buzbuzzer

Investment Summary

Risk assets have caught a bid since July and are now rallying to retrace losses incurred in early 2022. Within healthcare, there are numerous pockets of quality screaming out for capital allocation. Most notably, characteristics of free cash flow (“FCF”), tangible book value, and earnings quality are paramount.

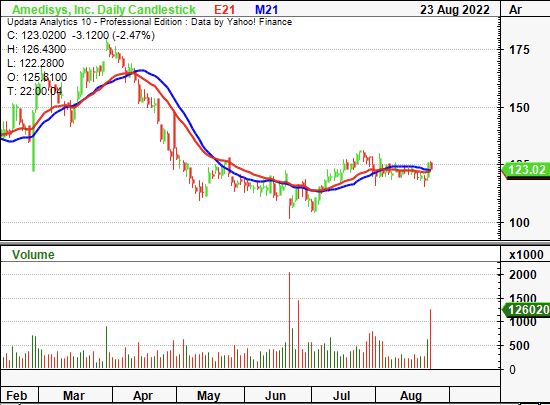

Exhibit 1. AMED YTD price performance

Data: Updata

In that vein, we note that Amedysis, Inc. (NASDAQ:AMED) displays a loose affinity to the equity premia we are seeking exposure to in H2 FY22. On closer inspection, the balance sheet is skewed towards intangible sources of value that are susceptible to mark downs and don’t provide certainty on the predictability of future cash flows. Valuations are also unsupportive. With these factors in mind, we rate AMED neutral.

Q2 earnings flat, insights for FY22 result

Q2 revenue came in with a 100bps decline to $558 million, below consensus estimates and behind guidance. Home Health turnover came in at ~$350 million, with a ~400bps impact from Q2 acquisitions. More on this a bit later. Structurally, the home health business now books 20% of revenue from a per-visit basis. This equates to ~200K/month of ~600K/quarter. However, management says it is moving towards a blend where more revenue upside is recognized on a per-case basis (instead of per visit). This has potential to unlock scale in the segment because it frees up more clinical capacity for greater patient uptake.

Meanwhile, the hospice segment printed $198 million for the quarter, backed by a 400bps YoY increase in net revenue per day, offset by a $2.88 cost per day. The company also realized a 200bps pass-through in hospice rate increase that’s been in effect since 1 October FY21′. Moving down the P&L, the company saw ~125bps of headwind at the SG&A line thanks to acquisition costs tied to Contessa and Home Health. Non-GAAP EBITDA was up 150bps YoY to $182 million ($5.60/share), whereas it printed GAAP EBITDA of $42 million ($1.31/share).

In addition, AMED recognized ~200bps upside in revenue per episode, helped in part by a similar increase in reimbursement. There was also a 6% increase in visiting cost per visit, underpinned by higher cost inflation, labour shortages and increase salaried employments.

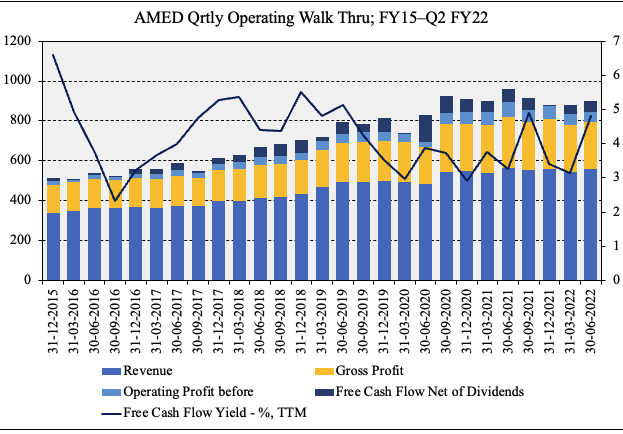

As seen in Exhibit 2, quarterly operating performance has begun to slow markedly for the company since FY19. Despite a small spike in sales and gross profit in FY20, this growth has stagnated and even receded back in range. Despite this, the company remains FCF positive and exhibits a sense of resiliency in its earnings profile. It printed $55 million in FCF last quarter, a YoY gain of 5.7% from $52.3 million. Although, total debt also increased by 146% YoY and ~3% sequentially to $442 million. The company also spent $17 million during the year on stock buybacks, with another $83 million under authorization.

