gorodenkoff/iStock via Getty Images

Software stocks, especially those that are not profitable, have suffered one of their worst downsides since the beginning of 2022 as it has become evident that the Federal Reserve would have to aggressively hike interest rates to address the high inflation problem. Also, recession risks starting to surface here and there did not help matters as investors increasingly sought the safety of lower valuation and dividend-paying stocks.

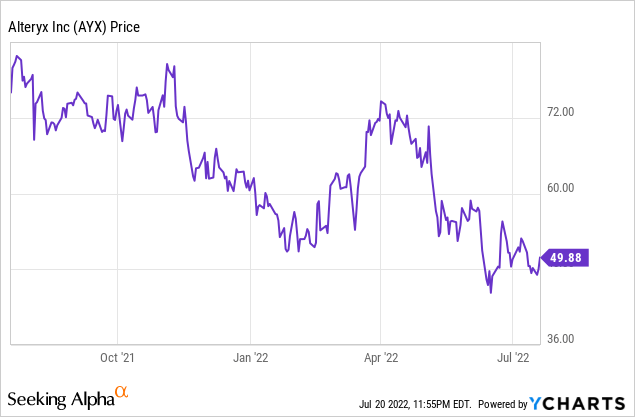

However, as seen by the episodic upsides enjoyed by Alteryx, Inc. (NYSE:AYX) in the chart below after its above-35% fall since July last year, investors are still buying the tech stock, which is flirting with that $50 level.

For them and others, I elaborate on factors that are likely to help a sustained upside in the share price, including achievement of profitable growth and the sustainability of the revenue model. Also, since we are living in highly uncertain times, there are also downside risks, too, and this is precisely the reason why a realistic overview of the business is needed.

Overview of the business

The company provides data analytics solutions. Using a platform-based and commoditized software approach. Alteryx has significantly reduced costs for companies. They now no longer need to invest capital buying expensive hardware and AI applications and incur operating expenses in financing teams of data scientists to manage complex systems as was the case previously, when analytics was within the reach of only some of the world’s largest corporations.

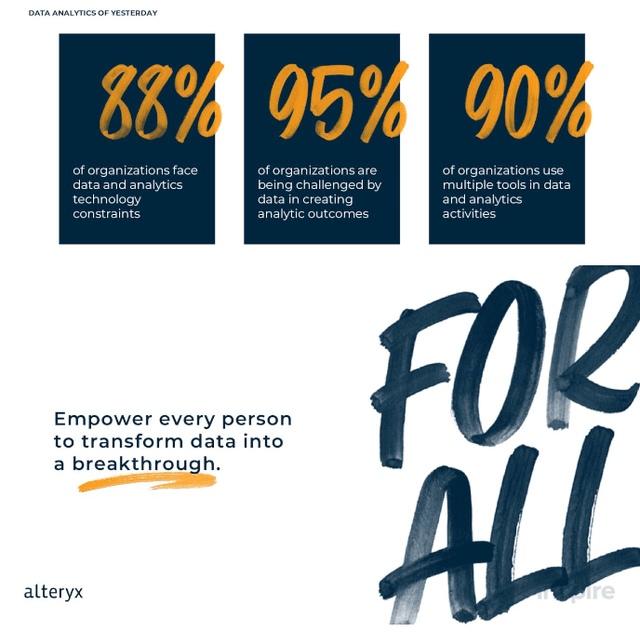

Moreover, as shown in the diagram below, most organizations face technological constraints which render the task of creating the right analytic outcome difficult, and those who manage to do so have to master multiple tools.

Company presentation (www.seekingalpha.com)

To address the issues, Alteryx’s “Analytics for All” aims to empower every office worker with the capability to transform data. The concept has found traction among beginners with employees with practically no knowledge about the field, to experts like data engineers, while not forgetting the normal business user wanting to generate data-driven reports in order to stay ahead of the competition. In so doing, the company has also been able to address challenges like integrating data from various sources in order to produce actionable insights for CEOs as well as combine information lying in the cloud and on-premises based on completely different technologies.

However, this does not mean that analytics now constitutes the same sort of “bread and butter” product as operational databases from Oracle (ORCL), for example.

The risks

Well, while it is true that analytics is used in decision-making for investments worth billions of dollars, the technology has less value than a database which enables the business to function in the first place, when things are viewed from the operational perspective. This is especially true in an economic slowdown or downturn when, faced with a tighter IT budget, a CFO is more likely to sacrifice value-adding analytics in favor of mission-critical database upgrades.

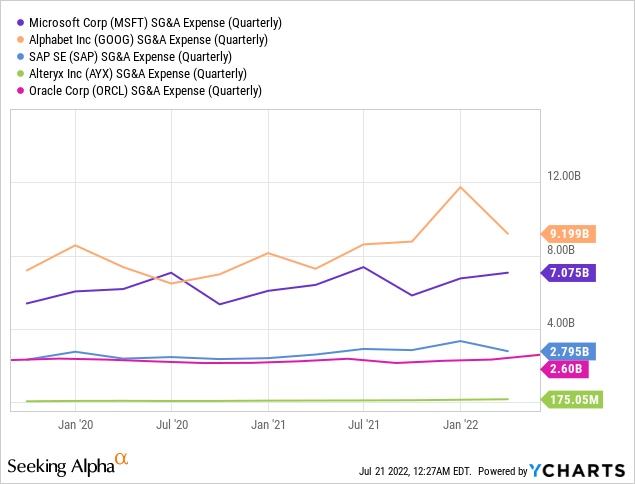

Furthermore, given the plentiful supply of cheap money and the fact that the software analytics industry does not come with high barriers to entry, there are many competitors. According to Gartner, some of the private companies are Tableau and Qlik. Bigger public ones are SAP SE (SAP) and Microsoft (MSFT). Looking further, there are also Google (GOOG, GOOGL) and Oracle with their analytics solutions which may not be similar to the ones proposed by Alteryx, but can nonetheless capture market share in the AI space using their much higher sales budgets. These costs normally form part of their SG&A expenses which dwarf Alteryx’s by 10 to 15 times as shown in the chart below.

Here, some will argue that the larger competitors have a diversified product portfolio and spend their marketing dollars not just to promote their analytics product offerings. My response to them is that marketing teams have a tendency to cross-sell whereby in the case of Oracle, for example, the sales team will not hesitate to propose the analytics add-on to a potential customer initially looking for a database solution.

This signifies that Alteryx operates in a highly competitive market which raises questions as to whether the pureplay analytics company is able to sustain spending and continue growing at 33%, or its year-on-year growth for the first quarter of 2022. Furthermore, considering that the Fed Reserve is tightening the money supply and borrowing costs are rising, this also creates doubts in the minds of investors as to the chances of becoming profitable one day.

Assessing the Profitable Growth Trajectory

First, one of the metrics investors use to gauge software companies is growth, and the higher this turns out to be, the more valued is the stock. Second, with rising wage inflation amid a tight labor market especially for IT skills, one of the questions which have been raised is whether tech plays will be able to recruit enough personnel to continue on driving higher quarterly revenues. Third, as for profitability, the issue can become whether they can hire employees at reasonable costs without significantly impacting margins.

To obtain answers to these questions, I consider the fact that big techs like Microsoft, Google, Apple (AAPL), and Amazon (AMZN) have decided to reduce hiring this year. This, as well as similar actions by private companies, has played to the advantage of the company according to Alteryx’s President and Chief Revenue Officer. Thus, she sees a larger talent pool to choose from in order to drive the company’s sales. This also augurs well for profitability, as it ultimately means that the IT labor market is not so tight as at the beginning of 2022 and smaller companies like Alteryx do not have to woo job seekers with high salaries to join them. This also plays favorably for staff costs as there is no need to pay perks in order to retain talent.

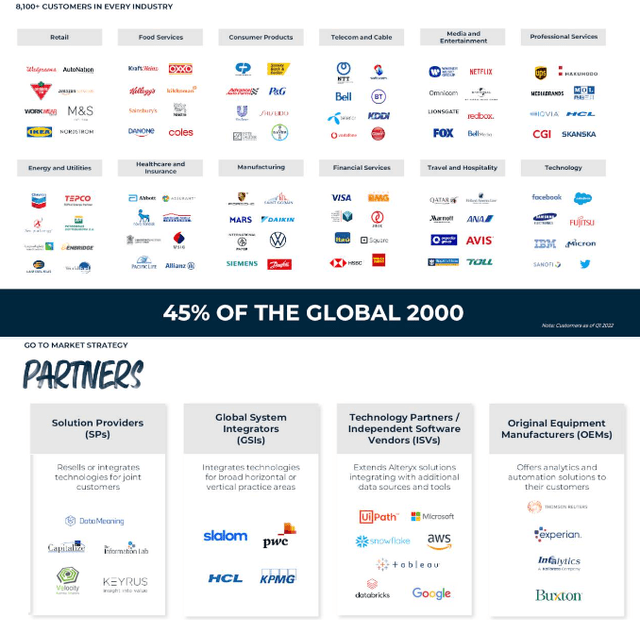

Furthermore, for Alteryx, which does not have the scale of Microsoft, one of the ways to address the huge market without necessarily recruiting thousands of salesman is to use a partnership strategy. While some part of the revenue has to be shared with the partner, this represents a more cost-effective way to market the product and is aligned with the strategy to seek more profitable growth.

