KeithBinns

“During the Cold War, we lived in coded times when it wasn’t easy and there were shades of grey and ambiguity.” – John le Carre

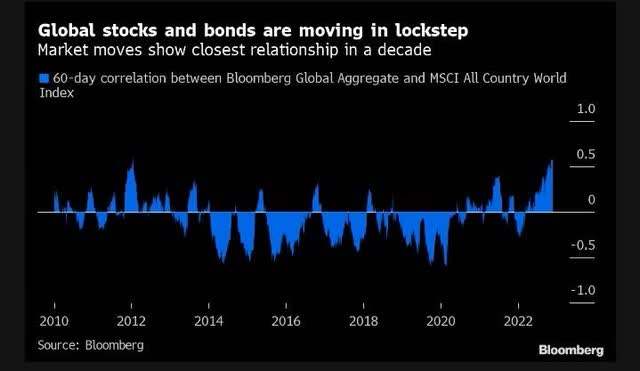

Watching with interest one central bank after another disclosing significant “losses” on their holdings, and, in continuation to our previous conversation relating to “ambiguity” in the current market set-up, when it came to selecting our title analogy we decided to go for “Ambiguous loss”. “Ambiguous loss” is a loss that occurs without a significant likelihood of reaching emotional closure or a clear understanding. As such, the return of “positive correlations” between bonds and stocks have rendered the 60/40 “unbalanced” this year, leading to many financial market participants such as “asset managers” unable to reach “emotional closure” on their “bread and butter” portfolios. As well, in crypto land, we are seeing a continuation of the “Minsky moment” with more dominoes falling within the universe as liquidity is being withdrawn as indicated by the fall of M2 being a broader measure of the money supply and future inflation.

In this conversation, we would like to look at what “Ambiguous losses” from for Japanese investors entail, given the importance of their role in global market “flows”. Also, we would like to discuss the Chinese reopening theme we touched on in our “The Scarcity Principle” conversation.

Whale watching in Japan

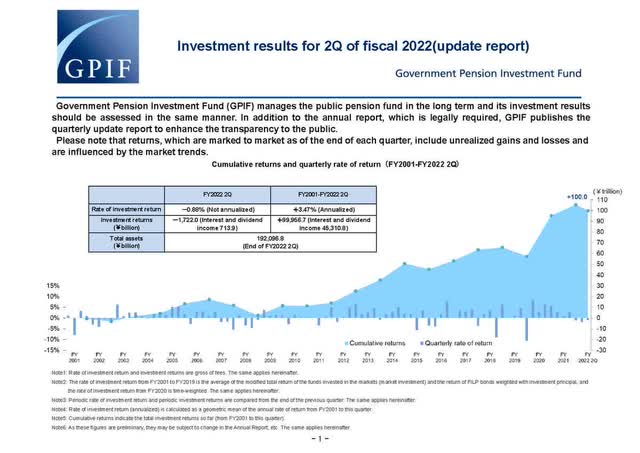

One should closely watch Japan’s GPIF (Government Pension Investment Fund) and its $1.36 trillion firepower. Key investor types such as insurance companies, pension funds and Toshin companies have been significant net buyers of foreign assets over the years. In terms of “Ambiguous loss” the investment performance of the big Japanese whale GPIF, which manages Japanese pension funds, was in the red in the July-September 2022 period, marking the third consecutive quarterly loss since 2008-2009. GPIF has “50/50” allocation: 25% in Japanese equities/25% foreign equities as well as 25% in domestic bonds/25% in foreign bonds:

While losses on Japanese equities were nearly twice that on their foreign equities exposure, GPIF’s bond losses were nearly two times worse on their foreign bonds exposure relative to their domestic bonds exposure.

Back in July 2016 in our conversation “Eternal Sunshine of the Spotless Mind” we indicated that “Bondzilla” which used to be the NIRP monster (When global bonds were negative yielding in size that is) was more and more made in Japan due to the important allocations to foreign bonds from the GPIF as well as other Lifers in conjunction with Mrs. Watanabe through “Uridashi” and “Toshin” funds (Double Deckers) being an important “carry player”:

“In the global reach for “yield” and in terms of “dollar” allocation, Japanese investors have been very significant hence the importance of monitoring the flows from an allocation perspective.

Not only Japanese Lifers have a strong appetite for US credit, but retail investors such as Mrs. Watanabe, in the popular Toshin funds, which are foreign currency denominated and as well as Uridashi bonds, the US dollar has been a growing allocation currency wise in recent years so watch also that space.

