piyaset/iStock via Getty Images

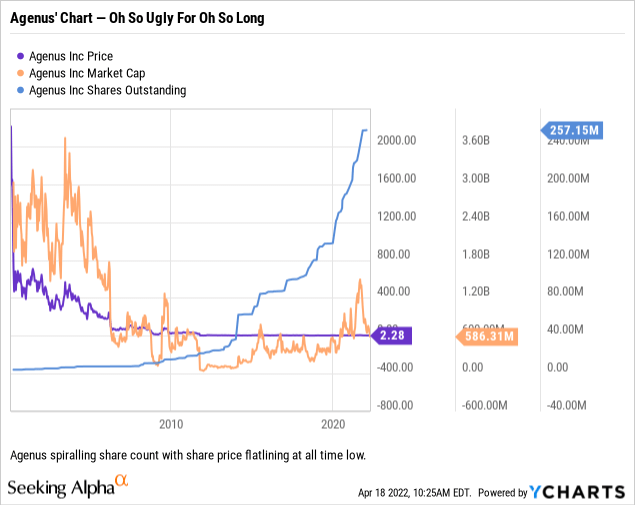

I last checked in on Agenus (NASDAQ:AGEN) back in 07/2019 with a Buy rating in “Agenus: Out Of Favor Immuno-Oncology Pioneer Powers On”. It has remained deeply out of favor. It shows little prospect of righting the ship in the near term.

Agenus has generated significant ongoing revenues from a variety of collaborations.

Agenus was founded in 1994. It went public in 2000 under the name Antigenics. Its S-1 described its initial therapeutic candidate Oncophage, at the time undergoing a number of phase 2 trials in treatment of a variety of cancers, including renal cell carcinoma, metastatic melanoma, colorectal cancer, and gastric cancer.

It planned additional Oncophage trials, including a pivotal phase 3 trial in renal cell carcinoma and additional phase 2 trials in treatment of sarcoma and low grade indolent non-Hodgkin’s lymphoma. Oncophage itself has not been a success. However, Agenus was not deterred. It motored on with a variety of molecules in treatment of various indications.

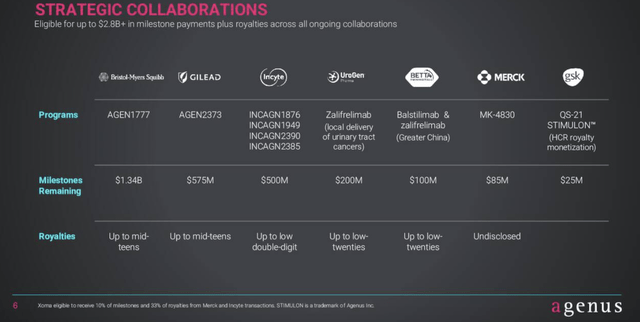

Per its latest 10-K (p. 17), Agenus has never succeeded in generating any direct product sales revenues. It has however attracted a significant group of pharmas to collaborate in advancing its therapies as shown by its Q4, 2021 earnings presentation slide 6 (Earnings Slide) below:

These peers, including several of pharmas’ most storied franchises have signed on to significant partnership deals with Agenus.

Such collaborations have been like so many little Agenus slot machines; they generate periodic revenues that Agenus tabulates in its 10-K as research and development revenues. These aggregated a tidy $244.4 million for 2021, eclipsing the ~$35.9 million it tallied for 2020.

Its 2021 revenue booty of $288 million was made up of three principal components:

- a non-refundable upfront license fee and milestone of $220 million earned under its Bristol Myers Squibb (BMY) License Agreement; and

- $22.4 million related to the recognition of deferred revenue earned under Gilead Collaboration Agreements.

- $44.4 million recognized revenue amortization from its 2018 sale of its GlaxoSmithKline (GSK) QS-21 Stimulon adjuvant royalties to Healthcare Royalty Partners.

As shown by the graphic above there is ~$2.88 billion in potential future milestones already signed up, not to mention a bonus payout of percentage royalties, ranging to the low twenties if any of the collaborations generate product revenues.

