Seremin

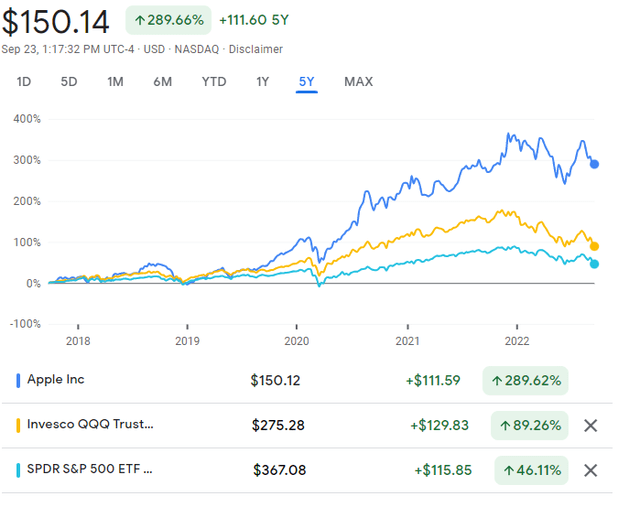

Apple (NASDAQ:AAPL) is a truly exceptional business that has enjoyed a broad period of success both in profitability and share price performance. Despite the poor performance YTD, AAPL is still up over the past year and has outperformed the broader market on almost any time horizon over the past five years. Furthermore, the AAPL chart looks much better than almost any other equity security and I believe the stock could continue to generate relative alpha over the broader market throughout the bear market. However, this does not guarantee positive nominal performance and I do believe that AAPL will give up a portion of its gains over the past three years.

Macro

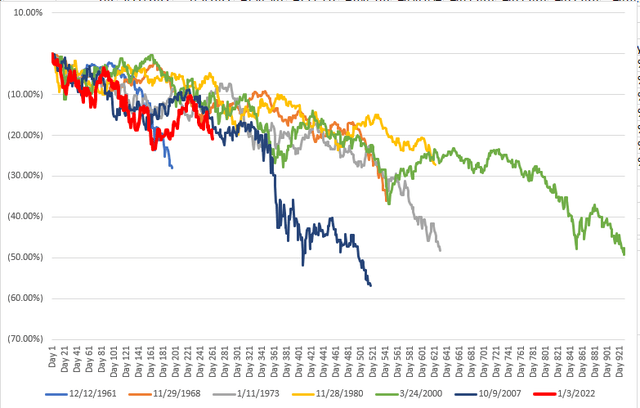

Given AAPL’s broad importance in equity markets – I’d like to take a step back and examine where we sit currently in this bear market. The red line represents the current bear markets and the other lines represent the various major bear markets since the 1930s. Based on this chart and where we sit in the current global liquidity and economic cycles, I believe that we are probably in the early innings of a broad bear market. This is relevant in the case of AAPL as its star performance will likely only be derailed in conjunction with a broad shock to the global economy and financial markets in my opinion.

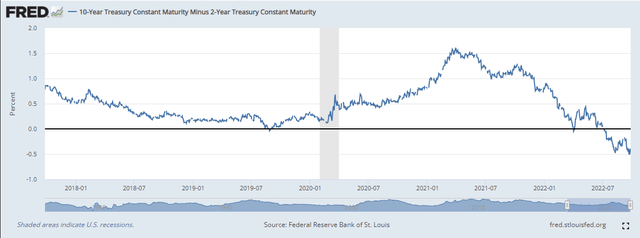

I’ll rehash two charts from my previous article to highlight recession risk (bear with me if you’ve already read my previous articles). First – 2s/10s spread.

As I’ve detailed in other articles (see: A Recession Is Inevitable, Don’t Get Fooled By Bear Market Rallies), the 2s/10s spread inversion has a 100% track record of predicting a recession in the US since the 1970s and after Chair Powell’s continued hawkishness last week, it is likely that the curve will become more inverted.

