Bastiaan Slabbers

The Walt Disney Company’s (NYSE:DIS) monthlong rally has been sustained after the company reported F3Q22 results that beat analyst estimates and demonstrated resilience across both its “Disney Parks, Experiences and Products” (“DPEP”) and “Disney Media and Entertainment Distribution” (“DMED”) businesses despite a slowing consumer end-market. Consolidated revenue came in at $21.5 billion (+26% y/y; +12% q/q), and outperformed the average consensus estimate of $21.0 billion. EPS came in at $1.09, also outperforming the average consensus estimate of $0.97.

Heading into the company’s latest earnings, investors were largely concerned about whether tightening household budgets amid an inflationary environment has slowed demand for its growing direct-to-consumer streaming services, particularly Disney+, and impacted visitor volumes and spending at its theme parks, thwarting a post-pandemic recovery – especially during the popular spring (F3Q22) and summer months (F4Q22). Yet, results released today reinforced investors’ confidence that Disney’s operations remain healthily positioned to weather the near-term economic uncertainties.

Specifically, visitor volumes and spending at its theme parks continued to recover towards pre-pandemic levels, offset by previously anticipated losses from Hong Kong Disneyland and Shanghai Disneyland closures during the June quarter due to COVID disruptions. With all parks having reopened as of late June, the company expects visitor volumes and spending to gradually progress toward pre-pandemic growth rates, given continued strength in consumer spending on travel and leisure services coming out of the pandemic.

Disney also reported continued double-digit YOY subscription growth across its streaming platforms, with Disney+ take-rates gaining sustained momentum as availability expands further to new regions during the fiscal third quarter and through the remainder of calendar 2022. The company is also making progress towards the initial roll-out of an ad-supported tier for Disney+ in the U.S. later this year and internationally beginning next year to better penetrate streaming demand.

The following analysis will zero-in on recent developments at Disney+, a critical driver of renewed growth for Disney’s sprawling media and entertainment business, as well as the implications of near-term macro headwinds and industry challenges facing the platform’s long-term goals of reaching 230 million to 260 million paid subscribers and achieving profitability, by 2024. Specifically, we will dive into: 1) the viability of Disney+’s 2024 subscription growth target; 2) the implications of introducing an ad-supported tier for Disney+; and 3) operational challenges in India given Disney+ Hotstar’s recent loss of streaming rights for the Indian Premier League (“IPL”).

Considering Disney+’s positive showing during the fiscal third quarter we remain confident in the Disney stock’s general bullish thesis built on expectations of renewed growth from its rapidly expanding direct-to-consumer (“D2C”) business.

Subscription Growth

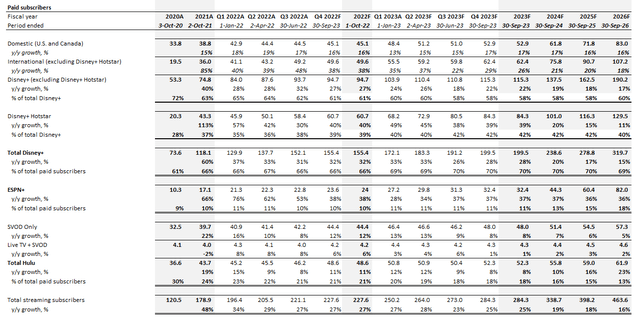

Disney added 15.6 million paid subscribers in F3Q22 across its portfolio of D2C streaming platforms spanning Disney+, ESPN+ and Hulu. Specifically, global Disney+ added 14.6 million paid subscribers and ended the period with more than 152.1 million sign-ups, up 31% y/y and 10%, buoyed by robust demand observed across all of North America (+17% YOY; +0% q/q)), India (Disney+ Hotstar +30% YOY; +17% q/q) and international regions (ex-Hotstar +48% YOY; +14% q/q).

