Editor’s note: Seeking Alpha is proud to welcome Jack Huang as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

LeoWolfert/iStock via Getty Images

Recommendation

I recommend a buy position on Andlauer Healthcare Group (OTCPK:ANDHF), Canadian ticker AND, at CAD$49.60 because it is undervalued by at least 14.5%, and its stock price could increase significantly in the next 12-24 months over earnings and additional M&A announcements. Note, the recommendation and investment pitch are based on investing in the company via the Canadian exchange through its Canadian ticker AND (or AND CN) – which is different from the US ticker.

Investment Thesis

The consensus forecast currently underestimates the company’s long-term organic growth and M&A growth potential. The market is overly cautious over the company’s premium valuation multiple on top of the current economic backdrop, but a closer look reveals that the company is a dominant player in its core Canadian market and that its premium valuation is well-deserved thanks to its competitive position in the industry.

Company Overview

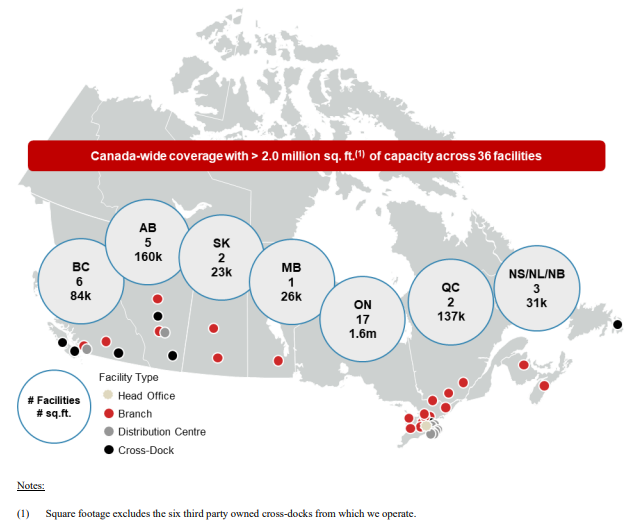

Andlauer Healthcare Group is a supply chain management company offering customized third-party logistics (3PL) services and specialized transportation for the healthcare sector. Across its coast-to-coast distribution network, the company offers transportation services with management/monitoring of various temperature ranges for its shipments, including ambient ground (15ºC to 25ºC), air (5ºC to 25ºC), cold chain (2ºC to 8ºC), ultra-cold (-70ºC) and heat (above 0ºC). Note, cold chain (2ºC to 8ºC) and ultra-cold (-70ºC) conditions are critical temperature requirements for transporting biologics such as COVID-19 Vaccine.

AHG Annual Information Form 2021

AHG Annual Information Form 2021

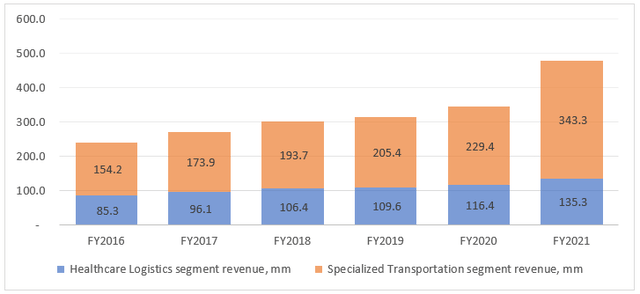

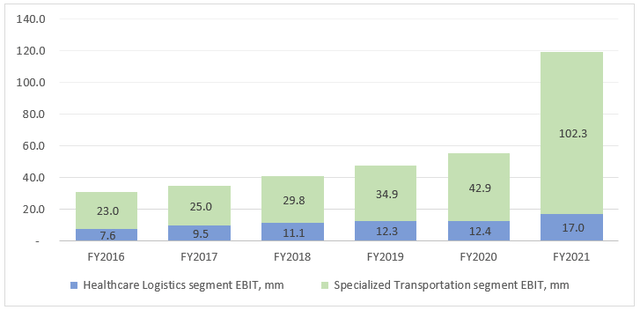

The company generates revenue from two operating segments: healthcare logistics (31% revenue mix and 15% EBIT mix as of 2021) and specialized transportation (78% revenue mix and 89% EBIT mix as of 2021).

AHG sales by segment (Own Excel Graph) AHG segmented EBIT (Own Excel Graph)

In the healthcare logistics segment, the company serves as an extension of its manufacturing clients to manage the client’s supply chain activities. Pharmaceutical manufacturers represent its largest client segment and the company provides services to several top pharmaceutical companies, including Pfizer (PFE), Bayer (OTCPK:BAYZF), Roche (OTCQX:RHHBY), and AstraZeneca (AZN).

