Woman pouring water from the tap Lazy_Bear/iStock via Getty Images

After a long hiatus for parenting and an international move, I’m excited to be back writing for SA!

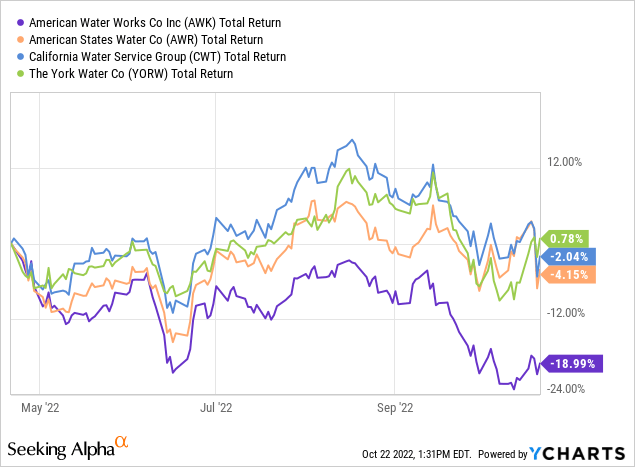

During this period of historically rapid rate hikes, it’s no surprise that water utilities have taken a beating with their relatively low yields and slow-and-steady growth profiles. American Water Works (NYSE:AWK) is the largest U.S. water utility serving over 14 million people in 24 states, and over the past six months its stock has performed significantly worse compared to its peers with notably weaker rebounds on up days. However, I view this period of underperformance as likely exhausted now that AWK’s valuation, EPS, and dividend payout ratio have reached more attractive levels.

Utilities Have Been Thrown Out with the Bathwater

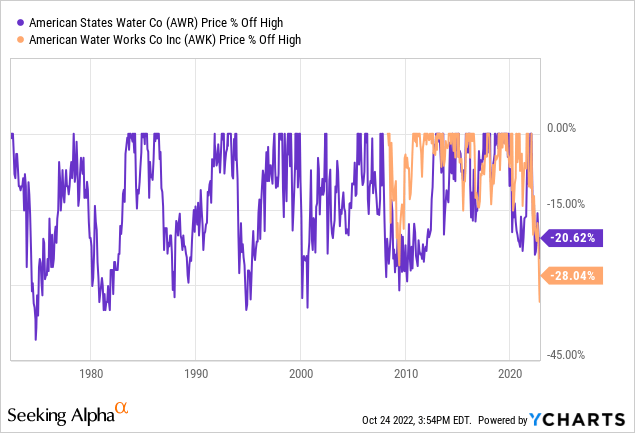

Despite traditionally being one of the most resilient safety havens in equities, many water utility stocks including AWK have now fallen more than they did during the Great Recession. AWK is down nearly 30% from its high, its largest sustained drawdown (excluding the one-week COVID crash) since its IPO in April 2008. With short-term treasuries now yielding over 4%, investors are discovering that utilities are no longer the low volatility play they’ve come to rely on. Panic has set in as Fed officials remain hawkish and portfolio managers re-calibrate their holdings for the current rate environment.

When the cost of capital is low, water utilities hold a special place in dividend growth portfolios, residing at an ideal intersection of growth, income, and safety. Among the most essential wide moat stocks, these companies typically sport higher top line growth and dividend growth rates than many electric and gas utilities with the added benefit of being plays on ESG, water scarcity, and global warming. However, in turbulent times like these, it’s easy to forget underlying fundamentals when discussions of prolonged inflation and unknown terminal interest rates dominate the news.

While defensive stock yields are becoming more important to compete with bonds, it’s important to remember that by many measures we are already in a deflationary period, that bonds do not offer the dividend growth and liquidity of stocks, and that long-term equity fund managers with restrictions on bond and cash holdings will likely be buyers of utility stocks whenever valuations are attractive. As individual investors, we need to think like experienced fund managers and use fear-based market moves to our advantage rather than letting them deter us from our long-term investing strategy, which in my case involves snapping up blue-chip stocks when they’re on sale.

How Low Can AWK Go?

AWK’s recent underperformance is especially notable because it has outperformed all of its peers in both total return and dividend growth CAGR since its 2008 IPO.

To get a sense of how rare a drawdown of this magnitude might be for AWK, we can see that its smaller but similar-yielding peer American States Water (AWR) has only experienced a 30% or greater drawdown approximately once every ten years.

