Dilok Klaisataporn

Article Thesis

Advanced Micro Devices, Inc. (NASDAQ:AMD) reported its third quarter earnings results on Tuesday afternoon. The company missed estimates on both lines, as business growth slowed down more than expected. That being said, the company has performed better than its peers, and its valuation and longer-term outlook are very healthy.

What Happened?

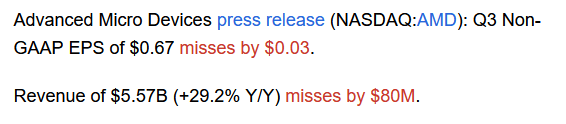

Advanced Micro Devices reported its most recent quarterly results on Tuesday. The company missed estimates on both lines, despite the fact that it recorded healthy growth. The following image shows the headline numbers as reported by Seeking Alpha:

Seeking Alpha

Revenue was up by a strong 29% year-over-year, although it should be noted that this metric was impacted by AMD’s takeover of Xilinx that closed at the beginning of the current year. Adjusted for that, revenues would have grown less, although the growth rate would still have been positive. Xilinx generated revenue of $1.01 billion in the third quarter of the previous year, while AMD’s revenue grew by $1.26 billion compared to one year ago.

There thus was organic revenue growth of around $250 million on top of the $1.0 billion in revenue AMD added via M&A. $250 million in additional sales equates to around 5% of AMD’s M&A-adjusted revenue, thus the company’s revenue growth was in the mid-single digits excluding the impact of the Xilinx acquisition. That’s a lot less compared to how much revenue AMD has been adding in previous quarters, when its relative growth rate also was a lot higher.

But on the other hand, AMD still grew its business, while peers Intel (INTC) and Nvidia (NVDA) performed worse – NVDA generated revenue growth of 3%, while Intel saw its sales drop by a hefty 20% during the most recent quarter. Thus, while Advanced Micro Devices saw its growth slow down compared to a couple of quarters ago, it still remained in an industry-leading position growth-wise, performing better than its competitors.

AMD’s Q3 – Strengths And Weaknesses

Delving deeper into AMD’s results, there are some important items for investors. First, Advanced Micro Devices continued to perform well in the data center space, one of the most important growth markets for semiconductor companies and an area where companies can usually generate above-average margins, which helps their profitability. AMD’s data center sales were up by a compelling 45% year-over-year, which easily beats the respective performance in the data center space by Nvidia and Intel.

AMD’s data center chips are energy efficient, which is a strong selling point in a world where energy is becoming more expensive. While energy efficiency was less important when energy was cheaper and when money was easily available, higher energy prices and increased pressures on Alphabet (GOOG, GOOGL), Amazon (AMZN), Meta Platforms (META), and co. to become more profitable mean that AMD’s energy-efficient chips are becoming more attractive.

That trend should continue, and with AMD releasing its next-level Genoa chips on November 10, it is likely that the company will continue to make gains in the data center market, I believe. In the long run, data center market growth will allow more than one company to grow profitably, but with AMD being well-positioned to gain market share from companies such as Intel, the company-specific growth outlook is better than the already very healthy market growth outlook over the next couple of years.

AMD did not perform as well in the “client” segment. Lower PC sales resulted in weaker demand for AMD’s chips. AMD was able to grow its average sales price in this unit thanks to the introduction of new products that improved its mix, but that was not enough to offset the headwinds from lower PC sales and inventory corrections. High inflation rates, especially in necessary goods such as food and energy, pinch consumers’ pockets, which is why the near-term sales outlook for consumer discretionary goods such as PCs isn’t great. That’s not an AMD-specific issue, however, and the company should be able to grow sales in this space again when the market starts to improve.

“Embedded” sales were up dramatically, but since this was almost entirely driven by the Xilinx acquisition, the comparison to the previous year’s quarter is not really telling much.

Looking at margins, AMD saw its GAAP gross margins decline over the last year, from 48% to 42%. More importantly, however, the company’s adjusted/non-GAAP gross margin expanded slightly, hitting a highly attractive level of 50%. An improved product mix was the driving factor for that, as AMD’s data center sales were up while the lower-margin consumer goods business saw its revenue decline.