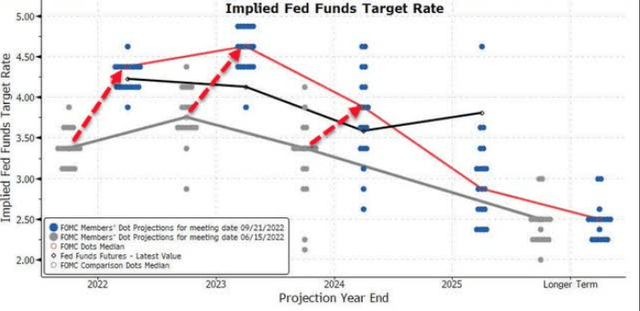

While market expectations (i.e., fed funds futures) are slightly less hawkish than the dot plot, the dot plot and fed funds futures moved up substantially following last week’s Fed meeting. Since the meeting, financial conditions have tightened materially as bonds have sold-off in historic fashion (as BofA describes – the Third Great Bond Bear Market). This is bad news for the majority of the economy – and should present major headwinds for AAPL as the consumer is increasingly squeezed by tight financial conditions. As always, tight financial conditions also present the opportunity for multiple contraction which can damage share performance even if fundamental performance is strong and why the first tenant of my investment framework is “Don’t Fight the Fed.”

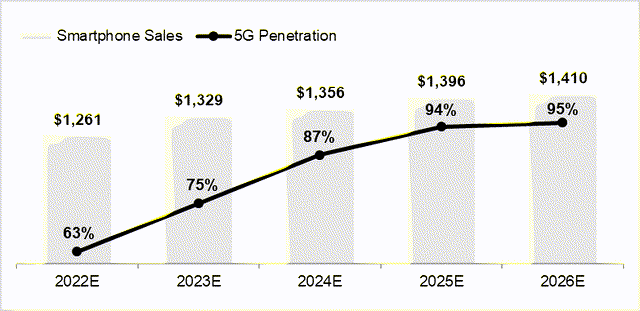

Depending on where you look – you’ll see varying degrees of pessimism around demand for phone sales. Gartner has projected phone sales to fall 7.1% in 2022, BofA is less dire as shown in the chart below and believe that increased 5G penetration will drive increased smartphone demand over the next few years. I agree with this assessment generally but I do believe that high-end smartphones are discretionary and somewhat rate sensitive as most phones are financed these days. Just as McDonald’s customers have moved down the price ladder from combo to value meals, smartphone purchasers will move down the cost curve as well purchasing older and used models in greater volume. This is also backed up by academic research which finds that while all smartphone purchases are relatively elastic, newer models are more price elastic than older models (the study also finds that phones purchased via a payment plan are more elastic than phones purchased for cash).

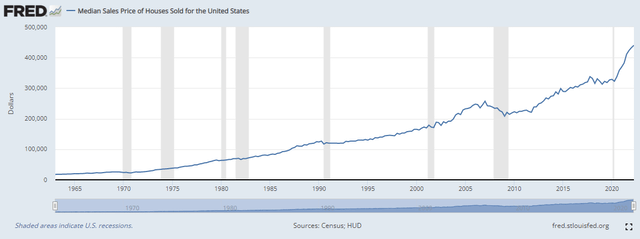

Given high-end smartphone demand is discretionary, it should also be subject to negative wealth effects as consumers continue to see their net worth fall along with the stock market and home prices. While the median sale price has not yet fallen off, with the 30-year mortgage rate at 20-year highs and average prices falling in most major metros according to Zillow (Z), broadly the median sales price should follow suit soon.

