hapabapa/iStock Editorial via Getty Images

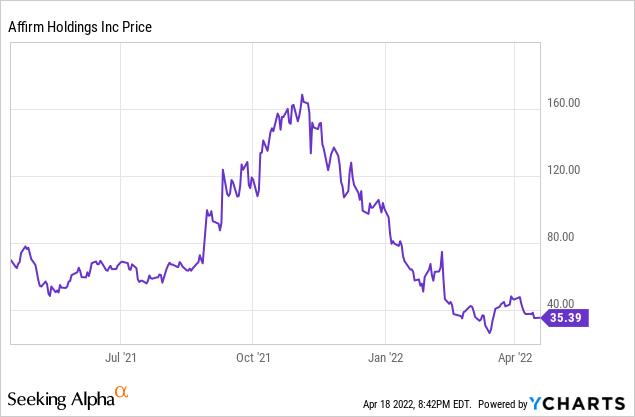

Since reaching an all-time high near $165 in early November 2021, Affirm (NASDAQ:AFRM) has proceeded to fall nearly 80%. What has caused this massive pullback? I believe there are several reasons, including fears that buy now pay later (“BNPL”) companies will remain unprofitable, fears around consumer spending starting to weaken, and higher interest rates.

While I do believe that BNPL has a role to play within the payments ecosystem (providing credit to lower income/less creditworthy individuals is important), I believe the stock price does not fully reflect the potential longer-term risks.

As discussed further below, I believe there continue to be risks around the true underlying profitability of BNPL companies. With some very large merchants (Amazon and Shopify) deciding to partner instead of building organically, I believe this could mean the tradeoff between investments and profitability may not be worth it.

In addition, consumer spending has been at some of the best levels in many decades given the numerous stimulus-related benefits passed out during the pandemic. As consumers’ personal balance sheets start to normalize and debt balances raise, as well as fears of a potential recession, BNPL discretionary spending could be some of the first to be hit hard.

Valuation also remains a little expensive given the combination of revenue growth slowing down and the company remaining unprofitable. While I do believe that BNPL has a place in the payments ecosystem, I remain very cautious around the current set-up heading into earnings and over the next few quarters.

Financial Review

Briefly looking back at the company’s Q2 report from February, underlying spending trends were pretty strong. Revenue grew 77% yoy and beat expectations by nearly 10%, with GMV growing 115% yoy to $4.46 billion along with 11.2 million active consumers.

Investors should remember that last quarter, Affirm reported an adjusted operating loss of nearly $8 million, which was an improvement from a loss of $45 million in Q1, but worse than the year-ago period loss of $3 million.

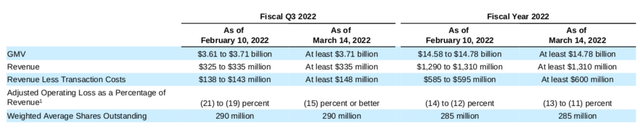

In mid-March, Affirm’s stock took a hit when they delayed an asset-backed securities sale. After a major investor who was investing in the top-rated portion of the deal backed out, Affirm provided an update to Q3 guidance metrics. While business metrics through March 14 were better than the company’s initial guidance, it does raise some level of concern on why the investor backed out of the ABS deal.

GMV for the quarter is now expected to be at least $3.71 billion and revenue at least $325 million, both at the high-end of their previous guidance range.

Interestingly, for the full year, revenue less transaction costs was raised to at least $600 million, up from the previous range of $5.85-5.95 billion. While the guidance raise is nice, investors likely expected a stronger beat and raise, given the valuation of the stock.

Operating losses continue to be of concern with the company expecting an adjusted operating loss margin of 11-13%, meaning there could still be a few more years of losses before the company turns a profit.

Cautious Into Earnings

Given the backdrop of recent events for Affirm, it seems unlikely the company will provide a much higher guidance raise, given it’s only been a month since their last update.

The recent addition of Shop Pay Installments via Shopify (SHOP) has led to an increase in the number of active merchants and gives Affirm access to more consumers. While we don’t fully know how profitable this relationship will be for Affirm, investors can look at their recent Amazon (AMZN) relationship for some context. Amazon has a significant scale in the market and likely pays Affirm very little, meaning Affirm’s profitability on that relationship is likely minimal, if any.

Shopify, while not nearly at the same scale as Amazon, still has some scale and can demand favorable pricing, meaning less profitability to Affirm. Yes, this is pure speculation, but typically in the payments ecosystem, when companies partner with large merchants, these merchants can demand very favorable profitability for themselves.

