Cappan/iStock via Getty Images

Overview

I believe Altus Power (NYSE:AMPS) is undervalued. There has been a high demand for electricity in recent times. AMPS’s goal is to look for ways to create “clean means” to generate electricity. This “clean means” is by using solar to generate electricity. AMPS is always out to look for ways to always satisfy their customers, and as long as they continue to satisfy the needs of these long-term customers and execute growth strategies, I think they will do fine.

Business description

AMPS’s main goal is to create a clean energy ecosystem and drive the clean energy transition of their customers across the US while at the same time facilitating the adoption of corporate ESG targets. The company is an inventor, owner, and operator of large-scale roof, ground, and carport-based PV and energy storage systems along with EV charging facilities, serving both commercial and industrial, public sector, and community solar customers. Basically, all they do is to sell power on an as-generated basis from the systems and send it directly to people living in buildings that are under a contract that both parties have.

Investments thesis

Evolving demand for electricity

Life constantly changes and evolves. The need for electricity, like everything else, has changed over the years. This shift, however, has accelerated as a result of the renewable targets and decarbonization goals established by numerous corporations that are demanding a change to clean electricity generation. Government agencies, private businesses, and even individual consumers are all contributing to the rising demand. Traditional utility-scale solar PV providers have historically under-penetrated the commercial and industrial markets due to the smaller scale of projects and difficulties associated with rising to the top tiers of the industry on a national scale. AMPS is in a good position to drive the growth of the commercial and industrial [C&I] segment of the solar PV industry. It has a strong network of national partners, efficient acquisition and deployment strategies, and a standard way of handling customer contracts and asset financing.

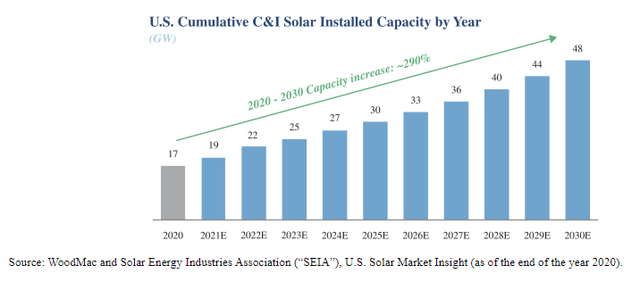

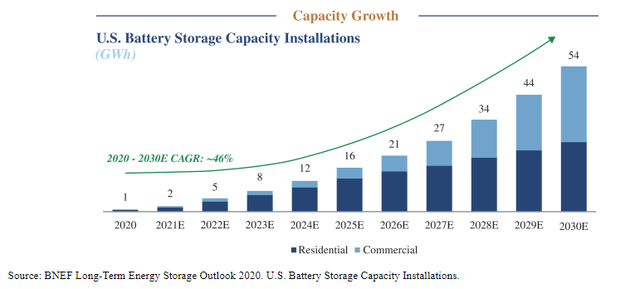

I strongly believe that the coming together of multiple clean energy trends will create a major market opportunity for AMPS. Every year in the US, $400 billion is spent on electricity, and out of that $400 billion, $200 billion is spent on C&I. According to data cited in the AMPS prospectus, an additional $98 billion of investment will be needed to meet the US’s 2030 sustainability goals. AMPS’s management believes that the key drivers for growth in this industry are the increasing customer demand for renewable energy and increased battery storage demand. Interestingly, as of now, according to a 2020 WoodMac Report, only 5% of commercial rooftops make use of solar power systems, and installed C&I solar capacity is predicted to grow at approximately 12% per annum from 2020 to 2050. (source: S-1).

Back-of-the-meter battery packs are popular with both consumers and retailers because they can be stacked. Batteries not only help in the case of an outage, but they also help control demand fees and add to the overall capacity of the system. The expected rise in demand for battery storage is partly due to a FERC order that lets storage resources take part in the wholesale market and to tax credits for investments in renewable energy with storage.

Strong value proposition for users

There are a whole lot of advantages that customers will get from AMPS’s services.

- Lower electricity bills. Solar energy credits get directly applied to customers’ utility bills, which enables them to realize immediate savings. This is made possible because of AMPS’s streamlined process.

- Increased accessibility to clean electricity. They use community solar, which gives them the ability to provide clean electricity to customers who would normally be unable to construct on-site solar. This ensures energy security for everyone and also increases the total addressable market.

