SimonSkafar

Investment Thesis

American Electric Power Company, Inc. (NASDAQ:AEP) is America’s leading electric utility company headquartered in Columbus, Ohio. In this thesis, I will primarily analyze AEP’s Q2 2022 results and its future growth drivers. I will also analyze the risks faced by the company and its valuation at current price levels. I believe AEP is a growth company with a stable dividend yield. I assign a buy rating for AEP after taking into consideration all these factors.

Company Overview

AEP is an electric utility company providing electricity across 11 states, catering to more than 5 million customers. It is one of the largest electricity-providing companies in the United States. The company generates, transmits, and distributes electricity to direct consumers and also to other electricity companies. It has around 224,000 circuit miles of distribution lines to deliver electricity to individual households and commercial properties. The company has nearly 22,500 MWs of regulated electricity generating capacity. It generates electricity through various methods, some of them being environment-friendly sources. AEP primarily generates electricity through nuclear, hydro, solar, wind, coal, and natural gas sources and methods. The great advantage that the company enjoys in the market is the vertical integration of its production, transmission, and distribution facilities. This integration ensures the smooth functioning of activities with limited dependence on external sources.

Q2 2022 Results

AEP posted stellar Q2 2022 results beating the market revenue estimates by a staggering 16.5%. The reported EPS was in line with the market expectation. The company has also reaffirmed the FY22 revenue and EPS guidance. AEP is also planning on increasing its renewable energy portfolio to 50% by 2030 and is in talks to acquire several renewable energy assets to attain that goal. It witnessed strong demand and is expecting a steady demand throughout FY22.

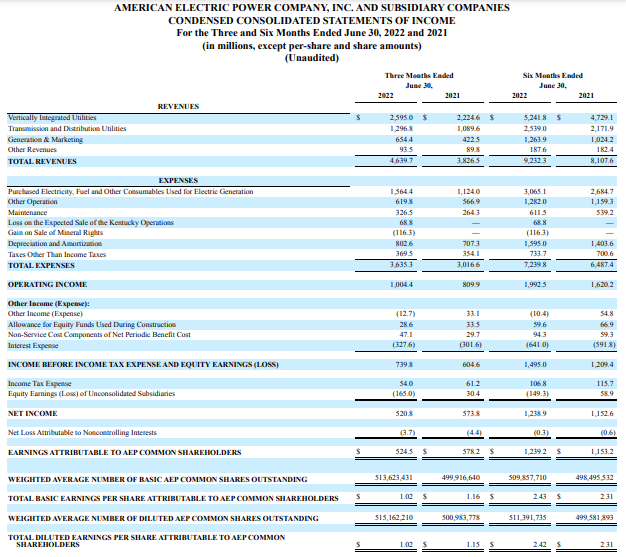

SEC:10Q AEP

AEP reported revenue from vertically integrated utilities of $2.6 billion, a 16.8% increase compared to Q2 2021 revenue of $2.2 billion. As per my analysis, the increase in electricity prices complimented by increased demand was the primary revenue driver. The revenue from transmission and distribution utilities was $1.3 billion, a 19% increase from $1.09 billion in the same quarter the previous year. The price rise was the main contributing factor to the revenue increase. The company reported total revenue of $4.6 billion, a 21% increase compared to $3.8 billion in the corresponding quarter last year. I believe the company will maintain its revenue in FY22 and FY23 by increasing its generation capacity and expanding its operation in other states. The company reported total expenses of $3.6 billion, compared to $3 billion in Q2 2021, a 20% increase. As per my analysis, the commodity price rise and labor cost were the primary factors in increased expenses. It reported a non-GAAP net income of $617.7 million, compared to $589.5 million in Q2 2021, a 5% increase. The increase could be even higher if we ignore the one-time equity loss of $165 million from unconsolidated subsidiaries. The non-GAAP EPS was reported at $1.20. The company also announced a dividend of $0.78 payable on September 9, 2022. This gives us an annualized dividend yield of 3.11% at the current price level.

Overall, the company posted strong Q2 2022 results with considerable improvement across segments. The company has reaffirmed its non-GAAP EPS estimates for FY22 in the range of $4.87-$5.07. I believe the EPS estimates of the company are conservative, and as per my estimates, the FY22 EPS could be in the range of $5.10-$5.25. The company is constantly trying to expand its operations and increase its renewable energy portfolio, which I believe will be crucial for the company’s growth in the coming years.

Nicholas K. Akins, AEP chairman, president and chief executive officer, stated,

We’re making significant progress on our plan to responsibly transform our generation fleet as we work to add approximately 16,000 megawatts of regulated renewable generation by 2030 and achieve our goal of net zero emissions by 2050. Appalachian Power recently received approval to own 409 megawatts of wind and solar, and SWEPCO filed in May for regulatory approval to purchase three renewable projects totaling 999 megawatts. We’re currently seeking new wind and solar proposals in multiple states and continue to add generation in line with our integrated resource plans to best meet the future energy needs of our customers. We also are making substantial progress on our planned investments of nearly $25 billion in transmission and distribution from 2022 through 2026 as we develop a modern, reliable and resilient energy grid that will benefit our customers. Net plant for our Transmission Holding Co. grew $1.2 billion, or 10.5%, since June 2021.

Key Risk Factor

Changes in technology and regulatory policies: The majority of AEP’s power is produced at sizable central facilities. Its transmission and distribution infrastructure is distributed to customers, typically inside an exclusive franchise. In comparison to dispersed generation using either new or existing technology and technical advances like fuel cells and microturbines, this strategy achieves economies of scale and usually reduces costs. Other technologies, like light-emitting diodes (LEDs), make electricity more efficient, reducing the demand for it. The expenses of emerging technology are falling to a point where they are competitive with some central station electricity generation and distribution because of modifications to regulatory rules and advancements in energy storage technologies like batteries, wind turbines, and photovoltaic solar cells. These advancements may threaten the competitive capability of AEP to keep reasonably affordable, reliable activities, fair regulatory frameworks, and cost-effective customer programs and services. Additionally, if alternative generation resources are introduced to the available generation supply and mandated through regulation or legislation can be commercially viable, this may displace generating units with a higher marginal cost, lowering the price at which market players sell their electricity. That’s the reason I think the technological advancements and regulatory policies can be a primary challenge for the company’s future growth.

Valuation

The company currently trades at $98.46 with a market capitalization of $50.91 billion. At the current valuation, the company is trading at a PE multiple of 20.77x. The company posted strong quarterly results and is experiencing increased demand. After considering both these factors, I have estimated EPS of $5.25 for FY22, giving us the leading PE multiple of 18.75x. Due to rising demand, I think the company might trade at a higher PE multiple of 24.5x, which gives the target price of $128.6, representing a 30.6% upside from the current level. The company has a dividend yield of 3.11% at the current price levels which is another attractive factor for the investors looking for safe and steady dividend yield. According to Seeking Alpha dividend grade, the company’s dividend payment is safe, growing, and consistent as it has A- in safety, B+ in growth, and A+ in consistency.

Conclusion

AEP posted strong Q2 2022 results and has reaffirmed its guidance for FY22. I believe the company will beat the market estimates in the coming quarters with increased demand and rising electricity prices. The company is currently trading at an attractive leading PE multiple of 18.75x, which can be a perfect entry point for investors. The company also has an attractive annualized dividend yield of 3.11%. After considering all these factors, I assign a buy rating for AEP.

Be the first to comment