In the specialized transportation segment, the company leverages its national infrastructure to offer coast-to-coast delivery to accommodate the full range of its client needs on an integrated and efficient basis. Clients in this segment include healthcare manufacturers, wholesalers and distributors, and 3PL providers, including Accuristix, McKesson Canada, and UPS Supply Chain Solutions.

Andlauer Investor Presentation 2022 Andlauer Investor Presentation 2022

Thesis #1: Industry tailwind has a stronger impact than what’s currently baked into the stock price.

In 2015, among the 7.3 billion people estimated worldwide, 617.1 million (9 percent) were aged 65 and older. By 2030, the older population will be about 1 billion (12 percent of the projected total world population) and by 2050, 1.6 billion (17 percent) of the total population of 9.4 billion will be 65 and older. This translates to a CAGR of 3.3% from 2015 to 2030 and 2.4% from 2030 to 2050. Based on management’s own statement pulled from Statistic Canada, 28% of the Canadian population between the ages of 25 to 44 take pharmaceuticals compared to 82.7% of those aged 65 or older. In the States, 46.7% of adults aged 20-59 used one or more prescription drugs in the past 30 days in 2015-2016 compared to 85% of adults aged 60 and over.

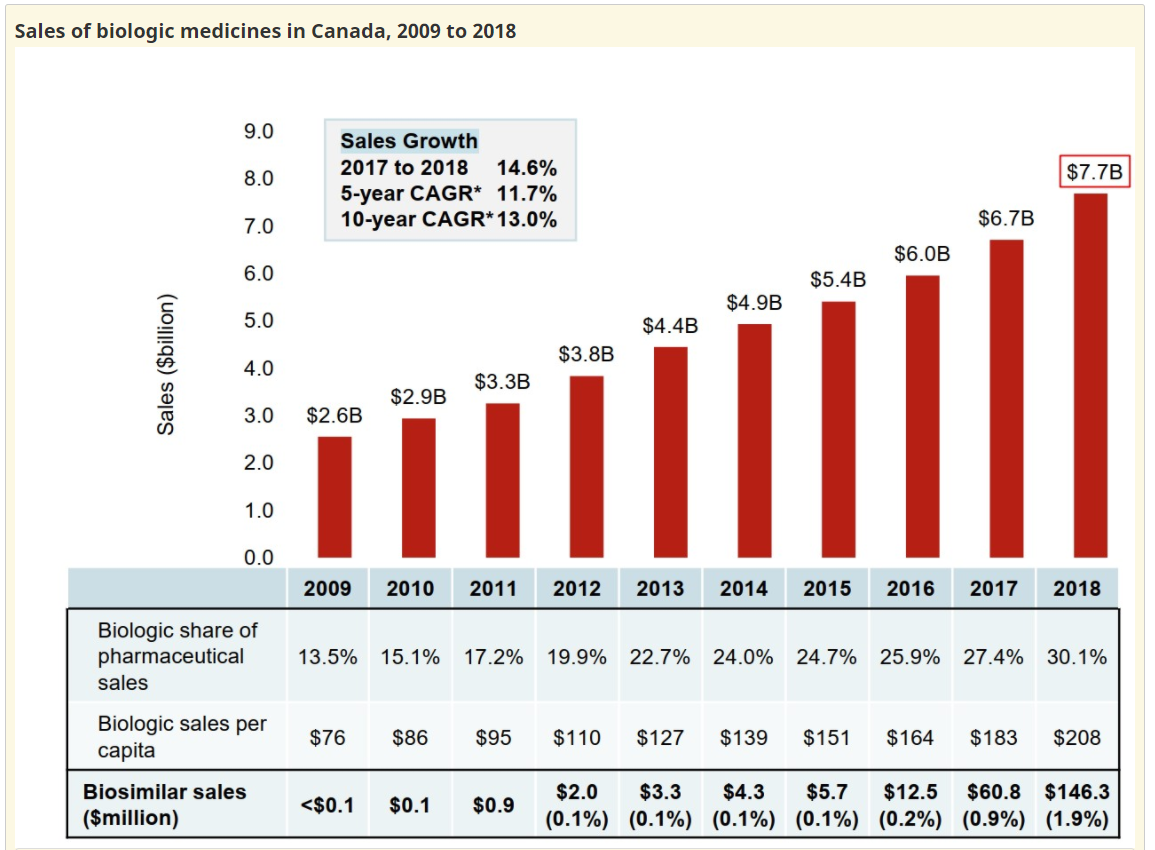

Pharmaceutical sales in Canada have a 2.1% share of the global market. Since 2015, compound annual growth has remained positive at 5.1%. (Source: Government of Canada) Furthermore, the biologic share of pharmaceutical sales has increased from 19% in 2009 to 30% in 2018, increasing at a rate of 13% CAGR and 14.6% from 2017 to 2018.

