gorodenkoff

Amgen (NASDAQ:AMGN) is becoming an under-owned blue chip stock. The large biotech company has several desirable attributes for this or any market, including a reasonable earnings multiple and a well-covered above average dividend. The stock also has strong relative outperformance that includes being up so far this year, and on the verge of a multi-year break-out.

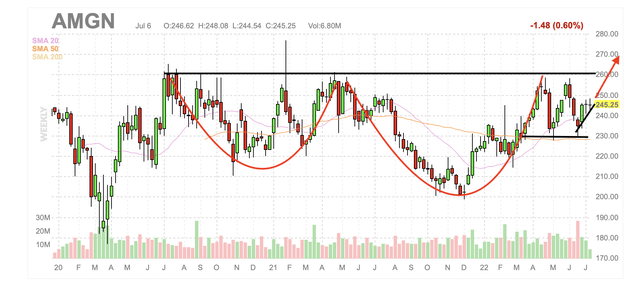

AMGN weekly candlestick (Finviz with markings by Zvi Bar)

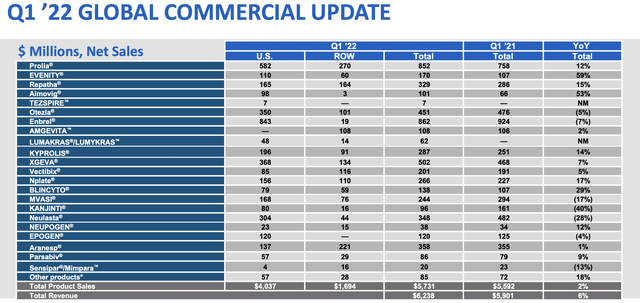

Amgen has a large and diversified portfolio of drugs that provides it with strong cash flow. Most of Amgen’s revenue comes from the United States. About 30% of the company’s revenue came from outside the U.S., and some of that does come with currency risk. Still, that is not bad compared to a great many large companies. Amgen recently divested a Turkish unit, and that sale should reduce AMGN’s currency risk.

Amgen’s portfolio is truly diversified, with a great many drugs pulling together. Some, like Otezla and Enbrel, are known blockbusters, but the roster is huge, with numerous profitable drugs.

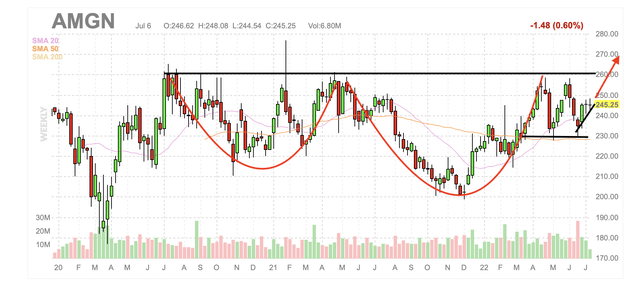

Amgen was unable to increase guidance this spring, which was not taken well. Amgen declined in late April, only to rebound throughout May, but then it roundtripped that move in the first half of June. Amgen is now in the middle of a channel created by those gyrations, and it appears to be developing some tension for a move to test recent resistance or support.

AMGN daily candlestick (Finviz.com)

Amgen is currently scheduled to report Q2 2022 earnings on August 4. That could end up being a catalyst to a test of either recent support at around $230, or resistance at around $260. I suspect Amgen will largely follow the market between now and then, but also that July tends to be a decent month for the market, and large caps. As a result, I believe Amgen is likely to test recent resistance on or before August 4.

If Amgen is capable of testing and besting this recent resistance point around $260 that bothered it back in April and then again at the end of May, it could really pop. This price has been an issue for around two years.

AMGN weekly candlestick (Finviz with markings by Zvi Bar)

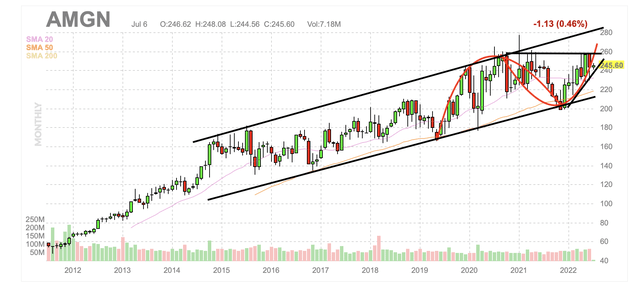

Amgen had numerous attempts in 2020 and 2021 where it failed to hold a weekly close in the $260s. It bounced off it twice so far this year, but I think it is finally ready to crack through the barrier. This would also take Amgen stock towards the high range of its long-term trend.

AMGN monthly candlestick (Finviz with markings by Zvi Bar)

All of that would imply a reasonable trading range in the second half of 2022 of between $230 and $280, with a possible test of $260 this August.

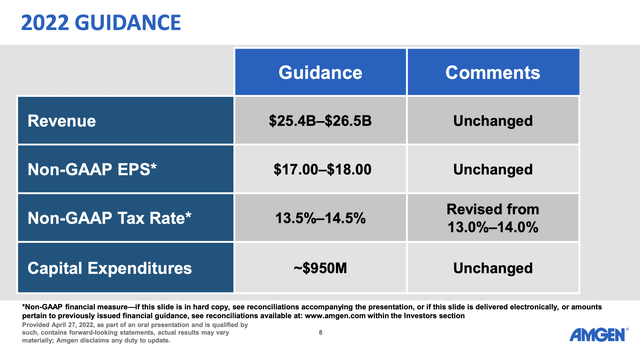

Amgen last provided 2022 guidance for revenue of between $25.4 and $26.5 billion, and Non-GAAP earnings per share of $17-$18 per share.

Amgen 2022 guidance (Amgen April 2022 guidance)

Amgen also has a reasonably high dividend. The company provides a yield of about 3.15% and has increased that payout for the last ten years. Also, the current annual payout of $7.76 is fairly well covered, at around 40 percent of forward non-GAAP EPS. Amgen’s well covered dividend makes further increases probable.

Amgen’s cash flow has also allowed the company to repurchase shares. By reducing share count, it becomes easier for the company to meet and beat per share expectations. Similarly, repurchases make dividend payments and increases less costly.

The greatest risks to Amgen, here, beyond a possible terribly received earnings report in August 4, would be upcoming mid-term election related risk. Pharmaceutical companies are often highly susceptible to capricious movements in advance of an election, and it is also frequently the case that some companies are singled out by campaigning candidates. Such weakness is likely already affecting the pharmaceutical industry this quarter, and any substantial weakness is likely a short-term opportunity.

Conclusion

Amgen appears to be prepared to test recent and long-term resistance at around $260. I believe Amgen is likely to break through such pricing in early August, when it reports Q2 2022 earnings. Amgen is also scheduled to pay a dividend in mid-August, which should help support early August pricing.

I believe Amgen has strong support in the low $230s, and would reconsider this thesis on AMGN shares if it broke down through $230 on or before earnings.

Be the first to comment