Stephen Lam/Getty Images News

Thesis

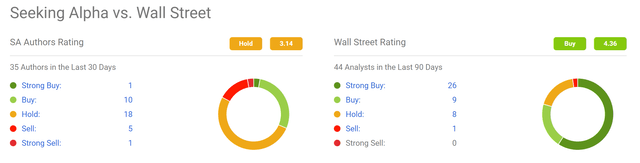

There is a clear divergence of opinion regarding Apple (NASDAQ:AAPL) between Main Street opinions and Wall Street opinions. As you can see from the following chart, a total of 35 Seeking Alpha Authors wrote about AAPL in the Last 30 Days. Only 1 is recommending Strong Buy. In contrast, out of a total of 44 Wall Street analysts, 26 were recommending a strong buy. On the selling end, a total of 6 SA authors are either recommending sell or strong sell. While in contrast, only 1 Wall Street analyst is recommending selling and no one recommends strong selling.

Usually, I do not like to follow investment advice from Wall Street. Wall Street opinions are almost synonymous with herd thinking in many investors’ minds, and for good reasons. However, in the case of AAPL under current conditions, I am going to do something that seems absurd. I am siding with Wall Street this time. Much of the financial, profitability, and valuation considerations have been detailed in our earlier articles.

And today, I will focus the article to address an issue that was frequently mentioned in many of the bear arguments. The issue involves Tim Cook and the arguments more or less go like the following: yes, Tim Cook is a fantastic professional manager, but not an innovator. As a result, Apple under his reign is becoming less innovative, less adventurous, and more mediocre.

And next, you will see why I disagree.

Yes, Tim Cook is a fantastic professional manager

There is no need to argue about this at all. During Cook’s tenure, Apple’s market cap grew almost sevenfold to a staggering $2.3 trillion as of this writing, transforming AAPL from a tech company into a tech giant.

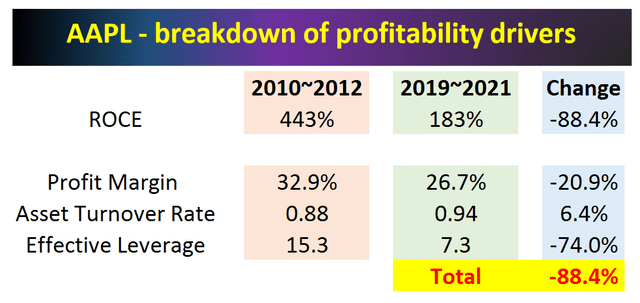

More importantly and fundamentally, as an operation genius, Cook has reshaped the profitability drivers for AAPL and made it more sustainable. No matter how much you love and admire Steve Jobs (like I do), AAPL has been consistently on the verge of chaos under his regain. A simple DuPont analysis elucidates this fundamental shift as shown in the chart below. At the end of the Jobs era (2010 to 2012), AAPL’s profitability, measured by ROCE (return on capital employed ), was an astronomical but unsustainable 443%. Since Cook took over, the ROCE has decreased by 88.4% in relative terms to 183% from 2019 to 2021. No one likes seeing a decrease in profitability, and the decrease here seemed so dramatic.

However, if you dissect the decrease, you would see that out of the 88.4% decrease, 74% of it came from the decreased leverage, which is actually a good thing. Cook also stabilized and improved the asset utilization, which contributed a positive 6.4% to the ROCE. Then profit margin decrease contributed a negative 20.9% to the ROCE change largely due to intensified competition in the smartphone market.

Source: author and Seeking Alpha data.

But he is not making Apple any less innovative

It is true that Steve Jobs, with Jony Ive behind him, delivered so many groundbreaking innovations and make Apple truly unique. It is not a tech company, but a luxury brand in my view. By the time Cook took over, innovation at the scale of creating an entirely new category like the iPhone or iPod has become much more difficult. As a matter of fact, managing AAPL’s existing iconic products like the iPhone, Mac, and iPad already presents tremendous challenges. And I consider Cook’s repositioning and streamlining of these existing products already a major innovation.

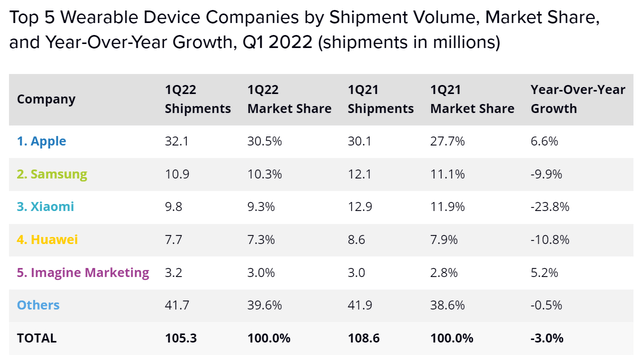

Furthermore, Cook has also been quietly bringing out innovative products that are massively popular and profitable at the same time. The Apple Watch and AirPods are two notable examples. He successfully adjusted the positioning of the Apple Watch after the release of the first generation. And this year, he further subdivided Ultra, a sports watch for the professional field.

