weerapatkiatdumrong/iStock via Getty Images

When we last covered Altria Group Inc. (NYSE:MO) we suggested that the fair value for this stock was lower, and investors would do well to play it defensively.

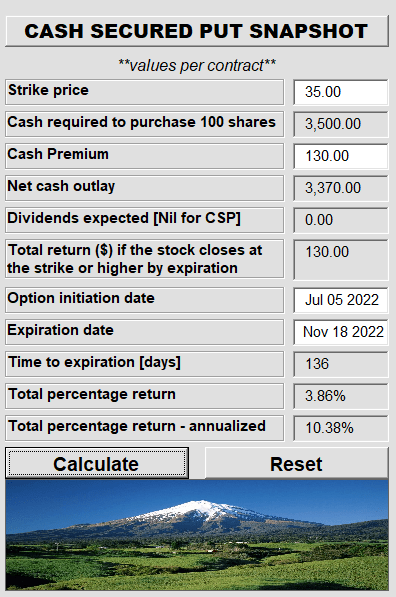

This should be valued with a terminal value of $0 in 7-10 years and investors should use a discounted cash flow analysis to figure out what price makes sense. For us, it is currently $35-$37.50 and that number will only trend lower over time. We did trade this in our marketplace portfolio and sold the $35.00 Cash Secured Puts.

Source: The 3 Certainties In Life

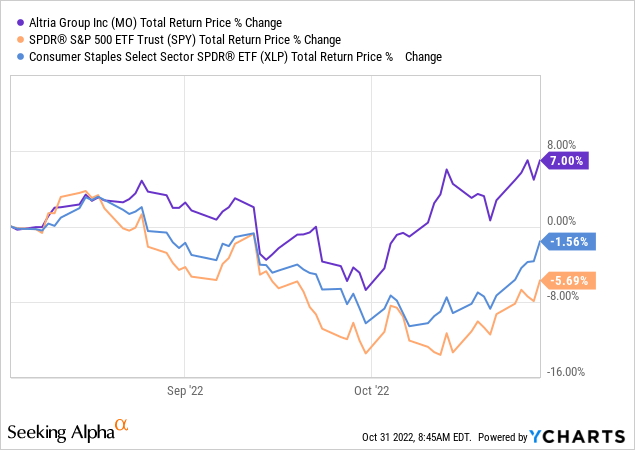

Altria has actually done a bit better than what we envisioned and outperformed both the S&P 500 (SPY) and the consumer staples index (XLP).

Of course our cash secured puts did pretty well too, and with less than 20% of the volatility of the common stock.

Author’s App

That is the big advantage of these option trades. They take the adrenaline out of the market and allow you to capture income with a higher level of confidence.

The Headwinds

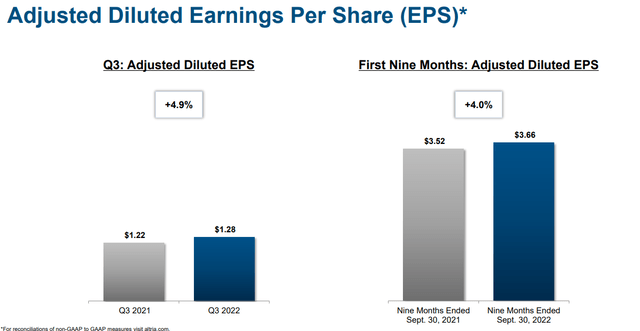

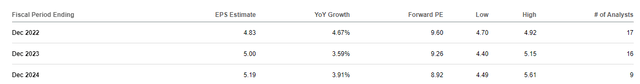

Altria’s EPS was slightly below estimates with a 2 cent, non-GAAP earnings miss. Revenue was more troublesome and came in $180 million below estimates. The company narrowed its EPS forecast for the year to $4.81 to $4.89 per share.

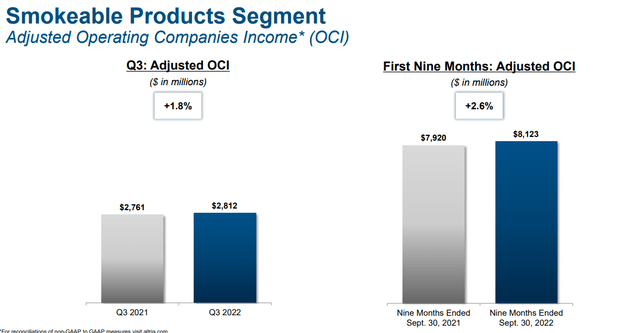

From the bull perspective, Altria is still churning out increased earnings per share.

Even in the face of strong inflationary pressures, Altria has actually increased its margins.

That is two for two for the company. Kudos.

From the bear cave, your longer term viability depends on your customers, and whether they are all dying to leave or just plain dying, it does not look good.

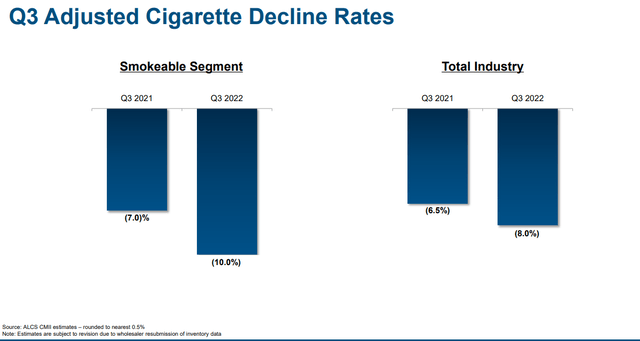

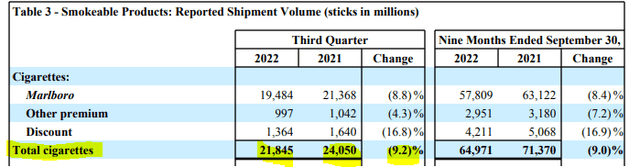

We have always been more pessimistic than consensus as to where decline rates would go and the numbers continue to come in even worse than what we have expected. Altria’s 10% adjusted decline rates were just an extraordinary hit to any bullish case. Total sticks sold were down to just 21.845 billion.

