Lintao Zhang/Getty Images Entertainment

Investment Thesis

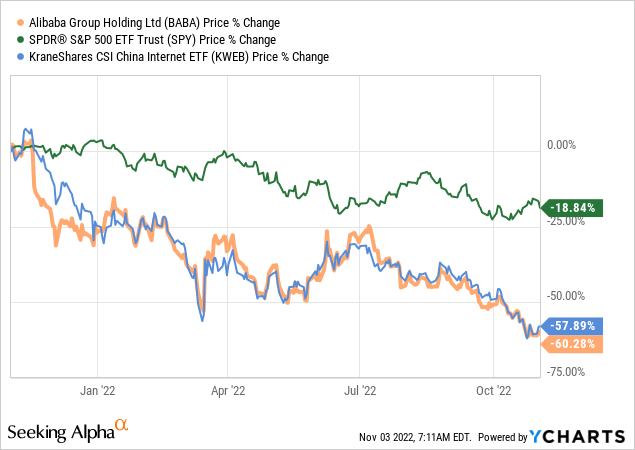

The neverending fiasco and drama from the western media goes on, and as we approach the end of the year, Wall Street is getting rid of China equities so as not to lose its clients.

Most investors and analysts tend to focus on fundamentals and view CCP as a value-destruction mechanism. Understandably, the Western media appears to be biased against China. Alibaba Group Holding Limited (NYSE:BABA) investors would be better off reading both sides of a story and comparing diligently and thoughtfully before jumping to conclusions.

BABA’s performance is tied to China’s economy, and any investor considering an investment in the company should prioritize understanding the political landscape, which directly affects the business. The analysis below explores the political arena, a vital part of BABA’s direction.

Chinese equities tumbled last week as investors overreacted to the unprecedented third-term reelection of Xi. Although BABA might not have bottomed yet, there are signs that the market conditions are starting to resemble a bottom.

Nevertheless, my initial strong bullish thesis remains intact, and thanks to Mr. Market, I get to average down my investment in Alibaba and maximize the long-term returns. Undoubtedly, Alibaba is not for everyone, and you should do your own research before considering any position.

China’s Political Landscape And Development

As we all know, China’s political system is authoritarian, and the CCP controls all religious activities; no duly elected national leaders, political opposition is controlled, conflict is not allowed, and civil rights are restricted.

One hundred years ago, when the CCP was founded, Mao Zedong was the first chairman to lead the communist party from the establishment of the People’s Republic of China (PRC) and a great supporter of Maoism, which is the collective name for his Marxist-Leninist doctrines, military tactics, and political ideologies.

Even though many see similarities between Xi’s presidency tenure and Mao, they differ in several respects. The most apparent characteristic I see in common is the strong desire to consolidate power. But, compared to Mao, Xi now runs a more united China that has become a superpower that challenges and confronts the rest of the world.

However, there are some core Maoist principles and ideals that still apply today:

- the CCP at the center;

- control of history and avoiding the Soviet path;

- rejuvenation of China.

At first glance, these principles align with the modern CCP’s actions, but the details differ. A quick throwback before Xi’s tenure, until the mid-2000s, China was closely tracking Western economies and policies until the global financial crisis of 2008, when they were convinced that the government should be more active and have greater control and influence over the economy so that they can prevent crises.

