gavran333/iStock via Getty Images

Co-produced by Austin Rogers

Always buy your straw hats in the Winter. -Benjamin Graham

Benjamin Graham, the mentor of Warren Buffett who is often called “the father of value investing,” was full of pithy wisdom. Among his keenest observations was the idea that intelligent investing is not so different than intelligent money decisions in other areas of life.

For example, Graham observed that it is a good idea to buy straw hats, typically used for sunny day trips to the beach during the summertime, in the Winter. Why? Because of simple supply and demand.

No one thinks so far in advance as to buy a straw hat six months before needing one. Instead, shoppers are buying fur coats and gloves during the Winter months, and whatever straw hats stores still have in stock are likely to be discounted as retailers try to get rid of them to make room for more full-priced Winter apparel.

On the flip side, when is the best time to buy a fur coat or gloves? During the summertime, when retailers are trying to get rid of their Winter garb to make room for swimsuits and straw hats.

Intelligent investing is not so different than intelligent apparel shopping. Always buy your straw hats in Winter, when they are cyclically discounted because of low demand. Likewise, always buy stocks when they are cyclically discounted and experiencing low investor demand.

This is basic contrarian investing.

Though Graham died nearly 50 years ago, his fundamental wisdom is as fresh today as it was during his lifetime. The economic cycle may not be quite as predictable as the changing of the seasons, but it is just as inevitable.

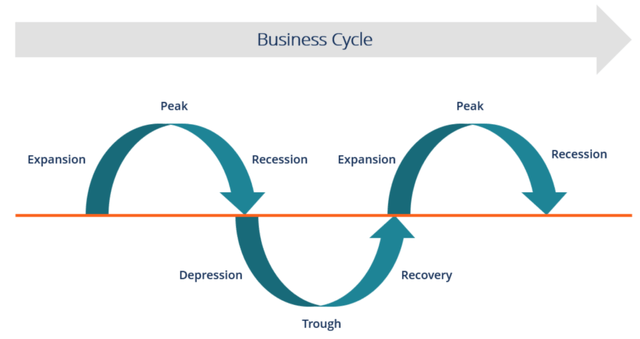

Business Cycle Diagram (Corporate Finance Institute)

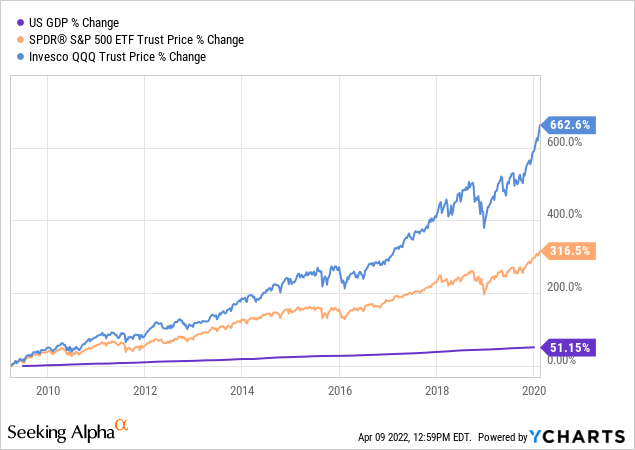

During periods of increasing economic growth, the S&P 500 (SPY) rises and technology-focused, high-growth stocks such as those in the Nasdaq 100 (QQQ) soar. The 2010s marked an excellent example of this:

Market returns are cyclical (YCharts)

