imaginima

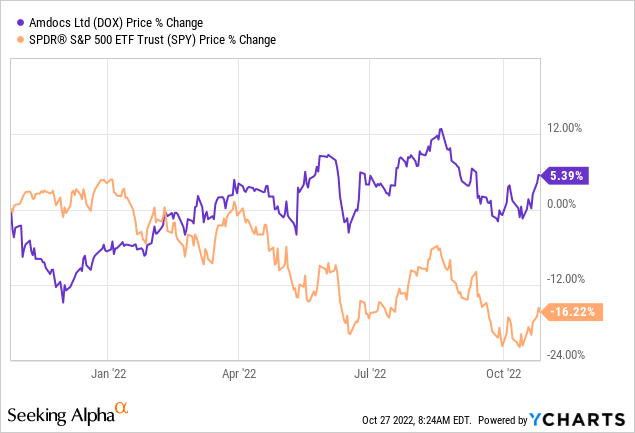

As I pointed out in my previous Seeking Alpha article on Amdocs (NASDAQ:DOX), the company has a high-quality, sticky, and resilient business model that continues to grow at a healthy clip. Recent quarterly results show that the company continues to see strong demand for its 5G and cloud-based networking, digital modernization, customer care, engagement, assurance and billing services despite a challenging global macroeconomic environment. In addition, DOX continues to use its strong free cash flow generation to make significant stock buybacks. As a result, and despite the 2022 bear market, DOX is up 45% since my initial Seeking Alpha coverage in the Fall of 2020 and has significantly outperformed the broad S&P 500 over the past year as well:

Investment Thesis

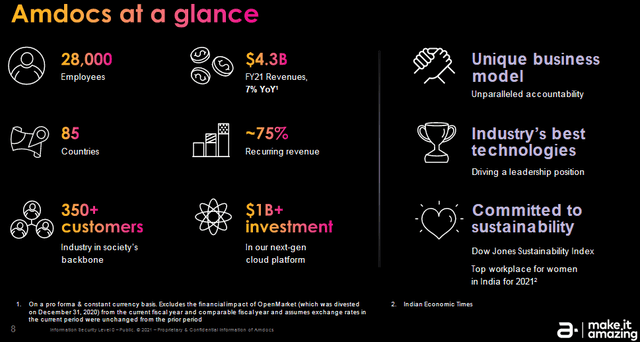

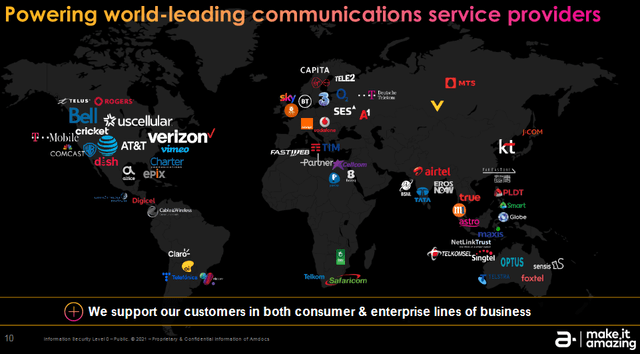

Amdocs provides 5G networking and cloud-based IT services, customer care, engagement, digital modernization, and billing support for customers in the Pay TV, media, and entertainment industries (see graphic below). These are the kind of sticky services that its customers (companies like AT&T, T-Mobile, Comcast, etc.) are hesitant to switch due to the potential for migration issues and customer hassles – both of which would increase cost and have the potential to lose customers. That being the case, DOX has a relatively stable revenue base (~75% is recurring revenue), which continues to generate strong free cash flow despite the macroeconomic slowdown. The company already has a strong balance sheet, so it is able to use its free cash flow to reward shareholders (mostly with stock buybacks) while using M&A to supplement organic growth.

Source: Amdocs Annual Presentation

As you can see from the graphics above, Amdocs has a diverse global footprint with both consumers and enterprises.

Earnings

The Q3 FY22 report released in early August was another very solid quarter. Highlights included:

- Quarterly revenue was a record $1.16 billion, +8.8% yoy (+10.8% yoy on a constant currency basis).

- GAAP diluted EPS was $1.04/share, at the high end of $0.97-$1.05 guidance, but down a $0.10 from a year ago.

- Non-GAAP EPS was $1.27/share.

- Record 12-month backlog of $3.95 billion, +10% yoy, on “strong sales momentum”.

- Free cash flow of $126 million, or an estimated $1.02/share.

- Normalized FCF was $144 million.

- GAAP operating margin was 14.6%.

On the Q3 conference call, Amdocs CEO Shuky Sheffer said:

In addition to North America, we continue to grow Europe as a strategic long-term growth engine for Amdocs. Adjusting for currency movements, Europe showed signs of second half acceleration, as projects awarded in recent quarters started to ramp up, as customer like PPS book for UK and various Vodafone Group affiliates. Q3 was also another quarter of robust sales momentum. We strengthened relationship with large and long-standing customers like T-Mobile and AT&T’s Cricket Wireless…

Going Forward

The MYCOM OSI acquisition – announced in May – is expected to close in Q1 FY23 for $188 million in cash. MYCOM OSI is headquartered in London and has offices in the US, France, the UAE, Singapore, and India. That being the case, the acquisition will boost DOX’s global presence and growth prospects. MYCOM OSI provides SaaS-based cloud network and service assurance solutions and, as a result, will add to DOX’s already strong recurring revenue base. MYCOM has business relationships with companies like Verizon (VZ) and Telefonica (TEF).

