Justin Sullivan

What is the Goal of this Article?

The goal of this article is to provide information to investors to help them choose if AMD (NASDAQ:AMD) is a financially resilient or fragile business currently and for the future. This is not financial advice and investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. For me personally, after doing the research, AMD still is a stock that fits my portfolio parameters and I believe it is making the right moves to becoming more financially resilient. Let’s dive in, and leave me a comment below to give your perspective, as investors, we all can learn from each other.

Didn’t AMD Just Pre-Release a Big Miss for Q3?

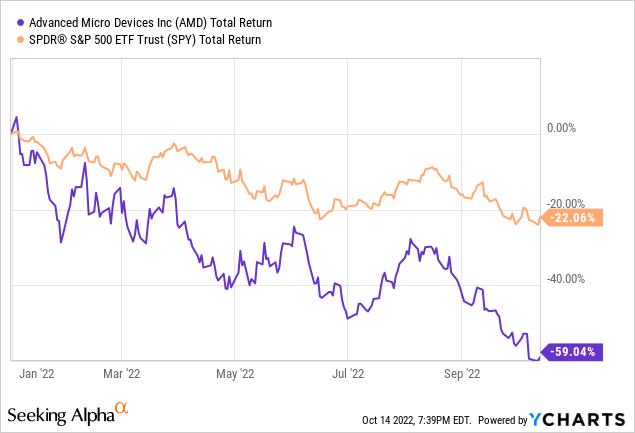

AMD did just announce pre-earnings for Q3 of a projected miss of nearly $1.1 billion, due specifically to their PC revenue segment. The overall revenue growth results for Q3 will be 29% year over year, which is much lower than the original 55% year-over-year growth. This steep decline was caused by reduced processor shipments due to a weaker-than-expected PC market and significant inventory correction actions across the PC supply chain. This huge miss along with the current macroeconomic headwinds and inflation caused AMD stock to drop nearly 59% YTD vs. the S&P 500’s decline of 22% this same period of time. Does this mean investors should hit the panic button and sell shares? Does this mean results are going to continue to get worse? Not necessarily, as we should not be surprised as to this decline of PC purchases globally and inventory surplus impacting AMD and other semiconductor companies are facing.

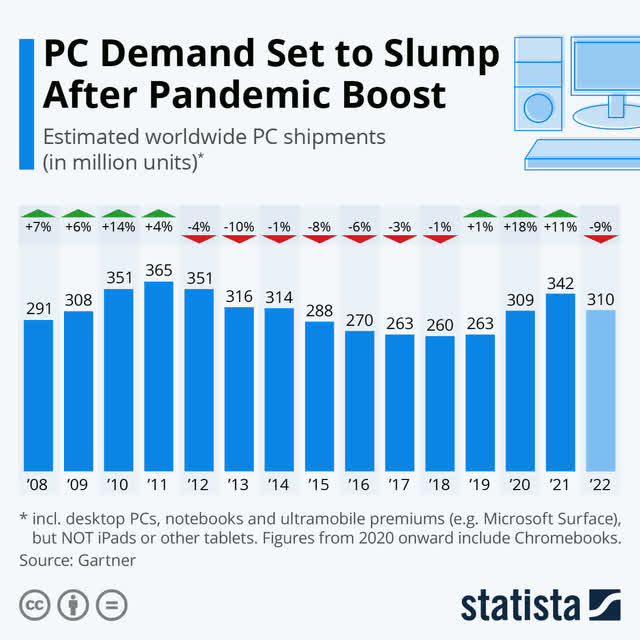

So much has happened in our world in the last three years and forward PC sales being brought in earlier due to the Pandemic is one of them. This chart should say it all for semiconductor investors who hold stocks in companies who service the PC market. As you can see below, the previous five years before 2019 PC sales were declining consistently and had an average of 269 million units sold annually during that time vs. 320 million for the last three years. There are several reasons for the decline in the previous five years and what caused the large irregularity in demand in the last three years comparatively. The pandemic lockdowns and the necessity of many businesses having to digitally transform to a hybrid workforce drove the large increase in unit sales for the last three years.