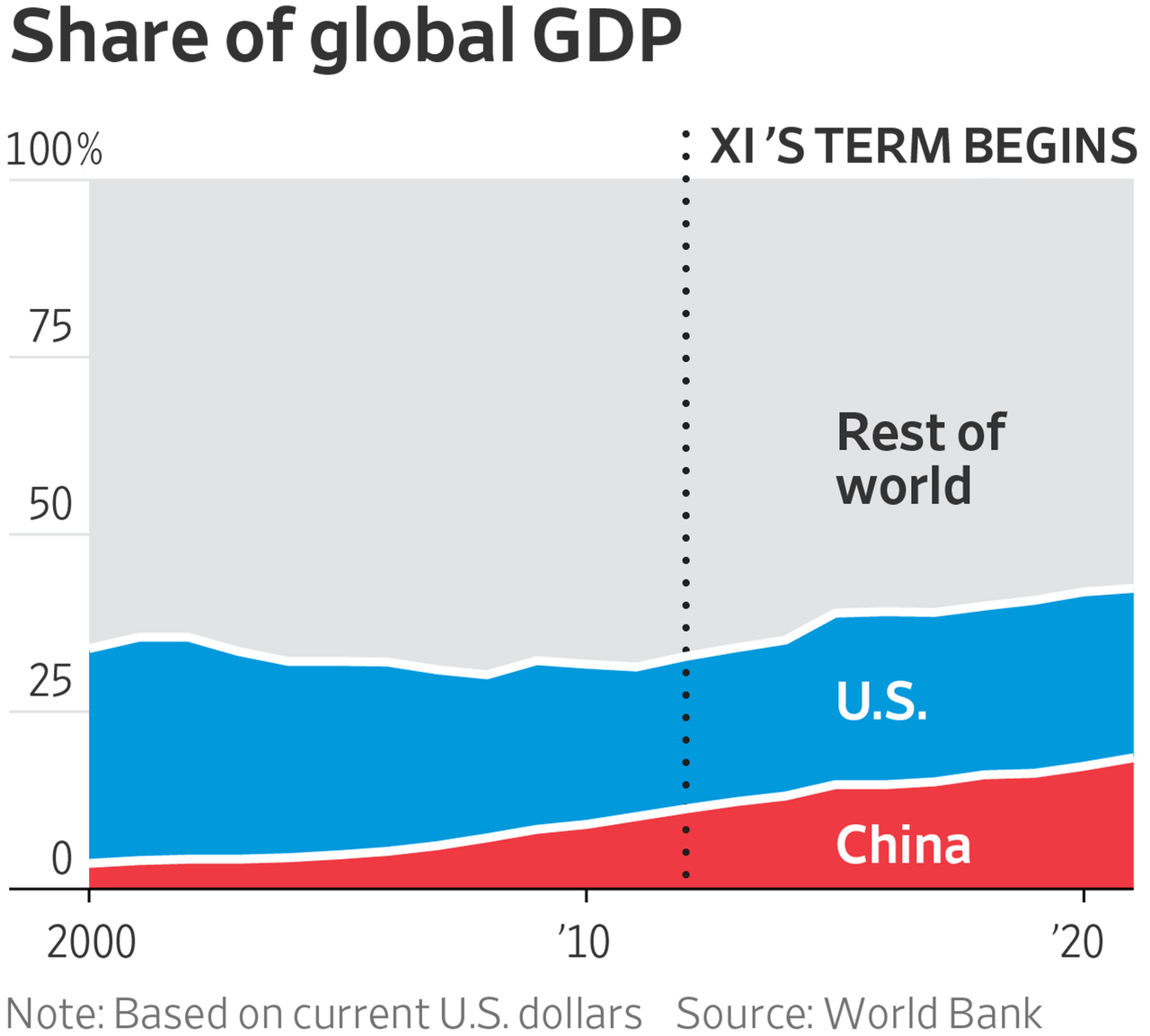

Since 2013, China, under Xi’s term, has shifted significantly domestically and internationally. We saw an anti-globalization movement with worsening US-China relations, rising corruption within the CCP, rising tensions with Taiwan, the CCP intervening in the economy, and slowing growth. On the positive side, we saw a continued expansion in GDP despite the slowdown lately, modest income rise, strengthening the military, and China being the leader in green tech.

We cannot say with certainty that Xi closely follows Mao’s ideas, but there are some similarities. For example, Xi is pushing for a centralized economic model while allowing space for the private sector to grow. Many critics insist that the policies are value destructive, but a closer look over the past decade since Xi’s terms impress to the upside despite the slowdown in growth.

