Astrid Stawiarz

Michael Burry recently closed his short position in Apple Inc (NASDAQ:AAPL) stock. In the first quarter, he revealed that he had bet against the company with $36 million worth of puts. The news came in the form of a 13F, so we don’t know exactly what Burry’s strike price was or the exact value of the stock when he started the short. However, it’s likely that he was able to close the position at a gain, as Apple stock trended downward in the second quarter.

As it turns out, Burry was smart to close the short when he did. Apple bottomed right near the end of Q2, closing at $130 on June 16. After hitting that low, it rallied to $174.4-a 34% gain. As I wrote in a Tweet on Wednesday, the stock was just 4.1% away from touching its all-time high set back in January.

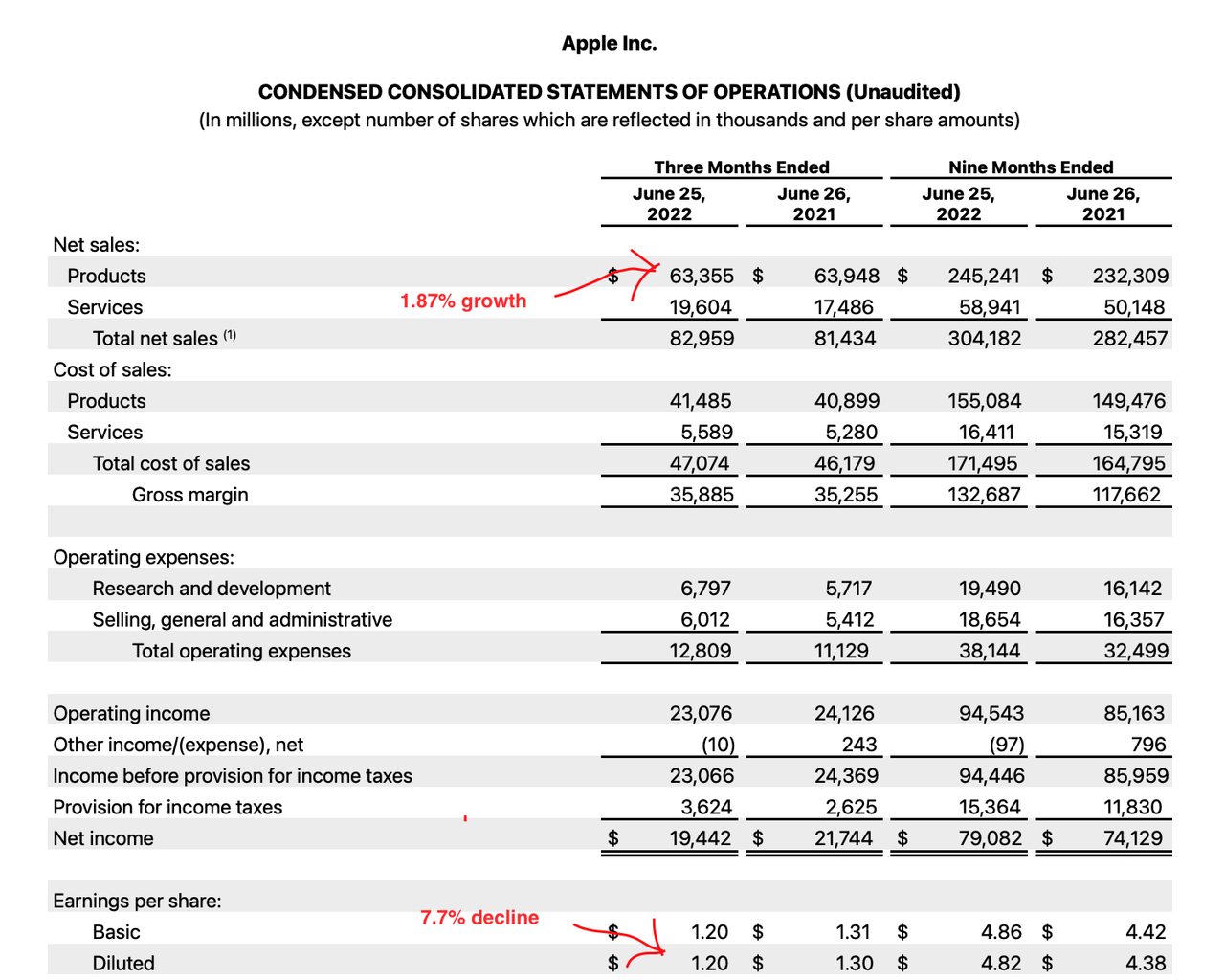

Apple is recovering from the bear market better than any of the other ‘FAANG’ stocks. It’s the only one in the group that’s anywhere near its 2021 high-Microsoft (MSFT) is in second place, down 14.85%–yet its business performance has been basically similar to that of its peers. In the second quarter, Apple’s sales grew 1.87% while its earnings fell 10.5%. Apple’s revenue growth was slower than that of Microsoft and Alphabet (GOOG); its earnings growth was in the same ballpark as Alphabet’s (-11%).

Apple’s second quarter release would seem to vindicate Michael Burry’s thesis. Sure it beat estimates by 2%, but it missed on the top line and delivered negative growth. If Burry thought that Apple was too expensive, he got confirmation in the third quarter release: this 2% grower trades at 28 times earnings!

But in the markets, it was not Michael Burry who was vindicated, but an investor with the exact opposite position:

Warren Buffett.

Apple’s price moves this year correspond to what Buffett has been saying about Apple for years: that it’s a high-moat business with fanatical brand loyalty, deserving of a premium price tag. Buffett has never denied that Apple is more expensive than his average stock; instead, he has repeatedly said that AAPL is worth paying up for because it’s a wonderful business.

Although Burry likely closed out his short at a gain, that was because he exited fairly early. The trade began in the first quarter and was done before the end of the second. Apple’s current stock price doesn’t conform to Burry’s initial thesis: the markets are saying that Apple is worth almost what it was worth at the 52 week high, before Burry bought his puts.

