CIPhotos/iStock via Getty Images

In my previous Affimed (NASDAQ:AFMD) article, I highlighted the company’s pipeline and partnered pipeline programs and how I believed the share price was approaching discounted levels. After experiencing the four-month-long small-cap healthcare sell-off, AFMD was able to catch a bid and has shown some support after the company reported their full-year 2021 financial results and earnings call. The company revealed that had a strong 2021 and that they were prepared for a transformative 2022 filled with some potent catalysts for their innate cell engagers. Affimed expects to have three innate engagers in the clinic by the end of this year, which should deliver steady data flow over the next several years. These catalysts in conjunction with potential partner milestone revenues should improve the company’s long-term outlooks and possibly inject some bullish sentiment momentum into the stock.

I intend to provide three points that defend my bullish outlook Affimed. In addition, I will reveal my plans for my dormant AFMD position.

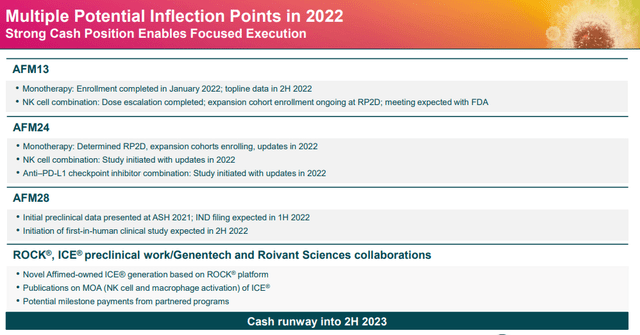

Point 1: Affimed’s Rock Platform

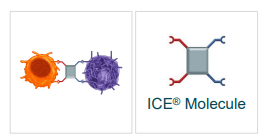

Affimed’s “fit-for-purpose” Rock platform is intended to cultivate “innate cell engagers” or “ICE Molecules”. The platform generates multi-specific antibodies that are tailor-made to an indication, which will permit the immune cells to lock on to their target. Affimed’s ICE Molecules bind to natural killer “NK” cells and macrophages by way of the CD16A-binding region, while concomitantly binding to the target cancer cells.

ICE Molecule (Affimed)

Affimed’s ICE Molecules have the potential to be a game-changer because the innate immune system is the body’s first line of defense and will activate NK cells and macrophages to destroy abnormal or foreign cells. Unfortunately, cancer cells can avoid revealing their location and, thus, dodge the innate immune system’s ability to attack with the NK and macrophages.

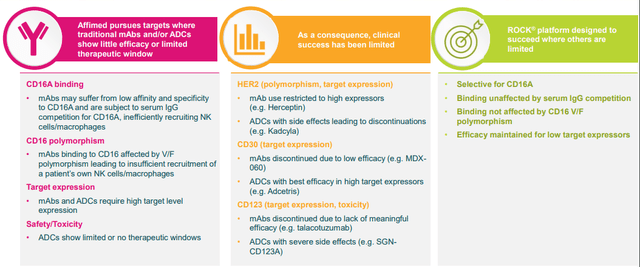

Rock Platform Overview (Affimed)

Affimed’s CD16A-targeting innate cell engagers can help the innate immune system to engage these tumor cells by creating a bond sandwiched between NK cells and tumor cells, which will initiate the release of perforins to produce openings in the cancer cell’s membrane to let granzymes to activate apoptosis and ultimately cell death.

So essentially, the company’s ICE Molecules muster a portion of your immune system that was on the sidelines to attack the cancer cells. Not only are Affimed’s ICE Molecules targeting the lysis activating CD16A receptor, but the therapy won’t require harvesting the patient’s NK or T-Cells. What is more, the company’s technology can be applied to several hematological and solid tumor types and possibly produce complete responses.

Currently, immuno-oncology therapies are rapidly taking over as the standard-of-care in multiple indications. Present-day immuno-oncology treatments consist of checkpoint inhibitors and cell therapies. In spite of the success of these novel therapies, immuno-oncology therapies engage the adaptive immune system and are not faultless in terms of safety and efficacy. As a result, Affimed’s ICE Molecules could quickly become contenders in the clinic and on the market.

