AndrewJohnson

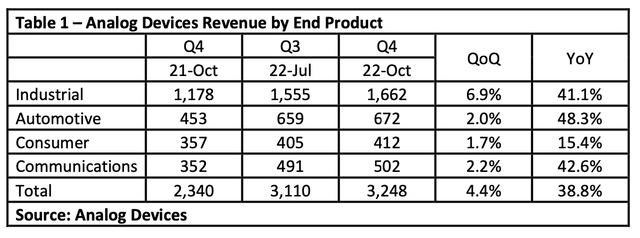

Analog Devices (NASDAQ:ADI) reported record fourth quarter and fiscal 2022 results on Nov. 22, 2022. Revenue was $3.25 billion (+38.8% YoY), beating by $90 million, and Q4 Non-GAAP EPS of $2.73 beat by $0.14.

According to Seeking Alpha’s follow-up to the call, Chris Ciaccia, SA News Editor, noted:

Following the results, investment firm Credit Suisse wondered if the company was “largely escaping” the downturn impacting the rest of the industry or if it had not been impacted by it yet.

“Since we have never seen a cycle in which industrial/analog suppliers have avoided a downturn, we’re assuming the latter,” analyst Chris Caso wrote in a note to clients.

I also question guidance, but want to address the consumer sector, since I have written extensively on Seeking Alpha the impact of reducing demand for consumer products and its impact on Micron (MU).

During the ADI earnings call, CEO Vincent Roche noted:

“Our Industrial, Automotive and Communications markets delivered all-time high revenues, and our Consumer business continued to grow despite industry-wide weakness.”

Indeed, Table 1 shows strong YoY growth of 38.8% for total revenues but just 15.4% for the Consumer sector. But QoQ revenues significantly show a degradation in growth. Total revenues grew just 4.4% and Consumer only 1.7%.

ADI

Guidance by CFO Prashanth Mahendra-Rajah was even worse for FQ1 2022, where he noted:

“Not surprisingly, bookings remain the strongest in the Industrial and Auto, while Communications and Consumer are weaker. We’re guiding first quarter revenue to $3.15 billion, plus or minus $100 million.

So in the first quarter, we expect Auto to be up slightly sequentially; Industrial about flat; Comms to decline by mid-single digits; and Consumer to be down double digits sequentially.”

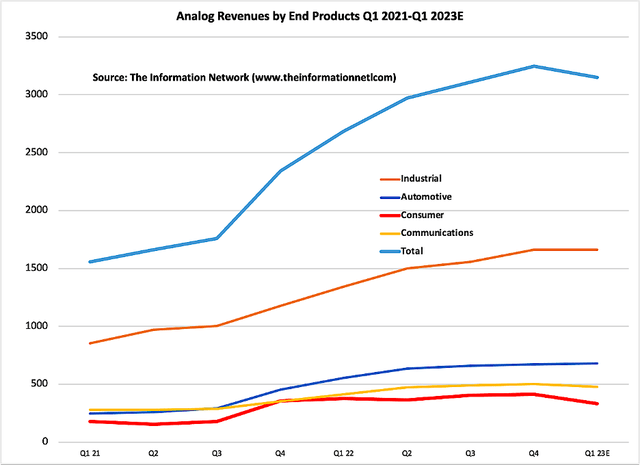

In Chart 1, I plot data for ADI’s revenues by end application from FQ1 2021 to Q1 2023, the latter quarter based on guidance. Here we see a slowdown in overall revenues (blue line) starting in FQ2 2021 ending April 2021. While guidance shows little change in Industrial, Automotive, and Communication sectors, the impact will come from the Consumer sector (red line).

The Information Network

Chart 1

Mahendra-Rajah continued:

“Consumer represented 13% of quarterly revenue and was up modestly sequentially and flat year-over-year. Despite a challenging year for the broader industry, Consumer finished up 8%. This growth is a testament to how we have diversified our Consumer business and the innovation premium our products command. Today, approximately 30% of revenue is derived from long life cycle prosumer applications, including next-gen conferencing systems, professional AV and home theater, while the remaining revenue in Consumer relates to the faster-growing wearables and hearables as well as premium smartphones.”