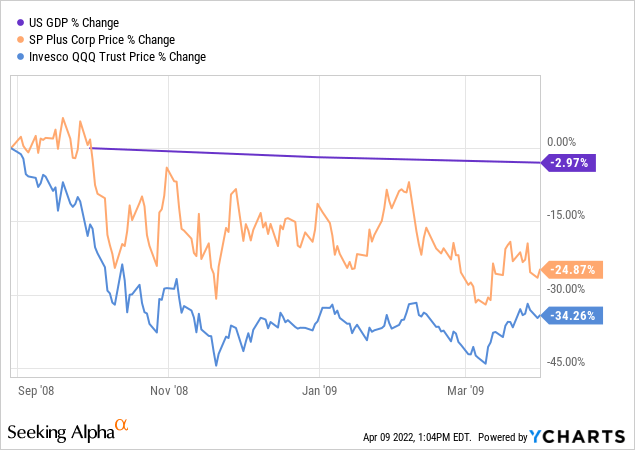

But when economic growth declines, such as it did during the Great Recession of 2008-2009, it is those techy growth stocks that are most severely discounted.

Market returns are cyclical (YCharts)

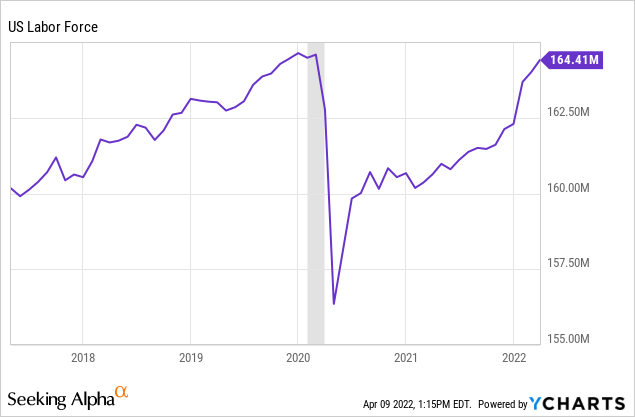

We find this not only in very broad strokes for the economic cycle generally but also in microcosms of the economic cycle. Take, for example, the ebb and flow of the labor force. During economic expansions, businesses are growing and adding workers to their payroll. The total U.S. labor force grows. Then, when the economy turns down, consumer demand cools and employers have to lay off workers.

This cycle played out very sharply to both the downside and upside during and in the wake of the pandemic.

The US economy recovered quickly (YCharts)

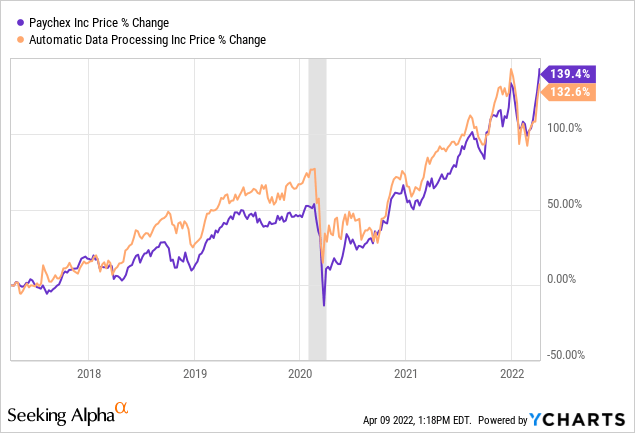

Think about how this affects certain businesses. Take, for instance, payroll services provider Paychex (PAYX) and human resources software provider Automatic Data Processing (ADP). Obviously, when the labor force is growing, these companies have more business opportunities and greater revenue growth. When the labor force shrinks, the opposite is the case.

Cyclical stocks outperform (YCharts)

When is the best time to buy these “straw hats” – when the labor force has reached a cyclical high or when it hits a cyclical low? Generally speaking, it’s better to buy when the labor force is at a cyclical low (or the unemployment rate at a cyclical high), because that is when the stock price is discounted.

Always buy your straw hats in the Winter.

