K_Thalhofer/iStock via Getty Images

Investment Thesis

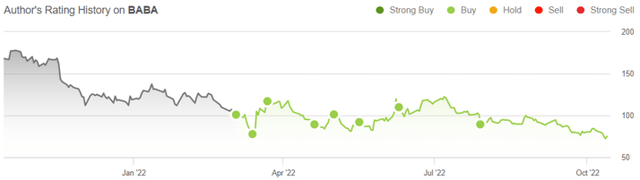

Historical Rating

As seen in our analysis history, we have been an Alibaba Group (NYSE:NYSE:BABA) bull with constant buy ratings, believing that its fundamental performance will hold its stock valuations steady, significantly aided by the lifting of delisting risks. Obviously, we were wrong, since geopolitical and macroeconomic issues have dramatically worsened in the past few months, putting further downward pressure on BABA’s stock recovery. The BABA stock had tragically plummeted to break new lows nearing its 2015 levels, with a -55.19% plunge in the last twelve months (LTM).

The US stock market continues to underperform as well, worsened by the sticky inflation rate in the September PPI and CPI Indexes, with the labor market remaining surprisingly robust thus far. An overwhelming sum of 95.8% analysts is also predicting a 75 basis points hike in the Fed’s next meeting in November, with a growing small group starting to project a 100 basis points hike instead. Combined with the potentially raised terminal rate to 5%, instead of the previous projection of 4.6%, we may see more carnage in the stock market, since the unnatural rally experienced on 13 October is likely short-lived.

Even if delisting is no longer a concern, things are unlikely to improve for BABA in the short term as well, due to the US mid-term and Chinese President elections both occurring in November. Thereby, possibly pointing to more aggressive posturing from both governments, leading to further market volatility then. With global economic activities dramatically slowed down through the difficult winter ahead, we will be seeing the perfect storm of maximum pain moving forward. Therefore, it is not overly bleak to assume that we may see BABA hit a catastrophic $70 or even lower in the $60s over the next few months. There is no clear floor here.

BABA May Report Improved Margins For The Next Quarter

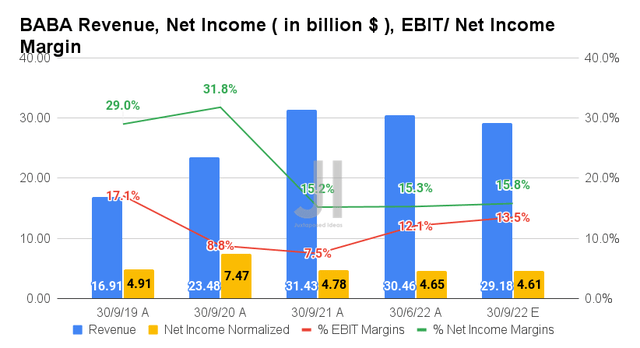

For its upcoming FQ2’23 earnings call, BABA is expected by analysts to report revenues of $29.18B and adj. EBIT margins of 13.5%, indicating a slight moderation of -4.2% though an excellent improvement of 1.4 percentage points QoQ, respectively. The former is attributed to China’s relentless Zero Covid Policy inducing a deceleration in economic growth, with the latter’s growth aided by the company’s aggressive cost-cutting strategies and massive layoffs thus far.

Naturally, BABA will also likely report improved profitability, with net incomes of $4.61B and net income margins of 15.8% for the next quarter. It will likely represent a relatively inline growth through an excellent improvement by 0.5 percentage points QoQ, respectively. Furthermore, we may see more lay-offs ahead, due to the Chips ban and potential trade war in other segments.

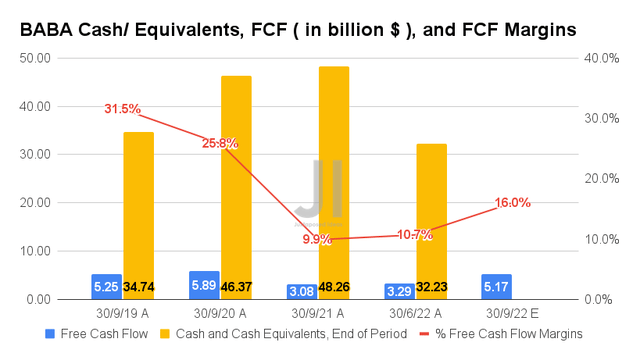

In the meantime, we expect to see a meaningful improvement in BABA’s Free Cash Flow (FCF) generation to $5.17B and an FCF margin of 16% for FQ2’23, indicating excellent QoQ growth of 57.14% and 5.3 percentage points, respectively. Otherwise, a tremendous increase of 67.85% and 6.1 percentage points YoY, respectively. Thereby, further bolstering its balance sheet, with a robust $32.23B of cash and equivalents reported in FQ1’23.

