Justin Sullivan/Getty Images News

After another booming quarter, Advanced Micro Devices (NASDAQ:AMD) should finally trade back above $100 for good. The market sold off the chip company on fears of a slowdown in PCs and other consumer electronics where AMD doesn’t generally sell chips due a lack of supplies. My investment thesis remains ultra bullish on the stock trading at a large discount to growth rates and ultimately saying goodbye to $100 despite the initial after hours weakness.

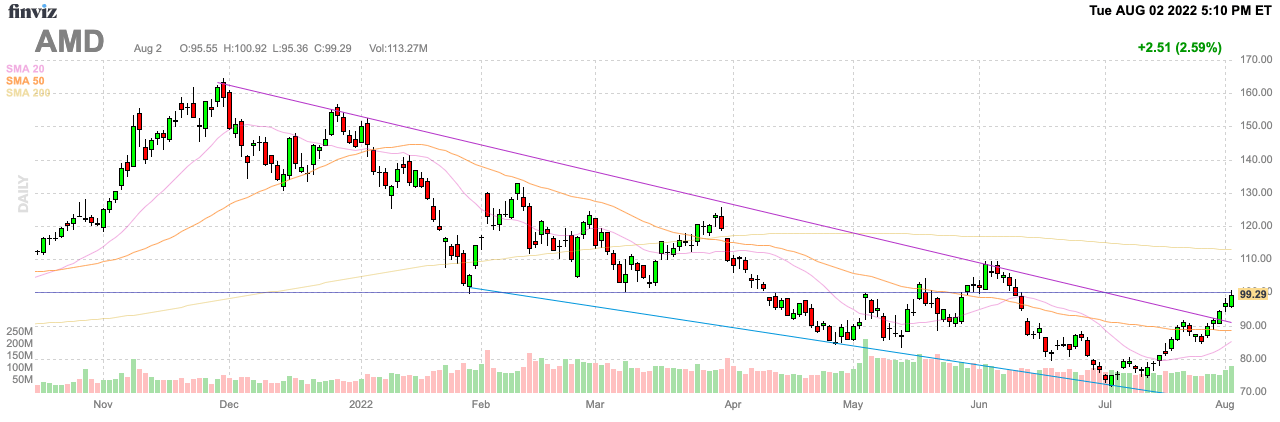

Source: FinViz

Booming Quarter

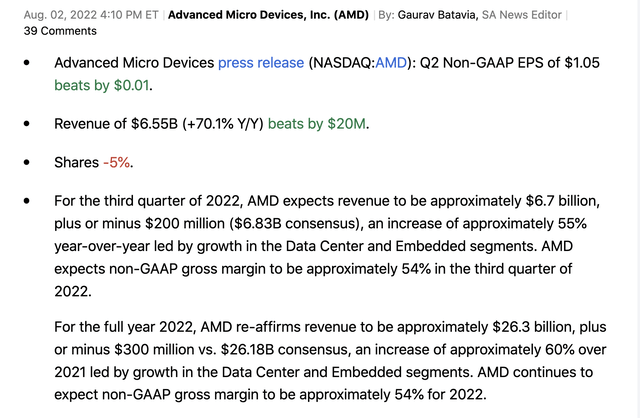

AMD reported revenues soared over 70% to reach $6.55 billion in Q2. The revenue numbers are boosted by the inclusion of the Xilinx business, but the key here is the big boost in EPS that is all organic:

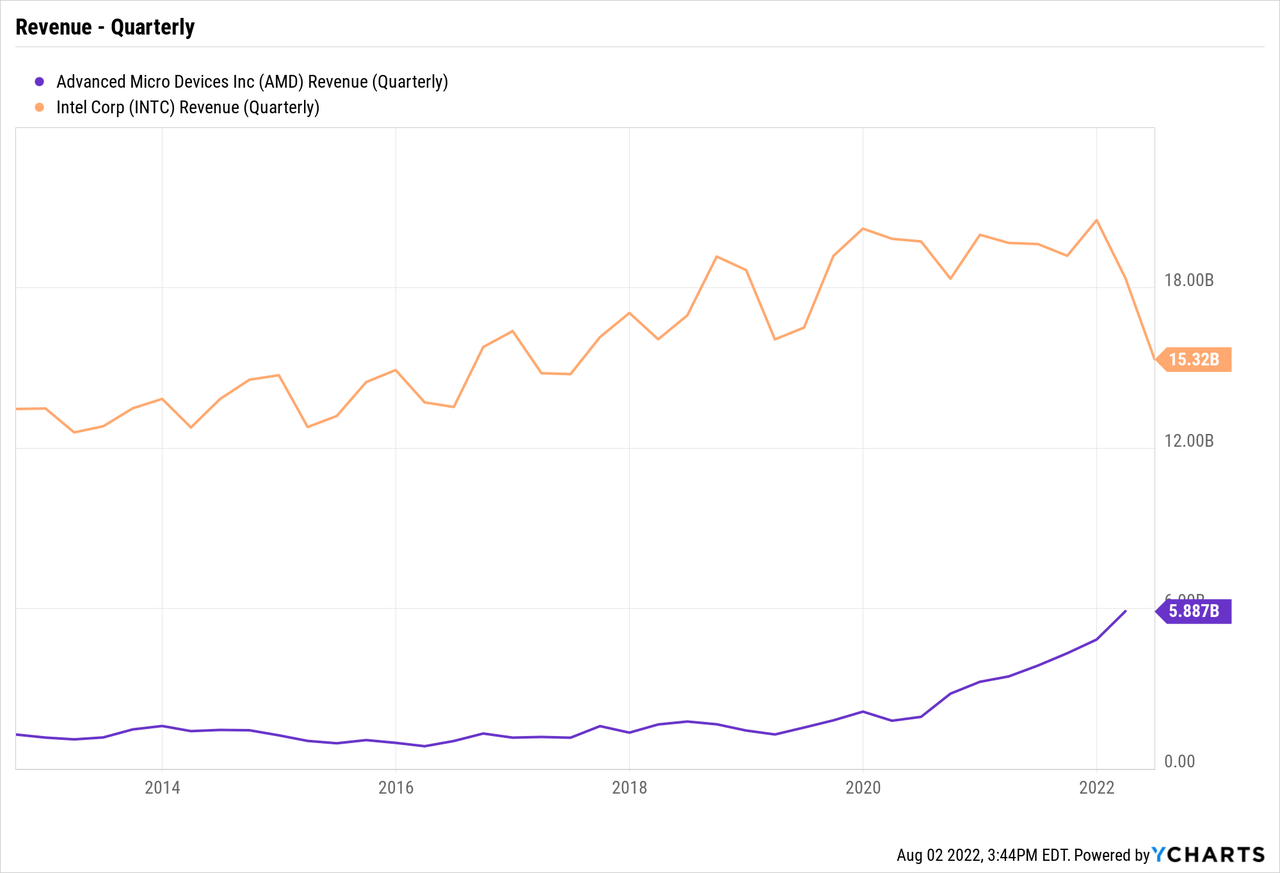

The company saw this growth despite the weakness reported by Intel (INTC). AMD is far more focused on premium chips where market demand remains strong, while Intel got stuck supplying low-end PCs where demand collapsed and pressured margins.

Investors sold AMD down to $71 despite knowing these facts were part of the story. The company previously guided to 2022 revenues of $26.3 billion with growth of 60% for the year (or ~35% organic growth) backed by knowledge AMD lacked supplies to meet ultimate demand. Otherwise, the chip company had a cushion built into the guidance for the year.

With the Q2’22 report, AMD maintained 2022 revenues at $26.3 billion. Despite all of the headwinds in the global economy, the company continues to grow due to the vast differences in market share with Intel.

Intel just reported a dismal quarter where the chip giant still topped $15 billion in quarterly revenue. The company recently reported quarters where revenues topped $19 billion and reached $20 billion back in Q4’19, while AMD is now only approaching $7 billion in quarterly revenues.

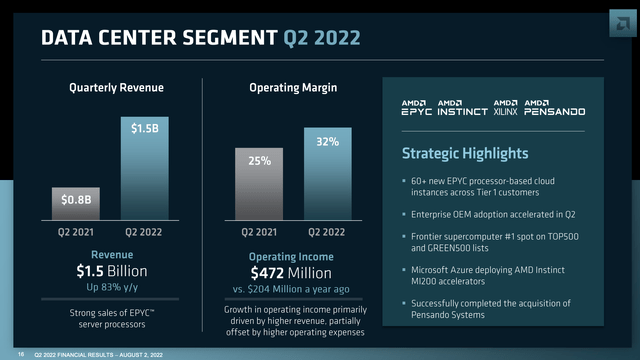

If AMD definitely has the better server chips and competes with Intel based on better performance for the price, AMD should continue gaining market share. Data center revenue soared 83% to reach $1.5 billion, up 83% YoY. AMD has to double revenues again to even approach the revenue based of Intel in data centers.

Source: AMD Q2’22 presentation

AMD ended the quarter with $2.65 billion in inventories. On the earnings call, CEO Lisa Su confirmed the scenario where the company still can’t meet demand for premium chips in the server and embedded categories.

Undue Punishment

The prime reason that AMD felt undue punishment last quarter when selling off to below $80 was the big EPS boost in the current cycle. My EPS targets were already up at $5+, making such a trade down to prices far below $100 highly illogical.

The updated financial model is as follows:

- ’23 Revenue (20% growth) = $32.0B

- Gross Profits @ 56% = $17.92B

- OpEx @ 23% = $7.36B

- Operating Income = $10.56B

- Taxes @ 13% = $1.37B

- EPS = $9.19B/1.5B shares = $6.13

The model is basically inline with previous targets with 20% growth and gross margins hitting 56%. AMD just reported 54% gross margins in the last quarter, supporting a further bump up next year.

The operating expenses are targeted at a slight decline from the 24% target for 2022. The slight difference in the model is reducing the effective tax rate to 13% from 15% of pre-tax income and the share count reduced to 1.5 billion shares after AMD repurchased $920 million worth of shares in Q2’22. The company ended the quarter with $3.2 billion in net cash to continue repurchasing shares.

The updated EPS goal tops $6 on the lower share counts. Analysts are currently down at only $4.86 for EPS next year, with expectations for just 12.5% revenue growth on top of the 35% organic growth this year.

The stock only trades at 20x analysts’ targets. AMD is much cheaper at 15x more realistic EPS targets, with the stock down at $95 in after hours.

Takeaway

The key investor takeaway is that AMD remains far too cheap for the opportunities ahead. Intel could always start recapturing market share or something could occur with Taiwan causing AMD to fail to meet financial targets. Otherwise, the stock is a bargain at 15x updated earnings targets, with AMD continuing to report impressive results during a tough economic period.

Be the first to comment