maybefalse/iStock Unreleased via Getty Images

Alibaba Group Holding Limited’s (NYSE:BABA) management is going all-in to expand the international revenue base. The current efforts should make the company more globalized instead of solely relying on its Chinese market where it is facing regulatory challenges. Alibaba has already shown success in key international markets like Indonesia, Vietnam, and Singapore within Southeast Asia. It has also improved its market share in European markets like Spain, Poland, Czechia, and others. This should help the company diversify its revenue base.

Looking at the peer valuation of other international e-commerce companies, we can say that Alibaba is massively undervalued due to its international operations. The standalone valuation of many of its international businesses is already very high and the company does not face any major regulatory headwind in these regions. The revenue base of international operations will increase significantly over the next few quarters, which should reduce the lingering bearish sentiment toward the stock. Investors should look at the future trajectory of retail and cloud operations of Alibaba in international regions to gauge the returns potential of the stock.

Diversify the revenue base

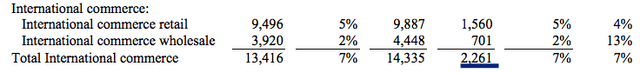

After the regulatory troubles in China, Alibaba’s management has doubled down on the expansion of their international business. The international business not only adds new growth opportunities for the company but also diversifies the revenue base away from the home base. In the latest quarter, Alibaba reported $2.2 billion of revenue in international commerce or close to $10 billion on an annualized basis. This is 10% of the revenue base of domestic China commerce.

The YoY growth rate in the latest quarter slowed down due to Covid-19 disruptions in China and new VAT rules in Europe. However, the long term growth potential in many international regions is a lot better than the saturated e-commerce market in China.

Figure 1: Annualized revenue base of international commerce is close to $10 billion.

Already showing major wins

The international operations of Alibaba are already reporting some major wins. Alibaba has a big presence in Southeast Asia through its Lazada and Tokopedia subsidiary. The company is in direct competition with market leader Sea Limited (SE) in e-commerce, payments, logistics, and many other segments. The Southeast Asian region saw massive growth during the pandemic. A Facebook and Bain & Company report mentioned that this region has increased online shoppers by 70 million. The average online spending per user has also increased from $238 in 2020 to $381 in 2021.

The Southeast Asian region is very important for e-commerce industry because the organized brick-and-mortar retail options are not well established like US. This makes more customers depend on online shopping. The Southeast Asia region has over 650 million people and the nominal GDP of this region is $3.3 billion which is more than 25% of the GDP of China. Hence, if Alibaba grabs a significant market share within this region, it will be a major bullish factor for its international business model.

Alibaba has mentioned that its Lazada business saw 82% YoY order growth in the previous quarter. This is significantly ahead of the Chinese market where Alibaba is showing signs of saturation.

Alibaba is also showing strong progress in Europe. According to Euromonitor International, Alibaba was among the top three e-commerce players in Eastern Europe. There are local players like Polish company Allegro and Russian rival Wildberries. However, over the long run, it is highly likely that most of the e-commerce market will be divided among Alibaba, Amazon, and bigger retail players. All these companies have the resources and technology to sustain their operations despite short-term losses. This might not be possible for small local players who cannot absorb the hit on margins due to big discounts.

Alibaba has over 85% stake in Trendyol which is Turkey’s leading e-commerce company with a valuation of $16.5 billion. From a long-term growth perspective, these investments will be very useful as Alibaba builds a better logistics supply chain.

The e-commerce industry requires a massive investment of tens of billions of dollars in logistics which is rarely possible by smaller players. Alibaba has the resources to spend heavily in Europe to build its logistics supply chain. It also has a major advantage over Amazon because of its close relationship with Chinese manufacturing base. Alibaba can make bulk purchases from China and deliver them to Europe through its logistics chain. This would not be possible for any other e-commerce player in Europe.

Impact on Alibaba’s stock

Alibaba’s stock saw one of the worst trajectories in 2021 as the company faced headwinds from Chinese regulators. The improvement in international operations will be a key driver for future stock growth. We can already see the potential of several international regions by comparing them with peers like Sea Ltd.

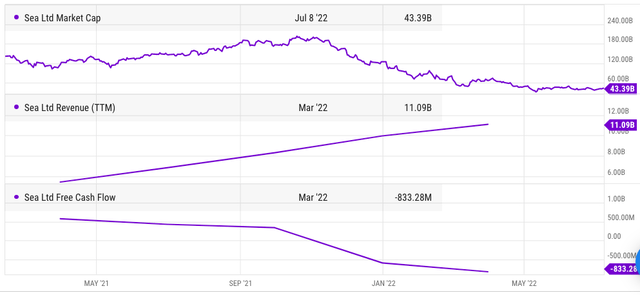

Figure 2: Market cap, revenue and free cash flow of Sea Limited.

Sea Limited has significant operations in Southeast Asia and is the direct competitor of Alibaba in major businesses. Before the recent correction, Sea Limited’s market cap had touched $200 billion. We can see that its net income is rapidly declining as the company has to make massive investments in logistics and other operations. Alibaba is in a good position to take away market share from Sea Limited in Southeast Asia. Alibaba also offers a wide range of services including e-commerce, payments, delivery, and others.

The company has the ability to sustain losses in this region for a much longer period compared to other players. A strong presence in the ecommerce industry will help Alibaba Cloud gain new customers. Hence, we can see that Alibaba has a number of monetization options within Southeast Asia and other international regions.

Alibaba is already reporting close to $10 billion in annualized revenue rate in international markets without including revenue from cloud operations. The company could get a higher P/S ratio than Sea Limited due to its cloud operations and the long-term ability to invest heavily and absorb losses. If we give Alibaba’s international operations a P/S multiple in the range of 10 to 15, it would put the standalone valuation of this segment at $100 billion to $150 billion. At the higher end, this is over 50% of the current valuation of the company.

Alibaba has a long growth runway in key international regions, especially in Southeast Asia and Europe. This will have a big impact on the stock valuation as the revenue share from these regions increases. Investors should closely look at the growth trajectory in these regions to gauge the long-term potential of Alibaba stock.

Investor takeaway

Alibaba is reporting strong YoY growth in international retail and wholesale operations. We should also see an expansion of cloud, payments and other services in international regions. The company is already among the main e-commerce players in Southeast Asia, Eastern Europe, and several other regions.

Investors should not only look at Alibaba’s China operations and the regulatory headwinds in this region but also focus on the ability of the company to massively ramp up its international operations. On a standalone basis, the international operations could end up becoming the biggest growth drivers for Alibaba stock.

Be the first to comment