Government of Canada

In the United States, the Pharmaceutical Market was worth 5.32 billion in 2019 and was projected to grow at a CAGR of 7%. Biologics represent 43% of invoice-level medicine spending in the United States, reaching $211 billion in 2019, and growing at a 14.6% compound annual growth rate over the past five years.

To summarize, there will be an increasing proportion of the older population in North America with more of them needing pharmaceutical products. On top of that, as biopharmaceutical products (Lantus, Humira, Remicade, influenza vaccines, etc.) increase in proportion relative to traditional pharmaceutical products, there will be an increasing number of healthcare products that will require specialized supply chain solutions that adhere to stricter regulatory standards (temp control/monitoring, safety control, visibility standards, and etc.). All these factors will contribute to higher growth for the Healthcare Logistics Market. According to “Healthcare Logistics Market in NA 2021-2025” by Technavio, the market will grow and accelerate at a pace of 6.09% CAGR in the next 5 years. (6.44% CAGR in CAD Healthcare Logistics). If Andlauer simply keeps pace with industry growth (which it has outpaced at a top-line CAGR of 11.8% while the industry has grown 5.8% for the last 10 years), it would imply that the stock is undervalued by 12-15% from top-line assumptions alone based on a 2 stage DCF model (refer to Exhibit A).

Thesis #2: The company is well-positioned for a successful roll-up story financially and strategically.

In the 2021 Q4 earnings call, when asked about their future M&A plans, management disclosed that the company currently does not have a dedicated M&A team nor it is actively looking through all potential M&A targets. However, when coming across an attractive opportunity the board is happy to consider it. So management is taking an opportunistic approach to future M&As and it makes sense that consensus forecasts reflect only ~26.9% YoY growth and ~4.5% YoY growth in the two subsequent years 2022 and 2023 – reflecting top-line impacts from its already closed Skelton US, Boyle Transportation, and LSU acquisitions as of Q4 2021 and Q1 2022 plus modest organic growth in the following year.

However, if we examine the company’s historical timeline, the company has always had “Expand[ing] and Strengthen[ing] Platform Through Healthcare-related Acquisitions” as a part of its growth strategy pre-IPO and post-IPO (IPO prospectus). Domestic tuck-ins, Domestic Expansion both horizontally and vertically, and Expansion into the U.S have always been considered compelling opportunities.

Looking at the company’s historical timeline:

Pre-IPO:

2007 – ATS Andlauer acquires MEDDS – expansion to last-mile delivery

2009 – ATS Andlauer and Accuristix (previously known as ALS/McKesson Logistics Solutions) repositioned to focus on healthcare services, operating under a common ownership platform – establishment of core business in healthcare logistics through the business combination

2011 – Andlauer acquires majority interest in Nova Pack – expansion to co-packaging solutions

2012 – Andlauer acquires distribution rights Credo Thermal Packaging Solutions – broadening temperature control solutions

2017 – Andlauer acquires 100% of Nova Pack

Post- IPO:

2020 – Andlauer acquires TDS Logistics and McAllster Courier – core business expansion by acquiring two regional focused temperature-controlled transportation business

Financial impact: C$15.9mm all cash for ~C$22mm net revenue per year. If we assume a 25% EBTIDA margin (AND CN’s margin at the time) then the acquisition price for the two companies would be 5.8X EV/EBITDA (15.9/(22*0.25*0.5)). Note that AHG already owned 50% of both companies so C$15.9mm would be for the other half.

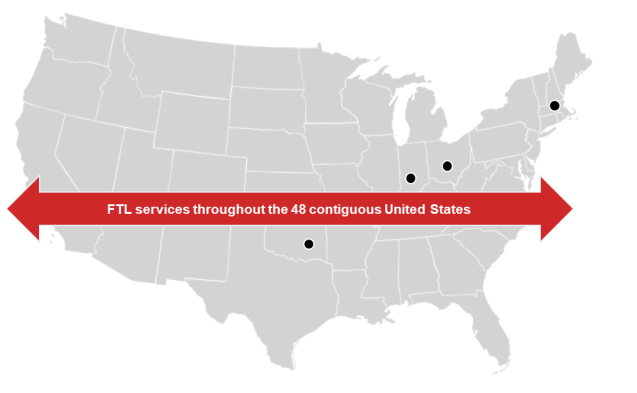

2021 Q1 – Andlauer acquires 100% of Skelton Canada and 49% of Skelton USA – core business expansion with additional opportunity to expand into the USA

