jroballo/iStock via Getty Images

Investment Thesis

Lithium is an essential metal for the current push towards electric cars and renewable energies, as these forms of energy fluctuate and must therefore be stored. Albemarle (NYSE:ALB) is not only planning to ramp up production in the next few years but is currently enjoying solid margins. The combination of increased production and possible lithium shortage (which means higher prices) makes the company an exciting investment.

Lithium market overview

Lithium is the lightest metal on the periodic table and can store a lot of energy relative to its mass. Lithium is part of a group of elements known as alkali metals, which have several properties in common – they are all soft, have low melting points and are highly reactive. Because lithium atoms are less massive than atoms of other elements, it is an excellent material for use cases where weight and size matter, such as consumer electronics or electric vehicles. Compare this with sodium (NA), the next element in the alkali metals group: sodium is approximately three times more massive than lithium. Because of this, sodium-based batteries will always be at a significant disadvantage when it comes to energy density.

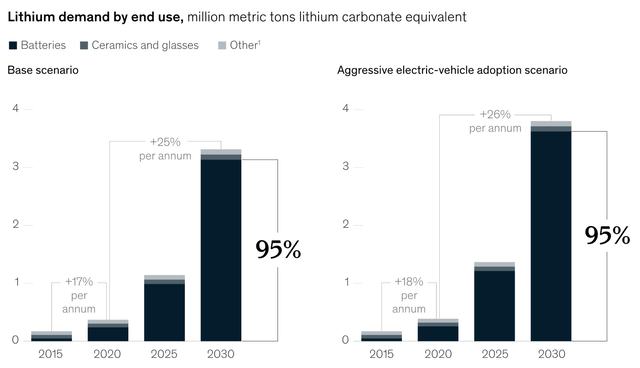

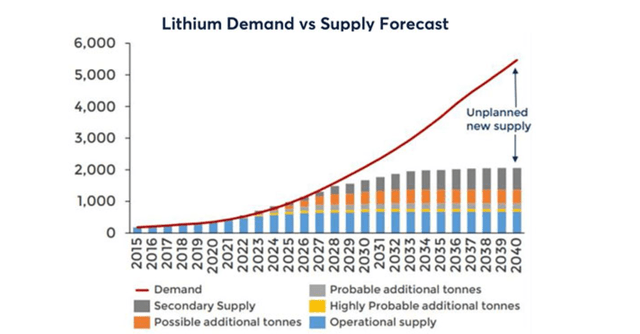

According to McKinsey, 95% of the lithium mined could go into batteries by 2030. This is mainly due to the rapid rise of electric vehicles. A typical battery for an electric vehicle weighs about 8-10 kg. The lithium needed for this would be enough to build thousands of smartphones.

McKinsey

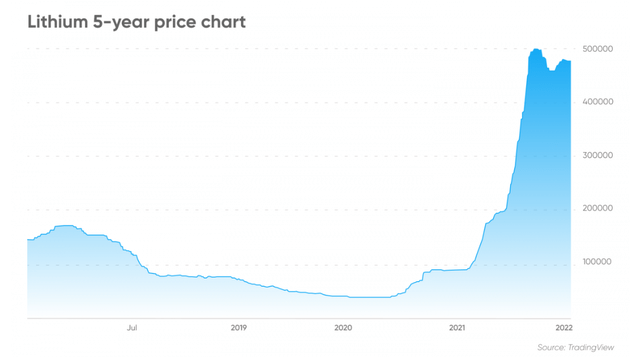

Due to the rapid increase in demand, there are several warnings from industry insiders that supply will not be sufficient and that we may experience a shortage of lithium as early as 2025. For example, Rio Tinto has warned of this, as has the IEA. The lithium price has increased more than fivefold since the 2020 low, leading to rising costs for electric car manufacturers. So, where the lithium price will end up is hard to predict because, as always, the solution to high prices is high prices. If lithium becomes more expensive, and therefore electric cars become more expensive, demand will decrease. At the same time, the construction of new lithium mines becomes more and more attractive the higher the price is, so that, contrary to current expectations, there could be a supply overhang if prices become too high in the short term and demand collapses.

However, lithium costs are only a small part of the cost of an electric car. This means that the car manufacturers would have to accept much higher prices. All sources I have found indicate that there will be a supply shortage in the next few years. So I think the most likely scenario is a permanently increased price (higher than the current price) until the end of the decade. And then we have to wait and see how many new mines can be developed, or if there will be new battery technologies and how the adaptation of electric cars is going.