With the roll-out of an ad-supported tier later this year in December, alongside continued expansion of Disney+’s availability to new regions, the streaming platform is progressing positively towards management’s long-term goals for 230 million to 260 million paid subscribers by 2024 – which represents an incremental add of at least 9 million sign-ups over the next nine fiscal quarters – as well as profitability within the same period.

Ad-Supported Disney+

We view Disney+’s upcoming introduction of an ad-supported tier to be a core driver of accelerated demand for the service, as it appeals to a new cohort of budget-conscious consumers. The roll-out also comes at an opportune time, given today’s macro climate where disposable income is low and competition is increasing.

While Disney has yet to disclose details on pricing for the new ad-supported offering on Disney+, the streaming platform is expected to benefit from a higher average revenue per user (“ARPU”) as a result of the roll-out, with lower pricing being compensated by higher uptake volumes over time – a broad-based trend experienced by both rival streaming services and Disney’s other streaming platforms that currently offer ad-supported tiers. Ad-enabled sign-ups represent more than half of rival streamers’ (including Disney-owned Hulu) subscription bases, underscoring how the additional offering will further Disney+’s market share within the growing, yet increasingly saturated, streaming business. Today, Disney+ represents about a fifth of the D2C streaming market in North America alone with its subscriber base of about 45 million in the region, rapidly catching up to market leader Netflix’s (NFLX) 73 million (and declining) subscription count.

In addition to a top-line advantage, Disney+ is expected to benefit from a bottom-line advantage in the roll-out of its ad-supported option compared to peers like Netflix that is currently preparing for a similar undertaking. The company plans to leverage its past experience in the successful implementation and roll-out of ad-supported options on Hulu and ESPN+ to fast-track the introduction of Disney+’s equivalent. Disney will also be maximizing returns on existing technology investments by building Disney+’s new offering on the existing tech stack used for facilitating ad capabilities on Hulu and ESPN+.

Overseas Expansion

In order to achieve the long-term subscription growth target for Disney+, the streaming service has forged ahead with its aggressive globalization plan, gaining further exposure to growing opportunities in streaming. Disney+ is likely to have successfully expanded to the “53 new markets across Europe, Africa and West Asia” during the fiscal third quarter as guided in Disney’s previous earnings call, given the impressive results on net paid subscription adds during the period:

Higher subscription revenue was due to subscriber growth and increases in retail pricing, partially offset by an unfavorable foreign exchange impact. The increase in subscriber as well as in technology and marketing costs reflected growth in existing markets and, to a lesser extent, expansion to new markets.

Source: The Walt Disney Company F3Q22 Press Release.

While this strategy bodes favorably for the streaming platform’s long-term subscription growth target, it is important to acknowledge that the global streaming landscape is becoming increasingly crowded. This means volume growth in new regions might come in moderation, especially considering Disney+ efforts in ramping up overseas availability have just missed out on the wave of pandemic-driven demand.

However, Disney+’s anticipated roll-out of an ad-supported tier in international markets beginning next year, as well as the value proposition it delivers via quality local original titles and world-class branded content remain differentiating factors that are expected to “attract new subscribers and drive engagement.” There are currently more than “500 local original titles in various stages of development and production, [with] 180 of those titles slated to premier this fiscal year, increasing to over 300 international originals per year in steady state” to facilitate continued market share acquisition efforts across Disney’s broader D2C business over the longer-term.

Cannibalization Risks

While some have raised concerns about whether continued Disney+ growth will cannibalize demand on Disney’s other D2C streaming platforms (ESPN+ and Hulu), the differentiated content offered across the services is expected to broaden Disney’s reach by catering to different consumer preferences instead. This accordingly allows Disney to take effective advantage of price discrimination by appealing to varying consumer budgets (e.g., ad-supported and ad-free tiers) across its diverse portfolio of D2C streaming platforms, and further its market share.

