Justin Sullivan

Thesis

Sundar Pichai’s career path is nothing short of a miracle. The CEO of Alphabet Inc. (NASDAQ:GOOG) majored in something as far removed from searching engine as you can imagine – metallurgical engineering. He then continued to study material science in graduate school at Stanford University and graduated in 1995. Then in the next 20 years, he will not only stage a miraculous transition from material science to software engineering but also became the CEO of GOOG in 2015.

Such a meteoric rise is only fitting given the role he played at GOOG. Back in the earlier days (2014 and before), GOOG’s search business was actually quite vulnerable. It was Pichai who led the efforts for a suite of products, notably Google Chrome, the Chrome OS, Gmail, Google Maps, and later the Android OS to provide a wide moat surrounding the search business (and filled it with lots of crocodiles too in Buffett’s language).

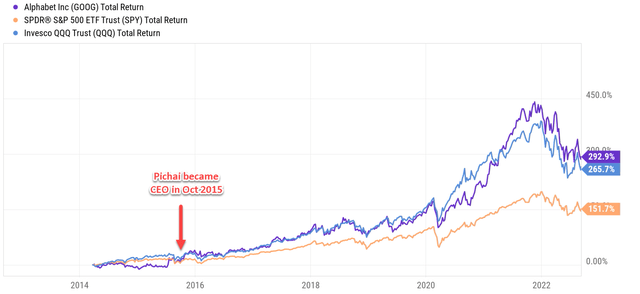

These innovations provided GOOG shareholders with spectacular returns as you can see from the following chart. Pichai was appointed to succeed Larry Page in Aug 2015, and he officially took office in October 2015. BTW, the formation of Alphabet Inc was also completed around that time. To wit, GOOG stock has delivered a total return of more than 292% since he took office, leading the overall tech sector (represented by the QQQ fund) by more than 27% and almost doubling the 151% total return from the S&P 500. Later, you will see GOOG’s performance (or the outperformance) is even more impressive when judged by the so-called Buffett’s $1 test in the next section.

Going forward, he will be facing a series of new challenges ranging from the shifting landscape of digital ad to the disruption of new social network entrants. And the main thesis here is to argue that Google is well-positioned to navigate these challenges and keep delivering its outperformance.

Sundar Pichai’s scorecard

Many SA articles (including some of my own) have already examined the various strengths of GOOG, ranging from its technological lead to its financial strength. Here I will add more one consideration: the effectiveness of its executive. As mentioned above, Sundar Pichai has been an extremely effective and visionary executive in my opinion. Putting subjective opinions aside, here let’s apply Buffett’s subjective $1 test on Sundar Pichai. The $1 test was promoted by Buffett himself and the gist is summarized in his 1984 shareholder letter (the highlighted was added by me):

“Unrestricted earnings should be retained only when there is a reasonable prospect – backed preferably by historical evidence or, when appropriate, by a thoughtful analysis of the future – that for every dollar retained by the corporation, at least one dollar of market value will be created for owners. This will happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors.”

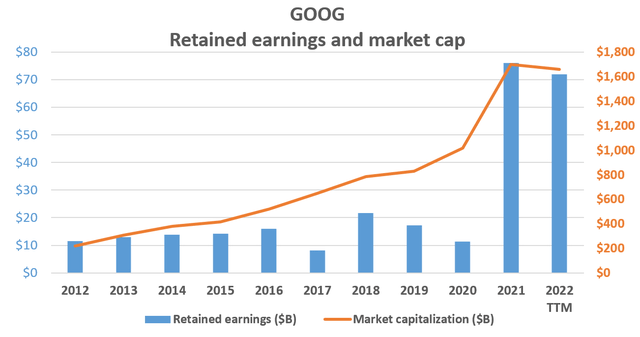

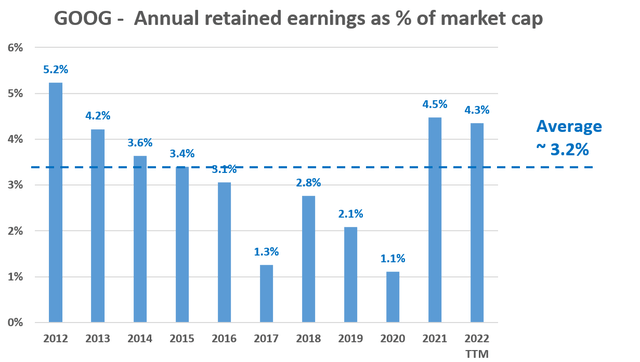

The first chart below shows the annual market cap (“MC”) of GOOG and the amount of retained earnings since 2012. Note I applied a 5-year average in the second chart to even out YoY noises. And the second chart shows the same information in relative terms, i.e., the annual retained earnings as a percentage of the average MC during a given year. As seen, GOOG has been retaining an enormous amount of earnings, actually, all of its earnings since it has not paid any dividends (yet). The retained earnings have been in the range of $10 to $20B per year in the past and skyrocketed to above $70 in 2021.