For Japanese investors increasing purchases in foreign credit markets has been an option. Like in 2004-2006 Fed rate hiking cycle, Japanese investors had the option of either increasing exposure to lower rated credit instruments outside Japan or taking on currency risk. During that last cycle they lowered the ratio of currency hedged investments to take on more credit risk. ” – source Macronomics, March 2019

In a similar fashion to the 2004-2006 Fed rate hiking cycle, higher US yields attracted flows from a “lower yield currency” such as the Japanese yen (JPY) but, it was not the case in 2022. Why so? The Japanese yen enables “leveraged carry play”, but only in a “low bond volatility” environment.

If we have passed the inflation peak in the US in conjunction with a Fed close to pivoting, then no wonder the JPY is acting again as a “safe haven” meaning in effect a strengthening of the JPY in the process which we think will continue (towards 130 level at least).

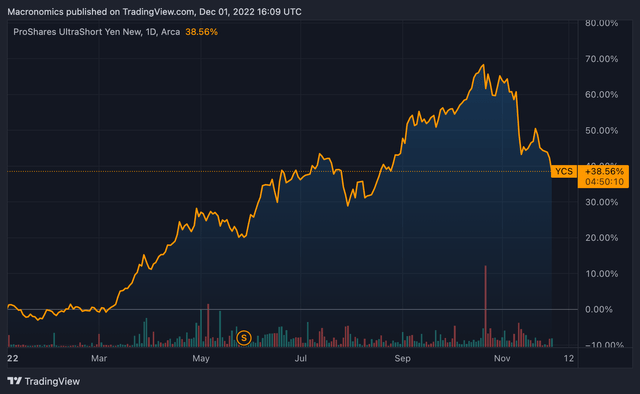

Since around the 18th of April, we recommended our OHM Research clients to use the ETF YCS which replicates twice the move in USD/JPY to play the weakening of the Japanese currency. The trade worked nicely but it is time to get out:

ETF YCS YTD (Macronomics – TradingView)

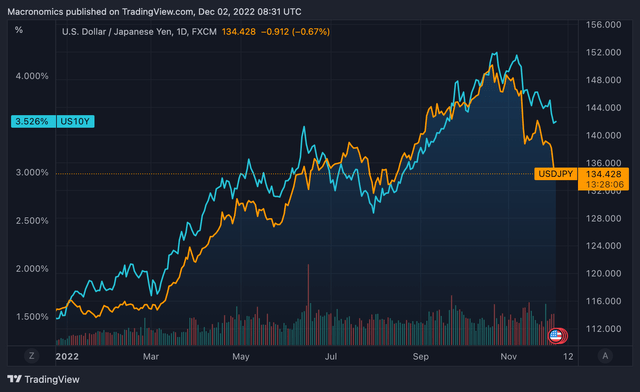

There is no doubt that both the US 10-year yield and the USD/JPY have moved in lockstep during the course of 2022:

UST 1O year YTD vs USD/JPY (Macronomics – TradingView)

As such, peak “Mack The Knife” marked the “peak weakness” in the Japanese yen and going forward we think that “Mack The Knife” bloody rampage is slowing.

Clearly, there has been a change in the narrative and as such, the previous “weakening” trend is no longer your “friend” when it comes to the Japanese yen. As Mack The Knife (US Dollar + US Yields) went up throughout 2022, the JPY weakened in the process wreaking havoc on the 60/40 players as well as central banks holdings and GPIF and their life insurer friends:

Positive correlations (Bloomberg – Twitter)

Positive correlations = pain distribution to 60/40 and GPIF. Very simple.

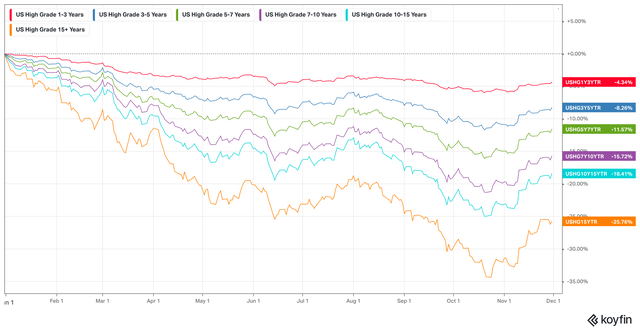

In our previous conversation, we recommended the “Make Duration Great Again” (MDGA…should we trademark it?) investing on the long end of Investment Grade Credit from a carry and roll down perspective:

