ipopba

Introduction

As a dividend growth investor, I constantly seek income-producing investments to supplement my passive income. Most of the time, I add to existing positions that I find attractive. On other occasions, I start a new position to diversify my portfolio further, increase my income and gain exposure to new segments. The current market volatility can provide an opportunity to acquire future income for lower prices.

My dividend growth portfolio lacks exposure to two main sectors: financials and information technology. Therefore, I will analyze more companies from these two sectors as they both suffered during the current downturn. I own banks, insurers, and asset managers in the financial industry. I will analyze a digital bank, Ally Financial (NYSE:ALLY), in this article.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Ally Financial, a digital financial services company, provides various digital financial products and services to consumer, commercial, and corporate customers primarily in the United States and Canada. It operates through four segments: Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations.

Fundamentals

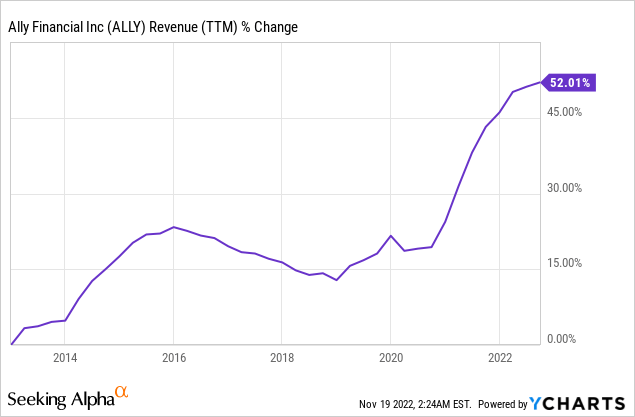

Sales of Ally Financial have increased by more than 50% over the last decade. Most of the sales come from its financing operations. The low-interest rates environment over the last decade and the increasing need to finance new purchases by the public supported the company’s growth pattern. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Ally Financial to keep growing sales at an annual rate of 2.5% in the medium term as it has to deal with slower growth due to higher rates.

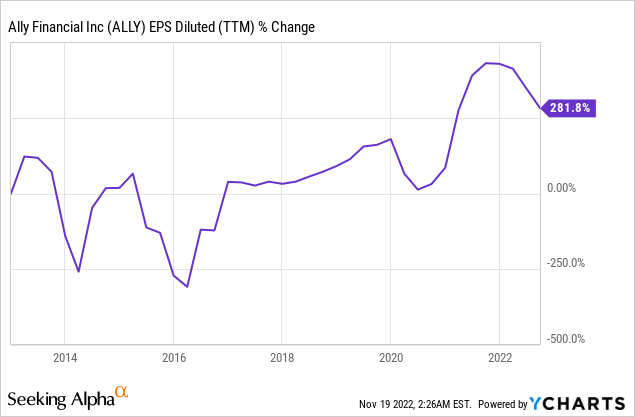

The EPS (earnings per share) has grown much faster during that decade. EPS has almost quadrupled during that decade as the company could raise money cheaply, offer low interest on deposits, and enjoy a high margin on its loans. A lower share count, higher sales, and higher margins led to fast growth. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Ally Financial to suffer from lower EPS before stabilizing in 2024 as the company has to deal with higher rates and possibly a recession with higher charge-offs. Even under that scenario, the projected EPS for 2023, which stands at $4.49, will be higher than the 2019 and 2020 EPS.

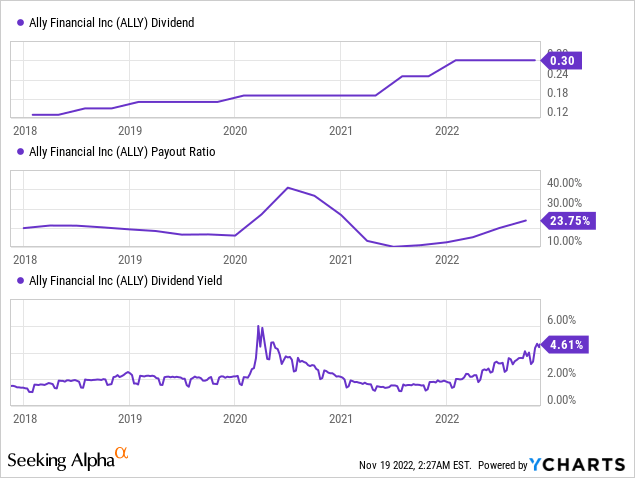

Ally Financial is a new dividend payer. It lacks a long track record as it only raised its payout for five consecutive years. However, the payment looks relatively safe, with a payout ratio of 24%. Moreover, the dividend yield is attractive due to the current extremely low valuation, and investors can enjoy a 4.61% yield. However, due to the current business environment and increasing rates, investors should expect low dividend increases as the company strives to preserve more capital than needed regulations.

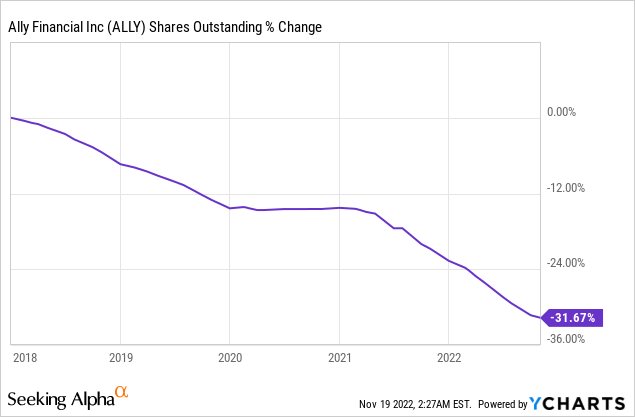

Another form of returning capital to shareholders is share repurchase. Over the last five years, Ally Financial has repurchased more than 30% of its outstanding share. Buybacks support EPS growth and are highly efficient when the company grows, as they unlock even faster growth leading to higher dividend growth. If the company trades for such a valuation, buybacks will be very efficient.

