Khanchit Khirisutchalual/iStock via Getty Images

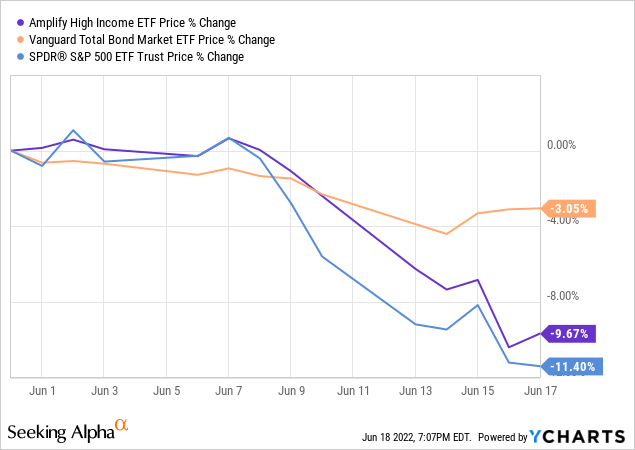

The Amplify High Income ETF (NYSEARCA:YYY) is an index ETF investing in the CEFs with the strongest yields, discounts to NAV, and liquidity. I last covered the fund close to eight months ago. In that article, I argued that the fund’s strong 11.6% dividend yield does not adequately compensate investors for the fund’s subpar investment strategy, consistent capital losses, and lackluster total returns. Since then, the fund has significantly underperformed relative to its peers and broad equity indexes, as expected. At the same time, the discount of YYY’s underlying holdings has widened to 6.8%, a relatively large amount.

In my opinion, YYY remains a subpar investment, as the fund’s strong 11.6% dividend yield and discount to NAV still fail to adequately compensate for the fund’s other failings. As such, I would not be investing in the fund at the present time.

Investors looking for a fund investing in a diversified portfolio of CEFs could consider an investment in the Invesco CEF Income Composite Portfolio ETF (PCEF), or the Saba Closed-End Funds ETF (CEFS). These two funds have broadly similar holdings as YYY, but much stronger investment strategies and performance track record. I last covered PCEF here, CEFS here.

YYY – Index and Holdings Analysis

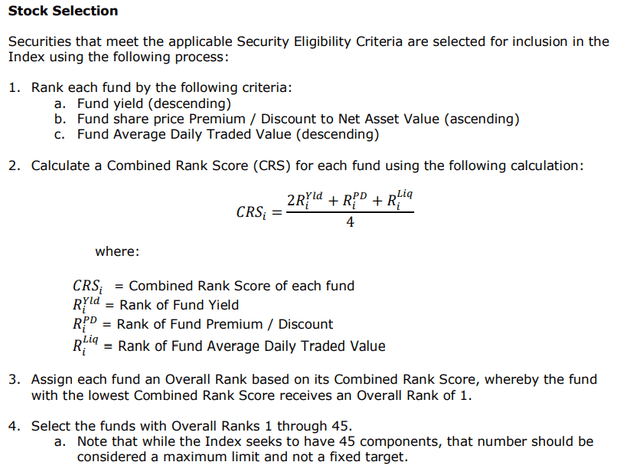

YYY is an index ETF investing in a diversified portfolio of heavily discounted, high-yield, liquid CEFs. The fund tracks the ISE High Income Index, an index of these same securities. Said index first selects all applicable CEFs meeting a basic set of liquidity, trading, size, and investment focus criteria. Said criteria are quite lax, so most CEFs are tentatively included. The index then scores and ranks said CEFs on their yield, discount to NAV, and liquidity. The index invests in the 45 CEFs with the highest ranks, meaning heavily discounted, high-yield, liquid CEFs. Weights are dependent on ranks, with higher-ranked CEFs being assigned higher weights. Security weights are capped at 3.0%, to ensure a modicum of diversification. There are no industry caps or minimums.

YYY’s index methodology is as follows.

As a fund of funds, YYY is incredibly well-diversified. The fund provides investors with exposure to 45 different funds, thousands of underlying securities, and exposure to most relevant asset classes. YYY is significantly more diversified than the average fund, although somewhat less diversified than the average multi-asset class fund, as the fund’s index is somewhat restrictive (no investments in CEFs with premiums, or with low yields). Diversification reduces risk and volatility, but risks remain relatively high, as YYY’s holdings are almost all relatively risky, heavily-discounted CEFs.

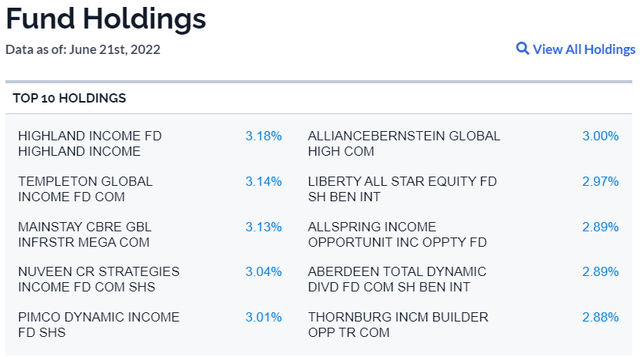

YYY’s largest holdings are as follows.