The question is, why is Buffett winning here? Apple’s recent earnings results do not suggest that it should be outpacing its big tech peers. Its top line growth was only a little better than Meta Platforms’ (META), whose stock is down 48% for the year; its bottom line growth was far worse than that of Microsoft (down 12% for the year). There has to be an explanation for the discrepancy. In this article I’ll make the case that Apple deserves its valuation, and that the discrepancy between its performance and that of other tech companies is mainly due to Apple’s unusually strong economic moat.

Apple’s Moat

To understand why Apple stock is doing so well this year, you have to understand its competitive position. Warren Buffett has said that Apple has pricing power that gives it high margins.

Where does that pricing power come from?

Apple’s economic moat.

An economic moat is a durable competitive advantage that other companies can’t touch. Sometimes a company’s moat is easy to understand, like a utility’s high barriers to entry. Other times, it’s a little harder to articulate. In Apple’s case, the moat is pretty amorphous, but it basically has to do with the brand, and the ecosystem.

Apple has been the world’s most valuable brand for over a decade. Its products dominate in the U.S. and Japan, and are making huge inroads in China. The company has an interconnected ecosystem of products that integrate with each other, providing an incentive for people to buy multiple products. Finally, it is going through margin expansion, thanks to its increasingly popular services business.

Apple’s brand gets people interested in the first place, and its ecosystem gives them a reason to buy multiple products. As a result, Apple enjoys high revenue per customer.

Apple enjoys a high market share in most of the verticals it operates in. It’s #1 in smart watches and tablets. It was first in smartphone sales last quarter-it frequently trades the #1 spot with Samsung (OTCPK:SSNLF). It’s second place in smartphone operating systems by user count, first by revenue. Finally, it’s second place in computer operating systems after Windows. So, Apple meets Jack Welch’s famous “first or second in every market” standard.

The bottom line is that Apple has strong high share in several tech sub-sectors, and its brand and ecosystem advantages suggest that its lead can be maintained. This gives Apple pricing power and high margins, meriting a premium stock price.

Buffett’s Thesis Vindicated

As I showed earlier, both Burry and Buffett have gained from their Apple bets. Buffett got the long term trajectory right, while Burry timed his short term trade right. Both likely made money. However, Apple’s current market price suggests that the markets are agreeing with Buffett more than Burry right now.