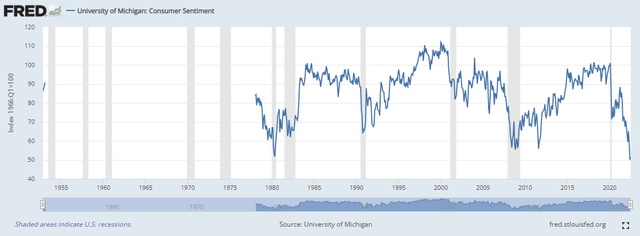

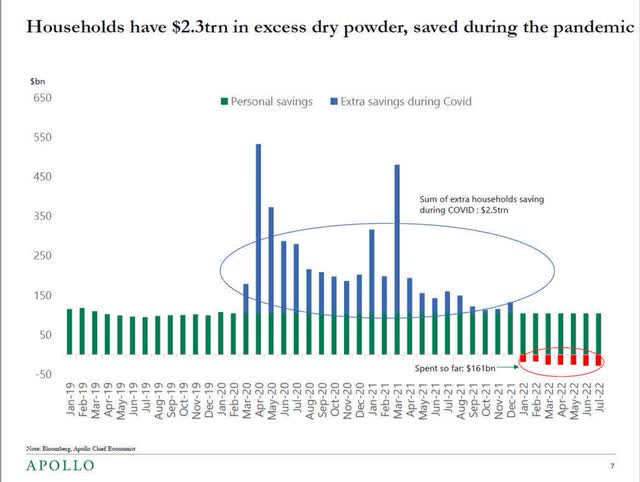

Consumer sentiment remains near all-time lows and while the consumer appears to have some cash reserves remaining from the COVID booms years, these reserves have already been depleted by rising inflation. As unemployment begins to tick up (which Powell all but guaranteed in his last press conference) and home prices tick down, the consumer balance will deteriorate rapidly – a risk I believe equity markets have been somewhat complacent towards.

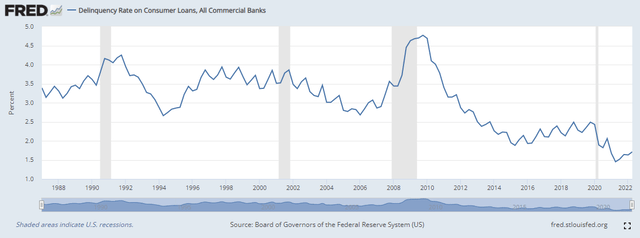

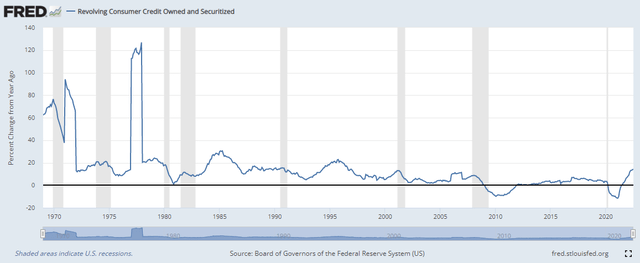

Default / Delinquency rates have yet to tick up and remain at historic lows. Revolving consumer credit (credit card debt) has seen its rate of growth increase as consumers are increasingly at the end of their savings, particularly for lower income earners. All of these trends represent major reversal risk as they are set to fall from historically strong levels in the coming recession.

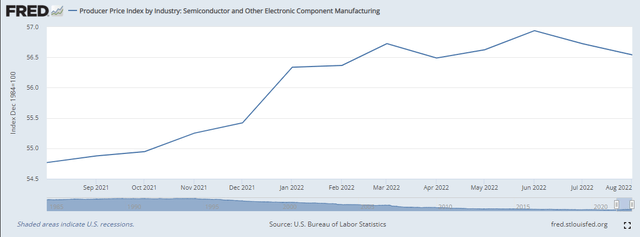

Semiconductor prices have ticked up modestly as the global semiconductor shortage continues. Intel (INTC) CEO Pat Gelsinger sees the shortage lasting until 2024. Furthermore, supply chain challenges persist in China due to COVID zero lockdown policies. Labor costs also remain high, and the strong dollar remains a headwind. The strong dollar will weigh on demand globally as long as the Fed continues its hawkish stance both through reduction in financing activity (i.e. deleveraging) and dollar shortages which make transactions increasingly costly and difficult. Fortunately for AAPL, other supply chain disruptions such as container and freight rates appear to be easing.

Zooming in on AAPL

AAPL is a fantastically run business with industry leading brand strength and consumer loyalty with a product ecosystem that is unmatched across industries and that continues to grow and add new products (There’s a reason why AAPL has grown to over $2T market cap).

Demand appears to be robust for he iPhone 14. UBS cites wait times of ~46 days in China and 40 days in the US, both around 1-2 weeks better than last year. Demand also appears to be solid in Japan and Europe with wait times of 37 days and 39 days respectively, both ~1 week ahead of last year’s levels, indicating solid demand and strength across the broader high-end consumer despite price increases (+16% and +8% vs. 13 pro max in UK and Japan respectively). Given the strength in iPhone 14 sales combined with the week macro outlook, it is likely that AAPL gains share in the coming months.