Company overview

Albemarle Corporation is a global specialty chemicals company with leading positions in lithium, bromine and refining catalysts. We power the potential of companies in many of the world’s largest and most critical industries, from energy and communications to transportation and electronics. Working side-by-side with our customers, we develop value-added, customized solutions that make them more competitive. Our solutions combine the finest technology and ingredients with the knowledge and know-how of our highly experienced and talented team of operators, scientists and engineers.

The company is active worldwide and operates lithium mines, research facilities, recycling sites, and conversion plants. It also produces bromines and catalysts. The lithium mines are located in Chile (in operation since 1980), in Nevada since 1960, and they have a 49% interest “in Talison Lithium in Australia with access to its world-class spodumene resources” (source). For all those who do not know Bromine, here is a small excerpt from the company website.

Albemarle’s bromine chemistry plays a leading role in providing performance products for fire safety, oilfield drilling, pharmaceutical manufacturing, high-tech cleaning, water treatment, food safety and more. Our leading portfolio of brominated fire safety solutions used in consumer electronics, construction and automotive applications help keep people and property safe.

Revenue composition

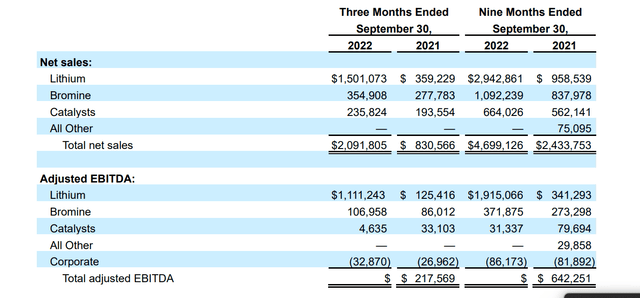

Lithium accounted for 75% of sales in the last quarter, bromine for 15%, and catalysts for 10%. However, in the investor presentations, we can see several interesting things, and I instead focus on the first nine months of 2022 vs. 2021 to better assess the development of the segments. First, we can see that the company has benefited tremendously from rising lithium prices. In 2021, the lithium segment accounted for less than half of revenue and about half of EBITDA. In 2022, lithium accounts for about three quarters of sales and even more of EBITDA. The margins here are, therefore, much better than in the other segments. So for the future, we can say that the revenues and profits of the company really depend on the lithium price. However, the YoY increase in bromine has also been strong, but the margin has been significantly worse. The catalysts segment generates not insignificant revenue but hardly contributes to EBITDA.

Profitability

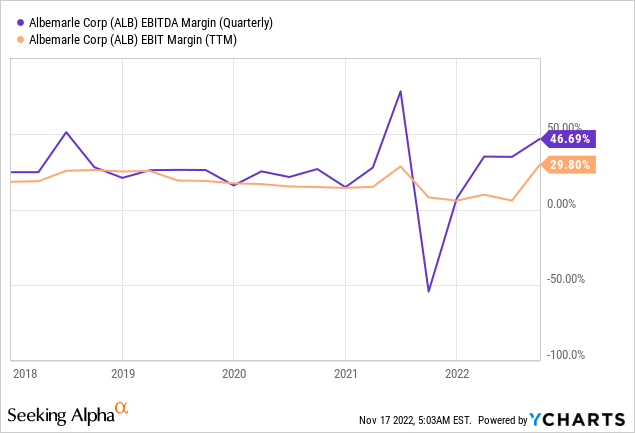

The company announces the total Adjusted EBITDA margin for the entire year at 46 – 47%. This margin is significantly better than the average of the last years.

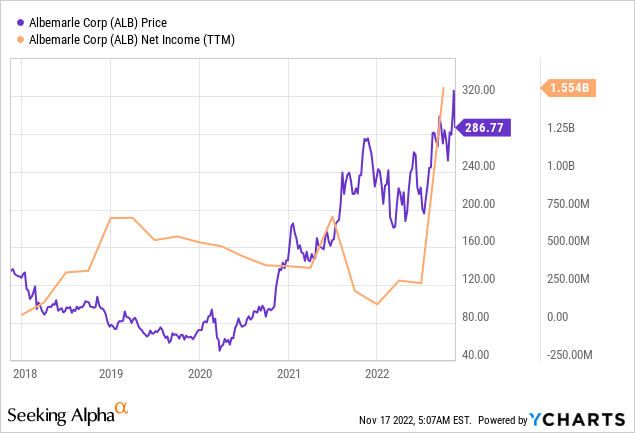

Accordingly, we see this reflected in net income. The share price has moved up, therefore.