Valuation

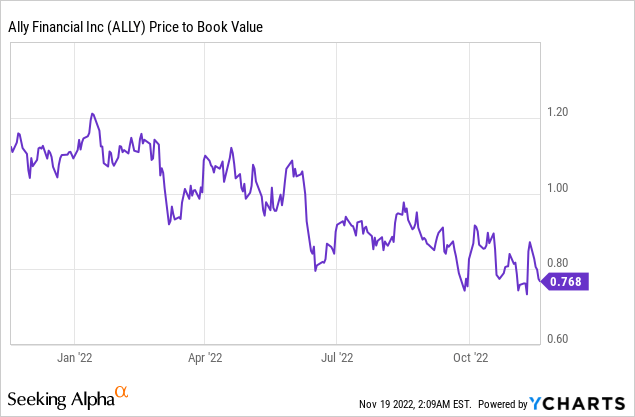

The P/B (price to book value) ratio has decreased significantly over the last twelve months. At the beginning of the year, shares of Ally Financial traded for roughly their book value. However, as we saw interest rates rising and the risk of a recession increased, the valuation contracted. The shares are trading for an almost 25% discount to book value. Investors expect challenging times ahead, and therefore there is a discount.

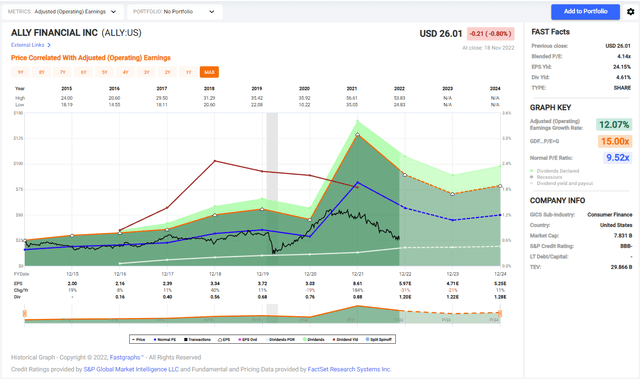

Looking at the graph below from Fastgraphs, we see that Ally Financial is attractively valued compared to its past valuation. Since the IPO in 2014, the average P/E ratio has been 9.5, and the current P/E ratio is more than 50% lower at 4.1. Therefore, some significant discount is derived from investors’ concern with its performance during the recession and high-interest rates.

To conclude, Ally Financial is a solid company. A track record of sales and EPS growth allows the company to pay increasing dividends and buy more shares. The valuation is attractive as investors are scared that the higher rates will affect the company more significantly than other financial institutions. They believe that the risk is high. Thus the potential seems high as well.

Opportunities

The company’s first growth opportunity is the growth of its Ally Bank business. The bank has total deposits of $146 billion, up $6.3 billion YoY, and it manages to increase the number of its retail customers. This is an important long-term opportunity as these deposits will be used for future loans. Ally Financial now has access to cheap capital that will allow fast growth in the future.

Ally Financial is fully digital, which has several advantages as we advance. It appeals to the younger generation and can roll out new products faster. The usage of data allows the bank to customize offerings to different clients better, and it also allows the bank to save significant amounts of money on staff, rent, etc., and be a very lean and efficient financial institution.

The company has proved that it can execute well even during times of uncertainty. This financial institution has been around for over 100 years, and therefore, it has dealt with significant challenges, including times of high inflation and high unemployment. With the current margin of safety due to the low valuation, there seems to be a medium-term opportunity for valuation expansion if the market becomes less concerned.

Risks

Interest rates are increasing, and it poses a risk for Ally Financial. On the one hand, the company has to offer higher rates to those who deposit their money in the bank. On the other hand, since the rates it charges on its loans are already higher than average, increasing them more may lower the number of future customers seeking a loan. Some possible clients may prefer to delay their purchases.

Another risk is the recession that may or may not come due to the higher rates. While the rates may make new loans less attractive, a recession will make it harder for Ally Financial to profit from its current portfolio. As unemployment ticks higher during recessions, there is a growing risk for charge-offs, and the company will lose money on an increasing part of its portfolio.

This risk is especially relevant to Ally Financial as it targets challenging customers. The company targets clients with lower credit scores to charge higher interest rates. Therefore, these clients will be the first to suffer from the weakening economy, especially during a recession. Therefore, the client profile is also a risk if the weakness in the economy is here to stay.

Conclusions

Ally Financial is a High-risk, high-reward play in the stock market. The company has strong fundamentals with sales and EPS growth. It also has been rewarding shareholders for several years. However, the company is in the risky business of high-interest loans, and it may become harder to grow during recessions. Therefore, investors should consider that both the upside and downside are substantial here.

Since there is such a gap between the positive and the negative scenarios, this investment is unsuitable for every dividend growth investor. Most dividend growth investors seek stability and a growing consistent dividend stream. Ally Financial has a different risk profile. Thus there is more room for volatility. It should fit dividend growth investors with a higher appetite for risk.

Be the first to comment