Share of GDP (wsj.com)

Additionally, Xi knows that for a country to become a superpower it must develop leading financial markets and attract foreign investments. Xi wants to attract foreign investments, but to the point where it cannot exert influence or take a leading role in the Chinese market. A recent example illustrating this is the actions of Mr. Son, the CEO of the Japanese conglomerate SoftBank Group Corp (OTCPK:SFTBY), and the outspoken Mr. Ma, which has made the CCP revengeful, taking action against the two moguls.

The Transition To A New Era

After devoting the first and second 5-year terms to consolidating his power, I believe Xi’s third term will differ in implementing his agenda and policies, especially in the following one to two years. Even though there was no direct competition between Li Keqiang (outgoing premier) and Xi, there were disagreements about policies. Undoubtedly, the new loyalists are within Xi’s circle of trust so that less political friction will lead to structural reforms.

Not surprisingly, Western media seems to misread China’s actions, and Li Qiang’s (next premier) appointment tells us something about Xi’s policy direction. First, western media presented Xi’s appointments as a move of loyalty and trustworthiness so that ”yes” people surround China’s most powerful man. Such an argument is weak since, in most of the world, whether Chinese or Western, political systems seek to appoint leaders they trust.

Who Is Li Qiang And Why It Matters

Li, the premier of the People’s Republic of China, or the prime minister, holds the second most powerful position in China’s political system under the CCP. Li is a tech-savvy supporter of high-tech entrepreneurs, evident from his ongoing efforts to support technological entrepreneurship and financial innovation in China. For example, he was one of the early supporters of Jack Ma, and at the internet industry conference, he said:

There should be more Alibabas and more Jack Mas,

Not surprisingly, according to Xi’s strategy outlined in his party congress work report, he is expected to concentrate on innovation and high-tech industries. People who have met Li have said he has a pro-business and practical working style. During his mandate, Li has presided over numerous international investments in Shanghai. He was the one who brought Elon Musk’s Tesla to China and also pushed for the STAR Market, the NASDAQ equivalent in the Shanghai Stock Exchange.

Li Qiang (asiatimes.com)

Xi’s Vision For The Next Five Years

Xi seems to adopt a long-term approach and is willing to sacrifice short-term economic growth to increase the economy’s growth quality. The ”common prosperity” slogan was adopted a few years ago by Xi and went after social equality, collective ownership, and equal distribution. This ideology will persist in the following years.

Not surprisingly, the ongoing trade wars and US sanctions, especially the recent semiconductor war, have left Xi with no option but to boost investments in technology and innovation to achieve greater self-reliance. However, modern history has proved that sanctions usually do not work and might have the opposite effect.

Last year when the CCP celebrated its 100th Anniversary, the 100-year development goals were clear:

Build a moderately prosperous society in all respects by 2021 and build a modern socialist country that is prosperous, strong, democratic, culturally advanced and harmonious by 2049.

No nation in the history of humankind has ever prospered and advanced in the absence of a dominant and growing private sector. Xi cannot rely on corrupted China’s state-owned industry to lead and transition China to the digital economy. In contrast, China needs more visionary entrepreneurs to innovate and lead the way.