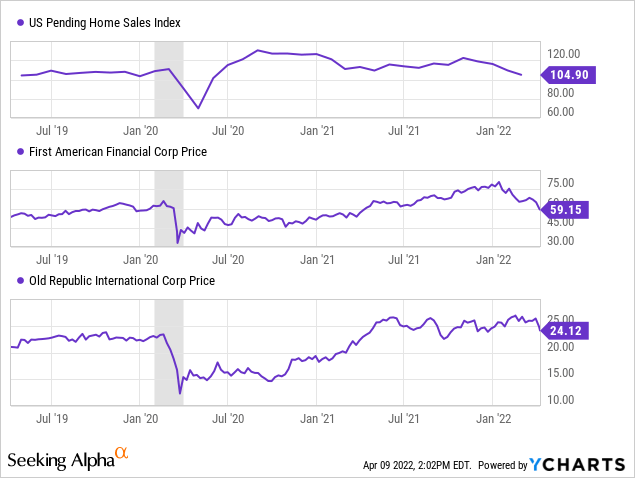

Let’s look at another example, this one taken from the housing market. Pending home sales surged in the second half of 2020 after mortgage rates dropped at the beginning of COVID-19. This sent the stock prices of title insurance and home warranty providers First American Financial (FAF) and Old Republic (ORI) higher, albeit with a lag.

Market returns are cyclical (YCharts)

But pending home sales don’t stay cyclically elevated forever. As pending home sales have moderated in late 2021 and into 2022, FAF and ORI’s stock prices have turned down again as business opportunities diminish.

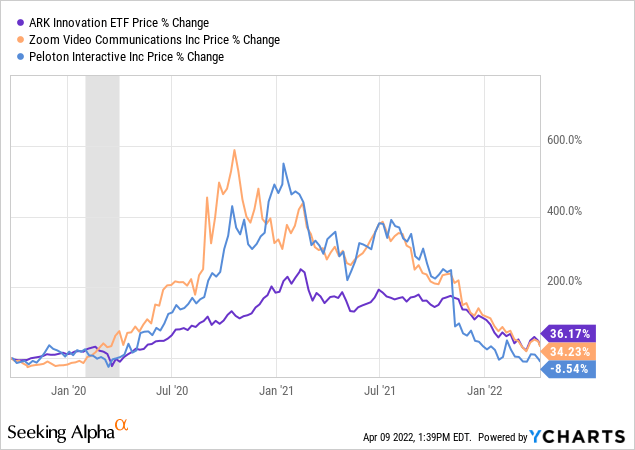

Let’s take one more example: “life at home” stocks during the pandemic. Companies particularly well-suited to social distancing and remote work like stationary bike maker Peloton (PTON), video communications provider Zoom (ZM), and (broadly speaking) the cutting-edge companies found in Cathie Wood’s ARK Innovation ETF (ARKK) soared to incredible heights.

Tech stocks deflate (YCharts)

It was a sunny day at the beach, and these “straw hat makers” made a killing off investor demand for their shares. But the sunniest day of the year, so to speak, turned out to be the worst time to buy. The seasons changed, and the pandemic didn’t last forever after all. The announcement of effective vaccinations killed investor enthusiasm, and demand for shares dampened as rapidly as the cool air of Autumn dampens enthusiasm for daytrips to the beach.

Of course, one shouldn’t buy something merely because the market has turned sour on it. Graham’s style of intelligent investing does not advocate contrarianism simply for the sake of contrarianism.

One must always take care to pick high-quality companies with skilled, shareholder-aligned management teams. Only once these strong companies are found should investors then seek to buy shares during cyclically low periods when stock prices are discounted.

That is what it means for an intelligent investor to “buy their straw hats in the Winter.”

Granted, this is easier said than done. Just because it’s simple doesn’t make it easy.

With that said, let’s take a look at two dividend stock “straw hats” that make interesting investment prospects right now during their cyclical “Winter” periods.