Point 2: Affimed’s Impressive Pipeline

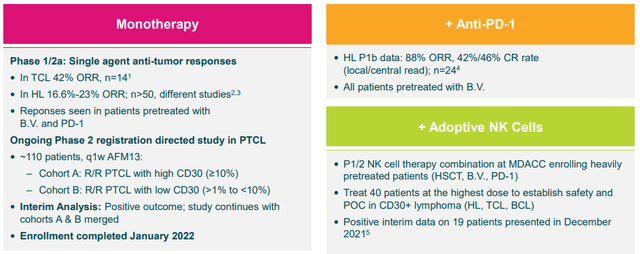

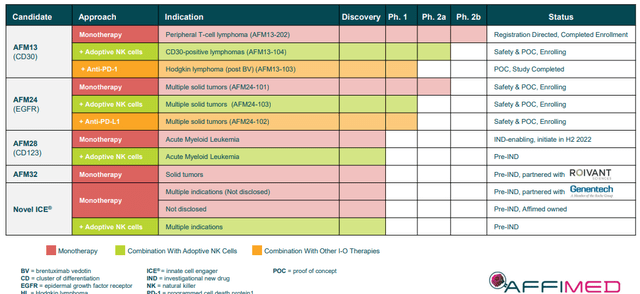

Affimed’s pipeline is filled with ICE Molecule programs as a monotherapy, in combination with cell therapies, and in combination with I-O products in a variety of indications.

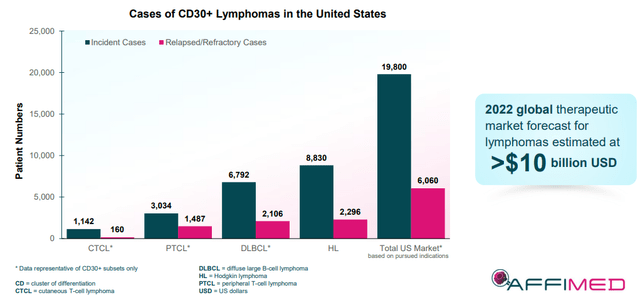

The company’s lead candidate, AFM13, is being tested as a monotherapy, in combination with adaptive NK cells, and with an anti-PD-1 product in CD30+ lymphomas. At the moment, the CD30+ lymphoma market in the United States is substantial, however, almost ¼ of patients are considered underserved in a >$10B global market.

So far, AFM13 has produced impressive data as a monotherapy and in combination therapies.

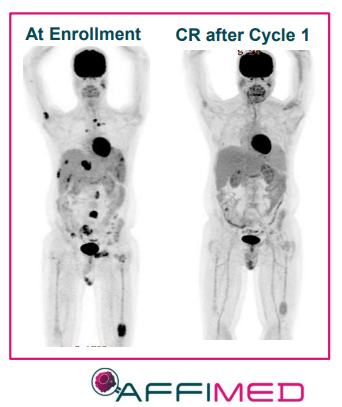

Remarkably, the NK cell combination (AFM13-104) produced impressive results in 40 heavily pre-treated patients that had a median of six prior lines of therapy. 13 of these patients that were treated with the highest dose responded to the treatment with 5 of them experiencing a complete response. One of these patients had already failed CD30 CAR-T therapy.

AFM13 Complete Response (Affimed)

Currently, Affimed has completed enrollment in AFM13’s registration-directed study in peripheral T-cell lymphoma. AFM13 has been a proof-of-concept product candidate for Affimed and has the potential to validate the remainder of the company’s pipeline programs both as monotherapies and in combination therapies.

The company’s AFM24 is taking aim at EGFR+ solid tumors, which over 400K patients in the U.S. and 1.5M patients globally. AFM28 is targeting CD123 in AML which is ready for an IND in the first half of this year.

In addition to the company’s wholly-owned assets, Affimed has partnered programs ROIVANT and Genentech. I am particularly bullish on the Genentech partnership because they will be accountable for the worldwide clinical development and commercialization of these programs. In return, Affimed was to receive a $96M upfront payment and near-term funding. In addition, Affimed could receive up to an additional $5B in developmental, regulatory, and commercial milestones, plus, royalties on sales. These programs have already provided milestone payments and limit the potential of the company having to take on crippling debt. Moreover, these partnered programs also validate the company’s platform technology.

