HJBC

Thesis

Amazon.com, Inc.’s (NASDAQ:AMZN) Q3 release demonstrated the double-edged sword of operating leverage/deleverage. Amazon benefited tremendously from its massive fixed costs leverage during the pandemic-induced craze.

However, it also led to poor execution by then-CEO Jeff Bezos’ and team, believing that the tailwinds were sustainable. As such, the company drove a massive CapEx buildout that now-CEO Andy Jassy & co. are left to dismantle. Given Amazon’s low operating profitability on the corporate level, management doesn’t have much room for error. They either get it right and benefit from massive fixed costs leverage or get it wrong and are forced to deal with the malaise.

Unfortunately for Amazon and its shareholders, the market got it right when it forced a bull trap in November 2021 after pushing AMZN into a distribution phase for more than a year. Astute investors knew Amazon’s committed push to drive its fulfillment advantage wasn’t sustainable, and they have gotten it absolutely spot on.

Amazon’s previous headwinds of supply chain disruptions have morphed into macroeconomic uncertainties driving excess capacity on its e-commerce front. But we all know that AMZN’s growth premium in recent years was unlikely predicated merely on the strength and scale of its retail business.

The market has accorded AMZN significant credibility on its first-mover advantage in the cloud computing business. As a result, the company has benefited tremendously as the leading hyperscaler, with extensive scale economics as AWS could leverage its massive retail footprint. That said, AWS has also come under pressure in Q3, with the growth in its operating profitability significantly impacted.

We believe the multitudinous macro headwinds have crimped Amazon’s ability to execute confidently, with the enterprise slowdown adding more pressure on its operating deleverage.

Therefore, we postulate that the significant slowdown in AWS’ profitability growth is a pivotal moment for Amazon to prove the durability of its most critical growth driver.

Our analysis suggests that the market had already anticipated a relatively poor Q3 but had not expected AWS to underperform so significantly. Hence, the market forced AMZN to re-test its May lows, likely driving weak holders into giving up their shares as the selling pressure took out its critical May lows.

We postulate that AMZN could still bottom out from these levels if a validated bullish reversal forms, proffering a significant double-bottom setup, which is considered very bullish.

However, we highlight the levels investors should consider if the bullish reversal setup doesn’t appear, as it could indicate the market intends to force capitulation before AMZN could eventually bottom.

Maintain Buy.

It’s AWS’ Turn To Demonstrate Significant Weakness

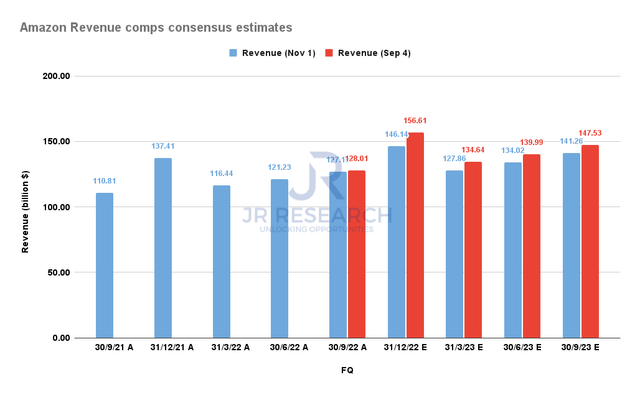

Amazon Revenue comps consensus estimates (S&P Cap IQ)

As seen above, Street analysts have gotten Amazon’s revenue pretty on point, in line with management’s previous guidance. While they revised their revenue estimates after Q3’s release, it wasn’t as bad as it seemed. Hence, Jassy & team have likely stabilized their topline execution after lapping its highly challenging COVID comps.

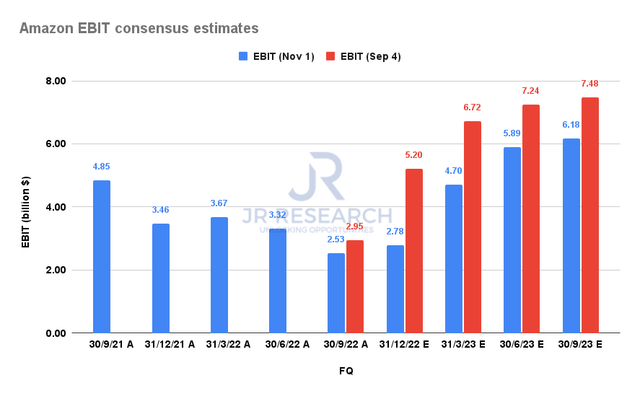

Amazon EBIT comps consensus estimates (S&P Cap IQ)

But, the Street’s estimates on AMZN’s ability to drive incremental operating leverage as its revenue growth recovered from Q2’s bottom were significantly off the mark.

Notwithstanding, Amazon’s EBIT of $2.53B in Q3 was well above the midpoint ($1.75B) of its previous guidance. Hence, Amazon executed well, according to its internal forecasts.

But, Wall Street expected more from AMZN, as its previous estimates suggested an EBIT of $2.95B for Q3. Hence, the 14% underperformance was likely unexpected. We don’t think forex was likely the main contributor, even though management would want investors to consider that. Forex headwinds were already a well-known issue, and we believe that analysts had reflected these challenges accordingly.