Michael Burry is, like Warren Buffett, a Graham-Dodd investor. He bases his trades on the margin of safety principle and his approach revolves around fundamentals. Given this fact, the markets are today rejecting Burry’s thesis in favor of Buffett’s. Burry’s Apple short could have been initiated with the stock price anywhere from $182 to $150-the stock’s range in the first quarter. As of this writing, Apple traded for $174.55. Only 23% of Apple’s first quarter range is above the current price, so Burry most likely started shorting at prices below today’s price. If he did so, then his thesis that Apple was overvalued at prices below $174.55 is being rejected by the market. Any profits he realized were from good timing, not a growing consensus that Apple was overvalued in the first quarter.

Apple’s Valuation

As we’ve seen, the market’s current pricing of Apple agrees with Warren Buffett’s thesis on the stock more than Michael Burry’s. That still leaves open the question:

What exactly is Apple’s intrinsic value?

That’s an interesting question.

The company’s moat suggests that its revenue will be stable, but it doesn’t on its own imply strong growth. In the second quarter, Apple’s revenue grew by a mere 2%, and its diluted EPS declined 7.7%, as shown below.

Apple’s Q3 earnings (Apple)

In estimating Apple’s future growth, we have to take two things into account:

-

We are possibly in a recession. Economic growth is negative and has been negative for more than two quarters. We would therefore expect Apple’s top line growth to improve in a future period of economic growth.

-

The negative earnings growth could be remedied with cost cutting. Apple is already in the process of doing this, so the bottom line growth could improve in future quarters.

Given that top line growth can improve and bottom line declines can easily be remedied, we shouldn’t assume that the present trend of negative earnings growth will continue. However, according to Seeking Alpha Quant, Apple’s 5 year CAGR revenue growth is only 11.5%, therefore we shouldn’t expect Apple to keep growing at 20% like Microsoft is. For my discounted cash flow valuation I’ll assume that FCF grows at 5% annually-conservative but not overly pessimistic.