Agenus has been a tough hold for its shareholders, never more so than now.

As I write on 04/18/2022, Agenus is dragging at the bottom of its long term share price path as shown below:

I have seen pathetic share price charts for a lot of different developing biotechs over the last half dozen plus years. Never have I seen one nearly as dismal as this one. The question that immediately springs to mind is why?

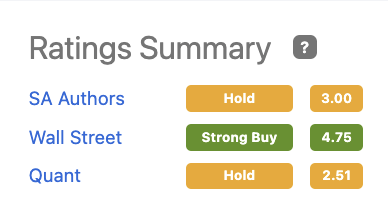

The answer is not at all clear. Seeking Alpha’s ratings summary graphic below for Agenus shows no apparent cause for concern:

seekingalpha.com

Scrolling through dozens of Seeking Alpha Agenus articles dated back to 2006 reveals no articles advancing a bear position on the stock. The very first (03/2006) Seeking Alpha Agenus article, “Analysing Antigenics’ Trial Failure” caught my attention. It discusses the FDA trial failure of its inaugural therapy, Oncophage; a short article, it lays the likely blame on management failures.

Management miscues are not a theme of any recent articles. Nonetheless one can hardly consider management as shareholder friendly in light of the chart above. Rampant dilution and price stagnation are not going to endear any management to shareholders.

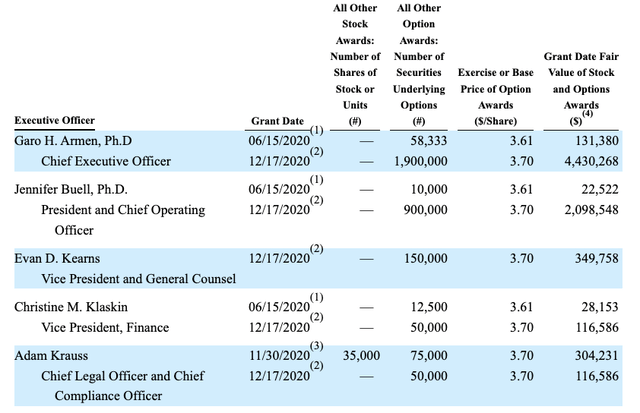

C-Suite compensation as shown by the chart below is bountiful, but not outrageous by comparison for like companies:

Agenus executive compensation table (seekingalpha.com)

Moving on to the other current (04/18/2022 as I write) neutral rating metric, Seeking Alpha’s quant rating, I noted that this metric registered a “strong sell” not so long ago from 11/23/2020 to 05/18/2021. Checking out its Q3, 2020 earnings call press release, I could not finger any reason for the quant downgrade.

From an overall current ratings standpoint, Agenus’ persistent stock doldrums seem an anomaly. This is especially so when one moves beyond Seeking Alpha authors and its Quant System rating to consider Wall Street Analysts “Strong Buy” rating.

This favorable analyst view is not just some recent analyst enthusiasm; rather it reflects the third year that analysts have been overwhelmingly positive as shown below:

The gap between analysts’ price targets (nearly $10) and Agenus ~$2.28 stock price is as high as it has been over five years. Is this a massive mispricing, or just overwrought analysts? I will examine Agenus Q4, 2021 earnings call to shed light on this question.

Agenus’ Q4, 2021 earnings call points to better times ahead.

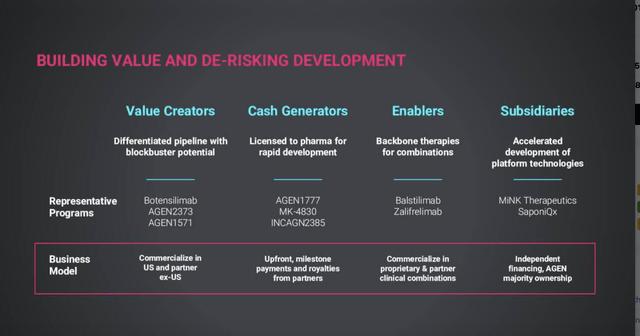

CEO Armen opened its Q4, 2021 earnings call (the “Call”) by outlining four pillars ungirding Agenus’ value proposition:

- Value Creators,

- Cash Generators,

- Enablers,

- Subsidiaries.