1. Evercore Inc. (EVR)

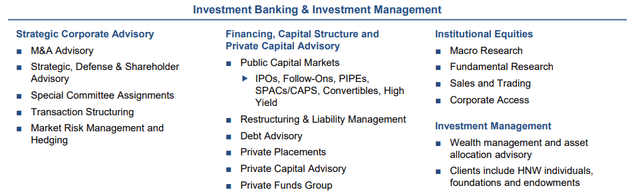

EVR is a leading independent investment bank that provides advisory and wealth management services. Most of EVR’s revenue comes from advising mergers and acquisitions, which makes it somewhat dependent on the strength of capital markets.

Evercore services (Evercore)

Generally speaking, EVR’s business is the strongest when the stock market is hot and bond yields are low. When stock prices are rising, companies are more likely to use their own shares as currency to engage in merger & acquisition activity. Likewise, when bond yields are low, companies are more likely to issue long-term debt at low rates for growth or M&A purposes.

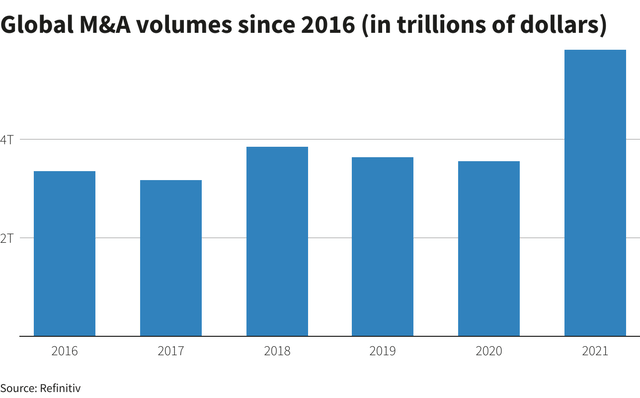

In 2021, global M&A volume surpassed $5 trillion for the first time ever.

Global M&A volumes since 2016 (in trillions of dollars) (Reuters)

Unsurprisingly, EVR had a fantastic year in this environment. Advisory fees reached $2.7 billion, up 57% from 2020, which was also a good year for EVR. In 2021, EVR advised on three of the top ten largest M&A deals.

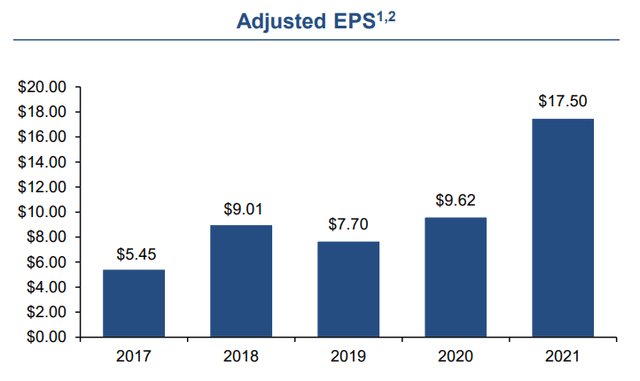

EVR turned this strong revenue growth into even stronger earnings per share growth: 82% year-over-year.

Evercore earnings per share (Evercore)

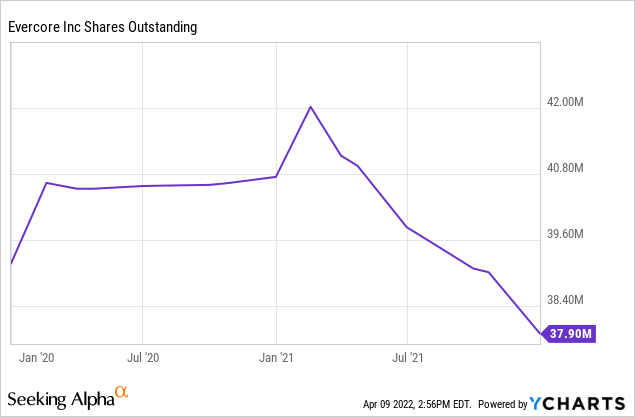

The independent investment bank used $721 million of its profits last year to repurchase stock, which wiped out several million shares by year end.

Evercore is buying back shares (Evercore)

This should, all else being equal, provide a boost to EVR’s earnings per share in future years.

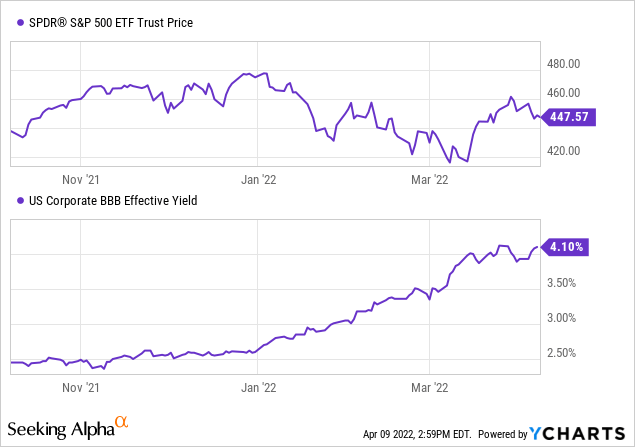

Now, will EVR have as good a year in 2022 as it did in 2021? No, almost certainly not. Stock prices have struggled this year, while bond yields have soared.

Interest rates are rising (YCharts)

This makes the capital environment less friendly to M&A deals.

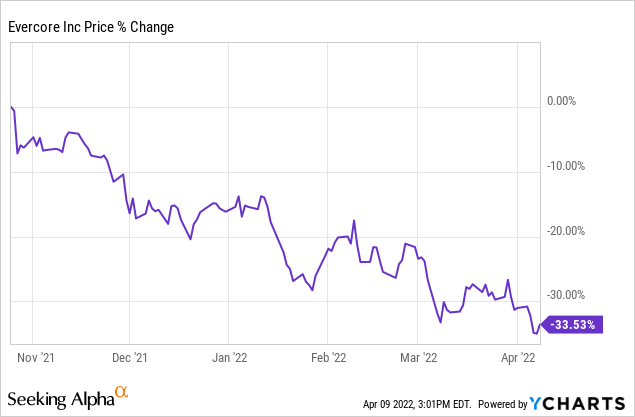

In other words, it appears to be wintertime for EVR this year. The stock price reflects that, as it is discounted roughly 1/3rd from its high:

Evercore is dropping (Evercore)

Right now, EVR offers a 2.5%-yielding dividend that has been raised every year since 2009. What’s more, dividend growth has come in at a double-digit pace, with the latest hike representing 11.5% growth over its previous payout.

Keeping in mind that the M&A market will almost certainly make a resurgence at some point, EVR looks like an attractive contrarian pick right now.

2. Leggett & Platt (LEG)

LEG is a manufacturer of various components of consumer discretionary products like mattresses, sofas, recliners, car seats, and carpets. About half of its revenue comes from bedding, with automotive the second-largest source of revenue, followed by furniture and flooring.

Leggett & Platt product (Leggett & Platt) Leggett & Platt product (Leggett & Platt)

LEG boasts the #1 or #2 market share in virtually all of its product categories. The company targets annual revenue growth of 6-9%.

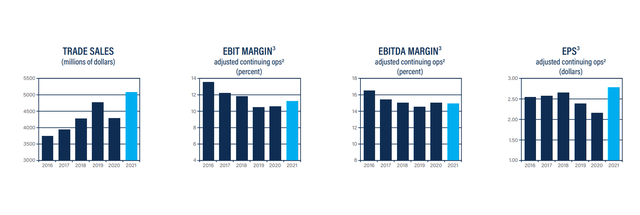

Despite a strong year in 2021 of record sales and EPS…

Leggett & Platt record sales and EPS in 2021 (Leggett & Platt)