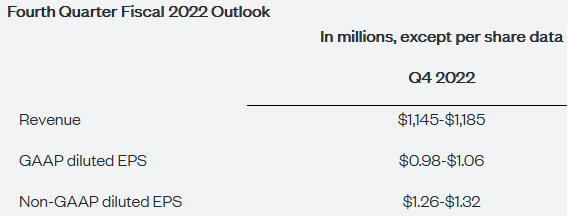

The company’s Q4 guidance is shown below:

Amdocs Earnings Release

Note that the mid-point of revenue guidance, $1.165 billion, is roughly flat with Q3. The mid-point of the GAAP income range ($1.02/share) comes in a touch lower while the non-GAAP EPS mid-point is two cents higher than Q3.

Note the company raised its full-year 2022 free cash flow guidance to $520 million from $500 million (+4%). In other words, DOX will generate FCF this year, equating to roughly 5% of its current $10.3 billion market cap.

Share Buybacks

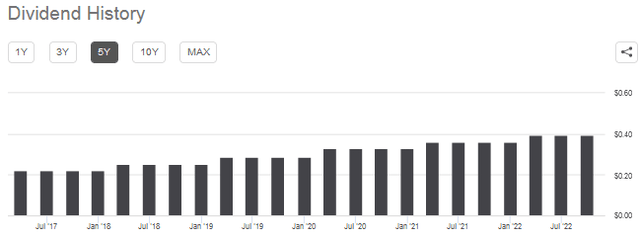

As I have mentioned in my previous articles, DOX’s return of capital to shareholders is primarily through share buybacks as compared to the dividend. After all, the $0.40/share annual dividend hasn’t changed in three years:

However, DOX does have a robust stock repurchase plan, and it spent $100 million on buybacks during Q3. That compares to $49 million in dividends during Q3, or a roughly 2x emphasis on buybacks over the dividend.

Note that the share buybacks have reduced the average number of fully diluted share count from Q3 of last year, 128.050 million, to 123.153 million as of end of Q3 this year (or -3.8%). All things being equal, that means if DOX continues on the present pace of buybacks, revenue growth of ~10% annually should lead to EPS growth of an estimated 12%, or slightly higher.

Risks

As can be seen from the comments on constant currency in the Q3 press release referenced earlier, DOX’s global footprint means the company is exposed to the strength of the U.S. dollar. Indeed, Q4 guidance assumes a ~$4 million sequential negative FX impact.

Q4 non-GAAP EPS guidance also “excludes amortization of purchased intangible assets and other acquisition-related costs, changes in certain acquisitions related liabilities measured at fair value, and approximately $0.12-$0.14 per share of equity-based compensation expense and other, net of related tax effects.”

Additional risks going forward include the integration of the MYCOM OSI acquisition, additional capex required for adoption of new technologies, and the potential for lower rates of retention for DOX’s managed services – 62% of total revenue in Q3 and the majority of the company’s recurring revenue base.

The balance sheet is superb: DOX ended Q3 with $850 million in cash and cash equivalents and $860 million in long-term debt (i.e., only $10 million in net debt).

Summary & Conclusion

DOX has a sticky and resilient business model that continues to grow despite a very challenging macroeconomic environment. The company continues to pump-out strong free cash flow and is using the majority of that FCF to buy back shares. As a result, the average number of fully diluted shares outstanding has been reduced by 3.8% over the past year. The stock is trading with a forward P/E = 15.9x and currently yields 1.9%. I still find DOX attractive and reiterate my buy recommendation based on the company’s record backlog, its strong free cash flow generation profile, and the significant reduction in share count. That said, I would like to see the company make a meaningful increase in the dividend, which it can easily afford by slimming back on the allocation to buybacks.

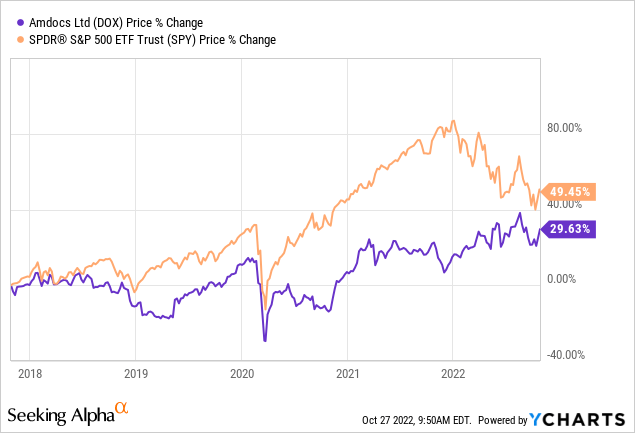

I’ll end with a 5-year price chart of DOX versus the S&P 500 as represented by the (SPY) ETF:

Be the first to comment