It’s been a turbulent year for the major market averages (SPY), and while Newmont (NEM) has been a sanctuary from the storm, Agnico Eagle Mines Limited (NYSE:AEM) has struggled to make much upside progress. The stock has now found itself 45% from its all-time highs, being thrown out with the bathwater of the sector with little justification. This is because AEM is more shielded from cost pressures, benefits from exceptional margins, and has a glowing track record among its commodity sector peers.

With the stock now trading at ~1.0x P/NAV and barely 8x forward cash flow, I see this pullback in the stock as a gift and one of the most attractive ways to play the gold producer space.

Agnico Eagle Operations (Company Presentation)

Gold Miners Q1 Results & Q2 Outlook

Overall, the Q1 Earnings Season was mediocre at best for the Gold Miners Index (GDX), both from a production and a cost standpoint. On the production front, several miners struggled to meet their targets given the tight labor market and elevated absenteeism related to the Omicron Variant. This led to higher costs than planned with slightly fewer ounces sold, which were exacerbated by higher labor, fuel, consumables, and materials costs. Looking ahead to Q2, production should bounce back, helped by limited impact from Omicron and the fact that seasonally Q2 is stronger than Q1 for most producers.

While this will help costs, many producers will have to contend with much higher fuel prices and the continued impact of a tight labor market. Meanwhile, we could see additional supply chain impacts from the Russian invasion of Ukraine and some impact on consumables like cyanide. Finally, while some producers in Africa benefited from lower fuel prices in Q1 due to in-country pricing, with them benefiting from lower prices than peers, we should see these prices creep up in Q2. The gold price hasn’t helped offset these costs fully, so we could see some margin compression sector-wide in Q2.

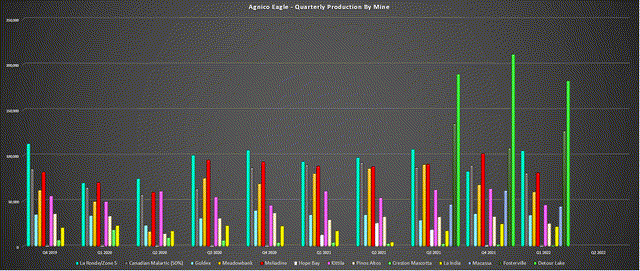

Agnico Eagle – Mine by Mine Production (Company Filings, Author’s Chart)

Fortunately, while it was a tough Q1 for the sector, Agnico came out of the gates strong, putting up a solid performance adjusted for the fact that Hope Bay didn’t contribute. This was because Agnico is taking a 2-year break to explore the asset, hoping to bring it back online with a leaner and meaner production/cost profile (2025). However, Fosterville had another solid quarter, Detour Lake had an exceptional quarter with ~182,000 ounces produced, and LaRonde/Zone 5 also had a great quarter, producing ~105,000 ounces. Overall, this was an encouraging performance, especially given the issues other companies had in Ontario/Quebec from a labor standpoint.

tracielouise/E+ via Getty Images

Industry-Wide Cost Pressures

Within the gold space, one of the most important figures to watch over the past year has been costs, especially with the inflationary pressures that have taken a toll on industry-wide margins. Two major areas where inflationary pressures have led to higher costs are labor and fuel, given that both are large buckets from a cost standpoint, with labor making up to 40% of costs. Given the increased contractor costs, much higher diesel prices, and increased labor costs for employees to help attract and retain talent, I expect to see industry-wide all-in sustaining costs [AISC] surge to $1,200/oz in 2022, up roughly ~$140/oz from 2020 levels.

As I’ve discussed previously, these cost increases have made many producers un-investable. Those producers that lack scale and are operating high-volume, low-grade operations are being hit especially hard, like Argonaut Gold (OTCPK:ARNGF). However, while Agnico may have a couple of these low-grade, high-volume operations (Detour Lake and Canadian Malartic), these mines benefit from economies of scale, allowing them to keep costs at industry-leading levels. In addition, over the course of this decade, Canadian Malartic is heading underground and into much higher grade zones (Odyssey Project).

So, while Detour Lake will be the lone low-grade operation that makes up a key portion of production, I don’t see any reason to worry about this asset from a cost standpoint. This is especially true given the potential to increase scale even further with the possibility of a progressive ramp up to 32 million tonnes per annum, and the potential to mine higher grades underground for a portion of the mill feed. Meanwhile, when it comes to Agnico’s other operations, they are mostly underground, also benefit from economies of scale, and have much higher grades than the industry average, which should allow the company to maintain sub $1,000/oz costs post-2022.

