chapin31/iStock via Getty Images

Antero Resources (NYSE:AR) has been actively repurchasing both its notes and common shares. It recently repurchased $326 million in note principal, helping reduce its interest costs by around $26 million per year. It also has $707 million in remaining authorization under its share repurchase program, which it expects to complete in 2022.

Antero’s projected near-term free cash flow at strip prices has been reduced a bit due to the decline in prices for oil and C3+ NGLs since I looked at it in June. It still should be able to generate around $4.8 billion in positive cash flow (after cash taxes) between 2H 2022 and 2023 though, as natural gas prices remain quite strong. My outlook on longer-term natural gas prices has also improved to a range of $4.00 to $4.50 for NYMEX gas. Thus I now estimate Antero’s value at approximately $41 to $50 per share.

Debt Repurchases

Antero recently repurchased $300 million of its notes via a tender offer. This included approximately $182 million of its 8.375% notes due 2026 (at 109% of par) and approximately $118 million of its 7.625% notes due 2029 (at 107% of par). It also made open market purchases in July for approximately $26 million of its 8.375% notes due 2026 (at 106.7% of par).

Antero paid approximately $26 million in premium for the notes that it repurchased, but also reduced its note interest costs by approximately $26 million per year.

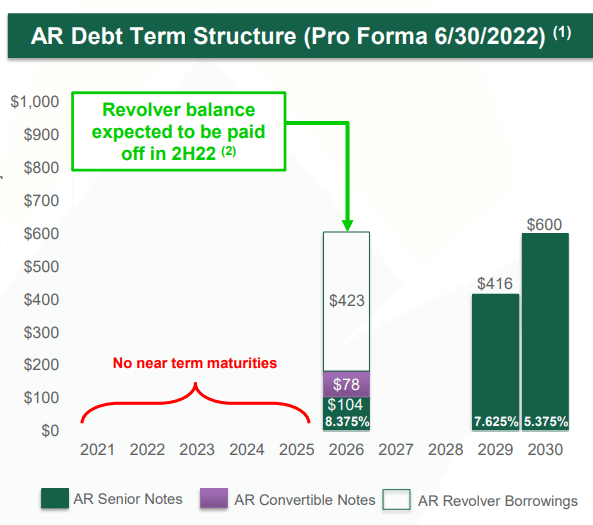

Antero’s Debt Structure (Antero Resources)

Pro forma for the note repurchases, Antero has $1.621 billion in net debt, as shown above.

2H 2022 Outlook

For the second half of 2022, Antero expects to average approximately 3.3 Bcfe per day in production including around 3.25 Bcfe per day in production in Q3 2022 and 3.35 Bcfe per day in production in Q4 2022. Antero updated its production forecast to account for a more exact estimate (during 2H 2022) of when the Shell ethane cracker will start up. That will contribute to the expected increase in liquids production later in 2022.

At current strip prices for the second half of 2022 (including approximately $8 NYMEX gas), Antero is projected to generate $3.676 billion in revenues (including the effect of dividends received from Antero Midstream and distributions to Martica).

This also includes the effect of Antero’s 2H 2022 hedges, which have around $1.123 billion in negative value. Antero has approximately half of its 2H 2022 natural gas production hedged at $2.48, resulting in that large projected hedging loss.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Natural Gas | 404,800,000 | $8.40 | $3,400 |

| Ethane | 10,672,000 | $21.00 | $224 |

| C3+ NGLs | 21,160,000 | $49.00 | $1,037 |

| Oil | 2,024,000 | $81.50 | $165 |

| Hedge Value | -$1,123 | ||

| Distributions To Martica | -$90 | ||

| Antero Midstream Dividends | $63 | ||

| Total | $3,676 |

Despite the large projected hedging loss, Antero is still projected to generate $1.613 billion in positive cash flow during the second half of 2022, as its margins at $8 NYMEX gas are very strong on the unhedged portion of its production.

| Expenses | $ Million |

| Cash Production Expense | $1,519 |

| Marketing Expense | $49 |

| Cash G&A | $67 |

| Cash Interest | $48 |

| Capital Expenditures | $380 |

| Total Expenditures | $2,063 |

Antero will use that cash flow to repay its $423 million revolver balance and will continue to repurchase shares. It has $707 million in remaining capacity with its $1 billion share repurchase program and expects to complete that program in 2022 along with initiating a new share repurchase program.

Notes On Share Count

Antero had 308.8 million shares outstanding at the end of Q2 2022 and has continued with its share repurchase program (reporting 306.1 million shares outstanding on July 22, 2022). Antero’s convertible notes can be exchanged into another 17.9 million shares (which would reduce its net debt by $78 million)

If Antero spends $1.19 billion on share repurchases during 2H 2022 (which would use up its free cash flow after paying off its revolver balance), then it may end up with approximately 297 million shares (also assuming full conversion of its remaining convertible notes) at the end of 2022.

2023 Outlook

Antero is projected to generate $7.675 billion in revenues after hedges in 2023 at current strip (high-$70s WTI oil and $6.05 NYMEX gas). Strip prices for oil and C3+ NGLs have gone down since I looked at Antero in June, but the strip for natural gas remains strong. Antero’s hedge position for 2023 remains relatively minimal.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Natural Gas | 784,750,000 | $6.35 | $4,983 |

| Ethane | 27,010,000 | $16.00 | $432 |

| C3+ NGLs | 41,975,000 | $49.00 | $2,057 |

| Oil | 4,015,000 | $70.00 | $281 |

| Distributions To Martica | -$145 | ||

| Antero Midstream Dividends | $125 | ||

| Hedge Value | -$58 | ||

| Total | $7,675 |

Antero is projected to generate $3.619 billion in positive cash flow in 2023 at current strip prices, before cash taxes. This assumes that it ends up spending $850 million in capex in 2023, which is close to its projected 2022 capex budget (including land capital).

After cash taxes, this may be reduced to around $3.2 billion in positive cash flow.

| Expenses | $ Million |

| Cash Production and Marketing Expense | $2,996 |

| Cash G&A | $137 |

| Cash Interest | $73 |

| Capital Expenditures | $850 |

| Total Expenditures | $4,056 |

Notes On Valuation

I now estimate Antero’s value at approximately $41 per share in a scenario where commodity prices followed current strip until the end of 2023 before reverting back to long-term prices of approximately $70 WTI oil and $4 NYMEX gas after 2023.

At long-term prices of approximately $75 WTI oil and $4.50 NYMEX gas instead, I’d estimate Antero’s value at approximately $50 per share.

I have increased my expectations on long-term gas prices to a range of $4.00 to $4.50, although this still is on the conservative side compared to strip, which is near $5.00 for the 2024 to 2026 period.

Conclusion

Antero Resources is still able to generate around $4.8 billion in positive cash flow in 2H 2022 and 2023 combined despite strip prices for oil and C3+ NGLs coming down a bit. Natural gas price expectations remain strong in the near-term, helping fuel that significant cash flow generation.

Antero has been repurchasing both its shares and notes, with the note repurchases helping to reduce its interest costs by around $26 million per year. I estimate Antero’s value at around $41 to $50 per share in a long-term $4.00 to $4.50 NYMEX gas scenario.

Be the first to comment