I believe that if both Amazon and Shopify are looking to outsource and develop partnerships for BNPL, it could imply that it’s either too complicated to develop or the profitability potential of BNPL is not attractive. Given that Amazon has developed a business model that touches almost every part of consumers’ lives, I am leaning more towards BNPL being unattractive from a profitability standpoint.

In addition, competition from traditional banks is starting to pick up, with U.S. Bank (USB) even noting they are rolling out their own BNPL option during their recent Q1 conference call.

We enhanced the service that we call Extend Pay, an offering which allows our existing consumer and business cardholders to a buy now, pay later option where they can choose a flexible payment plan that suits their needs.

On top of that, there are rising fears over the consumer strength as CPI inflation in March just reached 8.5%, and who knows when this will start to taper. Rising fuel prices continue to put pressure on the average consumer buyer power. Higher interest rates can also have an impact as the Fed looks to slow down inflation, though this will cause some more everyday expenses (mortgages, auto loans, etc.) to become more expensive.

Overall, the fears of economic slowdown will typically hurt discretionary spending and consumers with lower income the most. While Affirm is not 100% tied to these two factors, a fear of consumer spending slowdown could weigh on the stock for many quarters to come.

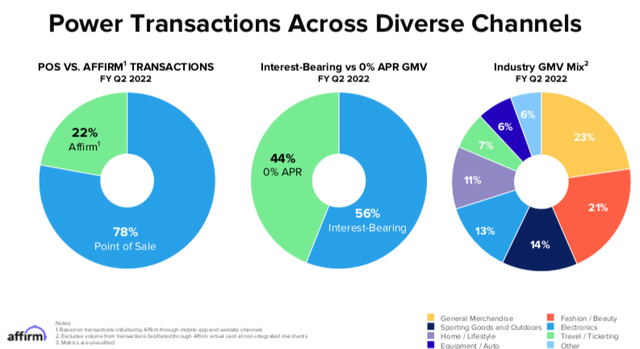

The chart above shows which areas of spending Affirm is most exposed to, with general merchandise, fashion/beauty, and sporting goods/outdoors representing nearly 60% of total GMV.

Valuation

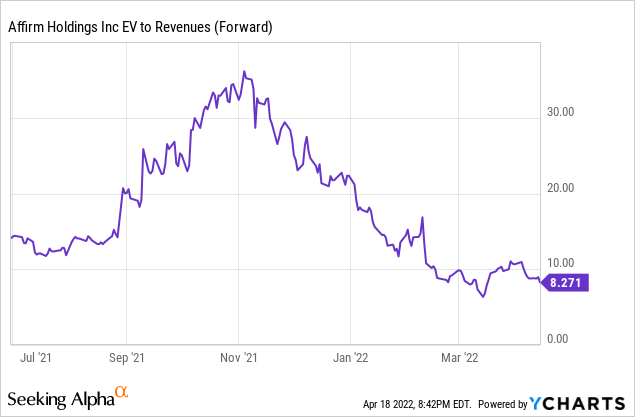

Even with the company’s stock pulling back around 80% from all-time highs, this is clearly representative of investors’ fears around the business model and valuation. Many fast-growing software/payments companies use forward revenue multiples to help frame valuation. While the chart below uses Affirm’s revenue, I prefer to look at revenue less transaction costs. These transaction-related expenses are automatically paid out and Affirm receives no financial benefit from them as they are simply pass-through revenue.

Affirm currently has a market cap of ~$10 billion and ended their most recent quarter with around $1.5 billion in net debt, giving the company an enterprise value of ~$11.5 billion.

For FY2022, Affirm is guiding to at least $600 million of revenue less transaction costs. Given the significant growth Affirm is seeing and will likely see over the coming years, it would not be surprising to see this more than double over the next few years. In a bullish scenario, Affirm could see $1.5 billion of revenue less transaction costs over the next two years.

This would imply a current valuation of ~7.7x FY2024 revenue less transaction costs. While this is not an overly expensive multiple to pay, investors need to weigh the balance of revenue growth and profitability. Given the amount of investments it takes to build scale, profitability may just be turning the corner during this time frame.

On top of that, if we enter an economic recession, consumer spending is likely to take a hit, meaning the use of BNPL providers will likely be hit hard. In a bearish scenario, we could see revenue less transaction costs reach $800-900 million over the next two years, giving a current valuation of 13-14x FY2024 revenue less transaction costs.

Given the potential risks of consumer spending slowdown, uncertainty around the long-term profitability of the BNPL model, and valuation remaining a little expensive, I believe investors should tread carefully heading into upcoming earnings.

Be the first to comment