ADI’s Position in Analog Chip Market

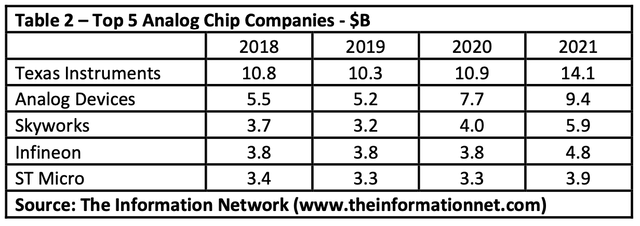

How large is Analog Devices? Table 2 shows the top 5 Analog Chip companies by revenue for 2018-2021. Texas Instruments (TXN) generated the largest analog chip revenues at $14.1 billion followed by ADI at $8.4 billion. This means ADI held a 11.3% share of the worldwide $74.1 billion analog market in 2021.

The Information Network

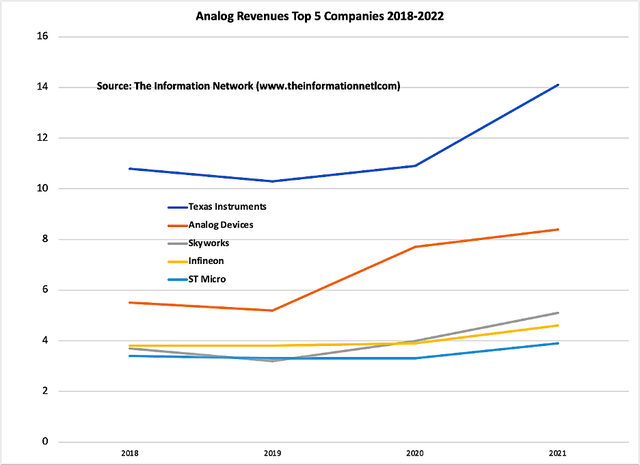

Chart 2 illustrates the revenue increase for each of the companies. ADI finalized the acquisition of analog company Maxim Integrated Products in mid-2021, increasing its share of the analog market. ADI also acquired Linear Technology in 2017.

The Information Network

Chart 2

Investor Takeaway

With the Federal Reserve still behind the curve, with an interest rate at 4% because of the high inflation rate, currently 7.7%, the length of the downturn is unclear. Consumer confidence has increased as gasoline prices have decreased, and so has inflation, but that will reverse as winter sets in, and heating oil and natural gas prices rise.

The consumer applications guidance don’t track well with data on growth of some of these sectors, particularly premium smartphones and conferencing systems.

Samsung Electronics (OTCPK:SSNLF) is revising its smartphone sales forecasts downwards for 2023. While the giant had initially set a target of 300 million units sold next year, its analysts deemed this figure far too optimistic and reduced it to 260 million, 10 million less than in 2022.

Also, according to Strategy Analytics:

“We forecast global smartphone shipments to decline -9% to -10% YoY in full-year 2022. Geopolitical issues, economic downturns, energy shortages, and price hike, exchange rate volatility, and COVID disruption will continue to weaken consumer demand during the last quarter of 2022.”

I noted in my Nov. 14, 2022, Seeking Alpha article entitled “Micron: Even The Best Technology Won’t Help Until 2024:”

“Driven by a mix of skyrocketing consumer demand followed by pandemic supply constraints, the traditionally cyclical memory industry moved along a new cycle that started in Q1 2021 and ended in Q2 2022. The downturn was amplified by a 40-year high inflation rate and recessionary fears that dampened demand primarily for consumer electronic products.”

Memory companies are responding with capex cuts:

- Micron indicated it would reduce 2023 capex by 30%, which includes 50% equipment and 50% building, which would imply a 15% cut in equipment. But MU is actually cutting back WFE equipment purchases by 50% in fiscal 2023, a significant impact on equipment suppliers to the company.

- SK Hynix (OTC:HXSCL) announced in late October it plans to reduce its investment next year by more than 50% due to poor demand in memory chip business. The move comes after the company’s third-quarter operating profit fell to 1.7 trillion won ($1.2 billion), missing analysts’ estimates of 1.87 trillion won. Revenue fell 7% to 11 trillion won.

And on ADI’s guidance based on its consumer application of “next-gen conferencing systems,” one only has to look at Zoom Video (ZM), which saw its share price drop 63.1% for the year. On its recent earnings call, Zoom said that for its fiscal fourth quarter, it expects to earn between 75 cents and 78 cents a share, on revenue in a range of $1.095B to $1.105B. That outlook fell short of analysts’ consensus forecasts for earnings of 81 cents a share on revenue of $1.115B.

My opinion on ADI’s guidance, based on results, guidance, and forecasts from other companies with products in the consumer electronics sector, is that it’s higher than I anticipate. However, the company is solid, and I rate the company a Hold.

Be the first to comment