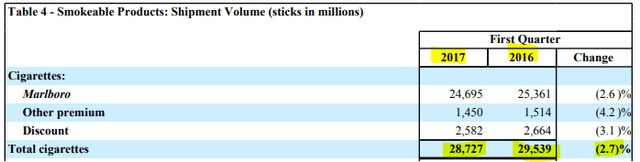

To be clear, this wasn’t always the norm. For example, in 2017, decline rates were just 2.7%.

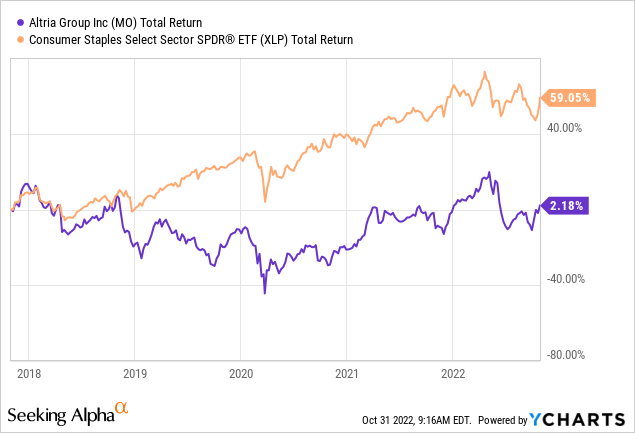

Assuming we have another year of 9-10% declines, we will have lost over one-third of stick volumes in the space of 7 years. Yes, through it all Altria has hiked prices like its life depended on it, and yes, earnings have grown. Both are reasons that we have stuck to a hold rating and never had a sell on this name. But those declines are also a reason why Altria’s total return (including those massive dividends) over the last 6 years has trailed that of XLP by a pretty wide margin.

Our conclusion at this point remains the same. A moment will come where price hikes will accelerate declines and that will only be apparent with hindsight. In fact, looking at the last 12-18 months suggests that we might actually be at that point or even past that point. We maintain a cautious outlook and bulls might suddenly be greeted to a few quarters where price hikes fail to actually offset volume declines. In that case the numbers below may look too optimistic.

Altria’s quarter also had important news from the Philip Morris (PM) partnership. In exchange for payments totaling $2.7 billion, Philip Morris International and Altria reached an agreement in which Altria would give up the sole right to market iQOS, PMI’s heated tobacco brand, in the United States starting in April 2024.

Altria and PM parting ways with respect to iQOS was not completely unexpected. Altria has already been paid $1 billion and will receive the final $1.7 billion by the beginning of the next year’s second half. Altria will likely invest somewhere near $0.5 billion to create its own heated tobacco brand. Starting this from scratch likely makes this harder for the company but the compensation it has received should soothe those wounds.

Finally, on the e-cigarette front, Altria’s entire investment in JUUL (JUUL) appears to be headed to zero. Not in a metaphorical sense, but in a literally goose egg equivalent. JUUL will likely file for its Chapter 11 soon. This validated our extremely early and accurate call (see JUUL Of Denial) that this acquisition was an incredible disaster. Altria redeveloping its e-cigarette capabilities will also drain cash flow and limit buybacks and dividend increases.

At June 30, 2022, the carrying value of Altria’s investment in JUUL was $450 million. We exercised our option to be released from our JUUL non-competition obligations on September 29, 2022, resulting in 1) the permanent termination of our non-competition obligations to JUUL, 2) the loss of our JUUL board designation rights (other than the right to appoint one independent director so long as our ownership continues to be at least 10%), our preemptive rights, our consent rights and certain other rights with respect to our investment in JUUL and 3) the conversion of our JUUL shares to single vote common stock, significantly reducing our voting power.

Source: Altria SEC Filing

Verdict

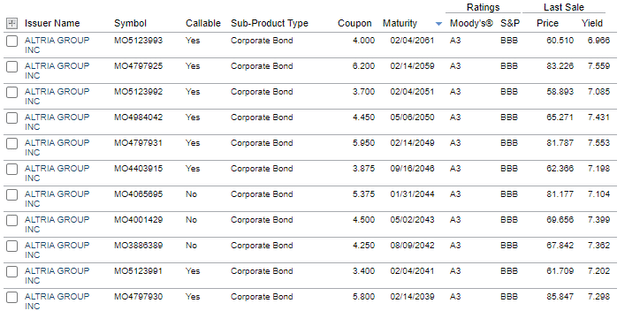

It is hard to find fault with the financial numbers Altria has produced this year. It is also hard to rest easy with the way its volumes keep falling. The new developments on iQOS will create more work for Altria down the line. We remain cautious and continue to think of this as a dangerous investment. Balancing that risk requires only buying at what offers an extraordinary margin of safety and for us that point currently remains at $35.00 per share. Investors who are comfortable in believing the longer-term viability of the firm can also consider the longer dated bonds.

We think covered calls or cash secured puts at lower strike prices are actually better and have handily outperformed the common shares since we started writing on it.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment