Hispanolistic/E+ via Getty Images

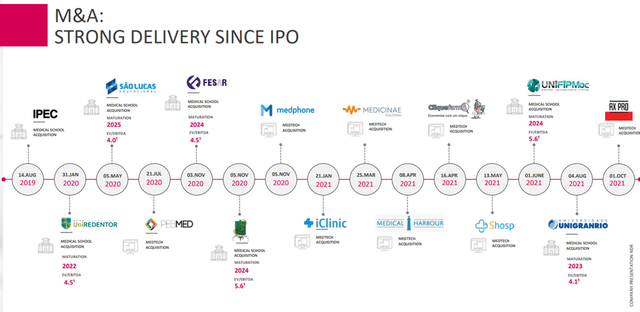

Afya Limited (NASDAQ:AFYA) recently announced its largest post-IPO acquisition yet, adding two higher-education institutions, UNIT Alagoas and FITS Jaboatão, to its portfolio. The acquisition will see Afya gaining 340 medical school seats upfront and potentially another 84 seats (currently under review) for up to R$825m (or >10% of its market cap). The payout will be broken down as follows – R$575m upfront and three annual installments worth R$250m in total, as well as a R$105m earn-out component if it successfully unlocks the additional seats. In essence, Afya is paying R$2.2m/seat on a per-seat basis, a sizeable premium to its prior acquisitions (typically,

I’ve had my reservations about the stock before (see my prior coverage here), but with Afya increasingly well-positioned to capitalize on the secular medical school demand tailwinds, I see ample room for outperformance against an uncertain backdrop ahead.

Adding >400 Seats with Two New Medical Campus Acquisitions

Afya’s recently disclosed agreement to acquire medical institutions, UNIT Alagoas and FITS Jaboatão dos Guararapes, will be well-received by investors. The assets will see the company gaining 340 seats and an additional 84 once the ongoing review by the Ministry of Education is cleared. As part of the deal, Afya will also extend its digital solutions for free to medical students at the acquired campuses. For context, UNIT Alagoas is a post-secondary institution with a leading presence in the states of Alagoas and Pernambuco. While it offers a broad range of courses (>4,000 on-site ex-medicine undergraduates), its medical program has been awarded the highest ‘Education Institution and Medical’ program quality evaluation by the Brazil Ministry of Education. In contrast, FITS Jaboatão dos Guararapes is a pure-play medical school.

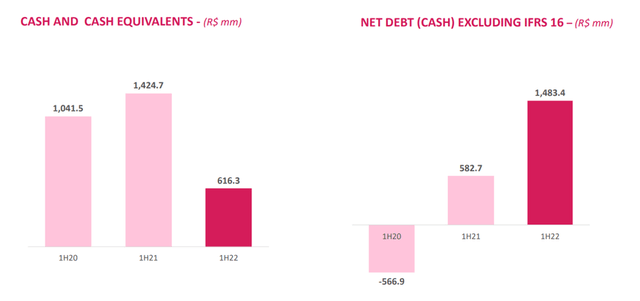

In total, both assets have ~1,800 medical students and a runway to >2,400 medical students by 2024 (i.e., at full maturity). For this year, the projected net revenue base is ~R$189m, with ~80% coming from medicine – this makes up a sizeable >10% of Afya’s current medical school seats. In aggregate, Afya will pay R$825m, of which R$575m will be upfront in cash at the closing date. Another R$250m will be paid in three adjusted annual installments according to SELIC (i.e., the Brazilian interest rate) at R$150m, R$50m, and R$50m, respectively. In addition, the deal also includes an earn-out amounting to R$105m (or R$1.25m/seat), conditional upon the approval of the 84 seats UNIT Alagoas currently has under review. In the likely scenario that the deal encounters no regulatory hurdles, closing is expected in January 2023.

A Likely Accretive Deal Despite the Sizeable Premium

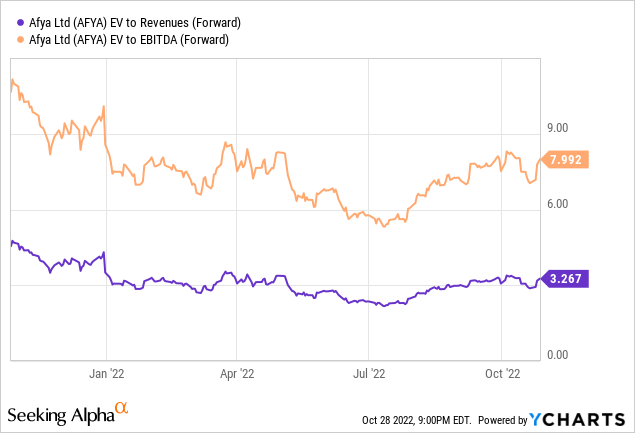

Relative to its FY22 guidance, the total deal price (comprising the ~R$575mn at closing, three SELIC-adjusted annual installments, and up to R$105m earn-out) implies a transaction multiple of ~4x EV/Sales. This seems hefty at first glance, but using management’s 55% long-term EBITDA margin assumption would imply a more palatable ~6x EV/EBITDA multiple. Given where AFYA currently trades at ~8x EBITDA, the acquisition is likely accretive in the mid to long run. On the other hand, the implied EV/Seat of this transaction equates to R$2.2m/seat (including the earn-out), a premium relative to Afya’s prior medical school acquisitions.

With M&A becoming more expensive, expect leverage to increase as well – the UNIT Alagoas/FITS deal will see Afya’s net debt/EBITDA (excluding leases from debt) exceed 2x at the guidance midpoint (up from 1.7x based on ~R$1.5bn of net debt in Q2 2022). If we were to also include Afya’s IFRS16 lease balance, net debt/EBITDA could rise further to ~3x, leaving limited headroom for more acquisitions in the near term.

Strategically Building Medical School Scale

Another key positive from this acquisition is that it allows Afya to exceed its prior guidance of acquiring >200 medical seats/year. Over the mid to long term, the scale benefit from adding these seats is significant as well – Afya’s medical school scale now stands at ~3,100 seats, a ~12% increase relative to pre-acquisition levels, making it uniquely placed within the overall medical ecosystem. Plus, in the current environment of rising interest rates and increased investor focus on earnings, the greater exposure to cash flow generative medical undergraduate programs is a strategic positive. Given the acquired assets have a 40% mix of undergraduate students in medical programs (vs. <30% for Afya), the guidance for a long-term EBITDA margin of ~55% makes sense, in my view.

Positioning for the Long Haul with its Biggest Acquisition Yet

Afya’s latest major medical campus acquisitions (UNIT Alagoas and FITS Jaboatão dos Guararapes) are a net positive, in my view. Not only does the company gain significant scale with 340 seats up front, but potentially another 84 as well at a ~R$825m price tag (including a R$1.25m/seat earn-out provision). In aggregate, though, Afya is paying a premium R$2.2m/seat valuation, well above what it has typically paid in prior acquisitions. That said, the transaction multiple after post-synergies stands at ~6x EV/EBITDA, which should prove accretive given Afya’s current trading multiple of ~8x EBITDA. Heading into another challenging year for higher education and following its YTD de-rating, Afya offers investors one of the best plays on the growing medical school demand in Brazil.

Be the first to comment