In relative terms, the annual retained earnings have been on average 3.2% of the average market capitalization. In other words, even if the business has been just hoarding cash under the mattress and earns no additional profit from the retained earnings at all, its market capitalization should grow on average by about 3.2% a year. If not, management must have done something even dumber than hoarding cash to squander the retained earnings, which of course, is not the case here for Sundar Pichai. GOOG’s market cap rose by almost 4-fold since Pichai became CEO, rising from about $416B in 2015 to the current level of $1.66T. Such return translates into a CAGR of 22%, almost 5.8x higher than the average retaining rate of 3.2%.

Source: Author based on Seeking Alpha data Source: Author based on Seeking Alpha data

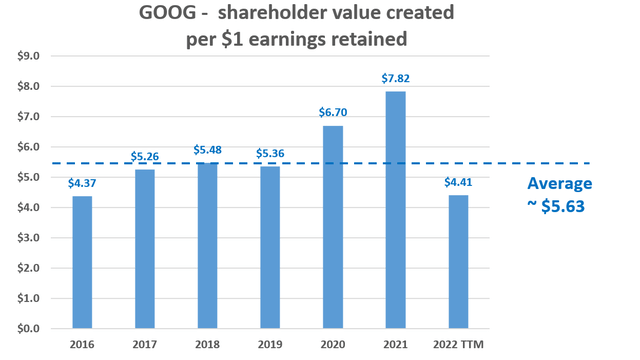

So obviously, Sundar Pichai has passed the $1 test with flying colors. And the next chart shows his scorecard more directly and visually. The business has created an average of $5.63 of MC for every dollar retained even with the large corrections suffered so far in 2022 included. Before this large correction, his score is even more impressive: he managed to deliver more on average more than $6.7 of shareholder returns per dollar retained in 2020 and more than $7.8 in 2021.

And next, we will see the challenges and opportunities that lie ahead for him and GOOG.

Source: Author based on Seeking Alpha data

The Digital Ad Triopoly

Looking forward, first, there are headwinds for its core digital ad business.

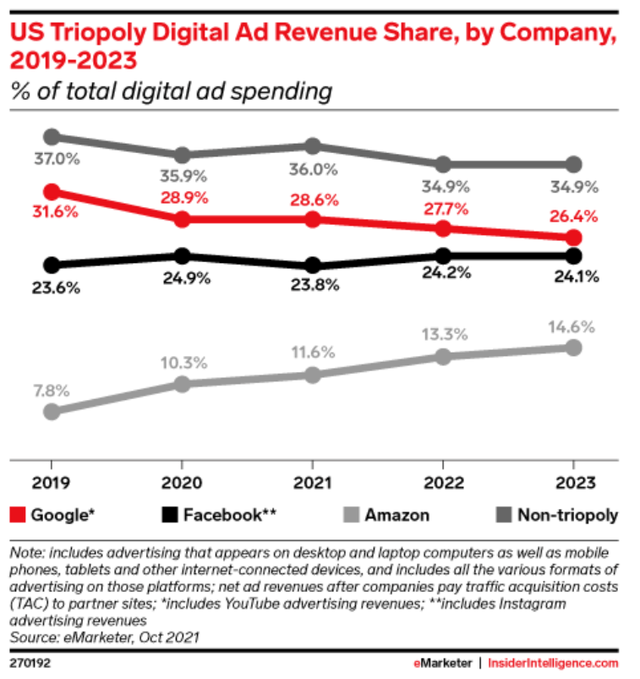

Digital advertising has been dominated by a triopoly consisting of GOOG, Meta Platforms (META), and also Amazon (AMZN). Currently, GOOG and META are the top two leaders and raked in 52.4% of digital ad revenue in 2021 as shown in the chart below, more than half of the total market. Then AMZN claimed another 11.6% of the pie, and the rest of the players competed for the remaining 36%. However, GOOG’s leading position is under pressure as seen. Its market share is projected to decline by 0.9% in 2022 and by another 1.3% in 2023. AMZN is projected to grab these shares as both META and others’ market shares are projected to largely stay flat.