Financial impact: C$114.7mm financed through cash on hand and C$75mm credit facilities plus issuing 757,576 subordinate voting shares. Given that Skelton Canada generated approximately C$11mm EBITDA in calendar 2020 with margins comparable to AHG (TTM EBITDA margin at ~26% as of Q1-2021), the acquisition is purchased at 6.1X EV/EBITDA (66.7mm for Skelton CAD with C$11mm EBITDA) with the expected top-line impact of 42.3mm per year. Given that the company’s trailing EV/EBITDA as of Q1-2021 was 19X this was immediately accretive to the bottom line.

2021 Q4 – Andlauer acquires 100% of T.F. Boyle Transportation and the remaining 51% of Skelton USA – further expanding its specialized transportation segment, expanding to the US government/defense sector, and significantly advances strategic expansion into the U.S. healthcare market.

Financial impact:

Boyle Transportation: total consideration of ~US$80mm (@0.7934 USD/CAD translates to C$100.84mm) financed through US$60mm in cash and US$20mm in stocks.

51% Skelton USA: total consideration of ~C$50mm financed through C$25mm cash and issuance of 518,672 subordinated voting shares (worth C$25mm at the time).

Note that Andlauer also completes a bought deal issuing C$96.4mm worth of stocks in conjunction with the acquisition, so the entire acquisition of both entities is pretty much financed through stock issuance.

Together, Boyle Transportation and Skelton USA generated over C$21 million of EBITDA (adjusted to exclude COVID-related government assistance) for the trailing twelve months ended August 31, 2021, at a margin of approximately 23.7% (AHG PR). This Implies a total top-line impact of 88.6mm per year. Given that the TTM EV/EBITDA of Andlauer as of Q4-2021 was 19.3X and that the purchase prices were 5.5X EV/EBITDA for Boyle Transportation and 39.2X EV/EBITDA ((C$50mm/0.51)/C$2.5mm) for Skelton USA *or 12.2X EV/EBITDA for combined Skelton (C$114.7 mm + C$50mm)/(C$11mm+C$2.5mm). The total acquisition is again immediately accretive to the bottom line all dilution considered.

2022 – Andlauer acquires 100% of Logistics Support Unit – Expanding its 3P logistics & distribution services in Canada

Financial impact: Total consideration of C$30mm financed through C$22.5mm cash/credit and C$7.5mm stock issuance with an expected top-line impact of ~$C11.5mm per year (this is assuming an EV/EBITDA acquisition price of 10X and an EBITDA margin in line with the acquiring company).

As evident from historical acquisitions, management is diligent and opportunistic when it comes to growth through M&As. Not only was AHG capable of consistent organic growth exceeding industry average by leveraging its dominant position in the Canadian Healthcare Logistic market, but it’s also able to carefully pick up accretive acquisition opportunities along the way leveraging on its strong financial position (bolstered especially by being a major benefactor of COVID 19 vaccine/test kit distribution over the last two years) and premium valuation through stock issuance. All M&As closed so far have been strategically aligned and financially beneficial for the company, paving a great start to a roll-up story both by strengthening its Canadian market and by expanding into the fragmented US healthcare logistics sector*. As a side note, Peter Jelley, Chairman of AHG’s Board, adds over 20 years of investment banking experience dealing with M&A deals to AHG’s table.

