MikeMareen

Thesis

Antero Midstream (NYSE:AM) is a leading midstream player that serves Antero Resources (AR). As a result, it provides AM tremendous visibility into the development plans of AR, allowing Antero Midstream to post high utilization rates and fee visibility consistently.

Given its high-margin operating model with clear revenue visibility, the company’s capital allocation framework is also generous, delivering high dividend yields for its investors.

However, AM has lagged significantly behind AR, underperforming significantly in 2022. AR posted a YTD total return of 129%, well above AM’s 12.43%. Therefore, AR investors have benefited tremendously from the surge in commodity prices, given its significant underlying exposure to natural gas prices.

Hence, investors in AM don’t benefit from the underlying commodity exposure. However, its operating model is more consistent, as it depends on fee revenue, which also has CPI-based escalators. As a result, AM investors rely more on stability and aggressive dividend payouts than capital appreciation in a total return framework.

Our analysis suggests that Antero Midstream’s ability to support its dividends should improve through FY23, driven by lower total capital requirements and improved reuse. Therefore, it provides tremendous stability and visibility for income investors.

While the price action is not ideal, its improved free cash flow (FCF) metrics should support AM’s range-trading momentum. Therefore, we are confident that the company can maintain its dividend payout. With an NTM dividend yield of 9% (below its 5Y mean of 11.73%), we believe its valuation is well-balanced.

However, we surmise that the market seems confident about AM’s medium-term prospects, as it improves its FCF profitability, which would provide a tailwind for AM’s buying sentiments.

As such, we rate AM as a Buy for income investors.

AM’s Free Cash Flow Metrics Should Improve Further

Antero Midstream highlighted that its low-cost advantages and visibility into AR’s development plans should help improve its CapEx requirements moving forward. In addition, its near-term CapEx needs have likely peaked in H1, given the completion of critical projects, such as the Castle Peak Station. Therefore, the company expects H2’22 to provide more FCF visibility into further paying down debt while maintaining a generous dividend payout.

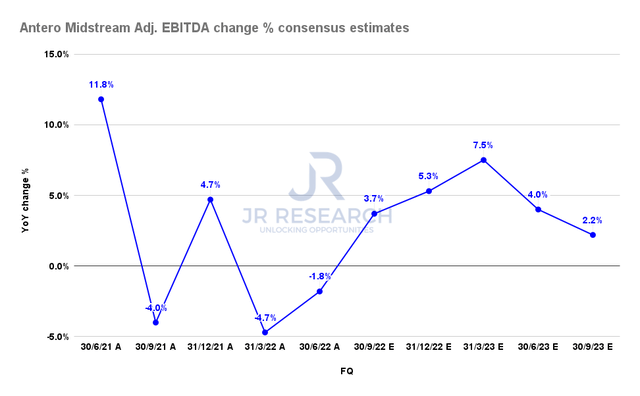

Antero Midstream adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As seen above, Antero Midstream’s adjusted EBITDA growth is expected to continue improving through H2’22, helping drive further gains in operating leverage.

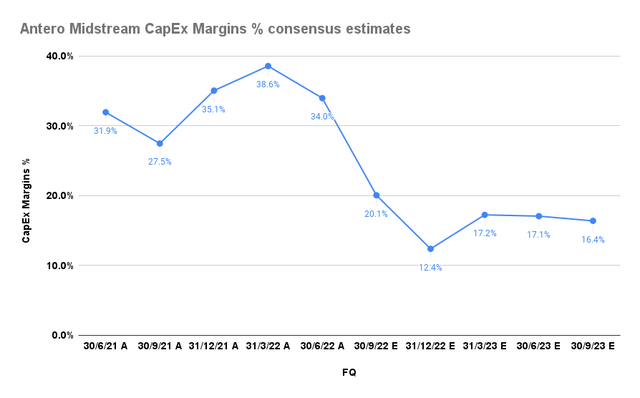

Antero Midstream CapEx margins % consensus estimates (S&P Cap IQ)

Coupled with significantly lower estimated CapEx margins through FY23, Antero Midstream would be able to convert much more of its adjusted EBITDA profitability into FCF. Consequently, it provides the company with improved leverage to drive further debt paydown while maintaining its dividends.

