchor service which can be combined with music streaming business to increase its attractiveness. It is increasing investment in TV+ but it would take a lot of time and resources to build a very attractive original library. Apple is also lagging in the smart speaker business. It had discontinued HomePod because the cost was quite prohibitive to customers who already had an option of Amazon and Google devices. The new HomePod mini is showing better reception due to lower price. However, Apple needs to cover a lot of ground in order to reach the market penetration of Amazon and Google devices.

The music streaming business on its own has very low margins. Spotify (SPOT) is barely making any profits despite being the industry leader. The main benefit of a strong music streaming business is that it can provide a flywheel effect to other services. If Apple does not have a host of services that it can tag onto the music subscription, it will not move the needle for Apple. Amazon already has a well built Prime business and Google is rapidly expanding its subscription business. Hence, Apple would need to show progress in this segment to gain better growth runway in other services.

Can Amazon and Google overtake Apple Music?

The current growth and market share trends should allow Google and Amazon to overtake Apple Music by end of 2023. This would be a very important milestone in the battle between big tech companies. Apple had touted its music streaming business for a number of years. If Amazon and Google can overtake Apple despite being late comers in this industry, it can reduce Apple’s ability to maintain market share in other important products and services.

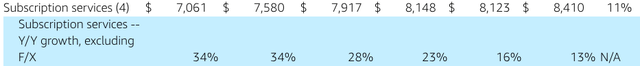

Figure 2: Amazon’s subscription business growth in the last few quarters. Source: Company Filings

While Apple’s Service revenue was $68 billion in the last fiscal year, Amazon also reported a robust $31 billion subscription revenue. Amazon last reported Music Unlimited subscriber number at 55 million in early 2020.

Google has been the biggest surprise within the streaming music industry. It reported over 50 million paid subscribers in Premium and Music subscription which is slightly behind Apple Music’s last announcement of paid subscriber numbers. YouTube has a massive user base and it is trying to promote the Premium services in almost every region. There are several levers available with the company which can help it increase the paid subscriber base. It has already announced another big price increase. This is a sign that the management is confident in customer retention and attracting new customers. At the current subscriber base and growth rates, the Premium and Music subscriber base could reach over 100 million by 2025.

It is very likely that we could see a change in market share ranking in the rapidly changing music streaming industry. Apple Music at the second spot could be a big loser as Amazon and Google ramp up their efforts to gain more subscribers by leveraging their ecosystem.

Impact on Apple stock

It needs to be noted that the contribution of music subscription business to Apple’s top line and bottom line is very low. If we take the annual average selling price of $100 for Apple Music and a subscriber base of 75 million, it will lead to revenue base of $7.5 billion. This is a mere 2% of its fiscal revenue base. The margins in this business are wafer-thin or negative. Hence, the contribution to bottom line would be even more insignificant.

However, there is a big impact of the music streaming subscriber base on future subscription services launched by Apple. The management has not released any subscriber numbers in this service for over two years. If other third-party estimates show a decline in Apple Music’s market share, it will send a negative signal to Wall Street on the ability of the company to enter new services and deliver good growth. We could also see a bearish sentiment towards the overall moat of the company and its long term growth projections.

Figure 3: Apple’s PE ratio over the last few years. Source: Ycharts

Despite the recent correction, Apple’s PE ratio is significantly above the long-term average PE ratio. A poor performance in music streaming business can have a negative impact on the overall subscription business which will pull down the growth trend for Services segment.

Apple’s higher PE ratio has been due to the growth potential of Service segment. If there is a major headwind within the Service segment it can lead to a strong bearish sentiment toward the stock. Investors should closely look at the evolving music streaming space to gauge Apple’s next move and its impact on the stock.

Investor Takeaway

Apple has been losing market share in the music streaming business as Amazon and Google increase their presence. Both Amazon and Google have a strong ecosystem of services and are leading in smart speaker market share. Amazon has over 50 million paid subscribers in its music streaming platform and Google also has over 50 million subscribers for its Premium and Music service. At this base, these services are moving the needle for these tech majors and we should see a massive increase in their effort to gain more subscribers.

Apple Music could find it difficult to defend its turf as it does not have other services which can make music streaming more attractive. Any big decline in market share within music streaming will hurt Services revenue and could be taken by Wall Street as a negative. This will hurt the sentiment towards the stock and limit the long-term growth runway for the company.

Be the first to comment