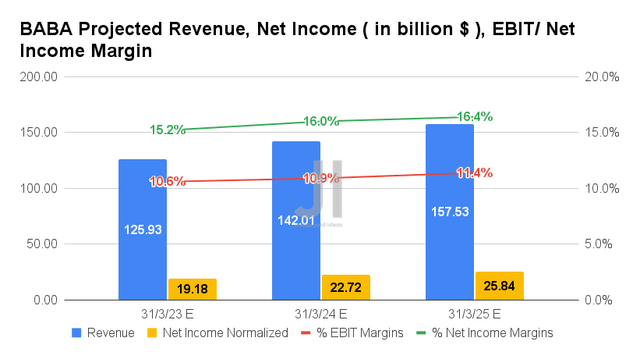

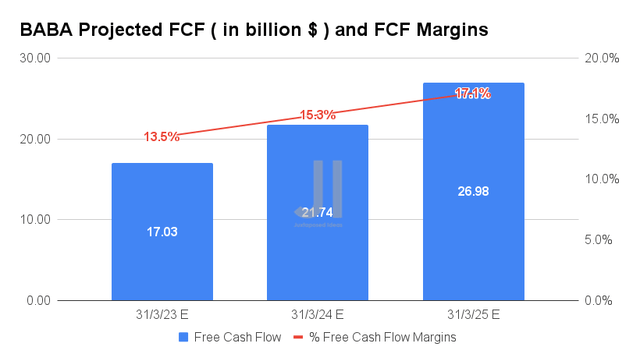

Over the next three years, BABA is expected to report revenue and net income growth at a CAGR of 5.4% and 38.10%, respectively. The company’s top and bottom line growth have unfortunately been downgraded multiple times, by -21.22%/-23.45% since our analysis in March 2022 and -10.4%/-8.94% since July 2022. Thereby, indicating Mr. Market’s growing pessimism about the recovery of geopolitical and macroeconomic issues in the short term. Its long-term projections remain weaker as well, with the projected net income/FCF margins of 16.4%/17.1% in FY2025, compared to pre-pandemic levels of 22%/23% in CY2019.

In the meantime, BABA is expected to report revenues of $125.93B and net income of $19.18 in FY2023, indicating a decline of -6.39% though an excellent increase of 95.51% YoY, respectively. Otherwise, a more modest YoY adj. growth of 39.28% in its net income, after accounting for the legal impairments in FY2022. Still impressive, despite the multiple headwinds thus far.

The growth in BABA’s FCF generation is stellar as well, with the projected FCF generation of $17.03B and net income margins of 13.5% for FY2023. It indicates excellent YoY growth of 20.78% and 3 percentage points, respectively. Despite its heavy capex in its cloud and logistics capabilities worth $9.72B in the LTM, it is evident that BABA remains cash flow positive thus far, with the projected FCF growth at an impressive CAGR of 24.15% through FY2025. Investors should be encouraged, since we believe these investments would eventually be top and bottom line accretive in the long-term, especially after the dust settles by CY2024.

In the meantime, we encourage you to read our previous article on BABA, which would help you better understand its position and market opportunities.

- Alibaba: The Purge Is Finally Here – Jack Ma Says Goodbye To ANT

So, Is BABA Stock A Buy, Sell, Or Hold?

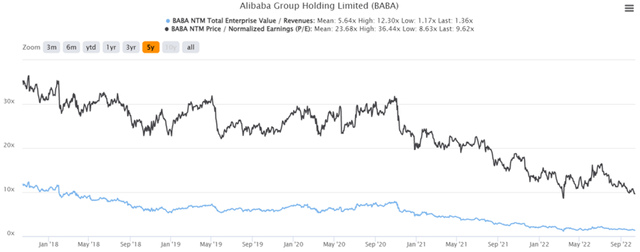

BABA 5Y EV/Revenue and P/E Valuations

BABA is currently trading at an EV/NTM Revenue of 1.36x and NTM P/E of 9.62x, lower than its 5Y mean of 5.64x and 23.68x, respectively. The stock is also trading at $75.01, down -58.80% from its 52 weeks high of $182.09, nearing its 52 weeks low of $71.40. Nonetheless, consensus estimates remain bullish about BABA’s prospects, given their price target of $144.60 and a 92.77% upside from current prices.

Well, things are no longer rosy obviously, since geopolitical issues remain the biggest problem for BABA, with things potentially worsening to a full-blown trade war ahead. Therefore, we are revising our price target to a mid $60s for those who remain interested in adding this stock, given the wider margin of safety at those levels. We must also highlight the fact that this stock is only suitable for those with a higher tolerance for risk, since no one would be able to predict the massive volatility ahead.

Be the first to comment