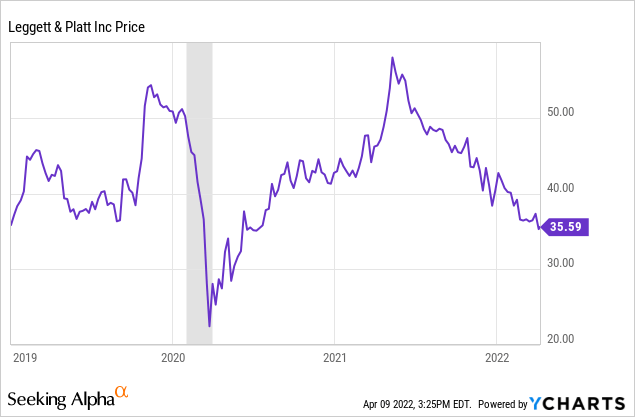

…LEG’s stock price has been trending down since the early summer months of 2021 and now sits around its lowest point from 2019.

Leggett & Platt is dropping (Leggett & Platt)

Why the stock price weakness? Three reasons:

- One of the primary catalysts for buying a new mattress is moving into a new home. Lots of people were buying houses and moving in late 2020 and into 2021, but as mortgage rates have soared since then, less people are moving. Those that are moving are often already homeowners and are thus less likely to buy a new mattress (i.e., they aren’t moving from an apartment into a first home and upgrading from a queen size to a king size).

- Microchip shortages have curtailed the number of new cars being manufactured, which in turn means LEG experiences less demand for car seat components.

- Materials inflation looks likely to continue pressuring LEG’s margins.

But will consumer demand for new mattresses remain low forever? Will chip shortages cause depressed vehicle production forever? Will input cost inflation pressure margins forever?

The answer to all three is “probably not.” Therefore, it looks like LEG is currently around a cyclical low. In other words, it’s a discounted straw hat in the Winter.

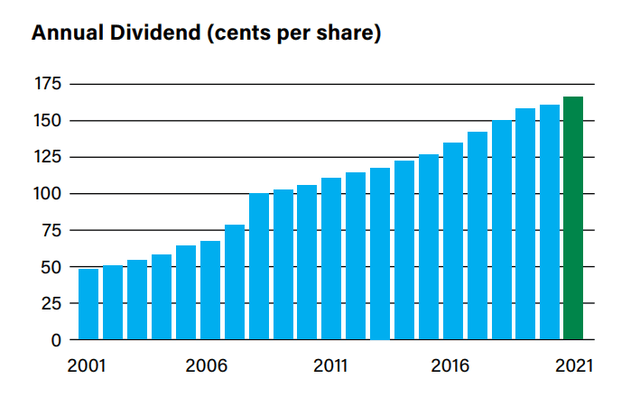

It is also a venerable dividend growth stock with an incredible track record of growing its dividend during good economies and bad, during periods of high inflation and periods of low inflation.

Leggett & Platt dividend is rising rapidly (Leggett & Platt)

This chart only goes back to 2001, but LEG is actually a newly minted Dividend King, having raised its dividend for 50 consecutive years (from 1971 through 2021). Obviously, with such an impressive dividend growth record, the dividend and its growth become sacrosanct to management, who will conservatively operate the business in order to protect and extend that streak.

Rarely does LEG ever offer a dividend yield as high as 4.7%, as it does now.

Bottom Line

Benjamin Graham’s most famous book is called “The Intelligent Investor.” To be sure, it does take a certain threshold of intelligence to pick high-quality companies, analyze balance sheets, and so on.

But even more so than intelligence, successful investing requires discipline. It takes discipline to resist the fear of missing out when stock prices only seem capable of going higher. And it takes perhaps even more discipline to buy stocks when the price seems to do nothing but fall and there is only bad news about the company.

Though we all know that seasons change, it takes discipline and foresight to buy straw hats in the Winter. Likewise, it takes discipline and foresight to buy strong yet discounted stocks during their cyclically low periods.

But that is what distinguishes great investors from average ones, and it is exactly what we focus on doing at High Yield Investor.

Be the first to comment