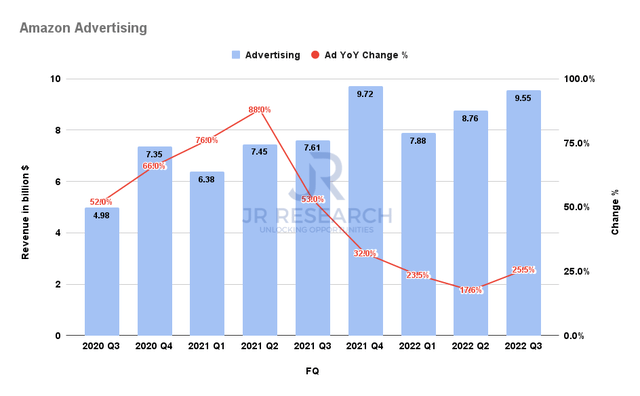

Amazon advertising (Company filings)

Furthermore, Amazon’s advertising business had another remarkable quarter as it grew by 25.5% YoY, up from Q2’s 17.6%. With the malaise seen in digital advertising leaders such as Google (GOOGL) (GOOG) and Meta (META), it was an excellent quarter for Amazon. We believe it continues to take share through its retail media ad business, leveraging its massive e-commerce footprint and driving its leadership.

However, GOOGL last traded at an NTM EBITDA of 9.5x, compared to AMZN’s 14x. Therefore, we postulate that AMZN’s growth premium is centered on its AWS puzzle.

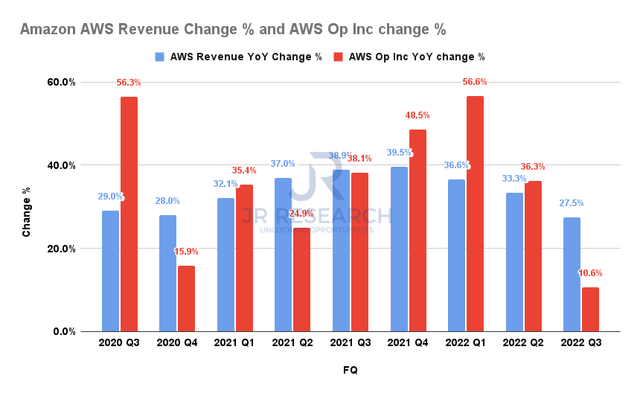

Amazon AWS Revenue and Operating income change % (S&P Cap IQ)

Trefis’ sum-of-the-parts (SOTP) valuation suggests that AWS comprised 54.6% of AMZN’s valuation.

Hence, we believe it makes sense that the market battered AMZN from its August highs, as it anticipated weakness in its most critical growth and valuation driver.

Therefore, we believe the deleverage from AWS caught Wall Street and investors off-guard, which led to them slashing their forward EBIT estimates markedly through FY23 (as presented earlier).

As seen above, AWS’ operating income grew just 10.6% YoY, down from Q2’s 36.3% growth. Despite posting revenue growth of 27.5% in Q3 (still a marked deceleration from previous quarters), we believe the tepid operating income growth likely caused investors to reconsider whether there are significant challenges under the hood.

Our analysis indicates that these challenges are a function of Amazon’s infrastructure-heavy business model for AWS. As a result, investors cannot expect the company to keep driving leverage when times are good and not expect the reverse when times are bad.

Management remains committed to driving growth again for AWS, likely recognizing the segment’s importance in its valuation. CFO Brian Olsavsky accentuated:

As far as new normal, we’re working very hard to make sure that current [AWS] profitability is not the new normal, and we’ll see how quickly we can make improvements. A lot of the improvements that I talked about on a macro level, capital efficiency, operations improvements are as important internationally as they are in North America. (Amazon FQ3’22 earnings call)

Is AMZN Stock A Buy, Sell, Or Hold?

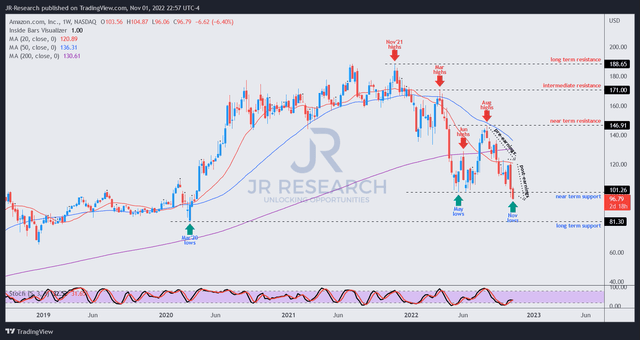

AMZN price chart (weekly) (TradingView)

AMZN is re-testing its critical May lows, setting up a potential double-bottom opportunity in the works.

Hence, investors should not view the re-test negatively as it proffers AMZN the opportunity to shake out weak holders through its post-earnings selloff (still ongoing) while taking out fearful investors who bought at its May lows.

It is a pivotal “clearance’ event to drive near-term panic before it could form a validated bullish reversal (still pending).

AMZN last traded at an NTM EBITDA of 14x, well below its 10Y mean of 22.2x. AMZN’s growth premium remains predicated on the performance of AWS’ ability to drive incremental leverage moving forward, so the market is likely attempting to price in Jassy & team’s credibility in achieving that.

We don’t have any price action resolution for now, so the risks remain for the market to force capitulation toward its COVID lows before bottoming. But, we are increasingly confident at these levels, anticipating a validated bullish reversal to form.

Maintain Buy.

Be the first to comment