The positive expectation is corroborated by Disney+ steady pricing gains observed in the fiscal third quarter. Demand has remained resilient despite recent price increases. With the service increasing the monthly charge on its ad-free option further to $11 (currently ~$8 a month) later this year upon introduction of a cheaper ad-supported tier, we expect the availability of choices for different consumer budgets and content preferences will continue to support ARPU growth for the service.

Subscription Growth Forecast

Based on the foregoing analysis, our base case forecast expects Disney’s portfolio of D2C streaming services to track favorably towards the addition of close to 50 million new paid subscribers in the current fiscal year. New paid subscriber adds will be primarily from Disney+, buoyed by key growth drivers that include the roll-out of an ad-supported tier later in the year, introduction of new exclusive content, and continued expansion of availability to new markets overseas as discussed.

And over the longer term, we expect total paid subscribers at Disney+ to reach the low-mid range of management’s target at approximately 238 million by the end of fiscal 2024. Related growth assumptions applied consider the streaming service’s long-term growth strategies and associated market trends discussed, as well as the service’s historical take-rates.

Disney+ Subscription Forecast (Author)

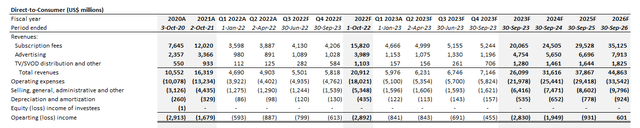

Advertising Revenues

While the addition of an ad-supported tier to Disney+ will likely drive subscription revenue growth and market share gains in streaming, Disney’s D2C ad revenues will inevitably take a hit amid ongoing uncertainties to the global economic outlook given the advertising industry’s cyclical nature. Leading media intelligence MAGNA Global has trimmed its prediction on global ad spending growth this year from 12% to 9% amid growing risks of a structural economic downturn later this year. This compares to global ad spending growth of +23% year-on-year in 2021 (U.S. +26% YOY), buoyed by a brief stint of post-pandemic economic recovery.

Market’s anticipation for a slowdown in advertiser demand is consistent with management’s caution of related headwinds during recent earnings calls. Ad sales have consistently represented more than 15% of Disney’s consolidated revenues over the past 12 months, or about of fifth of total D2C revenues, underscoring the company’s meaningful exposure to the industry’s near-term slowdown.

However, Disney’s diverse ad distribution channels, ranging from theatrical to linear TV to D2C streaming, are expected to help offset some of the related headwinds. As mentioned in the earlier section, Disney’s D2C platforms collectively command a meaningful share (~25% Disney+ and Hulu in the U.S.) of streaming viewership that is consistently growing in tandem with its subscription base expansion.

While Disney+’s ad-supported tier roll-out later this year coincides with a tough industry backdrop, the platform’s growing reach is expected to benefit from accelerating demand for streaming ads over the longer-term still. Internet advertising is expected to advance at a compounded annual growth rate (“CAGR”) of more than 8%, driven by accelerated online data consumption in coming years. Specifically, video streaming platforms are now home to about 23% of total ad spend in the U.S. And the figure is expected to expand further alongside the ongoing transition in consumer preferences from linear TV to on-demand streaming, which accordingly sets a strong base for Disney+’s launch of its ad-supported tier later this year.

Admittedly, there is a risk that ad revenues for Disney+ and Disney’s broader D2C segment this year will be softer than expected due to the looming economic downturn. However, the ad-supported tier at Disney+ is expected to attract a greater volume of consumer sign-ups, potentially offsetting the near-term weakness in related ad revenues with higher subscription sales.

Disney D2C Financial Forecast (Author)

Disney_-_Forecasted_D2C_Financial_Information.pdf

Author’s Note: Above F3Q22 figures are projections given actuals have not yet been released.

Disney+ Hotstar

Outside of external macro challenges to Disney+’s subscription and ad sales in the near term, the streaming business is also dealing with a potential internal challenge to subscription growth after its India-focused service, “Disney+ Hotstar,” lost streaming rights to IPL cricket matches.

