hapabapa

The spark for this article came as I parked in MSP’s cell lot waiting for a call from my wife that her flight had landed. It was a little late, so I had time to observe air traffic. A distant second to a fine airline Delta (DAL), Amazon (NASDAQ:AMZN) was flying more planes in and out than any other cargo carrier. My redux Peter Lynch moment.

Weeks later, driving south on US 99 – through the nut and fruit orchards of California’s Central Valley – there it was again. Recognizing that not all cabs and trailers display a brand, nevertheless, of those that were, Amazon dominated; we passed their semi’s, or they passed us, while we drove from Fresno before merging onto Interstate 5 and then turning off on the 126 toward Ventura.

In our neighborhood, same thing. Our mail carrier drives our circle once a day as do FedEx (FDX) and UPS (UPS). However, Amazon delivery vans are here two or three times daily from dawn to after dusk. I know this also from motion detectors both on our neighbor’s townhome and ours. Occasionally, when they trigger lights, I look out the window. If not a critter, it’s an Amazon delivery person walking up to one of our front doors; I’ve never observed FedEx or UPS service-providers hit our motion detectors; hmmm.

As For Packages

What about those Amazon packages? A few months ago, a clever phisher hacked me by spoofing an email from a neighbor who needed help and got into my Amazon account. To pass their security screen, the company required that I name our three most recent purchases. I couldn’t without going back and looking at our purchase history (which, by now, was locked). Was it that cat box, garage tool racking, vacuum stick, the jar of our favorite cranberry/horseradish sauce, COVID masks, toddler chairs, clothing, hiking boots, toys, coffee pods, cosmetics, desk supplies, hardback books, those streamed through Kindle, what about Amazon Prime movies; do our trips to Whole Foods count, my memory failed me. Their product list is inexhaustible.

Delivery Competition

Stepping back, I decided to look at a few no-BS metrics comparing Amazon to FedEx and UPS – how long the three companies have been in business, their annual number of packages delivered globally, employee headcount, annual revenue/growth, and most recent quarterly gross profit margin (all courtesy of SA and Wiki except for packages delivered that come from various sources with FedEx’s being suspect):

|

Amazon |

FedEx |

UPS |

|

|

Founded / Age |

1994 / 28 years |

1971 / 51 years |

1907 / 115 years |

|

Packages Delivered |

7.7 billion |

1.4 billion (?) |

6.4 billion |

|

Employee Headcount |

1,608,000 |

446,000 |

441,000 |

|

Annual Rev/Growth |

$470B / 22% |

$94B / 22% |

$97B / 15% |

|

Qtr. Gross Margin |

45% |

25% |

26% |

Now, there are those who argue that such analysis is bogus because these companies operate under different business models – fulfillment centers versus distribution hubs versus drop-off locations, whatever. While this is true, they all serve the same basic population of suppliers who are moving product to the same basic population of customers.

In other words, just because their value chains are different doesn’t mean that these companies are incomparable. Those who disrupt the status quo – with better / ‘substitute’ products, services, and/or processes – often win competitive races. By way of analogy, 20 years ago someone might have claimed that film and cell phone cameras were not comparable; we all know how that turned out.

And, as you can see above, the comparison is striking. Amazon, having been in business just over half the time of FedEx, and only quarter of that of UPS, has blown them away by all metrics especially headcount, revenue, and gross margin.

Indeed, we could take FedEx and UPS, add them together, and they would still not equal Amazon. And even if Amazon is “maturing” as a business, so what, if it continues to peel away market share from its primary competitors.

Big Box Competition

Putting delivery aside, I then decided to compare Amazon to three big-box retailers or what I prefer to call self-serve fulfillment companies, Target (TGT) and Walmart (WMT) of the ‘retail’ variety, and Costco (COST) of the ‘wholesale’ one. To be sure, all have online ordering and delivery capabilities. However, they are primarily walk-in, secondarily curb-side, serving those who like to get out and shop, my wife does, I don’t. Here is the same analysis except that our packages-delivered metric is irrelevant:

|

Amazon |

Target* |

Walmart |

Costco |

|

|

Founded / Age |

1994 / 28 years |

1962* / 60 years |

1962 / 60 years |

1983 / 39 years |

|

Headcount |

1,608,000 |

450,000 |

2,300,000 |

304,000 |

|

An. Rev/Growth |

$470B / 22% |

$106B / 13% |

$573B / 3% |

$227B / 16% |

|

Qtr. Gross Margin |

45% |

23% |

24% |

12% |

*Dayton’s, Target’s parent, dates to 1902.