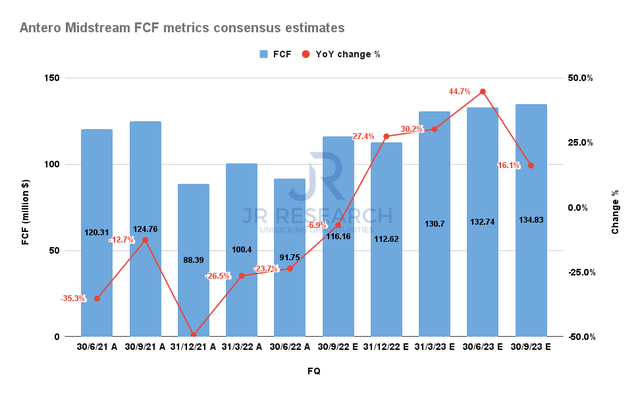

Antero Midstream FCF metrics consensus estimates (S&P Cap IQ)

As a result, AM’s FCF growth should continue to improve through FY23, benefiting tremendously from lower CapEx requirements. Investors should note that we normalized AM’s FCF metrics. Hence, there are some differences with what AM reported in its non-GAAP FCF metrics.

We believe its FCF growth leverage should provide confidence for investors through H2’22, as income investors invest in AM mainly for its high dividend yield.

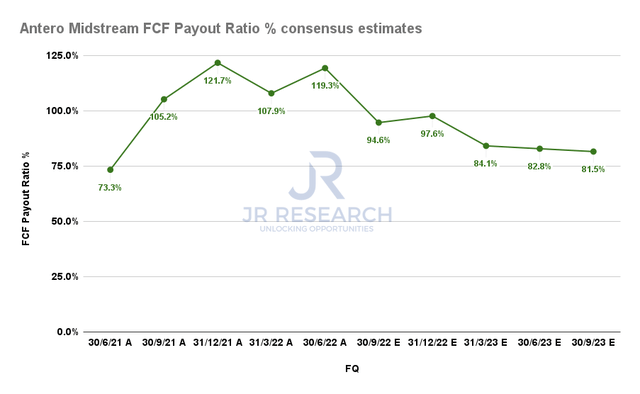

Antero Midstream FCF payout ratio % consensus estimates (S&P Cap IQ)

However, one red flag that we need to point out is AM’s high FCF payout ratio. Its ratio was elevated in H1’22, given AM’s CapEx buildout. However, the company emphasized its CapEx intensity should reduce moving ahead. Therefore, investors should expect a less aggressive payout ratio, improving the buffer for investors and allowing the company to pay down debt.

Notwithstanding, we remain concerned with the unsustainably high Henry Hub natural gas prices (NG1:COM). We surmise that it’s primed for a steeper fall moving ahead. While AM doesn’t have direct underlying exposure, given its midstream operating model, the company still highlighted the risks of forward commodity price volatility. It articulated:

Our existing operations and cash flows have little direct exposure to commodity price risk. [However,] future exposure to the volatility of natural gas, NGL, and oil prices, especially in light of the recent declines, could have a material adverse effect on our business, financial condition, and results of operations. (Antero Midstream 10-Q)

Is AM Stock A Buy, Sell, Or Hold?

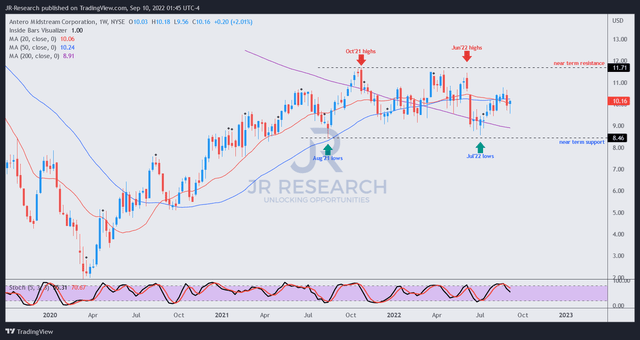

AM price chart (weekly) (TradingView)

AM has been consolidating within a trading range since August 2021, with its critical resistance at the $11.7 level. Therefore, it has failed to participate in the broad advance spurred by the underlying commodity markets.

It remains to be seen whether the consolidation range indicates an accumulation or distribution phase.

However, we like its strong dividend yield, with improved payout metrics, corroborating its sustainability. Notwithstanding, investors need to parse the impact of potential downside volatility in the commodity markets in future contracts that could affect its FCF visibility.

We rate AM as a Buy for income investors.

Be the first to comment