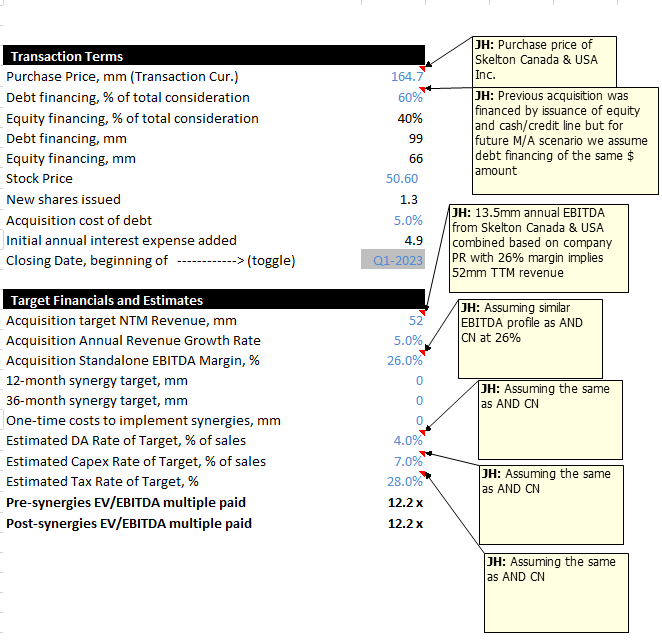

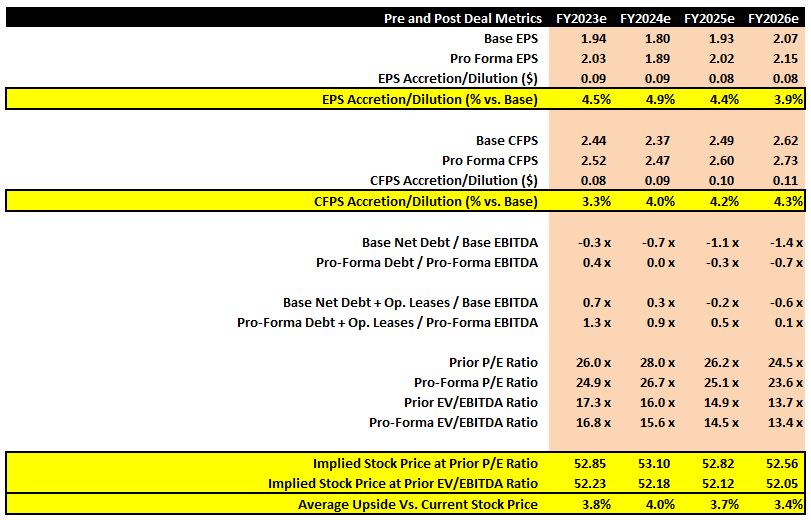

As a base case scenario, if Andlauer Healthcare were to acquire an additional company with a similar business profile and valuation multiple as Skelton Canada & USA Inc. over the next 1-5 years, we are looking at least 4-5% upside to its stock price due purely to EPS accretion with zero synergy assumptions (Exhibit B). In terms of accretion sensitivity, accretion would be 2-3% if the target was purchased at 15X EV/EBITDA and 7-7.5% accretion if purchased at 7X EV/EBITDA.

*Note: The U.S. third-party logistics market is relatively fragmented, with the four largest industry players expected to account for less than 15% of industry revenue in 2019 according to company IPO Prospectus pulling data from IBISWorld. Healthcare distribution regulation in the U.S. is also less stringent relative to Canadian regulation, meaning that as regulation becomes stricter, the US market is set to become a major contributor to North American healthcare logistics industry growth. Management commentary from the Q4 earnings call suggests that the FDA is looking to increase regulation more in line with regulation in the Canadian and European markets, greatly beneficial to companies such as AHG with facilities up north already complying with stricter regulations.

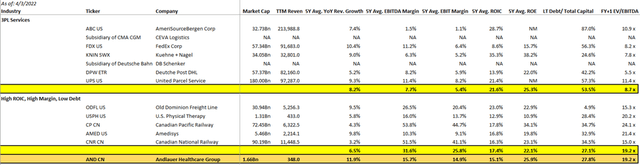

Thesis #3: The company’s current valuation multiple is well deserved.

Based on comparable analysis (Exhibit C), AND CN trades at a significant premium compared to the rest of the 3PL services – 8.7X forward EV/EBITDA compared to 19.2X. However, if we take a closer look, AND CN exhibits several factors that help explain its current premium over other 3PL conglomerate counterparts.

Firstly, the company has a stably high historic EBIT margin of 14.88% while the industry 5-year average was 5.4%. While being a pure-play company in higher growth, higher margin sub-industry (Canadian healthcare logistics) instead of an international multi-industry conglomerate certainly helps, the company does have a leading market share in its core market. The “passing through” pricing model plus long-term contract also helps AND CN maintain its stable margin even during periods of inflation and increasing gas prices.

Secondly, the company’s historically high/stable ROE and ROIC suggest that it exhibits a competitive moat against its peers and potential new entries. Management believes that AND CN is Canada’s only national third-party service provider focused exclusively on delivering end-to-end logistics and specialized transportation solutions to the healthcare sector. While I, unfortunately, do not have the research capacity to fact check this, the company’s EBIT margin, as well as ROE/ROIC track record since IPO, does prove that AND CN is in a strong competitive position in its Canadian Healthcare Logistics market. Not only does the company have a leading market share, but it also has both the fixed-cost infrastructure and the regulatory environment to deter new entries into its market. In another word, while the coast-to-coast distribution network and specialized equipment necessary for temperature control/monitoring limit the playing field to only deeper pocket contenders, AND CN’s track record, long-established client relationship, and regulatory compliance help the company secure its key barriers to entry (refer to “Key Barriers to Entry” below).