In general terms, YYY’s underlying holdings are heavily discounted, high-yield, liquid CEFs, as expected. From the above, all funds have large discounts to NAV, except the Liberty All-Star Equity Fund (USA), which has a massive 13.6% distribution yield instead.

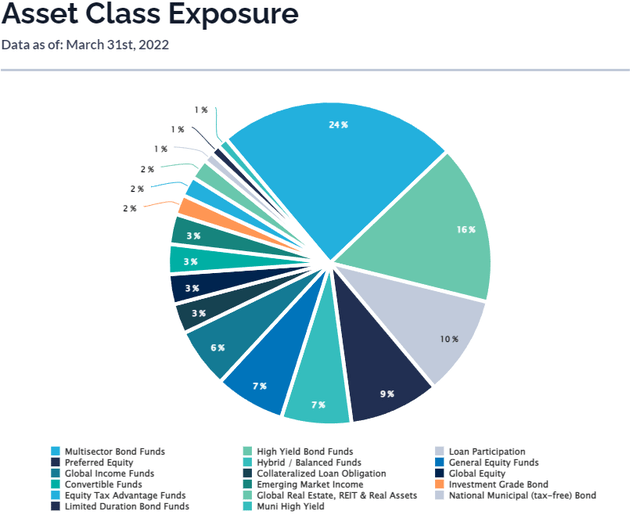

YYY provides investors with exposure to most relevant asset classes, with a strong focus on bonds, including multi-sector bond funds, high-yield bond funds, and loan participation bond funds.

Besides the above, nothing much else stands out about the fund, its index, or holdings. With this in mind, let’s have a look at the fund’s positives and negatives, starting with its negatives.

YYY – Negatives

YYY’s most significant negative is its ineffective strategy, with the fund consistently buying underperforming CEFs, and selling its best performers. Doing so results in significant consistent capital losses, distribution cuts, and underperformance, a dreadful combination.

Let’s go through one example of the above.

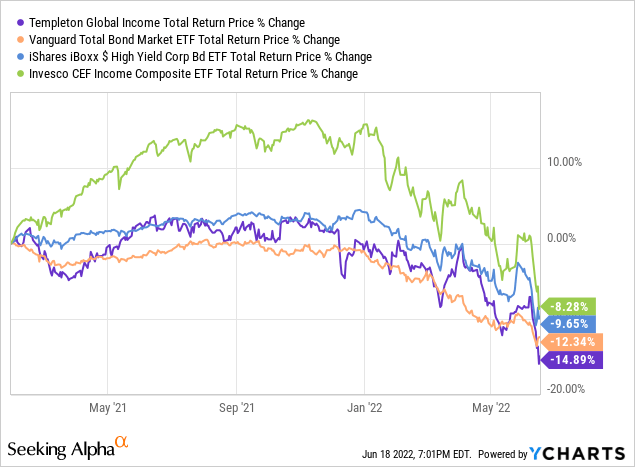

GIM is the fund’s second-largest holding, and from what I’ve seen, was the largest holding in early 2021. GIM is a diversified bond fund but tilted towards high-yield bonds. YYY bought GIM sometime after January 2021, almost certainly due to the fund’s high yield and high discount to NAV. Since then, GIM has significantly underperformed relative to the average CEF / CEF indexes and high-yield corporate bond indexes but slightly outperformed relative to bond indexes. GIM’s performance was below-average, at best, so investing quite heavily in the fund was not the right call.

From looking at past annual reports, it seems that many / most of the fund’s specific investment decisions lead to losses of underperformance. I went through some other examples in my previous article on YYY, most of which are extremely similar to the situation with GIM. YYY’s holdings are fine, but the fund doesn’t buy when it should buy and doesn’t sell when it should sell.

Although it is impossible to say why this is the case with 100% accuracy, I do have some hypotheses. YYY focuses on funds with above-average discounts, which are sometimes indicative of underperforming, sub-par funds. This isn’t always the case, but there are many funds for which this is true, and YYY invests in these, leading to losses and underperformance. YYY also focuses on funds with above-average distribution yields, which are sometimes indicative of unsustainable distributions. Unsustainable distributions are always cut, sooner or later, and when that happens, prices collapse, leading to significant losses for YYY and its shareholders. YYY then sells the fund, as a distribution cut means distribution yields are now lower, locking-in these losses.

