JHVEPhoto

Advanced Micro Devices (NASDAQ:AMD) has fallen over 50% in the last year due to a mismatch with chip supply and demand. The semiconductor company hasn’t faced a scenario where their chips weren’t in high demand and the new global push for more manufacturing supply should play nicely to the benefit of AMD. My investment thesis is ultra Bullish on the stock with profits on a path to return to prior expectations after the PC inventory correction ends.

Improving Margin Picture

For a chip design firm, the big push for international governments to fund chip manufacturing fabs is a very positive sign. The more manufacturing capacity that hits the market, the better the pricing for AMD, Qualcomm (QCOM) and Apple (AAPL).

The European Union recently agreed to a $47 billion package to fund chip manufacturing following the $52 billion plan approved by the US. The combined $100 billion subsidies will help shift chip production away from Asia and closer to actual usage in the west.

Intel (INTC) already has aggressive plans to build new fabs in Ohio, Germany and Italy in order to take advantage of these subsidies. Of course, AMD doesn’t currently use Intel and would be highly unlikely to shift production to a competitor away from the advanced manufacturing technology of TSMC (TSM).

The new fabs provide AMD with the leverage to extract better pricing from TSMC. Only last year, TSMC apparently pushed through a 20% price hike on top foundry customers with the potential for another hike in 2023 prices.

Hardware Times estimates the foundry costs for a Ryzen 7950x costs upwards of $70 to manufacture. An industry with extra capacity and Intel competing with TSMC on price would help AMD secure lower manufacturing prices in the future.

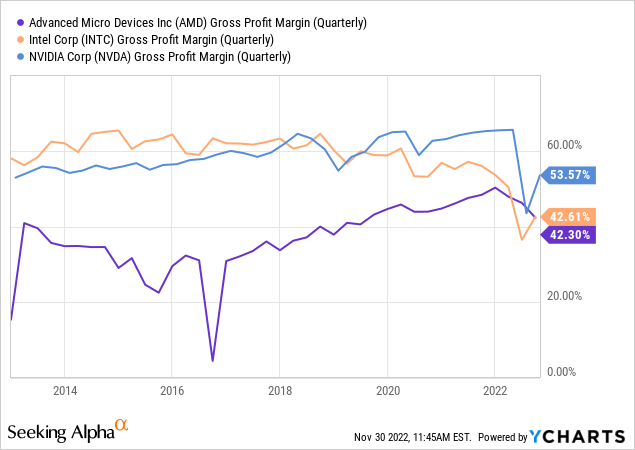

The top chip companies regularly produce gross margins in the 60%+ range. Until the last year or so, both Intel and NVIDIA (NVDA) had gross margins easily topping 60% while AMD had margins just recently topping 50%. Though, the below chart captures the lower GAAP margins, the chart provides a great indication of how AMD closed the gap with the chip giants over the last couple of years.

For Q2, AMD reported impressive non-GAAP gross margins of 54%. The company guided to 54% margins for the year normally in a sign AMD would reach 55% or more for the year.

As revenues were set to reach $26 billion in 2022 and top $30 billion in 2023 before the inventory correction, AMD would generate $300 million in additional gross profits from each percentage point increase in the gross margin. The chip company just pushing the gross margin to 58% generates $1.2 billion in additional gross profits and up to $1 per share in higher profits before taxes.

Profit Rebound

The prospects for AMD profits rebounding was already high. Any inventory correction only lasts so long and the market returns to normal after the correction ends. Even Intel was shipping fewer chips than consumption in the last quarter in a sign that a rebound is ahead whether or not demand returns to prior levels.

Remember, AMD saw Client Computing revenues plunge by ~$1 billion in Q3 from Q2’22 levels due to the inventory correction. The company had previously predicted weakness in the sector, but the inventory correction wasn’t an expected outcome.

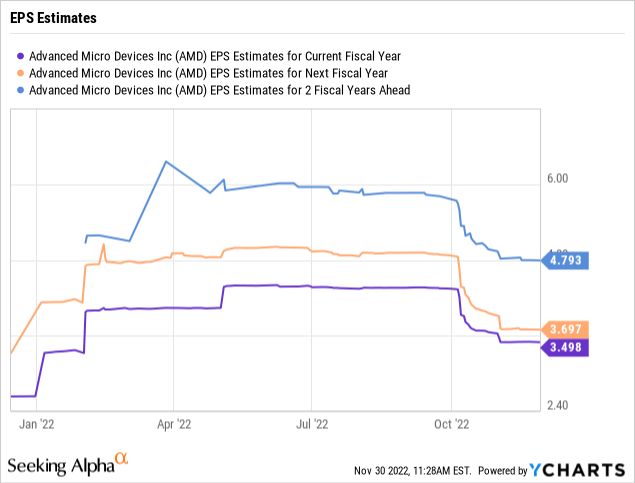

Prior to the correction, analysts forecast AMD earning over $5 in 2023 with 2024 estimates approaching $6 per share. Analysts cutting these targets appear premature with business eventually rebounding.

AMD is still set to grow data center share in the years ahead. Some estimates have the chip company at only 17.5% server CPU market share following Q3’22 results with Intel still garnering 82.5% market share.

Just using actual revenue data reported by the 2 chip companies shows Intel with $4.2 billion in data center revenues with AMD boosting revenues to $1.6 billion in the last quarter. Intel continues to struggle getting the latest Sapphire Rapids CPU chip to the market suggesting anything other than a lack of chip supplies will place AMD in the data center lead position.

The financial model for 2023 or 2024 depending on the chip rebound is as follows:

- Revenue (20% growth) = $32.0B

- Gross Profits @ 56% = $17.92B

- OpEx @ 23% = $7.36B

- Operating Income = $10.56B

- Taxes @ 13% = $1.37B

- EPS = $9.19B/1.6B shares = $5.75

The big key to my original 2023 financial target for AMD was a boost to the gross margin to 56%. The combination of $6 billion in additional revenue (20% growth beyond the non-PC inventory correction) and a 200 basis point boost in the gross margin contributes to a massive $3.7 billion boost to gross profits.

Once a company achieves the size and scale of AMD, simple boosts to gross margins provide a substantial boost to earnings due to the natural leverage in the system.

Takeaway

The key investor takeaway is that AMD remains a cheap stock. Our thesis remains intact with an inventory correction eventually ending and the data center growth leading to a much larger company with bigger profits.

The chip company should ultimately benefit from more competition and capacity in the chip manufacturing space to help bolster margins. AMD should be bought in the low $70s with a clear path to a $6 EPS.

Be the first to comment