OntheRunPhoto/iStock Editorial via Getty Images

In a recent report, I discussed the prospect of Apollo Global Management, Inc. (NYSE:APO) buying Atlas Air Worldwide Holdings, Inc. (NASDAQ:AAWW). Initially, no transaction value was known, but yesterday it became clear that the price paid per share would be $102.50. Today, Atlas Air has confirmed that it will be taken private for $102.50 per share, valuing the enterprise at $5.2 billion.

A Good Buy For Apollo Global Management

I believe that the deal is a good one for Apollo Global Management in its effort to expand its business in the airline industry. In 2019, Apollo acquired PK AirFinance, which is a specialized aircraft and aircraft engine lending business. Earlier this year, the global investment firm announced that it would invest $500 million into an Air France affiliate in return for bonds. Additionally, the company also holds shares in Sun Country Airlines (SNCY). The acquisition of Atlas Air fits in Apollo’s investments in the airline and aviation finance industry, aligning the company to benefit from long-term prospects.

Is It A Good Deal For AAWW Shareholders?

Whether the $102.50 per share offered, representing a 57% premium to the 30-day average volume-weighted trading price, is a good deal is subject to debate. I believe that currently the airline acquisition momentum is driven by relatively low valuation of share prices, making acquisitions attractive. As a result, I believe that the premium should be measured against the recent 52-week lows and not so much against current trading prices. With that in mind, I concluded that a 75% premium was being paid for Atlas Air and a 35% premium when compared to where stock prices were prior to any buyout rumors surfaced.

Not everyone will think this price is a good one, but I would like to remind investors that shares of Atlas Air were trading at 52-week lows not too long ago. Recession fears have mounted, which could over time result in significant softening in air cargo demand and subsequently rates, while more airlines are currently expanding their cargo activities, potentially creating a supply-demand imbalance depending on where the economy is heading. Also, important to keep in mind is that in 2019, pre-pandemic, Atlas Air was in a loss position due to write-offs on its fleets that were driven by lower cargo revenues. Its most recent earnings showed a $0.62 miss on the earnings per share level. While stock prices have shown strong momentum, absent of any M&A rumors, it is likely that we would have seen a big negative reaction in stock prices following Q2 2022 earnings.

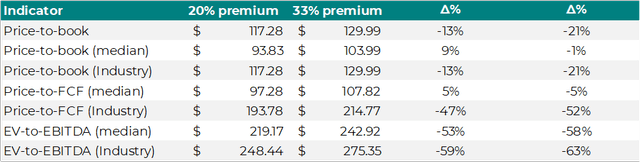

Valuation test purchase price Atlas Air (The Aerospace Forum)

Either way, if we would assume continued strength, it is interesting to look at what I believe could be justified prices based on historic price to book, price to FCF (free cash flow) and EV to EBITDA levels. Ideally, shares of a company trade according to their price-to-book and a premium is applied, for which I use 20 to 33 percent. Using that method, we get to a value of $117.28 to $130 depending on the applied premium. This would also signal that the price is 13 to 21 percent lower than a price-to-book plus premium would suggest.

So, with that in mind, I can understand that some investors are not fully satisfied with the offer of $102.50 per share. However, Atlas Air has a 10-year median price-to-book of 0.8, and when we keep that in mind, the price paid is either 1% too low or 9% above what the price-to-book median would suggest. Using the industry averages, the price paid is 13% to 21% too low, but it should be noted that this includes the transportation industry as a whole, and I don’t believe that it accurately reflects the airline industry itself. Doing the same for price-to-FCF shows that relative to its own past performance, there either is a 5% premium or a 5% discount. Again, the industry performance would suggest around 50% discount at the disadvantage to shareholders. Also, when considering EV-to-EBITDA, it seems Apollo is significantly underpaying for Atlas Air. That disconnect is mostly driven by Atlas Air trading at low multiples compared to its peers. Taking a 5 EV-to-EBITDA multiple would suggest a $120 price per share, meaning that the offer for Apollo is 14% too low.

Conclusion: The Buyout Drivers Are Different and Reasonable

I do understand that some shareholders are not fully satisfied with the price offered by Apollo. Relative to the transportation industry, it does seem that Atlas Air is undervalued at $102.50 per share. It should be noted that EV-to-EBITDA median and industry performance is a bit of a funky metric to perform valuation calculations with, as over the past 10 years there has been quite a big range of multiples.

However, it does seem that Atlas Air is valued according to its own median price-to-book and its ability to generate free cash flow. Given the uncertainties faced in what should be a long-term growth story, I do believe that the price paid for Atlas Air is fair, despite some metrics suggesting otherwise. One of the reasons to buy airline names is their current low valuation, which indeed at times will fail to recognize the strength of a company. In other words, the premium is not necessarily applied from a business as usual perspective but from the bottom of the pricing levels.

Be the first to comment