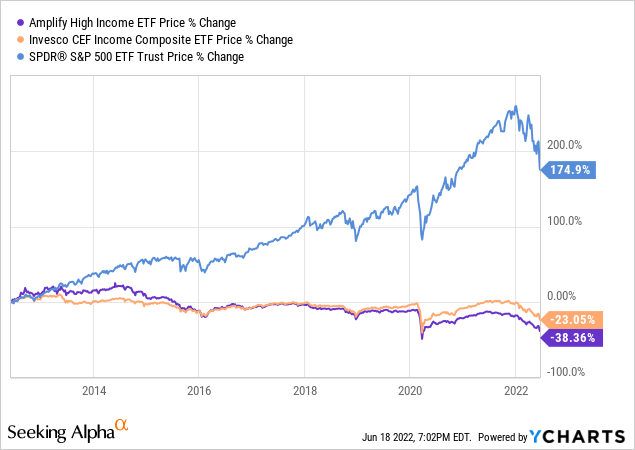

In any case, YYY’s investment strategy has proven ineffective in the past, with disastrous results for shareholders. YYY has seen consistent, above-average capital losses since inception.

Capital losses mean a lower asset base, leading to lower income for the fund, and lower distributions for shareholders. YYY’s distribution sees consistent cuts year after year and is down around 1/3rd since inception, close to nine years ago. Insofar as the fund’s strategy remains ineffective, and I do believe that this will be the case, YYY should continue to see consistent distribution cuts year after year.

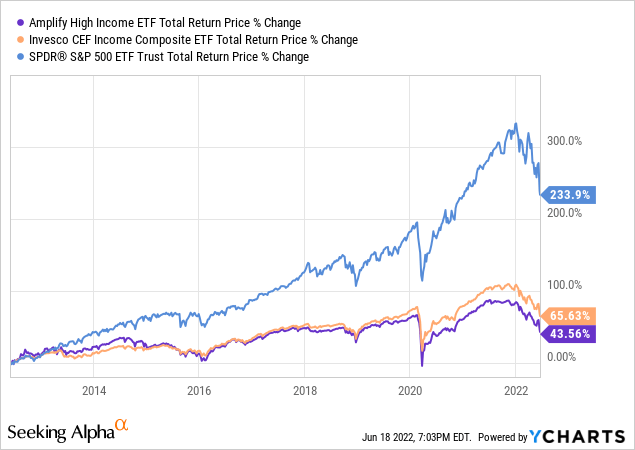

Finally, as YYY sees consistent capital losses and distribution cuts, total shareholder returns are quite low. Since inception, the fund’s total returns have had a CAGR of 5.2%, quite low for a fund focusing on CEFs. YYY’s returns are moderately lower than the CEF average and significantly lower than that of the S&P 500.

YYY’s ineffective investment strategy has led to consistent capital losses, distribution cuts, and underperformance in the past. The trend is set to continue, in my opinion at least.

YYY – Benefits

YYY is a broadly subpar investment, but it does have two key benefits.

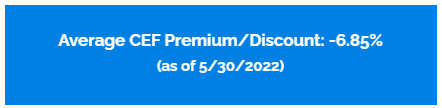

First is the high discount to NAV of the fund’s underlying holdings. Recent market weakness has caused CEF discounts to widen, with YYY’s underlying holdings trading with a 6.9% discount to NAV, as per the latest management report.

YYY Corporate Website

Discounts have probably widened since, as YYY is down these past few days, by more than expected for a balanced bond / equity fund.

Insofar as equity and bond markets continue to recover, YYY’s underlying holdings should see rising NAVs and narrowing discounts, leading to significant gains for the fund and its shareholders. Although there is something of a short-term trading opportunity here, I do think that the fund’s negatives more than outweigh this small positive / trading opportunity.

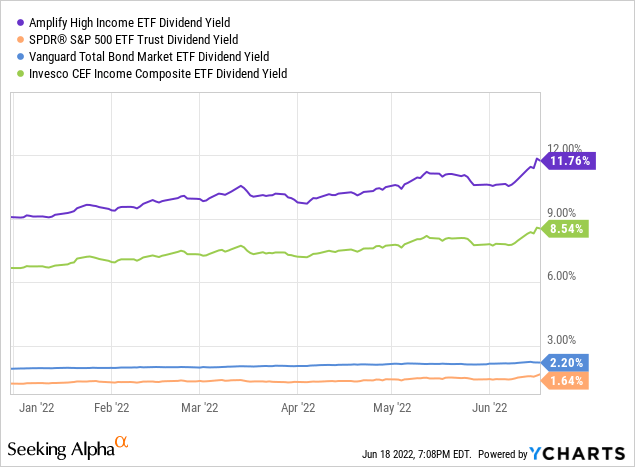

Second important benefit is the fund’s strong 11.6% dividend yield. It is a strong yield on an absolute basis, and quite a bit higher than that of most relevant asset classes or CEF funds of funds.

Although it is a strong yield, it has seen consistent cuts since inception and should see further consistent cuts in the future. These all but invalidate the fund’s strong yield, at least for long-term investors.

Conclusion

YYY is an index ETF investing in the CEFs with the strongest yields, discounts to NAV, and liquidity. The fund’s subpar investment strategy has led to consistent capital losses, distribution cuts, and underperformance in the past, a trend which I believe will continue into the future. As such, I would not be investing in the fund at the present time.

Be the first to comment