Exhibit 2.

Data: HB Insights Estimates; AMED SEC Filings

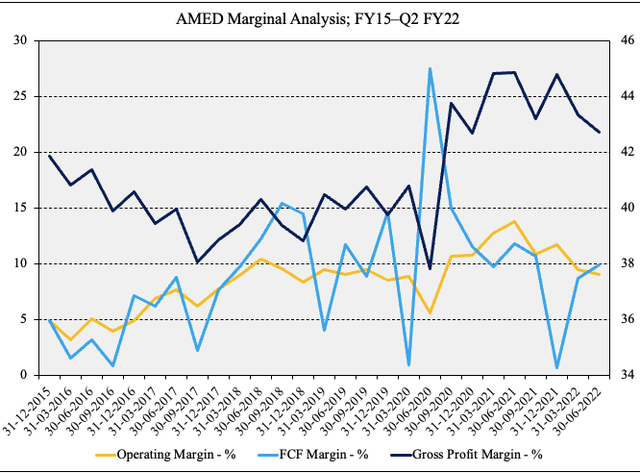

Further evidence of this separation in top-to-bottom line fundamentals is seen in the chart below. As seen, FCF margin (as a function of turnover) and gross profit margin have begun to bifurcate since mid-2020. Operating margin has followed suit since Q3 FY21′. As seen below, the trends have continued to widen and we estimate this to be a potential risk to earnings growth looking ahead. We also advocate for investors to pay close attention to movement in AMED’s operating and FCF margins as a measure of earnings performance.

Exhibit 3.

Data: HB Insights, AMED SEC Filings

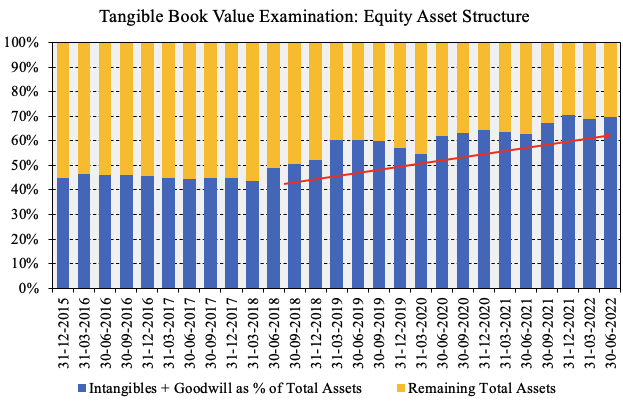

Additional balance sheet forensics reveal that tangible equity value has narrowed on a quarterly basis since FY18. As seen in Exhibit 4, the company’s asset structure has shifted towards an intangibles/goodwill bias, with approximately 70% of the company’s asset base now comprised of non-tangible sources of value. This has direct implications on valuation, and, also, as a measure of management’s effectiveness in its acquisition strategy. The company continues to build the breadth of its portfolio companies, however, questions arise on the fair value of these purchases considering the total in goodwill that’s tied to each.

Exhibit 4.

Image: HB Insights, AMED SEC Filings

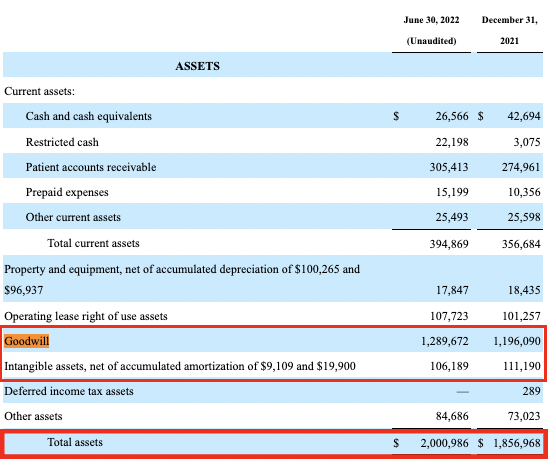

As seen in Exhibit 5, taken from AMED’s Q2 FY22 10-Q earnings report, goodwill and intangibles make up more than 130% of the company’s book value of equity. That means that tangible assets make up just 0.89% of book value. Moreover, patient accounts receivable comprises over 77% of the company’s current assets.