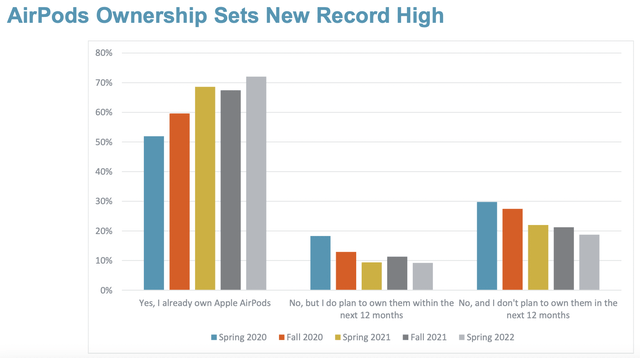

The Airpods are an even more impressive demonstration of Cook’s innovation capability and also his operation and marketing genius. From the appearance of AirPods to the release of the latest AirPods Pro 2, it has only been more than five years and there are only a few products in the AirPods series. But it has almost become a must-buy product for all iPhone users around the world. As a parent with a teenage kid, I have first-row seat to witness how the AirPods have become a life necessity for almost everyone in his school. Piper Sandler’s data confirms the same trend: 72% of US teens own AirPods (and 87% own iPhones, 87% plan to buy one, and 30% own an Apple Watch).

All told, IDC estimates that AirPods sales reached about 120 million pairs in 2021, accounting for half of Apple’s wearable device sales and becoming the fastest-growing product line in this part of the business. With the little AirPods, Tim Cook quietly created a new category (again, not as ground-shaking as the iPhone or iPad) valued at nearly $40 billion (to put it under perspective, it is equivalent to Xiaomi’s market cap).

And the genius of Cook is that, unlike the iPhone, the AirPods do not even update at high frequency and do need so many series. But it never fails to bring in beautiful sales data since its inception.

Risks and final thoughts

Besides Apple Watch and AirPods, under Cook’s leadership, AAPL has also been successfully transitioning into a subscriber-based business model and away from a hardware-based model. Cook has been building an inseparable ecosystem to connect all Apple devices and bring users a more convenient and seamless Apple experience. I see this grand plan itself as a major innovation of Tim Cook. And I also see that it has been succeeding and with almost limitless potential. Under this grand plan, buying a Mac, or an iPhone is only the beginning of the continuous purchases of other AAPL products.

Of course, there are definitely risks. Besides all the often-mentioned bearish arguments such as valuation, competition, currency headwinds, and global supply chain disruptions, I see two structural risks. The first one involves its large exposure to China, which is a key market that has been driving a good part of its growth so far. Key risks here include new lockdowns in China due to the COVID resurgence and the escalation of China-US trade tension. The second one involves a remote anti-trust risk with its expansion and dominance in several market segments.

To conclude, I am siding with Wall Street’s opinion on AAPL this time. My overall impression of its finances, profitability and valuation are summarized below (and detailed in our earlier article here).

Its current price of ~$140 corresponds to about 22x of its FW PE. To me, any valuation near 20x is very attractive for a stock with ROCE (return on capital employed) near 100% like AAPL. At about 100% ROCE, a 5% investment rate would provide 5% organic real growth rates (i.e., before inflation adjustments). And a 22x PE would provide about 5% owners earnings yield, leading to a total return close to double digits. For a stock like AAPL, I am always happy to buy/add when the total annual return is close to 10% or above. A 10% return is healthy enough to start with. Once you adjust for the risks (and I consider the risks from AAPL similar to treasury bonds), a 10% annual return is almost 3x of what you can get from bonds in the long term.

In this article, I want to focus on a bearish argument surrounding Tim Cook. My thesis is to argue that he is only a fantastic professional manager but also an innovator too. The Apple Watch and especially the AirPods are good examples. The design of AirPods inherits the Apple spirit beautifully in my view. The easy-to-use features quickly made the public accept this new product with a premier price tag of around $200. And both the Apple Watch and AirPods have become a trend, an icon, and a culture just like the iPod and iPhone.

Be the first to comment