byakkaya/E+ via Getty Images

Background

Amazon’s (NASDAQ:AMZN) Project Kuiper announced the largest commercial satellite launch deal in history. Project Kuiper has the intention to launch a constellation of 3,236 low-Earth-orbit (LEO) satellites via 83 launches over a five-year period. Amazon is contracting with Arianespace, Blue Origin, and United Launch Alliance for the heavy-lift launch services needed to deploy their constellation.

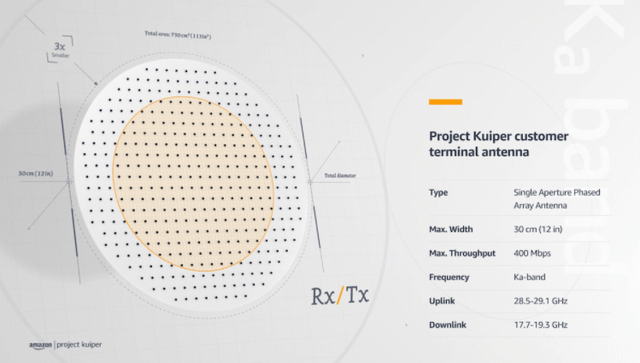

Dave Limp, the Senior Vice President for Amazon Devices & Services, explained that Project Kuiper aims to provide fast and affordable broadband internet services all over the globe, including unserved and underserved communities. Customers will be able to access the new Amazon internet through low-cost terminals and a secure, ground-based network. By decreasing the size of the antennas on these terminals, Amazon is able to reduce costs while not sacrificing delivery speeds, which are currently up to 400 Mbps (planning to improve in future designs).

Kuiper Earnings Potential

While I don’t believe Project Kuiper is a significant reason to own Amazon currently, it has the potential to provide immense tailwinds and earnings power later down the road in my opinion. The addressable market for total global internet use, and specifically underserved areas, is large and I believe Amazon will be able to tap into it. While there are inherent risks to Kuiper due to competition with SpaceX (I’ll touch on this later) I believe their resources and potential synergies will give them a chance to battle for market share even with a four-year lag behind StarLink.

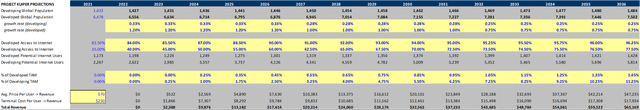

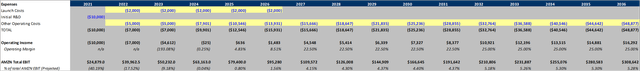

Below is my earnings model for Project Kuiper over the next 15 years. To forecast the potential earnings for Kuiper I focused on the population currently unserved or underserved regarding internet services. With expectations for further development of the satellites and terminals, I also included a percentage of the total global population that may switch to LEO satellite-based internet later on. Using the average high-speed internet cost ($70) and the expected terminal cost ($250) I was able to forecast revenues. I used an approximate launch cost of $10 billion amortized over five years alongside $10 billion in R&D costs upfront and ongoing operating costs

Earnings Model

Created By Author Created By Author

Even if Amazon can grab what I believe is a minimal market share for this industry over the next 15 years, they may be able to generate well over $15 billion in operating income by 2036.

Risks

SpaceX

I believe Project Kuiper’s biggest risk is SpaceX (StarLink) competition. Currently, StarLink launches its satellite fleet via SpaceX Falcon 9 rocket which could launch as many as 60 times this year alone. Not only does the reusability of the Falcon 9 first stage and payload fairing allow for more frequent launches, but it’s extremely cost-effective. Internal costs for SpaceX Falcon 9 are approximately $30 million per launch, Amazon is potentially paying on average three times as much per launch.

The other risk to Amazon and Project Kuiper is that SpaceX is the first mover and roughly four years ahead. Already being beta tested in parts around the world, customers are becoming familiar with StarLink internet services before Kuiper even has a satellite in orbit.

The mitigant to this competitive nature is the resources Amazon has, in my opinion. As the industry matures, I believe consumers globally will gravitate towards what is faster, cheaper, and available to them. That being said, even if SpaceX actively has StarLink services up, and while it may have been more efficient to launch the satellites to start, continuous development of the system will be a key driver for growth in my opinion. I believe Amazon has the resources to continue funding research and development efforts and potentially create a new form of widely used internet around the globe.

Summary

While I don’t believe project Kuiper will be a key stock price driver for Amazon in the next decade, I do believe it is a long-term initiative that can generate high, positive returns on investment. Project Kuiper, if successful, could bring millions of people around the globe high-speed internet access they once did not have access to. Not only would this generate earnings for this specific segment for Amazon, but could drive growth in both their e-commerce and Amazon Web Services (AWS) segments as it potentially brings millions more online. I believe with Amazon’s resources and ability to leverage AWS’ networking infrastructure and global customer base, Project Kuiper has high potential in capturing significant LEO satellite-based internet as well as total broadband internet market share.

Be the first to comment