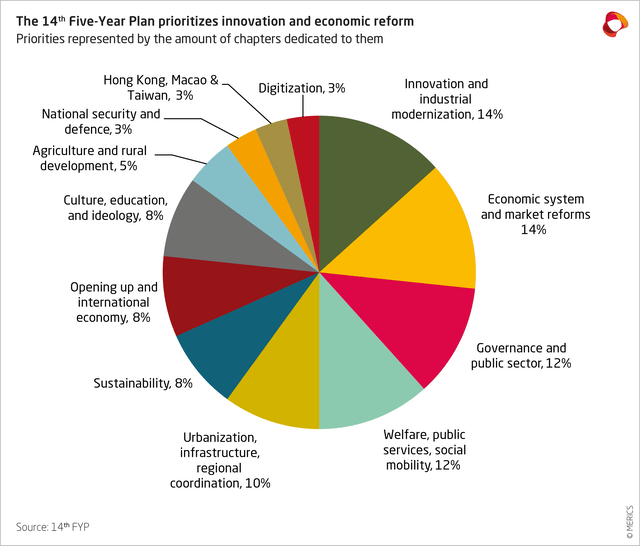

China’s internal cycle started in 2021 and has marked a period of consolidating social development and strengthening the domestic economy. As a result, we have seen a strategic shift from economic targets toward internal reorganization and resilience. Not surprisingly, innovation and industrial modernization remain the top priorities.

While I don’t expect BABA to benefit directly from the policies since the plan will focus on SMEs, the enhancement and growth of the digital ecosystem will indirectly boost Alibaba due to its deep ties in the most critical China sectors.

14th 5-Year Plan (merics.org)

Delisting Risk Remains Muted For Now

BABA’s conversion to dual-primary listing status in Hong Kong will be completed by December. Moreover, there is a possibility for BABA’s inclusion in the Stock Connect program to be fast-tracked, given BABA’s long history of being listed in the US and Hong Kong. Lastly, even though PCAOB inspections have begun, we are still very early in the process, and it might take months to complete.

Outlook For The Rest Of 2022

Considering the overall pressure faced by the macroeconomy and the consumption sector, operation efficiency improvement will be among the critical areas for BABA to focus on in the rest of 2022. In addition, as the core high-margin e-commerce business slows down, I expect BABA to be more disciplined on new investment and marketing activities, particularly on Taobao Deals and Taocaicai.

The reduced investment in CGB-related business can help BABA’s margin performance. As BABA maintains healthy margins for its marketplace businesses and is cutting losses on newer China commerce businesses such as TaoCaiCai, Taobao Deals, and Herma, I expect EBITA margins for BABA’s China commerce business to improve from the already impressive 30.7% level seen in June.

Soft demand for discretionary products, especially in categories such as apparel and cosmetics, and rising competition from short video platforms are weighing on the growth of BABA’s customer management revenue and will continue to do so in the coming quarters. The upcoming Double Eleven (11.11) shopping festival will serve as BABA’s merchants’ most important promotional event. However, the current expectation for the event is relatively moderate, given the overall shopping sentiment and the potential promotion budget from BABA as expense optimization continues.

Alibaba.com’s domain which represents a strong correlation between traffic data and revenues, has reported a decline over the past three months, reflecting the expected softening demand. However, this is not representative, as Alibaba group consists of many subsidiaries and marketplaces online (i.e., Taobao, Tmall, Freshippo, Aliexpress, Lazada, etc..), and to develop our best estimate for the quarter, individual domain analysis is essential.

Alibaba’s Traffic (jika.io)

Expanding Commerce & Cloud Units

Alibaba’s expanding commerce and cloud-based units could lift the company’s revenue by more than 10% annually through 2025. Increased user reach and spending frequency on Alibaba’s consumer services and grocery-related platforms in mainland China and the company’s overseas Lazada and Trendyol operations may outweigh a slowdown in receipts from Taobao and Tmall marketplaces. In addition, sales gains from the cloud may exceed commerce’s in the next three years as China’s push for increased digitalization spurs demand for related services. This would likely increase the cloud’s revenue contribution into 2025.