We saw a consistent decline in PC sales before the pandemic because:

- More applications have moved to the cloud or to mobile phones.

- Hardware performance of PCs, including semiconductors, has reached so high, refreshes for businesses and general consumers are less frequent.

- The amount of time spent on smartphones vs. laptops has grown significantly, due to the high capabilities of smartphones today.

Other Financial Metrics and Business Segments Impacted in Q3

AMD experienced not only revenue declines but margins were also impacted in Q3. The company reported that non-GAAP gross profit margins were going to be at 50% as opposed to the expected 54%. The gross margin miss was primarily due to the PC processor unit shipments and average selling price (ASP). There is also supposed to be an additional $160 million of charges that AMD had to endure in Q3, primarily for inventory, pricing, and related reserves in the graphics and PC business. So did this miss in PC business surprise the leadership teams at AMD and cause concern for the future? There may have been a little bit of surprise on how big the PC revenue miss was, but I believe this was a gamble they were willing to take in 2019. Some of the highest-growing semiconductor companies like AMD, NVIDIA (NVDA), and others were willing to gamble on securing inventory for driving demand during the pandemic. These companies wanted to capture the market share while it was available and if you look at their 2019 and 2020 stock returns, it also paid off in the short term but is also the reason for the inventory glut they are experiencing now.

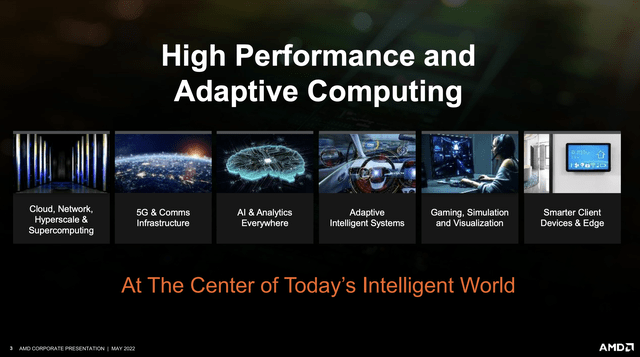

I believe it was more important to capture that market share was available, especially in the PC market, because overall, the market will continue to decline as we outlined before. The PC market is not the main focus for AMD’s future growth in the market and CEO Dr. Lisa Su’s comments on the press release of Q3 results and the slides in their investor day presentation illustrate this.

“The PC market weakened significantly in the quarter,” said AMD Chair and CEO Dr. Lisa Su. “While our product portfolio remains very strong, macroeconomic conditions drove lower than expected PC demand and a significant inventory correction across the PC supply chain. As we navigate the current market conditions, we are pleased with the performance of our Data Center, Embedded, and Gaming segments and the strength of our diversified business model and balance sheet. We remain focused on delivering our leadership product roadmap and look forward to launching our next-generation 5nm data center and graphics products later this quarter.”

1st Slide of the Investor Day Presentation (AMD Investor Day Presentation 2022)

Why Financially Resilient and Not Fragile

Let me explain why I believe this company is financially resilient, even though AMD suffered from steep declines in revenue, margins, and share price during Q3, and could continue to see declining PC revenues. The ability to view business results in perspective and in context is a great skill to develop as an investor. Even though AMD had a near $1.1 billion loss from expected PC revenues, the company is still projecting exceptional growth in many areas of the business.