Examples of Agenus deep bench of assets filling each of these niches appear in Earnings Slide 2 below:

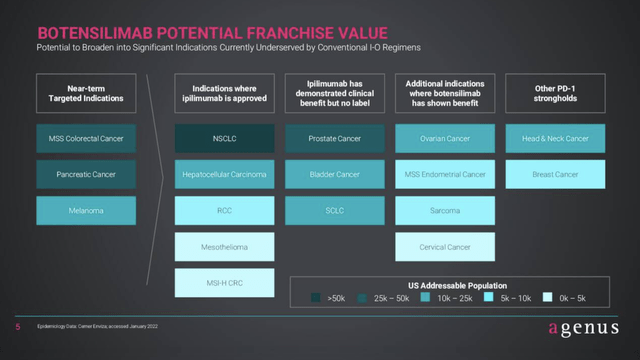

As further described during the Call, Agenus’ botensilimab value creator is a special asset for which it has high hopes in combatting an array of cancers. As a second generation therapeutic (Earnings Slide 3) it has shown impact against both hot and cold tumors with improved safety.

Agenus’ has specific development plans for it in treatment of Melanoma, MSS Colorectal and Pancreatic cancer (Earnings Slide 4). Earnings Slide 5 below shows how Agenus visualizes botensilimab blossoming into a franchise treatment for an additional 14 cancers:

In connection with this latter slide, CMO O’Day observed:

We have carefully chosen these indications in order to one, first demonstrate superiority to ipilimumab in melanoma, where ipilimumab is approved and has been studied the most as a single agent. Second builds upon the signals observed in our Phase I study by pursuing botensilimab in combination with our PD-1 antibody in MS stable colorectal cancer. And three established botensilimab as a superior combination agent for chemotherapy in cold tumors by evaluating botensilimab in combination with standard of care chemotherapy in pancreatic cancer.

During the Call, VP Finance Klaskin advised that Agenus had a cash balance of $307 million at the close of 2021. She advised that Agenus Q4, cash used in operations was $23 million, down from $36 million the previous year.

During the Call, Agenus did not offer any guidance, which may explain in part why investors are not gung ho about upping their share count. We have no timelines for how things might play out. CEO Armen did close his Call presentation by sketching out the following as “near term” objectives:

- launch Phase 2 trials… evaluating botensilimab in melanoma, microsatellite stable colorectal cancer and pancreatic cancer;

- complete enrollment of a proof of concept study evaluating botensilimab in combination with its conditionally active of CD137 agonist in melanoma;

- initiate a Phase 1 study for AGEN1571 a novel program targeting tumor associated macrophages;

- generate GMP grade QS-21 STIMULON through SaponiQx’s plant cell culture manufacturing method to enable partnership trials; and,

- pursue additional strategic collaboration.

On equally vague, “median term” goals he set out the following:

- pursue multiple paths to market for botensilimab;

- continue to advance its VISION platform for more efficient and effective clinical trial designs;

- advance several first-in-class programs, targeting stromal and myeloid biology;

- complete construction of its commercial GMP facility in Emeryville under the leadership of its Chief Manufacturing Officer, Dr. Al Dadson;

- continue to progress existing collaborations and pursue new partnerships.

Howsoever long “near term” and “median term” may last, it is clear that Agenus will have a full plate of activities. These will be creating expense with no near or mid term revenues. In response to a question as to when Agenus would be receiving next pieces of the projected $2.88 billion in future collaboration revenues CEO Armen was nonspecific. He noted that Agenus had received $800 million in payments over the last ~5 years and was trying to generate even more deals.

Conclusion

Agenus has some significant assets which can truly invigorate the greed gland in optimistic investors. It does not however have enough specific prospects to overcome the heavy inertia that is causing Agenus stock to flatline. I am optimistic for Agenus over the long run; over the short term it seems destined to see more of the same.

I rate Agenus a hold.

Be the first to comment