Boarding1Now

As I write this sentence, Alaska Air Group (NYSE:ALK) trades nearly 4% lower on its Q3 earnings day. This is not to say that the results of the quarter were bad, far from it. The airline beat consensus revenue and EPS by $10 million and 14 cents, respectively. After a long COVID-19 winter, summer sales vigorously topped pre-pandemic levels.

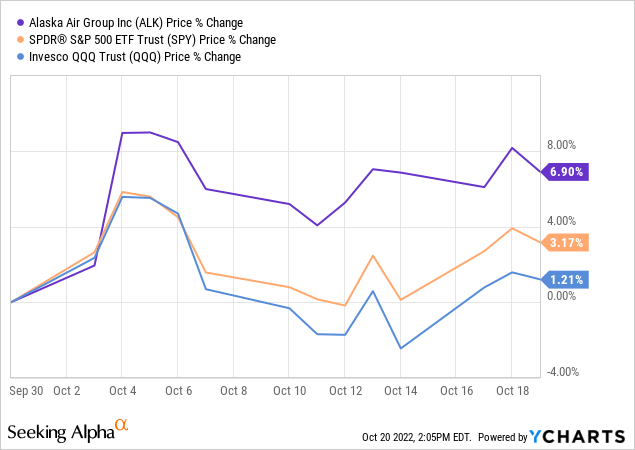

The problem is that, following a series of earnings stunners by the likes of Delta (DAL) and United (UAL), the bar had been set high for Alaska Air. In my view, at least considering the robust demand for travel services in the summer months, the Seattle-based air carrier missed the easy layup this time, particularly due to higher cost expectations. The stock, which had been up a market-beating 7% for the month of October alone (see below), ended up taking a hit.

Alaska Air Group reports solid Q3 results, but with an asterisk

It is now very well understood that air travel is back in full force. Compared to the pre-pandemic summer quarter, Alaska’s passenger revenues were up a respectable 18%. Credit must be given to a generous consumer that seems willing to spend whatever it takes to get out of the house and enjoy a post-COVID life. Revenue per available seat mile skyrocketed by 27% vs. 2019 to 17.3 cents.

The airline also seems to have done a good job on occupancy, at a load factor of 86.5% which improved nearly one percentage point relative to three years ago. On the occupancy metric, however, Alaska is still short of industry leaders Delta and United by at least one percentage point.

Less encouraging were capacity and traffic, which were still down between 5% and 7% vs. pre-pandemic levels — although this is certainly not an Alaska-specific issue. These metrics looked particularly ugly in the highly profitable regional segment, which accounts for about one-fifth of the company’s revenue passengers and one-fourth of the fleet. The regional business experienced drops in ASM and RPM (i.e., capacity and traffic) of more than 12% in the third quarter compared to 2019.

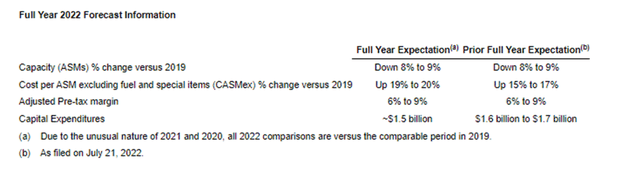

To me, the most concerning part of the earnings report was operating expenses per unit, especially given Alaska’s traditionally lower cost structure. In the same quarter that the airline celebrated the ratification of a few labor deals, CASM-ex jumped by more than 19% vs. 2019. Worse yet, the outlook for the full year was bumped to “up 19% to 20%”, worse than the previous guidance of “up 15% to 17%”. See the table below.

I suspect that costs incurred and projected may have been the key items driving bearish behavior toward ALK during Thursday’s trading session.

Alaska: decent, cheap stock

Before I dive into my opinion on the stock, keep in mind that the discussion below is about ALK relative to industry peers. In isolation, I remain very cautious about airline stocks in general, considering (1) the historically poor risk-adjusted returns and (2) the cyclical nature of the sector during a period in the economy that very few would argue is expansionary.

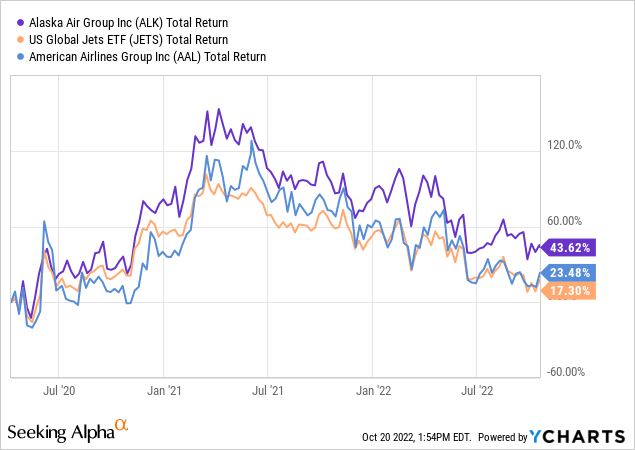

I changed my mind about ALK in April 2020 and, at that moment, turned more bullish on this stock relative to its airline peers. Supporting my stance was the perceived higher quality of the company’s fundamentals during a turbulent period (i.e., the early innings of the COVID-19 crisis). Since then, Alaska Air shares have lavishly outperformed the broad sector (JETS) and my least favorite full-service carrier, American Airlines (AAL). See the chart below.

Judging by the Q3 results released by airlines in the current season, the pandemic is clearly no longer a headwind to revenues. However, I think that the scenario is still one of high risk, given the macroeconomic challenges: record-high inflation, interest rates that don’t seem to find a ceiling, and deceleration in economic activity across the globe.

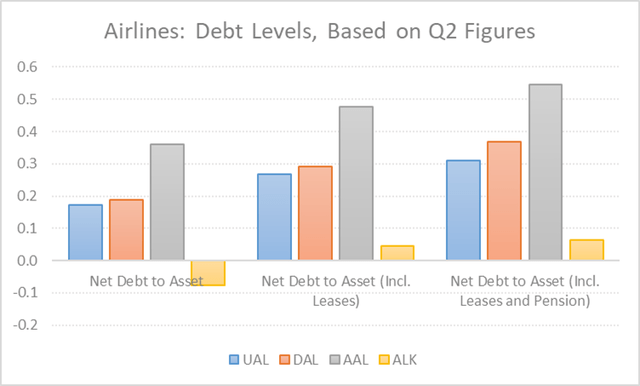

So, despite a Q3 that did not impress as much as it could have, Alaska Air’s fundamentals still look compelling to me amid an uncertain environment. This “lower-cost airline” has one of the best-looking balance sheets in the industry, as the chart below depicts. And now trading at a next-year P/E of around 8x, the lowest since late 2020 at least, valuations also look appealing.

Be the first to comment