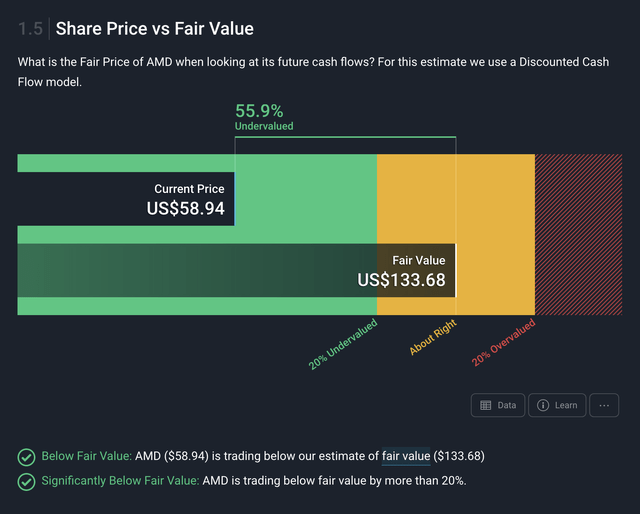

In Q3, AMD grew their datacenter revenue 45% year over year to $1.6 billion, their gaming revenue 14% year over year to $1.6 billion, and lastly, their embedded revenue grew an astounding 1,549% year over year to $1.3 billion. These are very strong numbers and I believe are not being factored into AMD’s long-term growth story of the company. AMD is undervalued at this share price if you are a long-term investor, based off the below DCF, it is 56% undervalued.

AMD DCF via Simply Wall St. (Simply Wall St.)

Another reason to expect AMD to continue to be financially resilient is their amazing leadership in CEO Dr. Lisa Su and her ability to turn the company around. Since 2014, when she became CEO, to seven years later, AMD got transformed from a penny stock to a stock yielding over 30x returns! This company turnaround story does not get highlighted enough, as in my opinion, CEO Dr. Lisa Su is a very under-appreciated CEO in the market. The operational excellence, innovation, and drive to make such a drastic turnaround in a company say a lot about its future durability if that same leadership team is still there. If Dr. Lisa Su was not at the helm at any point, that could be an investor’s bear case, but I believe she is building a long sustainable business regardless of personnel.

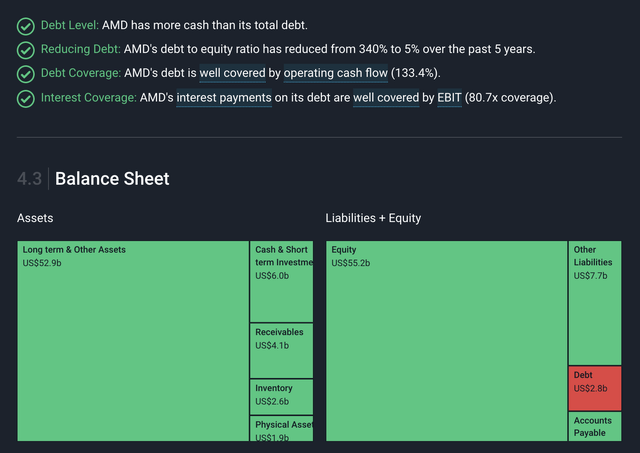

Let’s examine the financial foundation that has been created at AMD so it can endure difficult times like we are experiencing in the global markets today. AMD under Su’s leadership has become excellent at reducing their debt-to-equity ratio from 340% to 5% in the last five years. They have also shown this past year over 133.4% operating cash flow growth and financial strength of $13.5 billion of assets vs. $6.8 billion of long-term liabilities.

Financial Strength of AMD (Simply Wall St.)

What To Look For in AMD’s Future Growth

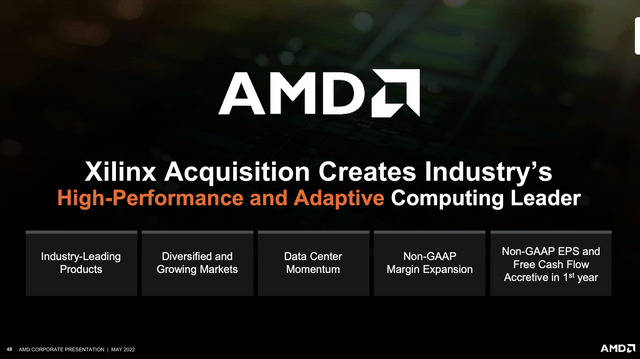

There are multiple secular tailwinds such as EV Automobiles, gaming consoles, PCs, and cloud computing that AMD is riding for continued growth. I would look for more coverage and news on the revenue growth of their chips that go into EVs. AMD’s Ryzen chips are currently in the Tesla (TSLA) model S, X, Y, and 3 EVs for their infotainment systems. I believe we will see more growth in the EV segment for AMD. I believe we will also see continued double-digit meaningful growth in their datacenter and gaming business segments moving forward. The business segment I believe the market doesn’t know how to forecast just yet and is new to the AMD business model is the Embedded Chips Segment. This is essentially the Xilinx chips that are used in industries like aerospace, communications, cloud computing, and automotive. This technology field-programmable gate array (FPGA) has numerous industry applications as these are integrated circuits that are designed to be configured by a customer or a designer after manufacturing – hence the term field-programmable. There is a lot to cover here and I will be doing a specific deep dive on what this acquisition has meant to AMD now and for the future.

Xilinx Results in Year One in AMD (AMD Investor Presentation)

There is no denying that stock prices could continue to decline from here in these uncertain macroeconomic times. However, at the undervalued share price of AMD today and its future price-to-sales ratio of 3.6, I could understand why an individual would want to start a position now. I became an AMD shareholder via the most recent Xilinx acquisition and have kept my shares because of their operational excellence and future growth potential.

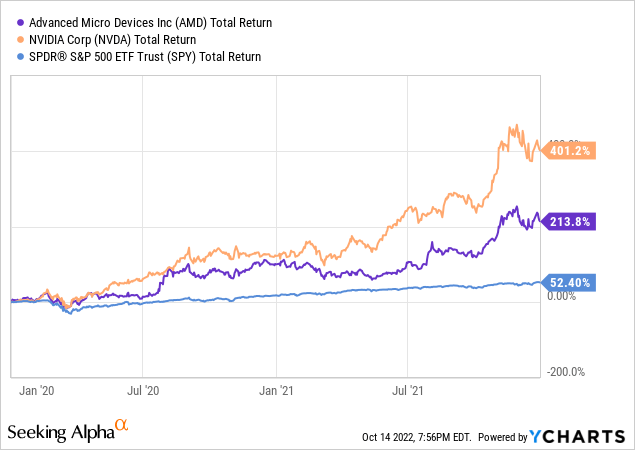

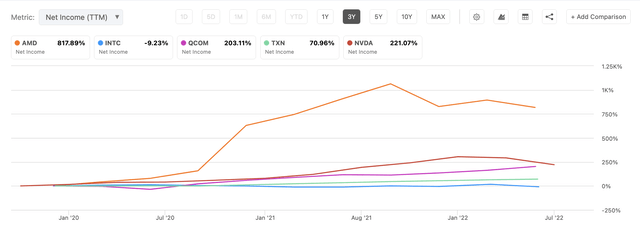

Any investor that follows me knows that NVIDIA is my number one position in my portfolio, but I believe this area of semiconductors and high-end compute has room for many winners. My second horse in this race is AMD, but there are also other good semiconductor companies like QUALCOMM (QCOM), Texas Instruments (TXN), Intel (INTC), who some investors feel are more affordable at lower price multiples. However, the two higher priced multiple stocks (AMD) and (NVDA) are higher priced for a reason with all of the revenue optionality they have executed, better net income growth, better over the last 3 to 5 years.

Net Income (TTM) last 3 years (Seeking Alpha)

In Summary

As you can see, there are many superb financial and operational metrics AMD is putting up against the competition. I encourage you to look deeper into the stock with your own research and I believe you will find many more. The question you have to ask yourself is “What is my time horizon and risk tolerance?”, because if your time horizon is less than a year or maybe even two, you could still experience much volatility until then with AMD or any growth stock. However, if you can have a longer time horizon, then the risk tolerance decreases substantially in my opinion due to the operational excellence and high growth AMD will continue to put up in its other business divisions.

So, let me know below in the comments, do you think AMD is set up to be financially resilient or fragile? and will it be a market-beating stock for the next three to five years? For my risk tolerance, time horizon, and research I have done, I would say this will be a market-beating stock over the next three- to five-year average and be financially resilient.

Be the first to comment