Spencer Platt

APA Corporation (NASDAQ:APA) has had a tougher time than most companies in the recent oil environment, with an almost 40% decline from the company’s 52-week highs. However, the company has a unique and manageable portfolio of assets and some of the strongest FCF in the industry which supports the ability to continue increasing shareholder rewards.

APA Corporation 2Q 2022 Results

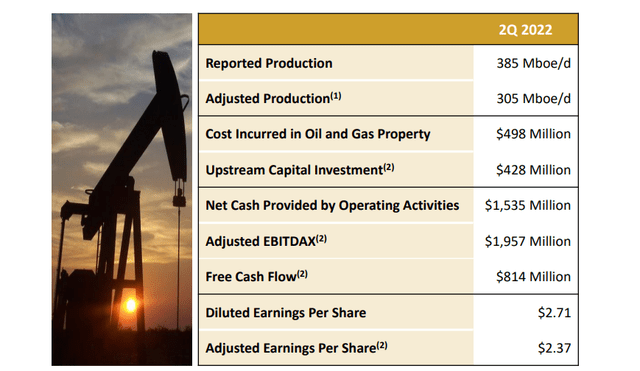

APA Corporation performed incredibly well through the quarter, supported by the strength of its assets.

APA Corporation Investor Presentation

APA Corporation Results – APA Corporation Investor Presentation

APA Corporation saw just over 300 thousand barrels / day in adjusted production with just over $400 million in quarterly spending. The company saw a massive $814 million in FCF giving the company a FCF yield of more than 30% and highlighting its financial strength with the recent weakness in the market.

The company is committed to using this massive cash flow on shareholder returns as much as possible. It has a minimal 1.5% dividend; the company’s dividends are roughly $40 million per quarter. In the same quarter, the company repurchased $290 million in shares, or almost 3% of outstanding, with more than $200 million repurchased in July.

The company’s share count is done ~10% YoY. Lastly, it also paid down $600 million in debt during the quarter, showing the company’s overall financial strength.

APA Corporation Asset Strength

The company’s assets are incredibly strong. It found 140 million barrels in Suriname, showing the strength of assets there.

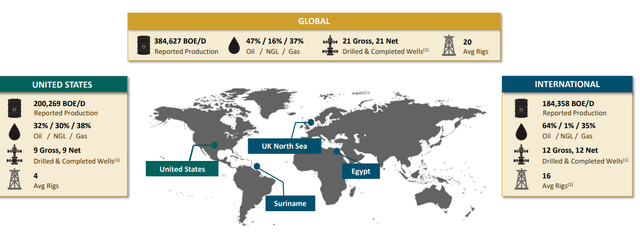

APA Corporation Investor Presentation

APA Corporation Global Portfolio – APA Corporation Investor Presentation

The company’s reported (non-attributed) production was almost 385 thousand barrels / day, at 47% oil. The company has 20 rigs, primarily focused on the international although production between the United States and International is roughly fixed. The company also has numerous areas of potential exploration it’s looking out.

The company’s margins remained strong during the quarter, although North Sea margins which are much more tied to direct prices than others, dropped. In Egypt, the company had almost $80 / barrel in realized prices, with $110 / barrel in North Sea, and more than $60 / barrel in the United States. The company’s margin across its assets are in the $50-70 / barrel range.

One potential risk is that the company’s U.S. production has dropped almost 20% YoY. However, going into 2H 2022, the company’s wells drilled is expected to expand significantly.

APA Corporation Guidance

The company’s guidance continues to indicate the potential for strong shareholder returns.

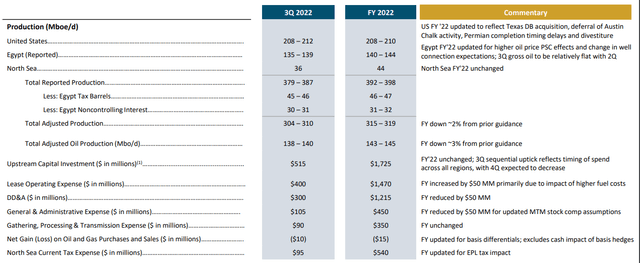

APA Corporation Investor Presentation

APA Corporation Guidance – APA Corporation Investor Presentation

APA Corporation’s total 3Q 2022 production guidance is in line with the second quarter, however, for the year, the company’s production is expected to be 3-4% higher than where it’ll be for the two quarters. That is a result of increased production coming online, especially in the North Sea where the company doesn’t have the same tax barrels and noncontrolling interest.

The company’s upstream capital expenditures are expected to be ~$1.7 billion which it can comfortably afford and we expect the company to be able to drive substantial shareholder returns. At current prices we expect FCF to be in line with the most recent quarter if not increase slightly.

APA Corporation Shareholder Returns

Putting this all together, APA Corporation has the ability for substantial shareholder returns.

APA Corporation Investor Presentation

APA Corporation Shareholder Returns – APA Corporation Investor Presentation

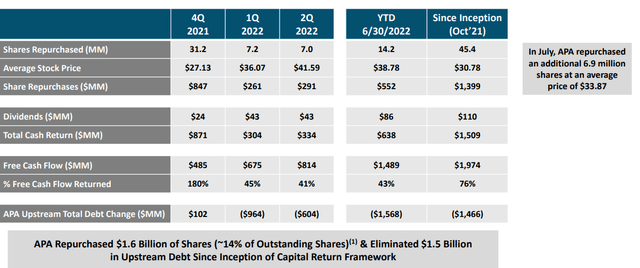

APA Corporation has a strong commitment to shareholder rewards and we expect that to continue. The company repurchased more than 30 million shares in 4Q 2021 and repurchased 7 million shares in each of the last 2 quarters. That’s a high-single digit repurchase rate for the company’s shares annualized.

The company has increased its dividends significantly and has the ability to continue maintaining its modest dividend even through a tough market. In recent quarters, the company has also focused on rapid debt paydowns. In a rising interest rate environment, we’d like to see those debt paydowns continue if not accelerate.

The company’s net debt is currently $5 billion versus $6.2 billion at YE 2021. Average interest rates have gone to 5.2% from 5.0%. The company has roughly $1.5 billion due until 2030, which it can comfortably afford. Its average maturity has increased by 2 years to almost 16 years. As much as the company can continue repurchasing debt we’d like to see that continue.

However, regardless of how the company spends its FCF we expect strong double-digit shareholder returns. As a percentage of market cap, the company has one of the largest repurchase programs in the industry.

Thesis Risk

The largest risk to the company’s thesis is crude oil prices. The company is incredibly profitable at current levels, even with the United States and Egypt not seeing full market prices. However, prices could always drop significantly, and when they do the company’s financials could quickly take a turn for the worse. Maximizing debt paydown minimizes the risk of that.

Conclusion

APA Corporation has a unique portfolio of assets distributed across the North Sea, Egypt, and the United States. The company also has exciting exploration assets for example in Suriname. While developing those will take years, there’s an exciting amount of potential there worth paying close attention to.

The company has manageable debt. We expect it to continue paying down debt and repurchasing shares. The faster debt is paid down the faster the company can direct shareholder rewards towards other sources, helping to generate even faster shareholder rewards. Let us know what you think in the comments below.

Be the first to comment