Exhibit 5.

Data: AMED 10-Q, July FY2022

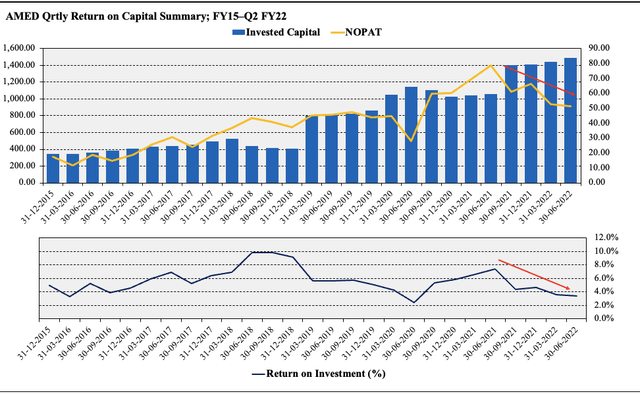

With an arguable lack of tangible value on offer, return on invested capital has narrowed in substantially as well. As seen below, we examined how much NOPAT was derived from the previous period’s invested capital. After some growth throughout the pandemic, both NOPAT and ROIC have receded and are now trending south.

Exhibit 6.

Data: HB Insights, AMED SEC Filings

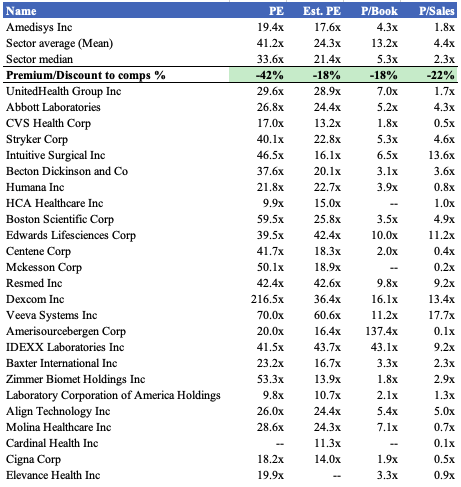

Valuation

Shares are trading at a discount to peers across key multiples used in this assessment. As noted, the company trades at ~4x book value, however, a large portion of its book value is made of intangibles and goodwill. AMED actually has a tangible book value of negative $410 million, and therefore struggles to justify this discount. Moreover, the stock is priced at 17.6x forward P/E, below the GICS industry peer median’s 21.4x, suggesting the market is pricing a below-sector result from the company.

Exhibit 7. Multiples and comps

Data: HB Insights

At 17.6x our FY23 estimates of $5.80, we price the stock at $102, suggesting there to be a lack of upside capture available on terms of valuation.

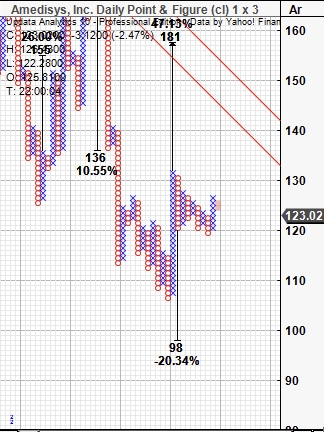

There are also numerous downside targets put out by daily point and figure charting analysis. Our studies reveal downside targets yet to be activated at $98, with upside potential to $181, an $83 spread between the two values that doesn’t inspire much confidence on estimating the mean valuation.

Exhibit 8.

Data: HB Insights, Updata

In short

There is plenty to like in AMED’s investment debate. However, the case begins to unravel when searching for measures of tangible value when prescribing a corporate value to the company and its stock. The balance sheet is heavily skewed towards non-tangible sources of value – i.e. goodwill – that stem from a series of acquisitions AMED’s made.

Moreover, whilst FCF came in at $55 million for the quarter, this was down by $11 million from Q2 FY21, plus long-term debt also increased alongside a $17 million stock buyback. Consequently, FCF and profitability appear less attractive, and on closer inspection, AMED has realized a downstep in ROIC in recent periods. Valuations are also unsupportive. With the culmination of these factors in mind, we rate AMED neutral.

Be the first to comment