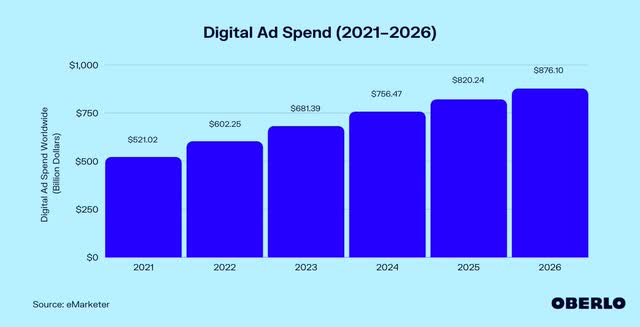

However, there is an unstoppable secular shift toward digital advertising and I do not think GOOG investors need to panic. First, GOOG is still a leader in this space and the projection may be too pessimistic about GOOG. Second, the world of advertising is moving toward digital advertising and the overall size of the pie would be growing. The year 2022 is likely to be a turning point in this transition. According to an eMarketer projection, 2022 probably would mark the first time that digital ad expenditure will surpass conventional ad spending. Furthermore, the report also predicts that by 2023, digital advertising spending will reach $681B and account for more than two-thirds of all media spending. The spending is projected to reach $876B in 2026 from the 2022 level of $602B, translating into a CAGR of 9.8%

The Short Video threat

In my mind, a bigger threat comes from elsewhere. As usual, what kills a successful business is not its immediate competitor, but a disruptive outsider. And the popularity and success of TikTok and the frenzy of short videos triggered by TikTok might be a more serious threat, for at least two fundamental reasons.

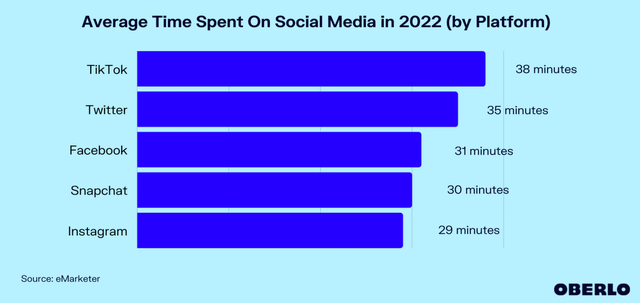

First, human attention is the ultimate limited resource. Everything else, energy, clean water, food, et al, history has shown that technological advancements always manage to find a way to produce more and enlarge the pie. But each of us only gets 24 hours of attention. If we spend more of it on short videos, we will have less to spend on other things such as YouTube or Gmail. And this seems to be the direction that the TikTok success has triggered. According to the latest data on time spent on social media provided by eMarketer, TikTok is grabbing the most of our attention in the U.S. U.S. users spent an average of 38 minutes a day on TikTok in 2022, followed by Twitter (35 minutes).

Second, short videos are intrinsically harder to monetize. There is no doubt that short videos cater to primeval human nature better than longer videos. They bring a more immediate dose of endorphin at quicker intervals. And instantaneous euphoria can be easily addictive.

Whether this is a good or bad thing is outside the scope of this article. But major platforms are already all rushing to enter the short video market. The list is long: Instagram’s Reels, Snapchat’s Spotlight, YouTube’s Shorts, and Netflix’s Fast Laughs, et al. I foresee a problem eventually developing as such trend continues, a monetization problem (again, ethical and health problems are outside the scope of this article here).

Ultimately, some degree of human concentration is required to appreciate content creation and eventually sell ads. As users’ attention becomes more and more fragmented and weakened by shorter and shorter videos, platforms, creators, and advertisers would all face the increasing difficulty of monetization.

Final thoughts and other risks

There are plenty of reasons to be optimistic about GOOG (as many other SA authors have already eloquently argued). And this article just added one more argument: Sundar Pichai. I see Sundar Pichai as an effective executive with extraordinary vision, management skills, and capital allocation savviness. Since he became CEO in 2015, he has passed the $1 test with flying colors and turned in a truly spectacular scorecard. Under his reign, GOOG has created an average of $5.63 of shareholder value for every dollar retained.

Going forward, Pichai will be facing a series of challenges, both old and new. And I am optimistic that Pichai will be able to lead Google through these challenges. Given Google’s leading position and wide moat, I am not too worried about the existing competition in the digital ad space. The rising popularity of short videos is a more concerning risk to me. And I am anxious and also intrigued to see how Pichai, and the executive of other platforms, evolve and respond. But here again, my view is that GOOG is better positioned given the dominance of its search business and its diverse revenue streams.

Besides the above longer-term risks, there are a few other risks in the near term too. It has been combating rising costs latterly, ranging from labor costs, general inflation, currency exchange headwinds, and also the rising TAC (Traffic Acquisition Costs). Also, it is very likely that there are some overcapacities to be digested in the near future after a long expansion cycle. Its headcount increased by 17% (or more than 23.9k) just over the past year alone. Pichai recently announced that he is looking for ways to enhance Google’s productivity by 20% and hinted that job reductions might be one of the options.

Be the first to comment