Lastly, the high growth, low debt, and reliable FCF yield profile is deserving its own premium in today’s market environment. The company achieved a top-line CAGR of 11.8% over the last ten years while the industry CAGR was 4.1%-5.8% (based on IPO prospectus data provided through Technavio). Net debt over capital over the last 5-years averages 30.3% while the net debt over EBITDA ratio averages 1.0X means there is plenty of dry powder for new investment and M&A opportunities. The 5-year FCF conversion consistently ranges between 32%-51% and has an average of 44% off EBITDA.

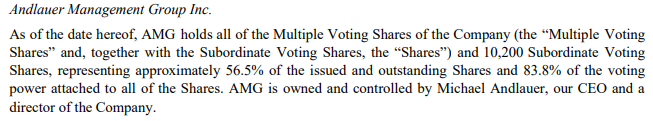

As a bonus, the Founder/CEO holds majority ownership/control and is still active with experience running the company since 1992.

AHG AIF 2021

Key Barriers to Entry:

- All pharmaceutical, radiopharmaceutical, biological, and veterinary companies in Canada must comply with good manufacturing practices (“GMP“) as governed by Health Canada. Among others, guidelines for Environment Control of Drugs during Storage and Transportation (“GUI-0069“) require distributors to comply with strict environmental control and monitoring standards to ensure proper storage and transportation conditions are maintained throughout the drug supply chain. GMP inspections for distribution and importation are conducted 4 times a year. In the States, similar standards are set by the United States Pharmacopeia (“USP“) and enforced by the FDA.

- In order to comply with domestic and international regulatory standards, as mentioned above, and ensure quality/temperature control for transported healthcare products, 3PL companies servicing the healthcare sector must-have sufficient capital to invest in and maintain their specialized infrastructures and vehicles. They must also regularly check in with regulatory bodies and upgrade their fixed infrastructure should the regulatory environment change. In other words, if a non-specialized 3PL company were to decide to move into the healthcare space, it must first invest in additional temperature-controlled vehicles, temperature management software, temperature mapped and validated coolers, liquid nitrogen containers, and Hazmat and aerosol containment systems, among other things, before even being considered for regulatory approval. In addition, coast-to-coast logistics in Canada require significant distribution network coverage across relatively thinly populated geography – which might not make economic sense for some firms.

- Supply chain logistics for companies in the healthcare sector, especially for large pharmaceuticals, although proportionally lower in cost compared to other expenses such as R&D, is a critical component for success. A poorly managed supply chain could jeopardize product yield as well as brand image for companies like Pfizer. Hence, for a third-party logistics company to earn business from, and keep doing business with, their clients, having a track record and a long-established client relationship is paramount.

Valuation

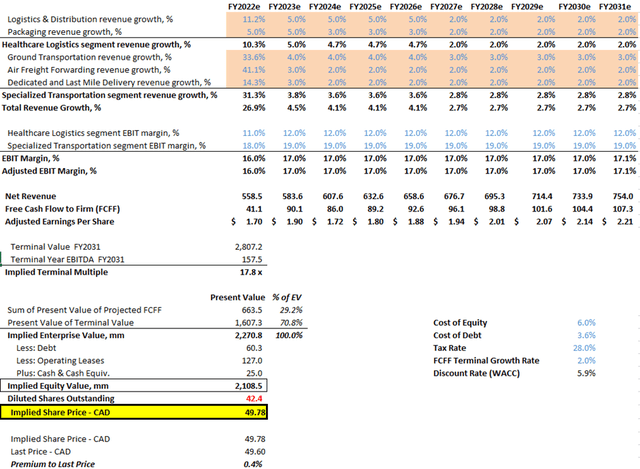

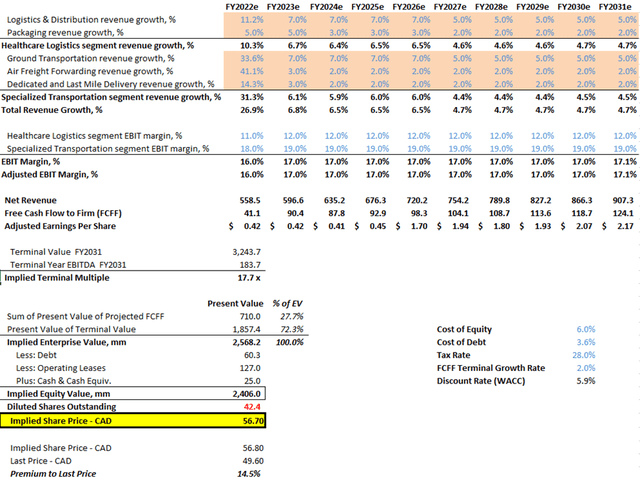

Exhibit A: DCF Analysis

The implied growth rate for AND CN is understated compared to projected industry growth even though the company has consistently outperformed its industry over the last decade.

To arrive at “implied YoY growth rates” for the company, I used a 2 stage DCF model with the following assumptions:

2 stage DCF assumptions – tune to consensus and current stock price (Own Model)

FY2022e’s YoY growth rate of 26.9% includes:

- Already closed Boyle Transportation and Skelton US acquisition impact of 66.8mm per year Already closed LSU acquisition impact of 11.5mm per year Organic growth rate of 4.6-5.6% over the next 5 years then trailing off to 2.7% for the next 5 years

- Cost of Equity and Cost of Debt assumptions are both pulled from the Healthcare Support Service row of Professor Damodaran’s cost of capital website

- Tax rate is assumed to be 28% Canadian corporate tax rate after federal abatement

- Terminal growth rate is assumed to be 2%

- Margins are to stay flat

The implied YoY growth is essentially FY2022e-FY2031e growth rates tuned to match both the consensus estimates as well as the current stock price after including all assumptions from above.

Note that if we modestly adjust sales projections for the specialized transportation segment incorporating industry growth rate with all else equal:

2 stage DCF assumptions – tune closer to industry growth projections (Own Model)

As a result, the implied share price would be at a 14.5% premium to the current stock price without considering the company’s potential for margin expansion.

Exhibit B: M&A Scenario

If Andlauer Healthcare were to acquire another company with a similar profile to Skelton Canada & USA:

M&A scenario assumptions (Own Model) M&A scenario pro-forma results (Own model)

The M&A scenario analysis demonstrates that, over the next 1-5 years, we are looking at least 4-5% upside to its stock price due purely to EPS accretion with zero synergy assumptions on a per acquisition basis.

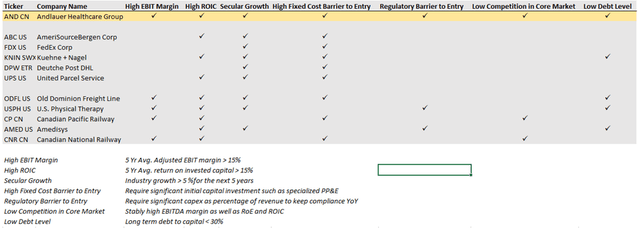

Exhibit C: Comparable Analysis

Comparable analysis with 3PL competitors and selected comparable (Own model) Comparable analysis rationale (Own model)

As per our comparable analysis table, we can see that due to having factors such as high EBIT margin, high ROIC, a regulatory barrier to entry, low competition in the core market, and low debt level, AHG’s company KPIs are much more comparable to KPIs from companies such as Canadian Pacific Railway (CP) rather than from global conglomerates competing in a highly competitive market such as Kuehne & Nagel (OTCPK:KHNGF)

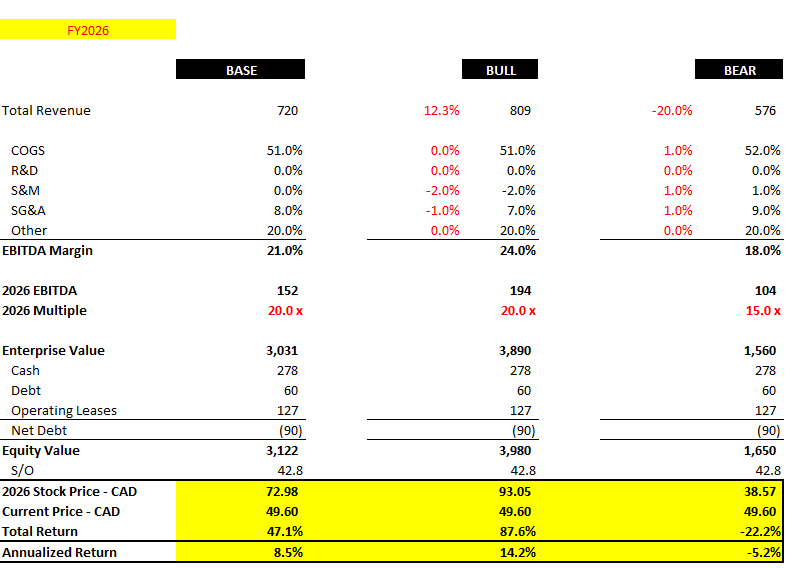

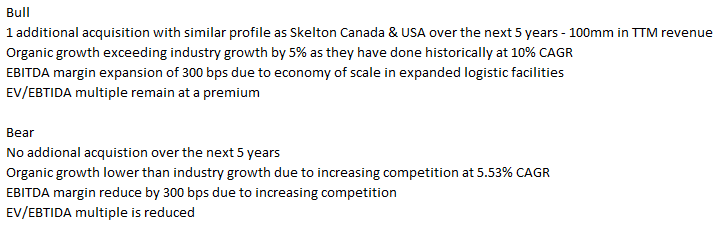

Exhibit D: Bull and Bear Cases

Bull/Bear Cases (Own Model) Bull/Bear case assumptions (Own Model)