Valuation

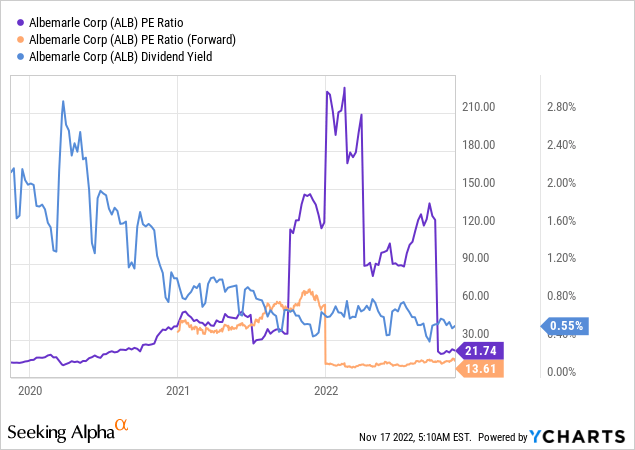

This raises the question of whether we are already too late to the party or whether the current valuation still offers room for upside. The following chart shows three key figures – the PE ratio TTM, the forward PE ratio, and the dividend yield. So the forward PE ratio on expected earnings is only 13. Non-GAAP EPS this year is expected to be around $21 at a current share price of $286. As for the dividend, the payout ratio is very low, at about 11%.

Non-GAAP EPS this year is expected to be around $21 at a current share price of $286. Analysts say earnings should rise to about $27 per share next year and fall again somewhat in 2024, but this has a lot to do with the price of lithium.

Production

Future earnings per share will depend not only on the lithium price but also on production. Let’s, therefore, take a look at what the company says about future production. According to the company, in 2022, the production has increased by 20% – 30% compared to the previous year “due to new capacity coming online.” Using various methods, they plan to increase lithium production by 20% annually through 2025. According to the company, there is even the potential for up to 500ktpa by 2030, more than tripling this year’s production.

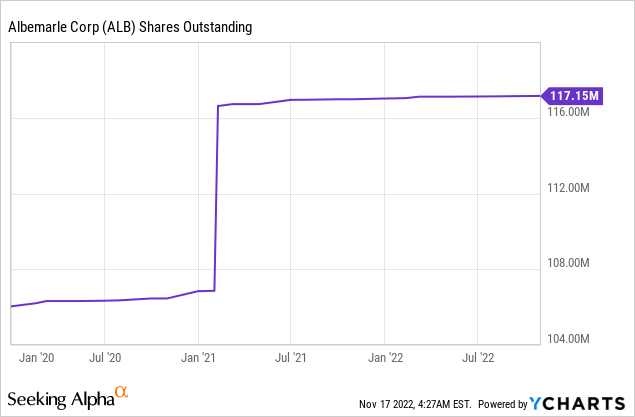

Share dilution and insider selling

I always want to look at stock dilution and whether there is insider selling. There was a little bit of both, but nothing major. These insider sales are insignificant, given the market capitalization of $37B.

openinsider

Risks

If demand for electric vehicles falls, lithium prices will be hurt. As lithium supply increases over the next years, a global recession could lead to a supply glut, and lithium prices could fall unexpectedly. If demand for electric vehicles falls, lithium prices will be hurt.

Another risk is that global electric vehicle demand does not develop as projected. These vehicles may not be competitive in terms of production costs or range. Hydrogen-powered cars could become established in the long term. There is also a risk that there may always be new battery technologies that will not use lithium. Batteries are a multi-billion dollar market that will be vital to humanity in the next few decades. Millions of people are working on it, and we cannot predict what discoveries will be made in the next few years.

Alternatives

A very interesting stock I wrote about recently is Lithium Americas (LAC). The company has very strong assets containing enough lithium for decades. However, production will only start here soon. Or, if you generally believe in the lithium market but do not want to commit to individual companies but want to diversify, the Global X Lithium ETF (LIT) could also be attractive, which I wrote about here.

Conclusion

While the company is not cheaply traded and the dividend yield is not exceptionally high, there seems to be a lot of upside potential in the company’s earnings from now on. Suppose they can increase lithium production as much as they have indicated, and at the same time, the predictions that we might run into a lithium shortage by the middle of the decade might come true. In that case, the company’s earnings could explode. Like Lithium Americas or the ETF mentioned above, this is an attractive investment. Of course, with risks, but I think the company is very favorable from a risk/reward perspective.

Be the first to comment