While this differentiation is a big deal, it’s just as important to discuss Agnico’s key advantages. For one, it is the employer of choice in Ontario/Quebec, and this region benefits from access to hydroelectricity, providing two key benefits:

- the company has a higher percentage of employees vs. contractors, which means less volatility in labor rates, given that labor cost increases for employees are a fraction of that for hiring contractors, where we’ve seen double-digit inflation

- the company benefits from using considerably less diesel than its 2.0+ million ounce producer peers, and hydroelectricity rates do not spike when we see spikes in the oil price, shielding it from cost increases on the fuel side

In addition, the company recently upgraded its outlook for synergies to $45 million per year in corporate synergies and $130 million per year in operational synergies following the merger. This could help to claw back up to $50/oz in costs, another key differentiator vs. its peers, helped by purchasing in bulk, operational improvements, and a centralized control room in the Abitibi region.

On top of this, the company hedges 40% of its diesel, and while fuel prices are contributing to cost inflation, the biggest hit to costs is equipment sitting idle due to an insufficient roster in a tight labor market. With two mines in Ontario/Quebec sporting 30+ year mine lives, there is no more attractive employer than Agnico Eagle in this region, meaning that its equipment is not sitting idle. Finally, Agnico is exploring ways to reduce costs through technology and innovation, such as automation. It could also look at trolley assist at Detour Lake, providing further long-term cost improvements.

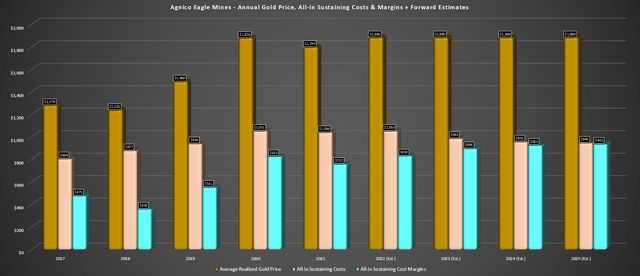

Agnico Eagle – All-in Sustaining Cost Margins & Forward Estimates (Company Filings, Author’s Chart & Estimates)

In summary, while Agnico Eagle is not immune from higher fuel prices or the tight labor market, it’s arguably one of the best-positioned companies to navigate this rising cost environment. Based on this, I see Agnico’s margins improving over the next few years, which assumes no material upside in the gold price (an average realized gold price of $1,880/oz). Assuming my estimates are correct and Agnico can pull costs down to $945/oz in 2025, the company would enjoy industry-leading 50% margins, which, combined with its Tier-1 jurisdictional profile, should translate to a premium multiple for the stock.

Industry-Leading Growth

For those following the gold sector closely, it is one industry with a dearth of companies sporting sustainable growth, especially among the mid-cap and large-caps. This is not the fault of these companies (in most cases). Instead, it is more related to the fact that it’s very difficult to continuously grow production at similar margins when one is depleting 1.0+ million ounces per year and high-grade discoveries are becoming more and more difficult to make. However, in the case of Agnico Eagle, and despite its laser focus on not only production growth but production growth per share, it is sitting on a phenomenal pipeline that gives it an industry-leading growth profile.

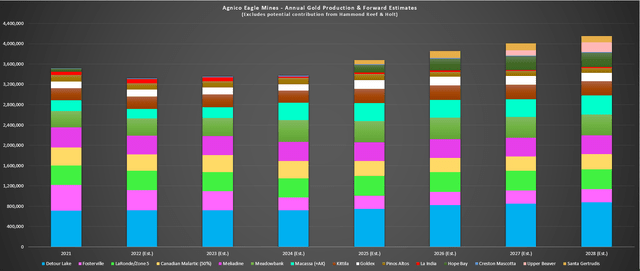

Agnico Eagle – Annual Production & Forward Potential (Company Filings, Author’s Chart & Estimates)

The chart above shows Agnico’s potential progression in annual production per my estimates. I have conservatively modeled Fosterville with an average production profile of 260,000 ounces per annum in case the company must employ a higher-tonnage, lower-grade model if it doesn’t make any new 10+ gram per tonne gold discoveries. However, even under this assumption, my 2029 production estimate of ~4.22 million ounces per annum is a base case (28% production growth), and the upside opportunities to this figure cannot be understated.

