morfous/E+ via Getty Images

Investment Thesis

American Tower (NYSE:NYSE:AMT) is one of the largest REITs with approximately 222,000 communications sites and is generally considered a very stable recession-resistant company. But is it currently an attractive investment? And what about further growth opportunities? Although the valuation is now higher than the historical average, I think AMT is a great buy to hold for the long term, even at this price. If you are patient, you will likely get even better buying opportunities from time to time.

Cell towers vs. satellite internet

We are still only at the beginning of a globally growing internet usage: 5G and internet of things are just starting. Even 6G can already be seen in the far distance. None of this will surprise anyone. I want to address another question that is very critical for AMT. Will data transmission in the future be via cell towers or satellites? Elon Musk was a pioneer, Jeff Bezos a copycat in my opinion, and apparently, even Apple (AAPL) is working on something to bypass cell towers.

According to Jim Taiclet, former CEO of AMT, satellite internet has certain use cases in low-density, low-data-rate environments. Still, it’s not an economic competition for cell towers in high-density areas.

In terms of scaling to hundreds of millions of people who are using 10 GBs per month with certain latency requirements and a megabits per second load… satellites don’t really work, and economically I’m not sure they’ll ever work outside those edge cases.

Satellite phones have been around for decades, but until now, they have never been economically competitive. It is possible that Starlink is the first service to achieve this to some extent. But even here, the monthly costs are much higher than for conventional Internet. Perhaps one day this will change, and satellite Internet could become real competition even for densely populated cities – technological changes are hard to foresee. But we still seem to be a long way from that. Looking at the next ten years at least, both will probably exist in parallel, and satellite Internet will serve its niche, where it is not worth building mobile towers.

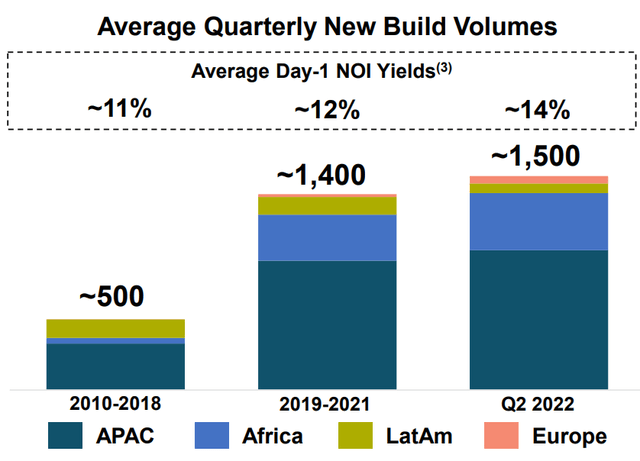

AMT’s future strategy

Already, 4/5 of all towers are located outside the U.S. (AMT is active in 25 countries). This trend is set to increase. The focus will be primarily on the Asia-Pacific region and Africa in the coming years. CAPEX in 2022 is about $1.8B ($2.7B for dividends). AMT also operates 27 data centers. However, this revenue is not shown separately, so it is impossible to analyze this area. Probably, these only account for a small part of the revenue so far.

Otherwise, American Tower describes its ambitions for this decade more or less as “we continue with what has worked so far”: More towers, 5G, more efficiency, and trying new possibilities (“Capture opportunities to serve new customers beyond traditional mobile operator client base”).

Recent Results & Financials

The latest Q2 results show strong revenue growth of 16% to $2.67 billion. Property revenue increased 17.1% to $2,615 million. AFFO attributable to stockholders increased by 7%. Note that all these figures would have been much stronger without exchange rate fluctuations. About 4/5 of all towers are in non-US countries, so AMT receives most of its payments in currencies that lost value against the US dollar this year.

AMT has repaid a little bit of debt (now at about $37B) and reduced its debt/equity ratio from 4.26 to 3.47 since the beginning of the year. From Fitch, the company received a BBB+ rating but a BBB- from S&P. While the company has a lot of debt and is highly leveraged, AMT also has assets important to society that provide cash flow with long-term contracts.

All in all, AMT is a growth machine:

- Revenue (10-year CAGR): 14%

- Net income (10-year CAGR): 20%

- Dividend growth (10-year CAGR): 38%

Valuation

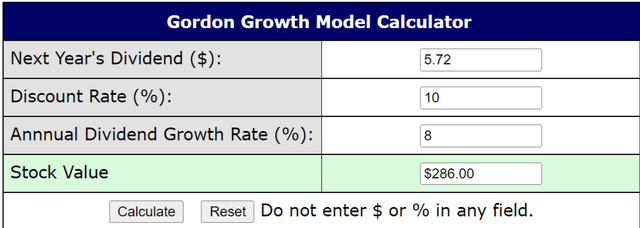

AFFO attributable to common shareholders per share for 2022 is expected to be between $9.62 and $9.86 (in 2021, it was $9.43). At the current share price of $261, we get a price/AFFO of 27. The current dividend yield is 2.19%, with a healthy payout ratio below 70%. FFO for 2022 is expected to be $11.82, resulting in a P/FFO of 22.

For safe dividend growers, I like to look at the Gordon growth model to determine a fair price – as it assumes that the stock pays an indefinite number of dividends that grow at a constant rate. This model shows AMT trading very close to its fair value.