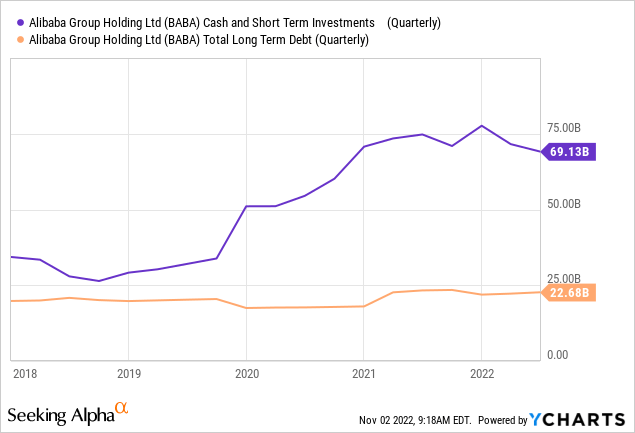

Investors Get 24% Of BABA In Net Cash

Alibaba’s balance sheet is a crucial differentiator for the company, which may endure in the midterm, given the market expectation for cash flow is to improve and remain robust. In contrast, net cash currently stands at $51 billion. The net position is by far the best in class among China tech leaders, giving it flexibility that shows few signs of deteriorating amid abundant cash and limited debt.

With $68 billion in cash at the end of June, Alibaba’s net leverage is significantly negative, which is considered a critical differentiating credit factor. Even with more lavish spending anticipated, consensus expects fiscal 2023 free cash flow to surpass $15 billion, supporting Alibaba’s above-average financial flexibility.

Excess liquidity is a key competitive advantage, with only a few large tech and internet players sitting on massive cash hoards. Alibaba and Tencent, with cash balances of $68 billion and $47 billion, respectively, hold a considerable liquidity edge against Chinese counterparts as well as their broader global investment grade peer group. Alibaba’s excess cash could focus on common prosperity commitments and greater shareholder returns.

Following a sharp share decline in October, the company’s market capitalization of $171 billion still provides one of the sector’s strongest equity-to-debt ratios. Remarkably, around 24% of BABA’s market cap is in Net cash, implying that investors who buy BABA today get it for approx $48/share, considering that $15.8 is net cash.

One Billion Annual Active Consumers In China

Annual active consumers reached a milestone of one billion at the end of fiscal 2021, rising to 1.31 billion at the end of fiscal 2022. That’s a quarterly net increase of 28.3 million, including one billion consumers across its China retail marketplace, Local Consumer Services, and digital media and entertainment platforms. However, as revenue growth slows, more robust user engagement becomes critical to longer-term success.

Alibaba has reached its target of serving a customer ecosystem of one billion in China by the end of the fiscal year via an annual net increase of 113 million and continues setting new long-term targets. In addition, benefits from a growing user base are enhanced as Alibaba executes plans to expand wallet share via cross-selling opportunities.

Alibaba’s Annual Report FY22 (alibabagroup.com)

Concluding Thoughts

After two years of declining revenues, Alibaba appears poised to return to double-digit growth in 2023 as regulatory pressures ease, and consumer spending in China starts to recover. In addition, Alibaba might sacrifice profit recovery in fiscal 2023 by investing in lifting user engagement and merchant support amid the Covid-19 outbreaks in mainland China this year. As a result, this spending will sustain Alibaba’s e-commerce lead in China. Lastly, expanding into new retail geographies, logistics, and cloud-based businesses remain the long-term growth drivers.

After a decade of consolidating power, Xi’s loyalists are within his circle of trust, so we might be entering a period of fewer internal conflicts and disagreements, allowing him to prioritize implementing his agenda and policies, which are expected to boost technological entrepreneurship and financial innovation, and indirectly Alibaba Group. Nevertheless, Xi’s reelection has spread fear in the market, and Chinese stocks crashed last week on the news, while Alibaba plunged to a new 5-year low, moving lower to its IPO price.

Despite the structural risks, the stock is now trading at historically low valuations, with the political risk and uncertainty being largely priced into the share price. Therefore, any positive news relating to the Chinese economy, including the reopening of the economy and fiscal and monetary stimulus by the government, would prove to be a catalyst for upside growth.

Mark The Date: 11/22/22

On November 22, I am launching Yiazou Capital Research, my research platform on Seeking Alpha Marketplace, where we provide our best-in-class in-depth equity research and top investment ideas in this bear market. After the launch and for a limited time, the first 20 members joining our community can lock in for a special legacy price forever.

| Editor’s Note:This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors;click hereto find out more and submit your article today! |

Be the first to comment