US IG YTD (Macronomics – KOYFIN)

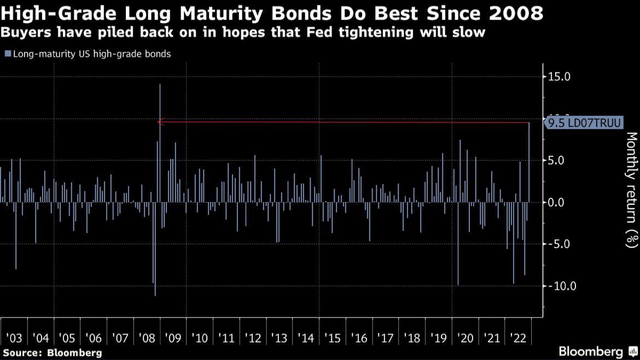

With the “pivot” narrative gaining traction on the back of FOMC statements and in conjunction with receding US yields, no wonder the long end in Investment Grade credit is outperforming:

High Grade performance (Bloomberg – Twitter)

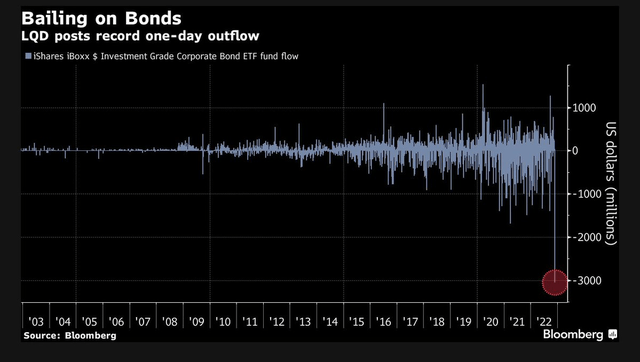

From a flow perspective, “retail investors” are traditionally more “feeble” when it comes to “holding” positions, particularly in the ETF space:

LQD Flows (Bloomberg – Twitter)

As such, no wonder $3 billion exited the $36 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) on Monday, November 29, Bloomberg data show. It was the biggest one-day outflow since the fund’s inception in 2002.

We told you in our last conversation the following:

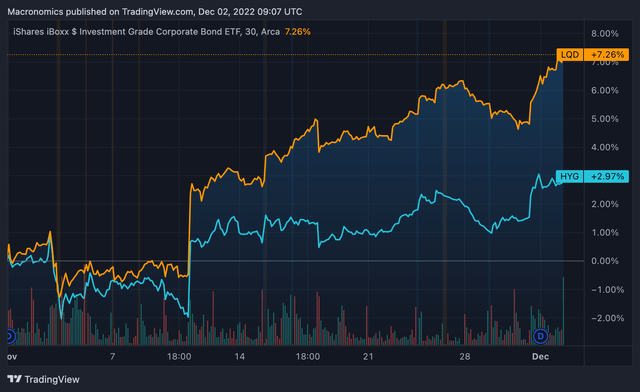

“There is indeed more room for “outperformance” of Investment Grade relative to High Yield when ones look at the two most liquid ETFs LQD for US Investment Grade and HYG for US High Yield” – Macronomics, 23rd of November

We continue to expect an outperformance of US Investment Grade relative to US High Yield (HYG) as per the below one-month chart:

LQD VS HYG 1 month (Macronomics – TradingView)

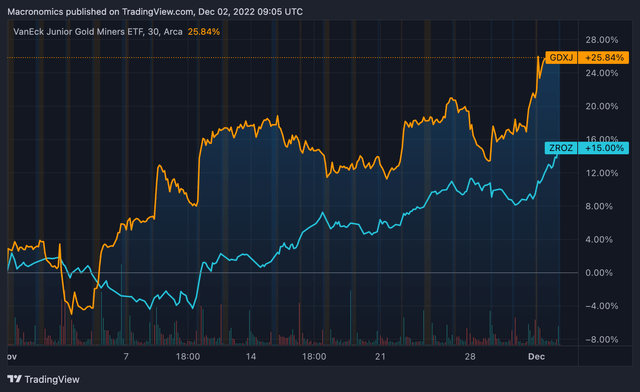

We also recommended the “Make Duration Great Again” (MDGA) trade via ETF PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (ZROZ) which is extremely sensitive to rates move in conjunction with buying Junior Gold miners through ETF GDXJ. Both trades are highly sensitive and convex (1-month chart below):