The bull case results in an annualized return of 14.2% over 5 years while the bear case suggests -5.2% annualized loss. All things considered, the risk-reward favors a long-term position with a targeted annualized return of 8.5% to 14.2% over the next five years.

Risks

Volatility in fuel prices impacts the company’s fuel surcharge revenues and may impact profitability.

Client contracts from AND CN mostly includes fuel-surcharge revenue programs or cost-recovery mechanisms to mitigate the effect of fuel price increase although it may not capture the entire amount of the increase.

Short-term labor shortage could affect driver wages which may adversely impact margin.

As per the most recent earnings call, management confirmed that they have experienced little pushback from the customer’s front while every input cost has gone up, some double-digit due to gas and talent shortage. My read on this is that as long as the company remains a market leader in its core market and maintains a good relationship with its customers, most clients should be relatively lenient with short-term price increases given that the supply chain is a relatively key component and that switching cost for pharmaceutical companies to another 3PL partner might a) not guarantee lower price given limited options in Canada b) have higher implied costs due to quality risks with less specialized alternatives.

Current rivals may decide to increase investment thus intensifying competition, driving down company prizing power, and reducing client contract volumes. For example, DHL announced that it will grow its healthcare business, and UPS is also moving into the space.

This might be difficult to mitigate given that many of AND CN’s competitors have strong financial positions and deeper pockets compared to AND CN. However, the Canadian Healthcare environment is more complex and less attractive compared to the US. In the short to medium term, it might not make economic sense for a company such as UPS Healthcare to directly invest in infrastructures in Canada – hence why UPS is currently an AHG client.

New competitors may emerge, driving down profitability margins.

New entry risk is relatively low given the fixed-cost and regulatory barriers to entry we’ve mentioned above.

The regulatory environment may intensify, increasing compliance costs.

Changing government regulation could add costs to regulatory compliance in the short run, but will actually be long-term strategically beneficial for a specialized pure-play company like Andlauer – increasing its competitive edge and the need for new customers to seek the few logistics company that does comply with health regulations.

More frequent extreme weather conditions like the B.C. flood in 2021 may increase temperature-sensitive transportation risks and add to long-term operating costs.

So far management is doing a good job in communicating potentially added costs with its clients. More extreme weather conditions add risks across all 3PL services which makes having experience and having a track record of even greater importance when pharmaceutical companies are trying to secure 3PL partners.

A broad economic recession could negatively impact clients and adversely affect organic growth.

Healthcare is generally more resistant and less sensitive to broader economic conditions. If pharmaceutical companies were rendered to a condition where they must cut costs drastically, supply chain logistics should be at the bottom of the list given its criticality to operations and its relatively lower cost status to other components such as selling and marketing.

Keyman risk if Michael Andlauer were to depart, putting a question mark on the company’s long-term trajectory.

Michael Andlauer has been with the company since its inception and has brought tremendous success to the firm. Currently, he holds 56.5% of the company and 83.8% of all voting power through Andlauer Management Group. If the CEO were to depart, investors could react negatively to the stock and question the company’s long-term trajectory. However, he’s currently 56 years old and has had zero negative press releases regarding his health. He has also not made any announcement with plans to retire anytime soon.

Bottom Line

While the company certainly isn’t cheap, Andlauer Healthcare Group deserves a premium valuation relative to comparable companies with similar characteristics –high margin, high ROIC, secular growth, and a strong balance sheet. With its strong competitive position in the Canadian healthcare logistics market, the company is in a great position to leverage its expertise, facilities in the north, and low debt position to expand into the fragmented US market through accretive M&A deals. With aging population, increasing healthcare logistics regulations, and increasing biologics pharmaceutical product consumption in the next decade, secular tailwinds will favor high-quality and specialized logistic companies like AND CN. All things considered the risk-reward favors a long-term position with a targeted annualized return of 8.5% to 14.2% over the next five years (Exhibit D) with the DCF implied share price of $CAD56.81 per share (Exhibit A).

Be the first to comment