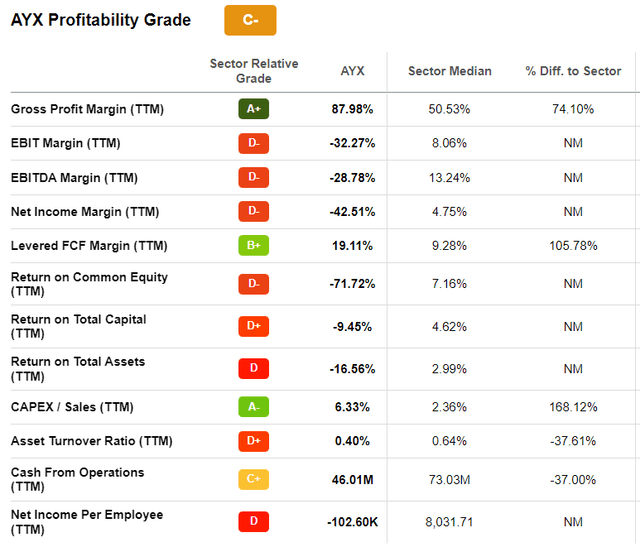

Therefore, the ingredients are there for more profitable growth and improvement of the EBIDTA margins which remains well below the sector median. Conversely, having such high gross margins will certainly help in the path to becoming more profitable.

Profitability Grade (www.seekingalpha.com)

Another factor that can help Alteryx to achieve more profits is the business category served together with ARR (annual recurring revenues).

In this respect, the company’s strategy to lay emphasis on the part of the market with the highest TAM (total addressable market) led it to target the “Global 2000” which is a list compiled by Forbes including the world’s top 2000 publicly listed companies weighted according to market cap, sales, profit, and assets held. Interestingly, Alteryx has already enlisted 45% of these as customers and is actively working to include the rest.

Coming to recurring revenues, a noteworthy point is that after the initial adoption of its analytics solutions, the after-sales team relentlessly follows up with customers to ensure continued utilization and, eventually, renewals of licenses. In this way, ARR increased by 33% in 2021 and the first quarter of 2022 respectively.

Company presentation (www.seekingalpha.com)

I find that the ARR metric is better than just focusing on multi-year contracts alone. The reason is that it not only includes subscription costs on a yearly basis but also additional revenues obtained from add-ons or upgrades. Equally important ARR also accounts for losses from cancellations.

Discussion and key takeaways

Another recent development that should increase sales is the introduction of the Enterprise License Agreement (“ELA”) in the second half of 2021 which basically gives clients access to the full product portfolio and also encourages them to consume more. This venture is actually proving to work with adoption being motivated by some of Alteryx’s products which enable companies to save on costs, “to the tune of millions of dollars by creating real-time analytics for their sales and accounting teams.” This becomes an attractive proposition during high inflation.

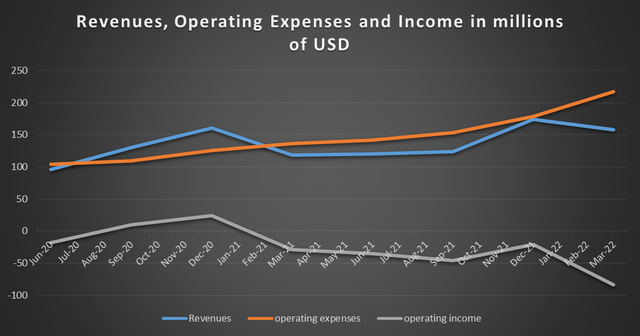

At the same time, deeper penetration into the Global 2000 customer base implies more efficient customer acquisition, which is positive for Alteryx’s margins. Consequently, as seen in the blue chart below, in case of revenues increase above the $150 million range and operating expenses (orange chart) fall below the $200 million, the company could turn in positive operating income, as in the December 2020 quarter.

Table built using data from (www.seekingalpha.com)

For this purpose, the CEO, without giving an exact time frame expects profitability and free cash flow margins in the 22%-25% and 20-25% ranges respectively. For investors, the company has enjoyed a sustained rise in free cash flow during the last four quarters.

As for valuations, despite falling by more than 35% in one year and at a price to trailing sales ratio of 5.63x, the company remains overvalued with respect to the sector median, but, with an RSI of less than 50, it is momentum factors related mostly to analysts’ upgrades which are driving up Alteryx’s shares instead of fundamentals.

Finally, with several factors pointing to profitable growth, this is a stock to watch out for when second-quarter results are announced in August, but with no exact time frame as to when positive income will be obtained, I maintain a hold on the stock.

Be the first to comment