ZROZ vs GDXJ 1 month (Macronomics – TradingView)

“If the policy compass is spinning and there’s no way to predict how central banks will react, you don’t know whether to hedge for inflation or deflation, so you hedge for both. Buy put-call parity, if there is huge volatility in the policy responses of central banks, the option-value of both gold and bonds goes up.” – Macronomics

We have seen the US long end of the yield curve collapsing rapidly in conjunction with Gold breaking the $1800 level, in effect vindicating this “convex” recommendation which, we believe, will continue to play out in 2023. Let’s call this trade “PCP” (not drug-related, just a plain convexity trade to put on).

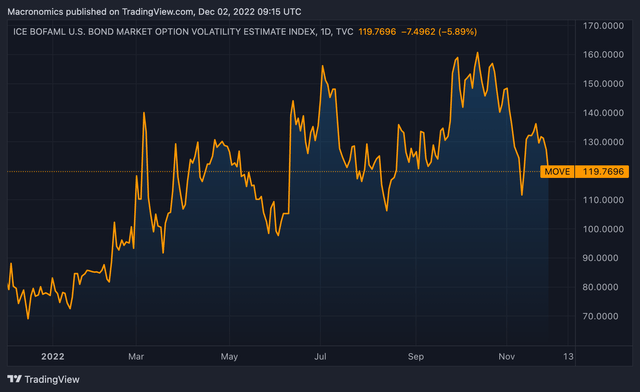

As we indicated in previous conversations, the rally in credit markets is depending entirely on bond volatility receding as per below YTD MOVE index:

MOVE INDEX YTD (Macronomics – TradingView)

“Bond volatility” falling is much more supportive of the “long end” of Investment Grade quality-wise, so go for higher “rated issuers” and reduce your beta exposure to US High Yield. For instance, US High Grade (Investment Grade) 15+ years has “rallied” considerably from -33.25% YTD in our previous conversation to -25.76% YTD (-27.73% YTD in our previous conversation).

But, returning to our large Japanese whale friends, in a similar fashion to the 2004-2006 Fed rate hiking cycle, increasing “credit exposure” might be more enticing for them going forward. USD corporate credit in recent years has been supported by a large contingent of foreign investors, in particular Japan. Throughout 2022, Japanese retail investors through Uridashi funds have been net sellers of foreign bonds. Despite global bond yields continuing to decline since the US CPI data miss, Japanese investors according to Nomura have been reluctant to “dip-buy” foreign bonds most likely because they are afraid of the risk that US bond yields could rise again due to “Ambiguous losses”. The continued fall in USD/JPY may have discouraged them from buying US bonds without “currency hedges”. We believe you want to “front run” the “Japanese retail crowd”. We think Uridashi investors will return to buying hedged US corporate credit currency. Trade accordingly.

China reopening?

In our conversation “The Scarcity Principle” where we argued that a full re-opening of China could bring in more inflationary pressure in the commodities space in that context. As such, we are already seeing signs of a bounce in base materials such as “copper”:

COPPER (Bloomberg – Twitter)

We hinted in our conversation from the 7th of November that Copper inventories are at an all-time low and that there were only three days of global consumption in visible inventories.

As such, we indicated that copper prices could rise very significantly and copper players as well in that context.

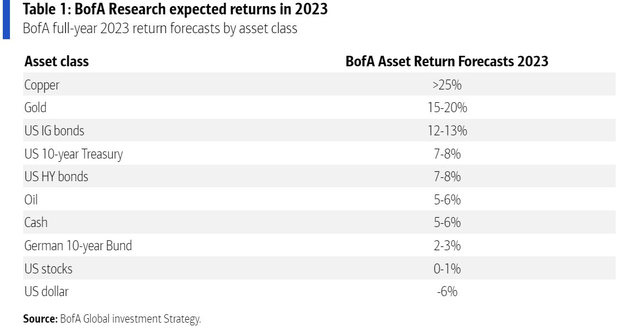

We are not the only ones to believe that it could be the case in 2023 as pointed out by Mike Zaccardi, CFA, CMT on his Twitter feed on the 23rd of November indicating Bank of America’s top trade for 2023:

2023 Trades BofA (Mike Zaccardi, CFA, CMT – BofA – Twitter)

Given our recommendations for “MDGA” and “PCP” trades in our previous bullet point, it might be just a case of great minds thinking alike. The jury is out there.

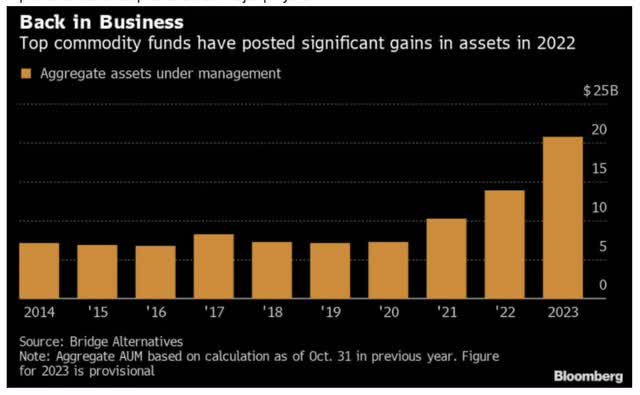

Flow wise, “commodity funds” are making a return as indicated by Bloomberg:

Commodity funds flows (Bloomberg – Twitter)

Could it be an application of the “Scarcity Principle” we discussed on the 7th of November?

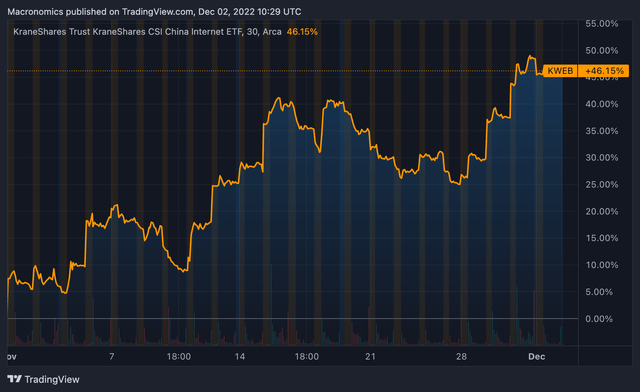

Returning to Chinese reopening following very strict COVID lock-down policies, given the market is a “voting machine” according to legendary Benjamin Graham, no wonder some “wise” pundits have been “front-running” the narrative since our early November conversation as per Chinese Tech ETF KWEB’s performance during the month of November:

ETF KWEB 1 month (Macronomics – TradingView)

We recommend you start reading the “tea leaves” in our musings, particularly the “Chinese ones”:

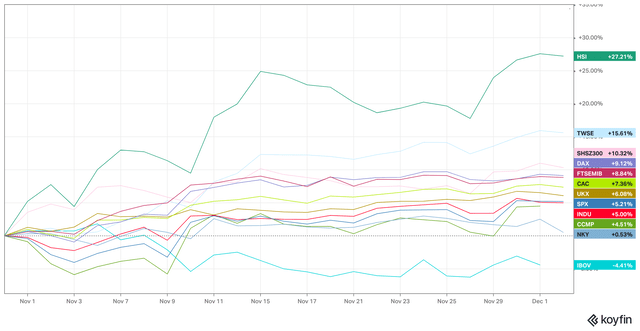

World Indices 1 month (Macronomics – KOYFIN)

Hang Seng is up by 27% during the course of November.

For those who have been following us for many years, you know that like any good cognitive behavioral therapist, we tend to watch the “process” rather than focus solely on the “content” (negative stories on Chinese demonstrations, MSM, to name a few).

As we pointed out in our conversation from the 7th of November in December 2020 we recommended our viewers on OHM Research to take a look at coal plays, and in particular troubled Peabody Energy Corporation (BTU) which was trading around $5 at the time and as well dividend play ARLP (less volatile). Now, BTU is trading close to $32. As a rule of thumb, and contrarian minded, we like to buy not only what is “cheap”, but what is “out of favor”. As such, regardless of the “negative narrative” being spun daily on China, we like what is “cheap” and “convex”, not what is fully priced in. 2023 could be a massive year for Chinese equity in particular and Asia in general. In relation to “Ambiguous loss” we are not in the “grieving business” as per the Kübler-Ross model but we ramble again:

- Denial

- Anger

- Bargaining

- Depression

- Acceptance

“You miss 100% of the shots you don’t take. I skate to where the puck is going to be, not where it has been. A good hockey player plays where the puck is” – Wayne Gretzky

Be the first to comment