In the near term, this trend should remain in place, which is why AMD is forecasting that gross margins will remain highly attractive going forward: The company’s Q4 guidance sees an adjusted gross margin of 51%, which is even slightly more than the already strong showing from the third quarter. That also suggests that the ongoing economic slowdown is not pressuring AMD to lower its sales prices meaningfully, otherwise the company would not have been able to maintain, or, even better, grow its margins.

Advanced Micro Devices’ profits were up as well compared to the previous year’s period, which isn’t surprising, as gross margins expanded and since the company grew its revenue considerably. For investors, earnings per share growth is more important than company-wide profit growth, however. On that front, AMD didn’t perform too well, as the increase in its share count that was caused by the Xilinx acquisition unfortunately more than offset the tailwinds from higher company-wide net profits. As a result, AMD’s earnings per share declined from $0.73 to $0.67, down by 8%. That’s not a disaster, but not a great showing, either.

Since AMD’s management has seen some value in the Xilinx acquisition despite the dilutive impact, things may very well improve going forward, e.g., due to additional synergies being captured, or due to the improved growth potential following the acquisition. But at least for now, the Xilinx acquisition has not generated a lot of shareholder value, I believe.

AMD Is Inexpensive With Ample Growth Potential

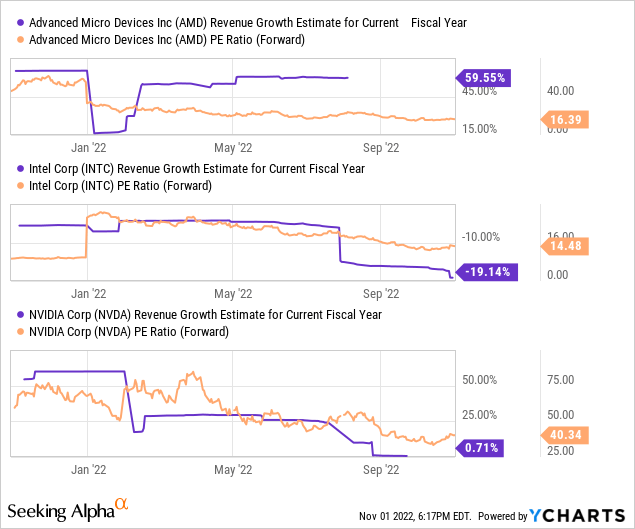

For the current year, analysts are currently predicting earnings per share of $3.64. That could get revised down following the Q3 earnings miss (by $0.03), thus let’s assume AMD will earn $3.60 this year. That translates into an earnings multiple of 16.7 with shares trading at $60. That is neither a high valuation in absolute terms, nor is it a high valuation considering AMD’s long-term growth potential. Looking at how AMD’s peers are valued, it also seems inexpensive:

Looking at a combination of expected growth and valuation, AMD looks like the best pick among its peer group by far. Intel is trading at a comparable earnings multiple despite a hefty revenue decline, while no-growth Nvidia is trading at 2.5x the valuation AMD trades at.

Advanced Micro Devices is forecasted to grow its earnings per share by around 10% next year, which translates into a 2023 earnings multiple of around 15. That is, again, a pretty inexpensive valuation, in absolute terms and also considering how AMD was valued in the past – not too long ago, the company traded at 30x its net profit and more. Of course, growth has slowed down since then, and the law of large numbers dictates that AMD will have a much harder time delivering outstanding 50%+ revenue growth quarters in the future. But even with a much lower growth rate, AMD could be a solid pick at the current undemanding valuation.

If AMD grows its earnings per share by just 10% a year going forward (the forecast is 15% a year, on average, through 2024), it could deliver 13% annual returns if its earnings multiple expands to 18 over the next three years – which would still be an inexpensive valuation, I believe. AMD has a small net cash position and thus operates with a great balance sheet, which gives the company considerable potential when it comes to M&A and/or increased shareholder returns, e.g., via its $8 billion share repurchase authorization.

Takeaway

AMD missed estimates on both lines. That being said, its growth was still very decent, especially compared to what its peers Intel and Nvidia have reported. At the same time, AMD saw its margins expand even during this downturn, its position in the data center market is great, and its shares are trading at an undemanding valuation.

The outlook over the next couple of years is still compelling, I believe, thanks to market growth, market share gains, shareholder return potential, and an inexpensive valuation that could allow for some multiple expansion. AMD missed on both lines, but I think it remains the most favorable choice in its peer group.

Be the first to comment