While not a perfect comparison, if we apply the above chart to AWK’s theoretical historical performance, it’s clear that although rising rates could still push the stock lower, it’s also fair to say that this is a once-in-a-decade opportunity to add shares — especially because my goal is never to time the absolute bottom, but to cost average in when the risk/reward is favourable to the upside.

But What About The Fed?

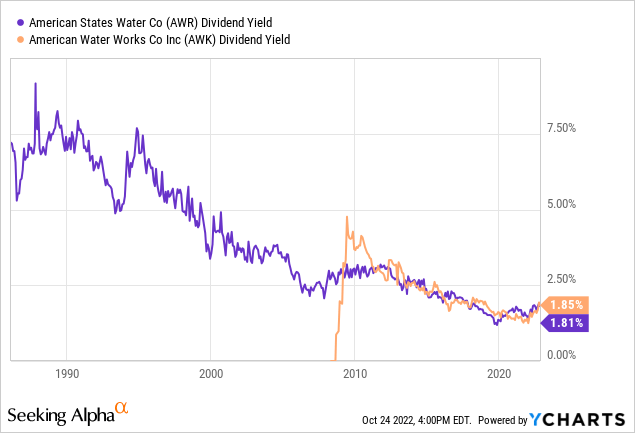

On the other hand, since interest rates are the main cause of the current drawdown, it’s also important to look at how AWK (and by proxy, AWR) measure up against their historical values:

As bears will rightly point out, the above chart looks downright scary. In the current context, however, I think we can breathe a sigh of relief due to a few mitigating factors.

First, A quick look at the fed funds rate historical chart shows us that the last time the U.S. experienced 4-5% rates was from late 2005 thru 2007, at which time AWK’s yield bounced between 2-3%. Looking further back with AWR, a similar pattern holds where the stock’s yield typically remained at least 1-2% below the peak fed funds rate in a given decade. So we don’t need to expect that the yield of AWK must equal the terminal fed funds rate, as the market has historically afforded it a 2% cushion.

Second, prior to 2011, AWR’s dividend growth was far lower (1-2% CAGR) than AWK’s current dividend growth (9-10% CAGR), which is also the highest among water utility stocks. This should further insulate AWK’s shares from interest rate pressure, with the obvious caveat that higher rates and a recession could depress the company’s earnings and dividend CAGR going forward. Still, with a current annual yield of 1.97% and 5-year dividend CAGR of 9.74%, AWK’s 10-year projected yield-on-cost is a healthy 4.72%, which, given the cushion we discussed, compares well with the market’s current projected terminal fed funds rate of 5.25%.

High Quality, Historically Low Valuation

The final reason I’m not too worried about further drawdowns is AWK’s valuation, which I view as very attractive compared to its peers. The company has continued its steady earnings growth while its stock price has declined, so now it boasts the lowest PE and dividend payout ratios among water utility stocks by a significant margin.

| AWK | AWR | CWT | MSEX | YORW | WTRG | ARTNA | |

| Current PE Ratio | 19.6x | 36.3x | 34.7x | 38.4x | 32.4x | 24.8x | 27.8x |

| 5-yr Avg PE Ratio | 34.8x | 35.5x | 34.0x | 34.4x | 34.9x | 35.1x | 23.5x |

| Div Payout Ratio | 55% | 60% | 58% | 58% | 58% | 63% | 57% |

| Div Yield | 1.88% | 1.87% | 1.77% | 1.45% | 1.82% | 2.71% | 2.10% |

| 5-yr Div CAGR | 9.74% | 8.75% | 6.58% | 6.54% | 4.00% | 6.99% | 3.27% |

Now that the immediate rate-driven selling has abated, I think AWK’s competitive valuation and historically high profitability will help to reverse its recent underperformance and return it to its past trend of outperforming its subsector. Looking at the chart above, I’d also like to note that Essential Utilities (WTRG) appears quite undervalued to me, and I may take a closer look at them in a future article.

Conclusion

I view AWK as the premiere water utility in terms of long-term safety, geographic diversification, and dividend growth, and at the current valuation I rate the stock a buy with the knowledge that further announced rate hikes beyond the current projected terminal fed funds rate of 5.00-5.25% will likely push shares lower. Given the interest rate risk and the increased volatility of utilities in general at the moment, I recommend cost averaging into this blue-chip SWAN stock at these levels and adding on any future legs down.

Be the first to comment