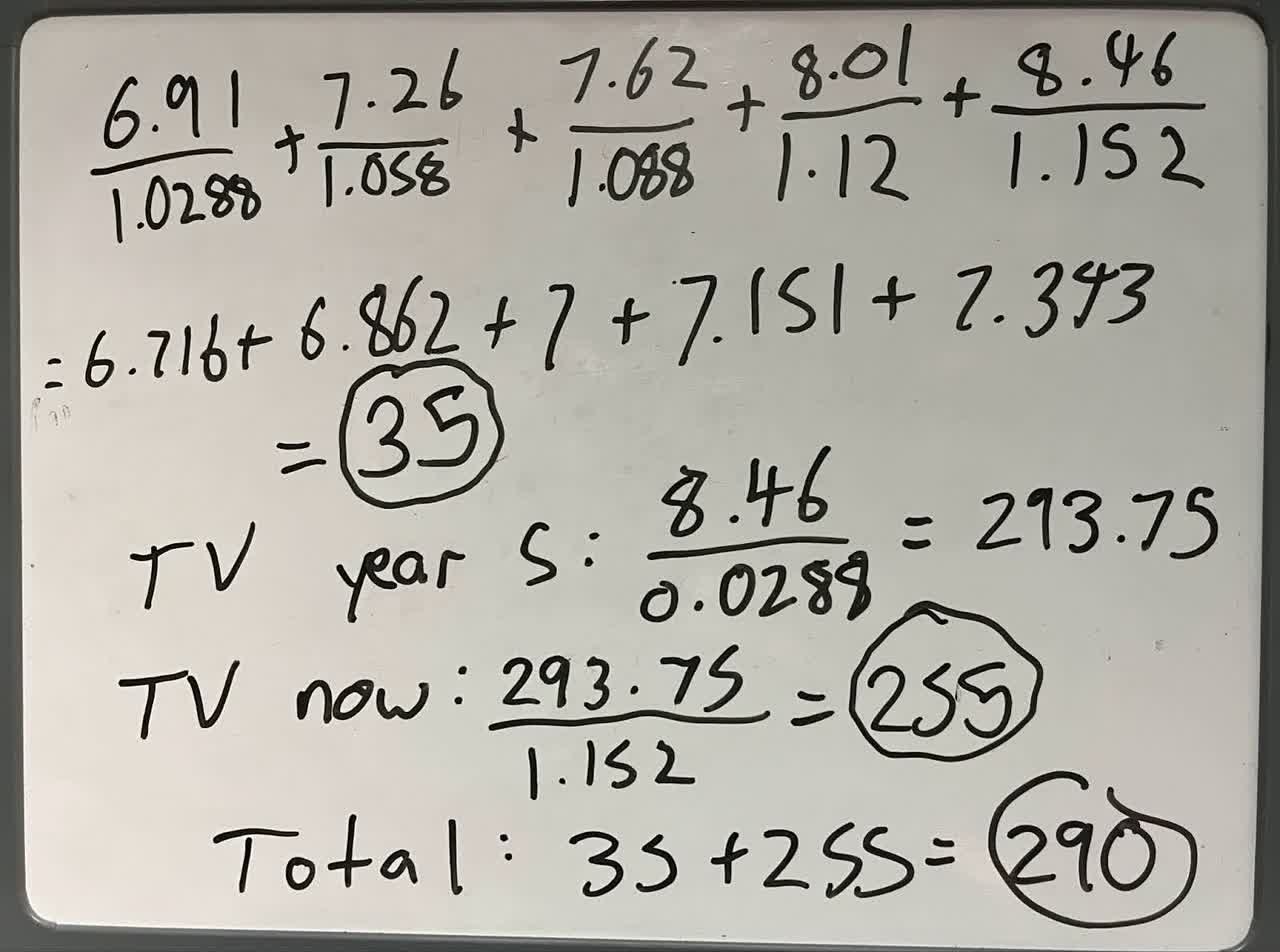

If we assume that Apple grows at 5% for the next five years, we get the following five year FCF growth trajectory:

-

TTM: $6.59.

-

Year 1: $6.91.

-

Year 2: $7.26.

-

Year 3: $7.62.

-

Year 4: $8.01.

-

Year 5: $8.46.

Assuming 0% terminal growth and discounting at the current treasury yield (2.88%), we get a fair value estimate of $290-significant upside to today’s price.

Apple DCF model (the author)

If, however, we discount at Apple’s estimated cost of capital (8.3%), we only get $96. At that discount rate, you need to assume 20% CAGR growth to get upside to today’s price.

Risks and Challenges

As we’ve seen, Apple’s stock is undervalued today if we assume that the treasury yield is a fair discount rate, and if the company can grow at 5% CAGR. Some would say that my choice of discount rate is too lax, but it’s the same discount rate Warren Buffett uses, and it represents the investor’s opportunity cost. So it’s a defensible assumption. Nevertheless, it does expose my thesis to some risks and challenges, including:

-

Higher interest rates. Currently the 10 year treasury has only a 2.88% yield. If it rises, then my model has to be updated for the higher rates, which will give a lower estimate of intrinsic value. Currently, the Federal Reserve is in the process of raising interest rates. The Fed doesn’t influence the treasury yield as directly as it does the policy rate, but its actions do have an effect. If the Fed starts selling treasuries in massive quantities and demand doesn’t change, then the 10 year yield will rise. In that scenario, my model’s estimate would have to be revised lower.

-

Exposure to China. Apple currently does 90% of its manufacturing in China. It’s in the process of moving some of it to Vietnam, but that process will take time. Currently, relations between China and the U.S. are icy. China is conducting military exercises near Taiwan and the U.S. isn’t happy about it. If these tensions escalate, we could see trade restrictions or even more extreme measures that could harm Apple’s manufacturing. On a related note, China’s zero COVID policy has been shuttering factories this year, so that’s another China risk to keep in mind.

-

Litigation. Many people think that Apple’s business practices, like taking huge fees from app developers and not letting them use alternative payment systems, are anti-competitive. Epic Games sued Apple over the app store policy and won a partial victory. Other companies, like Meta, say that Apple has been denying them access to user data. All of this exposes Apple to significant litigation risk, which could take a bite out of earnings in the future.

The risk factors above are serious enough to merit attention. However, Apple has been subject to the China and litigation risks forever, and neither of those have prevented it from growing. The interest rate risk is real, but it isn’t guaranteed to materialize: the Fed’s tight monetary policy doesn’t necessarily mean treasury yields will rise, the bond market is much bigger than just the Fed. On the whole, Apple is subject to fewer risks than the average tech company is, and its economic moat justifies its premium price tag. Warren Buffett was right, again.

Be the first to comment