Disney+ Hotstar currently accounts for close to 40% (~58 million paid subscribers) of global Disney+ subscriptions, and is the fastest-growing segment under the Disney+ umbrella, underscoring robust demand from the Indian market. And Disney+ Hotstar’s previous streaming rights to IPL cricket matches have been applauded for the platform’s success in India over the past few years – cricket goes beyond just a sport in India; it is an entertainment favorite among Indian households (if you have been to India, you would know that many household goods from cleaning products to chips are endorsed by cricket players, not just athletic wear). However, the region generates a significantly lower ARPU (less than $1 per month) when compared to other regions where Disney+ is available, which “makes it hard to justify the high yearly IPL rights fees” given annualized Disney+ Hotstar revenues of less than $500 million.

But now without the rights to stream cricket matches on Disney+ Hotstar, many are fearing that Disney+ may no longer be able to reach its long-term subscription growth target. When asked about the anticipated unfavorable impact to Disney+ Hotstar without the IPL streaming rights, CEO Bob Chapek remained confident in reaching the streaming platform’s long-term growth target, citing the platform’s success in diversifying its value proposition for the local market in recent years.

To validate Chapek’s bold statement, we have reached out to a few of our pals in India for their take on Disney+ Hotstar to better gauge the general demand sentiment for the platform. All of them have indicated that they are either subscribed to Disney+ Hotstar themselves, or know of family/friends that are signed up to the service. When asked if they think the lost streaming rights for IPL will impact Disney+ Hotstar take-rates, our peers have unanimously agreed that it will have an adverse impact, though nominal.

Specifically, they have pointed to the volume of local and international content released on Disney+ Hotstar that make it an enticing choice still, especially given the attractive price point. They have also pointed to Disney+ Hotstar’s particular appeal to the working class with steady income, considering streaming has become an increasingly popular choice since there is simply no time for catching up on scheduled series via cable TV.

For instance, one of our colleagues mentioned that everyone in the office had a subscription to Disney+ Hotstar when it released the eighth season of “Game of Thrones” prior to the pandemic, and cited this was the kind of value proposition that the platform continues to deliver, which justifies their subscriptions to the service. They have also added that Disney+ Hotstar offers a lot of local content that rival platforms like Netflix, which is more expensive, do not. Another thing they liked about Disney+ Hotstar is the volume of new content and films offered, which makes up for the lack of content available at local movie theatres that have only recently reopened after a tumultuous year for India in dealing with the pandemic. These added values have collectively broadened Disney+ Hotstar’s appeal to the local mass market.

And accordingly, we view this as the exact kind of value proposition that will help Disney+ Hotstar wean its reliance off of cricket over the longer term. The common theme we hear is that Disney+ Hotstar demand might mildly decelerate in the near term due to lost IPL streaming rights, but not decline. This is consistent with our subscription growth forecast for Disney+ discussed in the earlier section, which anticipates the mix of Disney+ Hotstar subscribers in global Disney+ to decrease over time – partially due to the anticipated acceleration in North America and International Disney+ take-rates from the addition of an ad-supported tier and continued globalization, as well as anticipated cricket-related impact, offset by quality content- and value-driven demand.

Key Takeaways on Disney+’s Outlook

Much of the Disney stock’s value today reflects market’s expectations on its media and entertainment business’ refreshed growth acceleration promised by its D2C business. Its ability in capitalizing on tailwinds stemming from the migration from linear TV to on-demand streaming over the longer term is also a critical focus area for investors, given the latter’s importance in compensating for the gradual slowdown in Disney’s legacy cable and broadcasting business.

For now, Disney’s expansive D2C business appears resilient in the face of mounting macro concerns and increasing competition, with its rapidly expanding Disney+ platform steadily gaining market share based on its latest results. This accordingly bolsters Disney’s ability in reaching its long-term expansion goals for the segment, a requirement for driving renewed growth for the consolidated business as consumer preferences in media and entertainment continue to evolve.

Be the first to comment