Justin Sullivan

Huge Q3 miss on the top line

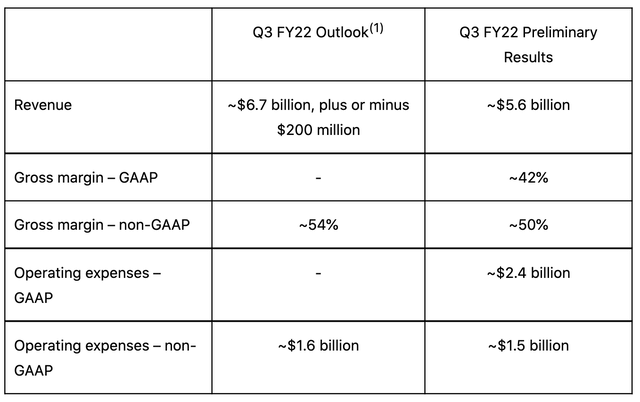

Advanced Micro Devices, Inc. (NASDAQ:AMD) announced preliminary 3Q22 results that were materially below management’s previous expectations communicated in August. Q3 revenue is now expected to be ~$5.6 billion (+29% YoY), ~$1 billion less than previous guidance of $6.7 billion +/- $200 million (+55% YoY at the midpoint). Additionally, Q3 gross margin will come in at 50% vs. previously guide of 54%. OPEX will be $100 million lower thanks to lower variable compensation expenses. Management will hold a conference call on 11/1.

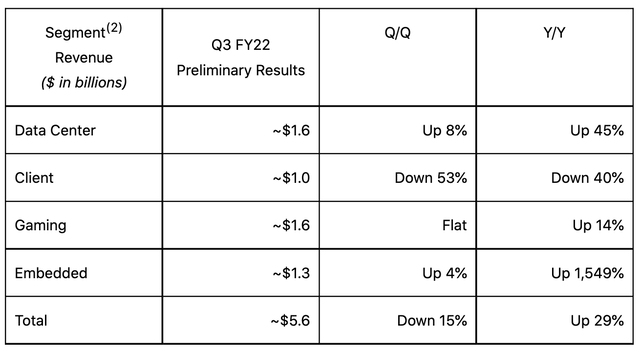

The 16% difference between reality and expectations on the revenue side is largely a result of a soft Client segment (microprocessors, processing units and chipsets that go into desktop and notebook PCs) that is currently going through heavy inventory corrections. Like many companies dealing with a broad-based slowdown in the PC market, AMD is not immune. Q3 Client revenue of ~$1 billion (18% of revenue) represents a YoY decline of 40%. As mentioned in my article on Microsoft (MSFT), PC makers from ASUS to Lenovo have all noted weakness in end demand.

On the bright side, Data Center (29% of revenue) growth remained positive with revenue up 45% to $1.6 billion. While the server market (expected to still grow 10% in 2022 and 5% in 2023) is not immune to an overall slowdown, AMD stands well to take market share from Intel as ARM-based products continue to threaten the x86 architecture. Additionally, Intel’s delay in Sapphire Rapids until 1Q23 is also a positive for team Red.

In terms of Gaming (29% of revenue), Q3 is usually the best season, driven by strong console demand. However, it’s worth noting that historically, console unit sales tend to start declining in the 4th year of the typical 7-year cycle, so the Gaming business could experience some pressure in 2023 (year 4).

Last, growth in the Embedded segment (23% of revenue) was primarily due to the Xilinx acquisition in early 2022.

Industry heavyweights also feeling the pain

In July, Intel (INTC) reported a Q2 net loss of $454 million as revenue fell 22% YoY, the largest decline in more than a decade as management noted PC inventories were being cut at a record rate. The Client Computing Group (CCG) segment saw revenue down 25% YoY to $7.7 billion, while operating income was down 73% YoY. For 2022, Intel expects revenue to decline by 9-13% YoY, gross margin to contract by 9.1 points, and EPS down 57% to $2.30.

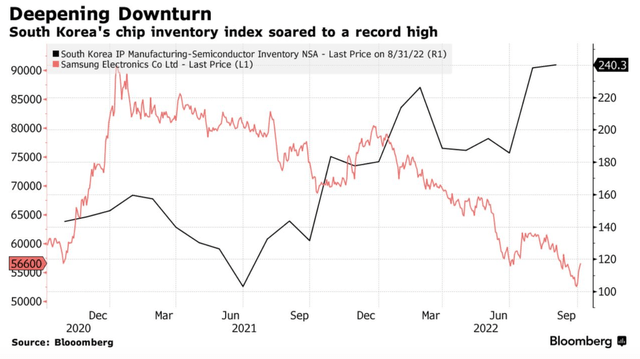

Samsung (OTCPK:SSNLF) also recently reported a disastrous 3Q22 where operating profit fell by 32% to $7.7 billion, noting a weaker-than-expected consumer electronics market with elevated inventory levels and order cuts even from data center clients. Per the below graph, South Korean chip inventory build is at a record high. Aside from supply-demand dynamics, management highlighted increasing geopolitical risks, as a U.S. ban on AMD and Nvidia (NVDA) chips sold to China will impact memory earnings.

Then there’s Nvidia, which reported a 33% decline in 2Q22 Gaming revenue to $2 billion (30% of total sales) driven by challenging crypto prices and weak GPU demand post-Covid. Q3 revenue outlook of $5.9 billion (-17% YoY) at the midpoint was also materially below the $8.4 billion consensus before the 8/24 warning, due to ongoing softness in Gaming and Professional Visualization. Data Center and Auto were the only bright spots, where DC revenue grew 61% to $3.8 billion in Q2, but a slowdown should be reasonably expected going forward.

Good news and bad news

The bad news is overall PC softness is likely to stretch into 1H23, so it shouldn’t be surprising to see further weakness in AMD’s Client segment in the next few quarters. Just like the memory business (see recent analysis on Micron (MU)), the current PC downturn will lead to aggressive price competition to get rid of excess inventory. This will weigh on margins even if sales volumes recover in the near term.

The good news, however, is that the PC problem looks increasingly de-risked, as investors have a better grasp of the magnitude of the slowdown. Despite falling PC sales, AMD has been steadily gaining market share, where its desktop unit share reached 20.6% and Mobile unit share in the notebook market reached 24.8% in 2Q22. In the server market, AMD’s Epyc products have also taken a meaningful share from Intel’s Xeon offerings with a ~14% share vs. a little over 1% in 2018. Given server is a higher-margin business, it should provide AMD with some cushion on the bottom line.

Final thoughts

Shares of AMD are down 50% YTD (vs. -35% (SOXX)), so markets have digested the majority of bad news while looking for early signs of a recovery in the broader semiconductor space. As painful as the current downturn may be, AMD remains a convincing share-gain story as its biggest rival Intel continues to struggle with timely delivery of new technology. That said, investors will probably have to deal with more bad news and choppy price actions in the near term as the Fed embraces a hawkish attitude on the back of inflation.

Be the first to comment