AAPL just announced that they will be producing the iPhone 14 in India rather than China with Foxconn continuing to be the manufacturer. While a majority of iPhones will still be made in China, the move highlights the growing strategic importance of India as a manufacturing hub and a consumer base (and perhaps a causality of China’s covid policy as lockdowns have negatively impacted AAPL’s supply chain).

Looking to future growth, I would heavily discount the value of AAPL’s auto opportunity. The core business is strong enough that long-term investors should not be too concerned about the outcome of this endeavor. I would likely give $5-10/share of value to this endeavor as an expansion into an adjacent category.

Overall the third quarter was strong with AAPL outperforming on revenue and EPS despite supply chain challenges, forex headwinds and the decision to shut down the business in Russia. Apple did not provide formal guidance for the fourth quarter but CEO Tim Cook did state that he expects “revenue to accelerate in the quarter despite seeing some pockets of weakness.” Services and wearables segments continue strong growth and are a testament both to AAPL’s innovate capabilities as well as their brand strength and ability to capture consumer wallet share across categories. The Apple Ecosystem is a true moat / competitive advantage that should drive relative outperformance in the future. International growth has also continued to show resilience (although impacted by a strong dollar).

Ultimately, I believe AAPL is a strong business and despite macro headwinds will likely see its financial performance deteriorate less than many other discretionary businesses due to its competitive advantages discussed above. This is part of my reasoning for a “neutral” rating despite my belief that share price will fall as AAPL will likely still generate portfolio alpha throughout the bear market.

Valuation

While AAPL has been one of the great success stories of the past 30 years across sectors and geographies (and appears to be holding up the NASDAQ in large part by itself), it did enjoy a period of relative underperformance during the 2008 financial crisis. Multiples contracted substantially with EV/EBITDA falling from over 30x to less than 7x at lows. I believe that a similar contract of multiples is likely as the market begins to fully price in demand destruction from the recession. Obviously, the business has changed substantially over this period and given that the business is trading around 16.5x currently – the downside / total drawdown risk from multiple contraction is less.

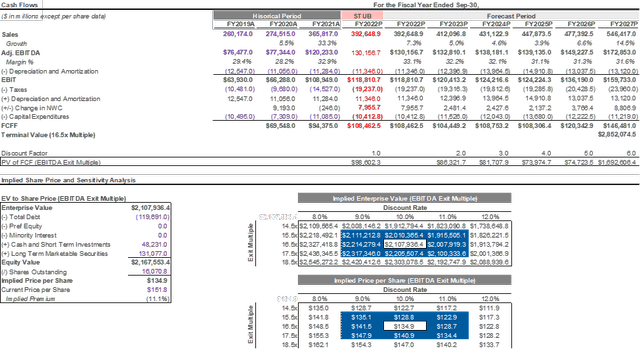

Lastly for reference, I am going to start including a consensus research model (based on S&P Capital IQ consensus analyst estimates) for each company that I cover. I don’t think much stock should be given to these types of models as analyst estimates are notoriously inaccurate (this is part of the reason why equity research is viewed with skepticism across the financial industry). However, from a reader’s perspective, I do think it’s valuable to see what the “consensus” is thinking as a reference point. For example, for AAPL you can see that analysts expect growth to slow in the coming years, particularly in profitability / cash flow. At a 10% discount rate, this implies that AAPL is slightly overvalued. Again, this is only a reference is not a key factor in my ultimate investment thesis.

DCF Cash Flow Analysis (Proprietary)

Conclusion

In conclusion, AAPL is a legendary business with an incredible moat and healthy financial profile. I believe that the market has yet to price in demand destruction and the company is likely to experience top-line headwinds in the coming months as the consumer runs out of spending power. I also believe that the broader market environment / bear market will present potential for multiple contraction, similar to in 2008. I do believe that AAPL’s share price will fall in the next 6 months, but I retain a neutral position given the relative strength in the business. I will look to accumulate once I feel the bear market is nearly over.

Be the first to comment