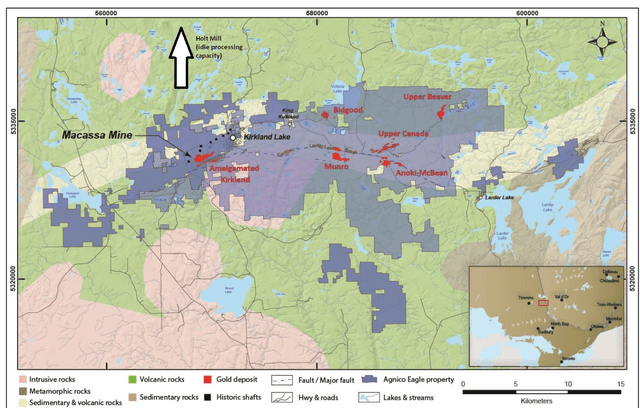

Holt Mill + Kirkland Lake Mining Camp Position (Company Presentation)

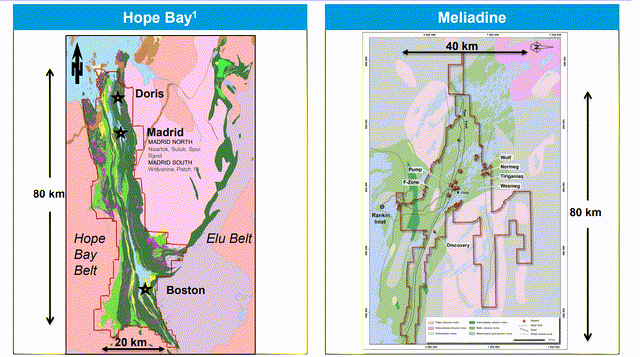

In addition to the potential to see Hope Bay produce 300,000 to 400,000 ounces per annum (125,000 ounces above my estimates at the high end), there’s the potential to add another 120,000 plus ounces per annum with the Holt Mill by processing Upper Canada material. This is one of the more exciting opportunities, given that the Kirkland Lake Camp could become a mining complex with the potential for ~600,000 ounces per annum, only slightly behind that of the Cortez Complex in Nevada. Mining complexes benefit from lower costs due to their synergies. Agnico is well on the way to this goal, with the ramp extending over 200 meters at Amalgamated Kirkland and feasibility level work underway at Upper Beaver.

Agnico Eagle Operations (Company Website)

Finally, the wild card that seems to be forgotten is Fosterville, where the company is dedicating significant exploration dollars. This asset produced ~600,000 ounces of gold in FY2019 and ~640,000 ounces in FY2020 and was the world’s highest-grade gold mine. Since then, we’ve seen the highest-grade reserves at the mine depleted, with the mine operating at a slightly higher throughput rate but with much lower grades, hence the decline in production. However, the best place to make an ultra-high grade gold discovery is next to where ultra-high grade gold has been mined for years. For this reason, I would not rule out another 15-25 gram per tonne discovery being made at this mine.

Under Agnico Eagle, which has growth coming from several areas and a diversified base of 10+ mines, there’s no urgency to make a discovery here, which was the case for Kirkland Lake, given that production would have dipped materially. However, that doesn’t mean the company isn’t working to make a new discovery. So, while Fosterville complements the portfolio nicely at its current production rate, it could return to a top-4 asset in the case of a major discovery, which could push production back to 425,000 to 500,000 ounces per annum, boosting production materially above what I’ve modeled for the remainder of this decade (~260,000 ounces per annum).

Detour Lake Operations (Company Presentation)

In summary, while I see ~4.20 million ounces of annual gold production as achievable in FY2029, I see meaningful upside to this production profile that could push Agnico’s production profile above the 4.5 million ounce mark by 2030. This is not heavily reliant on a major discovery at Fosterville and could stem from an extra 100,000 ounces per annum at Hope Bay and utilizing the idle Holt Mill to process additional ore. This should excite current and prospective investors because I don’t recall the last time I saw an organic growth profile this attractive among a 3.0+ million-ounce producer.

Hope Bay Project Scale vs. Meliadine (Company Presentation)

Finally, post-2030, the organic growth opportunity is just as impressive, with growth already bought and paid for in the portfolio. This includes Hammond Reef (200,000+ ounces), the potential to sink a second shaft at Malartic (180,000+ attributable ounces), and the potential to push Hope Bay closer to 450,000 ounces if the company’s exploration success exceeds its expectations. So, investors do not need to worry about an acquisition that would place Agnico in the penalty box (as we’ve seen in the share price of other producers). This is because Agnico arguably has 4.65+ million-ounce potential already in its portfolio by 2032 in a perfect world (40%+ production growth).