Same basic story. Amazon, who has been in business not nearly as long, is proportionately way out ahead of Target and Costco, less so Walmart. Without disclosing my source, I have a good friend who was an executive for one of these companies during the time they began to realize they were coming under threat from Amazon. He and his colleagues went to the CEO to express their concerns and ask whether they should modify their business model. Their CEO declined (setting up the situation we see above).

Growth Investing

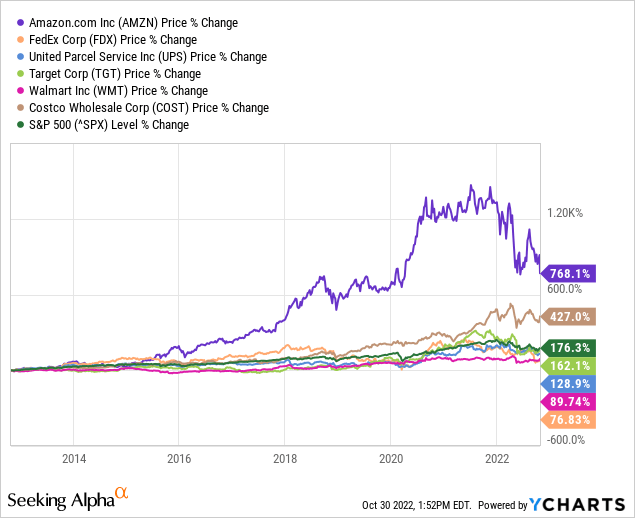

As far as investors are concerned, the back test is how the five stocks of these competitors – FDX, UPS, TGT, WMT, and COST – have performed compared to the big dog, AMZ (and the S&P 500, while we’re at it). Again, no comparison, Amazon, the growth competitor, has far outperformed them all over 10-years. Cut off Amazon’s “COVID shop-from-home bump” – visually interpolate its line below from early 2020 to the present – the company is still pulling away from its core competition imperceptibly, perhaps, at a slightly slower rate.

Both the snapshots and trend lines above, demonstrate that Amazon is the rare bird that is capturing market share while delivering shareholder value, meaning not sacrificing margins to build revenues.

Moreover, there is nothing to suggest that Amazon will let up. It has the financial strength – represented above and with phenomenal cash flow and capitalization – to keep on keeping on. We see it in their numbers, and we see it in their latest offerings such as an insurance portal, “influencer” home décor collections, new delivery alliances, and even prefabricated houses for under $50k. (Except for packaged foods with long shelf life, I hope Amazon backs away from the grocery business which has notoriously thin margins.)

|

Amazon |

FedEx |

UPS |

Target |

Walmart |

Costco |

|

|

Operating Cash Flow |

$46B |

$10B |

$15B |

$9B |

$24B |

$7B |

|

Cash & Equivalents |

$59B |

$7B |

$11B |

$1B |

$14B |

$11B |

|

Liabilities to Equity |

2.12x |

2.41x |

3.10x |

3.95x |

2.08x |

2.11x |

High multiple, flat to expectations, and Friday’s battering notwithstanding, the street still likes AMZN with 39 out of 51 having it as a “Buy” with a median price target of $140, representing an appreciation of 35% over Friday’s close. SA’s quants and authors are notably blasé having the stock as a “Hold” because of its valuation.

Risk / Reward

As to risks, the obvious one is macro-economic, recession. On the one hand, given the GDP and PCE numbers announced last week, I’m inclined to believe that the threat has peaked. On the other hand, our extraordinarily low unemployment rate suggests that the Fed may bump the overnight by another 75 basis points. Whatever happens, it will affect all competitors in this article but is unlikely to change the comparative realities / trends.

At a micro-level, I would like to see Amazon running with more liquidity. Yes, the company holds a lot of cash but, in fact, its working capital (current assets minus like liabilities) is negative $9B against a current ratio of .94x. That said, the company turns over its inventory about 8 times per year or every 45 days. There is some evidence that Amazon squeezes its suppliers but, of course, their alternative is to realign their distribution through a lesser portal, a decision that most suppliers would probably prefer to avoid.

No, for us the rewards more than counterbalance the risks for the primary reason that, again, Amazon is a market share machine. IMO, comparative / competitive analysis here is more applicable than other approaches. Argue with me.

Be the first to comment