- Supporting a Clean Energy Ecosystem: The demand for clean electricity will continue to increase. Their aim is to continue supporting their customers as they are transitioning to the clean energy ecosystem through AMPS’s solar PV, storage systems, and EV charging stations. I think that if they continue to grow, they will be able to help more customers through this change.

Proprietary platform – Gaia

AMPS has proprietary software that has been developed to provide a fully-integrated platform to enable asset management throughout the development and operations lifecycles. This proprietary software system is called Gaia. The following are the values that Gaia offers:

- The software pulls data from real-time data acquisition systems to track performance and make sure that solar systems meet baseline forecasts and work at their best.

- It also assists users by putting customers’ records, important project data, and contracts into a centralized system.

- It also centralizes alarm monitoring, repair, and warranty enforcement, which keeps records and logs all important issues and replies.

Promising business model with strong partnerships

The businesses are placed in such a way that they are the preferred option for partnership for asset owners and other counterparties that want to divest operating portfolios. This is because AMPS gives a high level of certainty about execution and is also good at getting deals done quickly. The way they do their business is in an innovative way to the development process. They also have long-term relationships with their customers that allow them to cross-sell additional present and future products and services. They presently have contracts with customers that will still be there in 18 years.

For competitive bidding on asset acquisition and development, Blackstone’s (BX) scalable credit facility, which has an investment-grade rating, provides access to financing at a cost of capital that is among the lowest in the industry. Along with this, they are affiliated with CBRE, the largest real estate services firm in the world. These partnerships will pave the way for them to attract new customers and grow their business.

Forecast

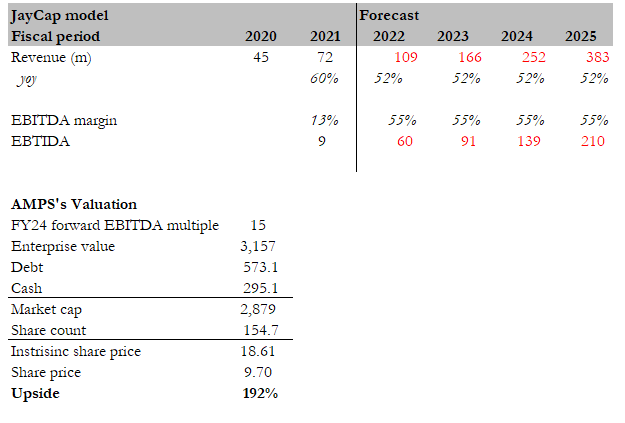

My model suggests that AMPS has the potential to roughly 2x from the current share price. This is based on consistent high growth rates, constant margins, and no change in valuation multiples. Below are the key assumptions:

- The revenue base is still relatively small when compared to the TAM

- AMPS’s competitive advantage should enable it to sustain high growth rates

- FY22 growth rate is based on management’s guidance (calculated from guided EBITDA dollar and margin)

- EBITDA margin could improve, but it is difficult for anyone to pinpoint any exact figure, hence I assumed it to be flat moving forward. Any margin increase is definitely a plus for investors

Using these assumptions, AMPS could be worth 2x more than its current share price of 9.70.

Author’s estimates

Red flags

Industry filled with competitors

There is intense competition and rapid technological advancement in the solar and energy industries, both in the US and globally. Competitors will always look for an edge over others that are in the market, and as such, these people may provide energy at a lower cost than AMPS does. Some of these competitors have also made their mark on the industry and are widely recognized. The failure of AMPS to meet up with the competition will definitely affect the business adversely.

Industry characterized by rapid technological changes

The continuous technological changes in batteries and other EV technologies could adversely affect their business. They will need to upgrade their charging stations as EV technology is changing and also introduce new products and services so that they will be able to serve vehicles that have the latest technology, some of which may cost a fortune. If they are not able to meet their customers’ demands or if they are not meeting the demands fast enough, their relationship with their customers may be damaged.

Business concentration risk

Most of AMPS’s total installations are in Massachusetts, New Jersey, Minnesota, and Hawaii. If there are negative changes in these places’ economies or weather, AMPS might suffer a considerable amount of loss.

Conclusion

I think AMPS has the potential to 2x from its current share price. From all indications, AMPS has created a sustainable way of generating electricity. An investor needs to invest in a business that is not just in a thriving industry but one that is also doing well in a thriving industry, in my opinion. More importantly, AMPS has long-term customers that continue to keep the business afloat.

Be the first to comment