These higher assumptions are based on ~425,000 ounces per annum at Hope Bay, a second shaft sunk at Canadian Malartic (plus utilizing excess capacity at the mill), and either:

- a major discovery at Fosterville

- bringing Hammond Reef online

- utilizing excess capacity at Holt

Capital Allocation

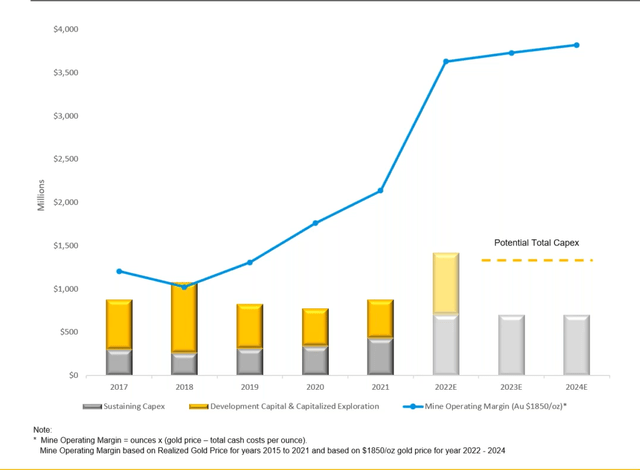

Agnico Eagle has paid a dividend for 39 consecutive years, giving it a glowing track record among its peers in the commodity space. Notably, this dividend yield has grown to a very attractive level of ~3.30%, despite a relatively low payout ratio, suggesting there is room to increase the dividend over the next two years. In addition, the company has unveiled plans for the excess portion of its cash generation, with plans for a $500 million buyback program and further buybacks looking likely. This has been employed to return capital to shareholders vs. using a formulaic policy for the dividend, which, by definition, means that it will have to cut the dividend at some point, something it does not want to do.

Agnico’s base dividend yield of $1.60 annualized (~3.30%) with additional capital returned through share buybacks and the potential for a slightly higher dividend as the balance sheet improves makes Agnico Eagle one of the more generous companies from a shareholder return standpoint sector-wide. Meanwhile, this weakness in the share price has opened up the opportunity to retire 2.2% of its outstanding shares, with the possibility of another 2.0% being retired next year. This would help claw back share dilution from its recent no-premium merger, a clear differentiator for this deal vs. the high premium Yamana (AUY) deal announced, which will lead to considerable share dilution for Gold Fields (GFI).

Agnico Eagle – Mine Operating Margin (Company Filings, Author’s Chart)

To summarize, investors buying Agnico Eagle today could secure a 4.0% yield on cost over the next few years even if we just see the gold price hang out in the $1,700/oz – $2,000/oz range while benefiting from higher earnings and cash flow per share (share buybacks). While this may not seem like much of a yield to most (compared to some REITs), this is a highly accomplished and conservative gold mining powerhouse with minimal debt and growing production. Hence, I would argue that the risk of a dividend cut is near zero, meaning that investors are getting a hedge for their portfolio away from more interest-rate sensitive sectors while collecting a nearly 4.0% yield.

Agnico Eagle Operations (Company Presentation)

Summary

It’s easy to be negative about gold miners after two years of lethargic performance. In fact, it’s become popular to bash several of these companies, given their weak share-price performance and constant missteps. However, there is a clear difference between the sector’s conservative, well-run, and disciplined champions and the poorly run, undisciplined, and un-investable chaff. Given the latter’s poor performance, we’ve seen the proverbial babies thrown out with the bathwater, with zero justification for this underperformance. This is especially true in Agnico Eagle’s case, with the company in a better position from a margin standpoint than its peers.

Given this violent decline that is entirely unjustified, I see this pullback in Agnico Eagle Mines as a gift, and I have continued to add to my position below $50.00 per share. At these prices, it not only trades at a massive discount to its historical multiples at just ~1.0x P/NAV and ~8.7x cash flow vs. ~1.50x P/NAV and ~13.7x cash flow), but it offers the lowest-risk exposure to gold producers outside of the royalty/streaming space with its Tier-1 jurisdiction profile and industry-leading margins. To summarize, this looks like one of the lowest-risk entry points into the name in the past decade, and I would be surprised if the stock remained on the sale rack much longer.

Be the first to comment