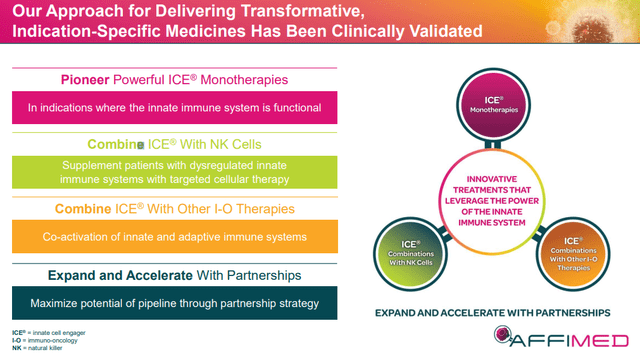

Point 3: Affimed Has Got Potent Catalysts

Affimed has numerous potent catalysts on the docket this year for most of their pipeline programs. The company expects top-line data from AFM13 monotherapy in the second half of this year.

Affimed Potential Catalysts (Affimed)

For AFM24, the company is looking to report updates from their monotherapy, NK combo, and anti-PD-L1 combo programs. For AFM28, the company is looking to file an IND in the first half of this year and initiate a clinical trial in the second half of the year.

Affimed is moving their pipeline forward in monotherapy programs, combination NK programs, and I-O combo programs. Furthermore, we could see additional milestone payments from Genentech as they progress their partnered programs. Altogether, we could see Affimed finish 2022 with data needed for approval AFM13 and have a clear path for the rest of the pipeline.

Starting A Decade of Dominoes

The company’s Rock Platform has created impressive CD16A-binding ICE Molecules that may well modernize the present immuno-oncology landscape by unlocking the power of the innate immune system in the fight against cancer. Affimed is advancing novel and differentiated pipeline programs set to deliver data milestones in 2022 in several programs with potential progress in Genentech partnered programs. These three points might seem obvious to current shareholders, however, I would stress the implication of these points for both the near-term and long-term outlook for the company. The potent catalysts could drive the share price in the immediate term. The pipeline programs reveal how the company could be a potential market disruptor over the next several years. The Rock Platform has the potential to pump out additional assets that deliver significant revenue into the next decade. Essentially, these three points have set up a decade-long domino chain that could be triggered by AFM13’s top-line data in the second half of this year.

Downside Risks

Despite the bullish outlook, investors need to consider a looming downside risk for AFMD… cash. Affimed ended 2021 with €197.6M in cash and cash equivalents, which they anticipate will support operations into the second half of 2023. Indeed, it does appear the company is not going to have to raise any cash in the near term, but I have to suspect they are going to have to pull the trigger on an offering at some point next year. The company is going to need a substantial amount of cash to continue funding their pipeline and possibly prepare for commercialization. Consequently, investors need to accept there is a strong likelihood the company will have to perform some form of dilutive funding.

My Plan For AFMD Stock

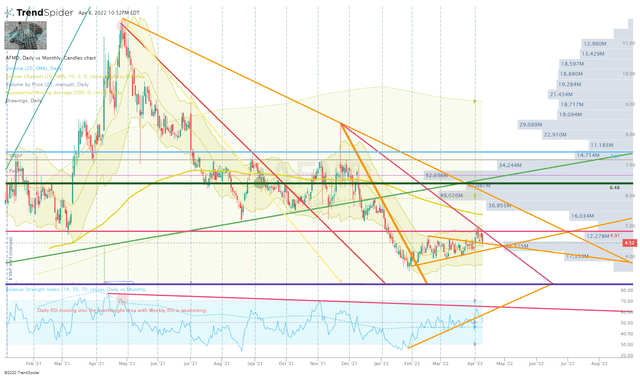

If all goes well, Affimed could be leaving 2022 with milestone payments and critical data needed for approval. As a result, I am looking to take my AFMD position out of mothball and apply some profits in the coming months while it is still trading under $5.00 per share. However, I am still holding off from going “all-in” until we get AFM13 top-line data.

AFMD Daily Chart (Trendspider)

I am still looking for a potential bullish divergence in the Daily RSI in conjunction with some support in the $4.50-4.90 range. Unfortunately, it looks as if we will need the share price to drop below $4.50 to achieve a bullish divergence. If the share price remains under $4.50, I will switch to a DCA approach by making additions every couple of weeks until the charts show signs of a potential reversal.

On other hand, I will set sell orders, in order to generate some profit and maintain my “house money” position.

Long-term, I plan to hold AFMD in the Bio Boom portfolio for at least five years in anticipation that I will get a large return on my investment.

Be the first to comment