Funtap

Introduction

The two-day Federal Open Market Committee (FOMC) meeting of the US Federal Reserve was held this week and the committee headed by Chair Jerome Powell concluded by announcing a 0.75% interest rate hike.

Rising inflation data was the main driver behind the Fed’s move in order to alleviate price pressures. Previously the FOMC raised federal fund rates by 0.25% in March, followed by a 0.50% in May and a 0.75% hike in the June and July meetings taking the present policy rate to 2.25%-2.5%. Fed Chair Jerome Powell said the Fed’s chief goal is bringing down high inflation:

“No one knows whether that process will lead to a recession or how significant a recession it will be,” Powell said. “I don’t know the odds.”

The market was at its usual bouncy self on such days as traders position and then reposition themselves according to market oscillations. The US dollar was up, down, and back to more or less where it started. The S&P 500 was down, up, and then slumped 66 points or 1.77%. Gold, which is very close to my heart, dipped, then rallied, then settled back to trade around $11/Oz higher registering a gain of around 0.66%.

Historically this level of interest rates is still very low, and one would expect the economy and the markets to accommodate these rate hikes. However, a rising interest rate will impact borrowing resulting in the postponement of some major projects, housing, consumer spending, etc. This in turn leads to layoffs, strike action and civil unrest. It is a delicate balancing act that needs to be handled with great dexterity in order to avoid a calamitous situation.

I am still of the opinion that rates will not rise to the levels we endured in 79/80 and will be moderate by comparison. But inflation could become eye-watering and so I remain invested in the precious metals space as I expect gold, silver, and their associated mining stocks to emerge the least battered from the coming economic storm.

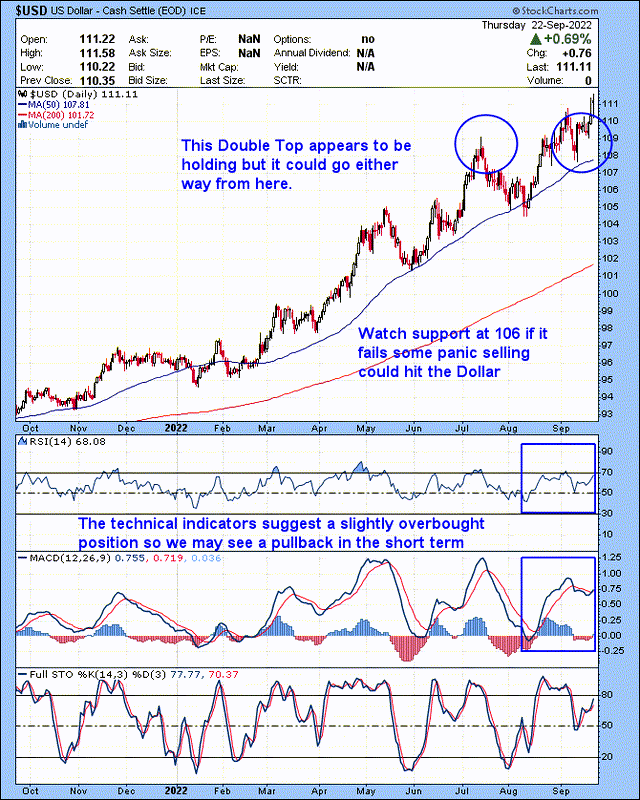

One Year Chart of the US Dollar

The chart below reflects the dollar’s response to US monetary policy in that an increase in the base rate tends to make the dollar more attractive as an asset to hold as well as possibly a safe haven when times are uncertain.

One Year Chart Of The US Dollar (Stockcharts)

As we can see the US dollar has managed to make steady progress and remain above its 50-day moving average. Also note that the 200-day moving average is also trending north, both are supportive of the US dollar. As they say, the trend is your friend, until it’s not.

The technical indicators shown are the RSI, MACD and the stochastics and they suggest that the US dollar is slightly overbought, however it still has room to move higher.

One Year Chart of the S&P 500

The chart below shows the S&P 500 acting inversely to the US dollar as the US dollar strengthens the stock market tends to weaken. The prospect of finance becoming more expensive is a negative influence on the stock market. The rate hike today clearly demonstrates this relationship as the US dollar had a good day and the S&P 500 fell out of bed.

One Year Chart of the S&P500 (Stockcharts)

The technical indicators suggest that the stocks are slightly oversold at the moment so US monetary policy is now the main influence on the market and as such will play a significant role going forward

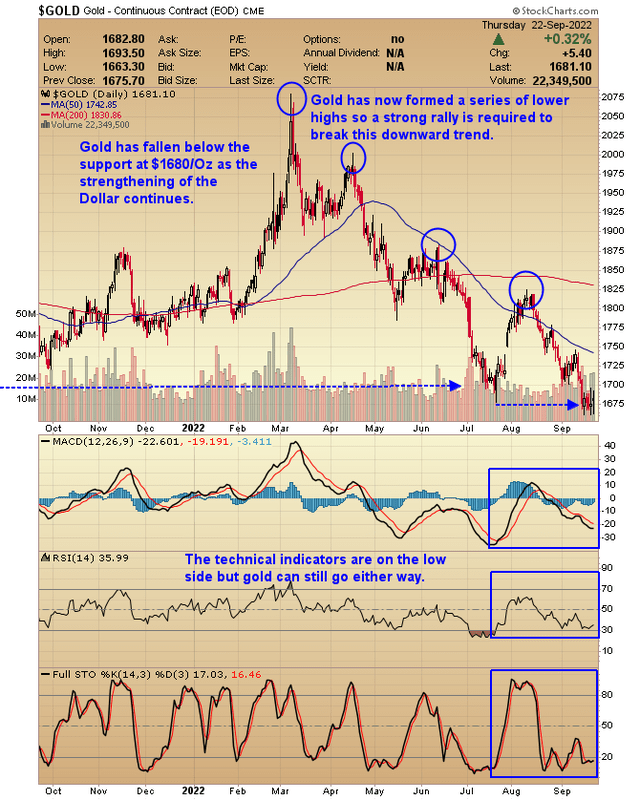

One Year Chart of Gold

The chart below depicts gold’s demise since March 2022 when it hit a new record high, again this suggests to us that the strengthening dollar and its inverse relationship to gold is the reason for gold’s decline.

The support level at $1680/Oz is being severely tested and gold needs to hold this level and build a base as the foundation for a future rally.

One Year Chart of Gold (Stockcharts)

The technical indicators suggest that gold is in the oversold zone and that a near term technical bounce could be on the cards, but we can’t count on it

Conclusion

Inflation is no longer transitory. Rate hikes are coming thick and fast. The stock market is in decline. Hard assets such as gold offer some protection against the coming economic storm.

Gold mining stocks are in the bargain basement and are worth at least a little of your time to consider an acquisition or two.

For the record, I have been long physical gold and silver for a number of years and also own a portfolio of stocks in the precious metals sector including Sandstorm Gold Ltd (SAND), Wheaton Precious Metals Corp (WPM), Agnico Eagle Mines Ltd (AEM) and SSR Mining Inc (SSRM).

Your comments are very much appreciated so please fire them in, and I will do my best to address each and every one of them.

Go gently.

Be the first to comment