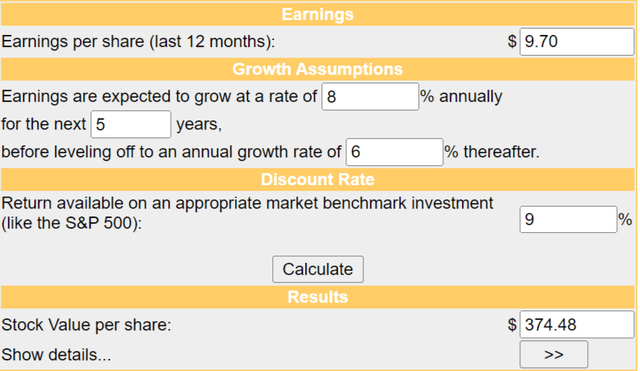

A discounted cash flow calculation using the AFFO of $9.70 gives me a fair value of $374. Note that my assumptions are rather conservative here.

According to Fastgraphs, we can expect a return of only 1% p.a. until the end of 2024 (with the historical average FFO valuation of 21.5). And with a higher valuation of 25, we can expect about 8.50% p.a.

However, AMT has built-in rent increases tied to inflation in most countries. Therefore, it could well be that earnings per share will be better than expected in the near future – especially if/when the dollar softens again.

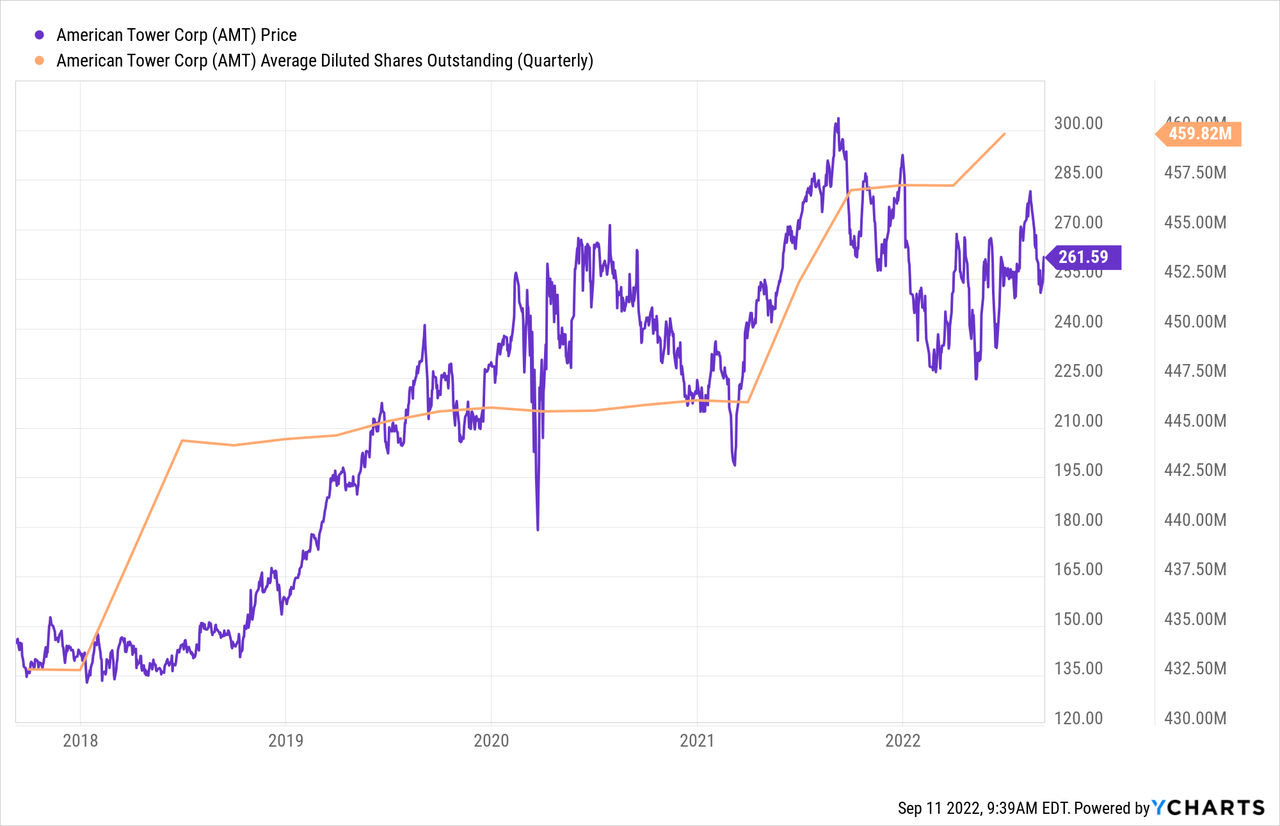

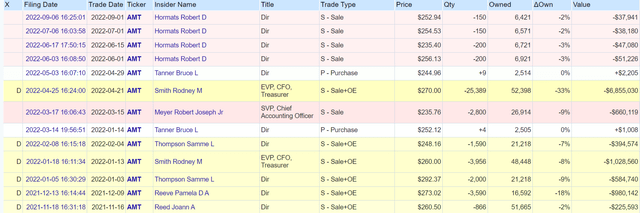

Share Dilution and Insider Selling

I always want to look at stock dilution and whether there is insider selling. There have been a little bit of both, but nothing spectacular.

openinsider.com

Risks

Overall, I have to say I don’t see many risks here. But the USD could strengthen even more, causing AMT to suffer more than other companies in the S&P500. I cannot envision that cell towers will no longer be needed or replaced soon. However, consolidation within the towers’ tenants is always possible, leading to less revenue per tower.

Conclusion

We probably won’t get super premium returns with American Tower anymore, but the stock still offers many advantages of a value stock:

- you buy the global leader in mobile towers

- built-in inflation protection

- recession-resistant

- diversified worldwide

Negative factors are the high debt, the low dividend yield, and the somewhat too high valuation. In the event of short-term weakness due to a generally weak market, one should take advantage of the opportunity and buy. But even at the current price, AMT will likely be an outstanding stock to buy and hold.

Be the first to comment